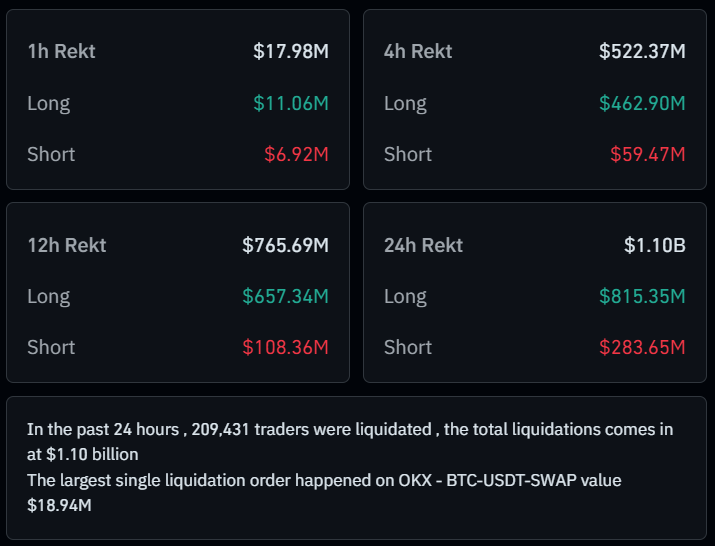

A sudden drop in Bitcoin (BTC), the world’s largest asset has resulted within the liquidation of a major $1.10 billion value of lengthy and brief positions up to now 24 hours. Of this large liquidation, BTC alone accounted for $565 million, with $417 million coming from lengthy positions and $145 million from brief positions, as reported by on-chain analytics companies Coinglass.

High Crypto Liquidation

In the meantime, XRP, Solana, and Ethereum skilled liquidations of over $54.11 million, $30.15 million, and $108 million, respectively. The one largest liquidation order occurred on OKX within the BTCUSDT pair, valued at $18.94 million. Knowledge reveals that bulls have been the toughest hit on this current crash.

Moreover, for the primary time since BTC crossed the $100,000 mark, it has didn’t maintain this stage, ensuing within the liquidation of 208,389 merchants’ positions. Throughout this market dip, BTC’s value declined by 5.47% in simply minutes, dropping from $98,338 to $92,957. Nevertheless, because the drop, the value has rebounded as of press time.

Bitcoin Present Worth Momentum

At press time, Bitcoin is buying and selling close to $96,935 and has recorded a value decline of over 2.10% up to now 24 hours. In the meantime, this crash has attracted notable participation, as evidenced by the buying and selling quantity. In line with CoinMarketCap, BTC’s buying and selling quantity surged by 98% throughout the identical interval.

Nevertheless, this value drop has created worry amongst merchants, as there isn’t any clear motive recognized for the decline. This has raised considerations about whether or not the drop will occur once more or if the market will now rebound.