Curve Finance, one of many greatest decentralized exchanges in crypto, is experiencing a large flight of capital because the platform recovers from an exploit.

Early on Sunday, Curve said that due to a vulnerability with programming language Vyper 0.2.15, a number of liquidity swimming pools on the platform have been exploited, and requested customers within the affected swimming pools to withdraw their funds.

Curve, an automatic market maker (AMM), caters largely to stablecoins, permitting merchants to earn yield, seize arbitrage or alternate their cash. Clara Medalie, director of analysis at Kaiko, instructed Bloomberg that “falling liquidity isn’t a very good factor for markets, particularly stablecoins, which must commerce with a really tight vary.”

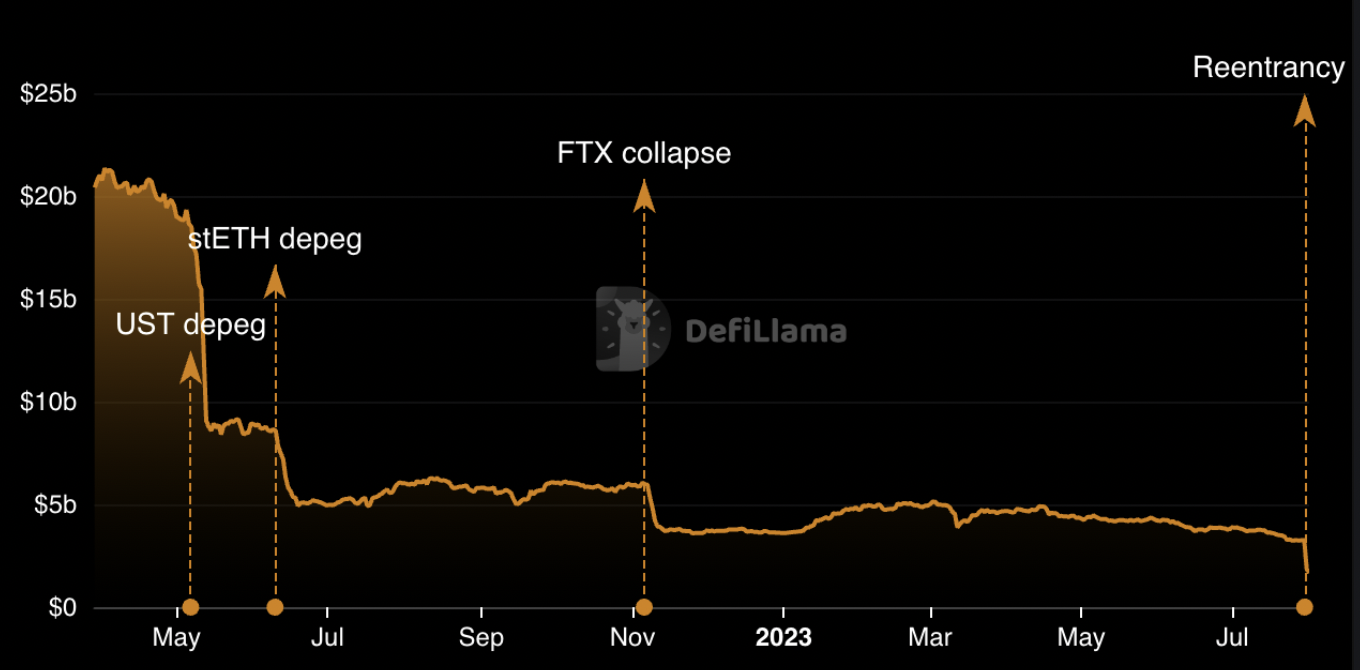

In response to blockchain analytics service DefiLlama, Curve’s complete worth locked (TVL), or worth sitting within the platform’s good contracts, has plunged by almost 50%.

Simply earlier than the exploit, Curve’s TVL was sitting at $3.25 billion. At time of writing, the TVL is $1.67, representing a $1.58 billion flight of crypto property from the platform as merchants take further precautions. Solely about $70 million is gone resulting from precise theft, based on crypto safety analysis.

CRV, Curve’s native token, has fallen 19% because the hack, buying and selling at $0.59, down from $0.75.

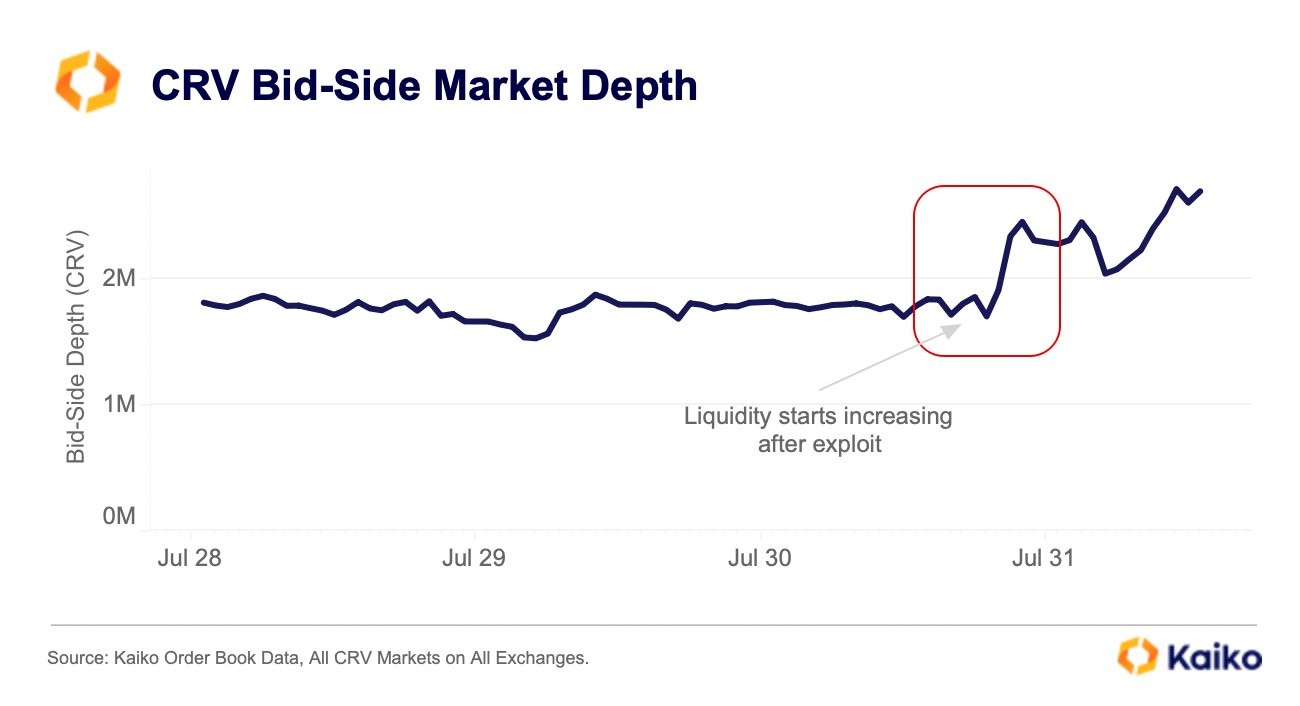

In response to Kaiko, market makers might have stepped in to stop additional worth depreciation, based mostly on a sudden surge in buy-side liquidity on centralized exchanges.

“Proper after information broke of the Curve exploit, CRV bid-side liquidity began growing on centralized exchanges.

Throughout a worth crash liquidity sometimes drops, so this pattern suggests market makers stepped in shortly to stop additional losses.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you might incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/ppl/Fotomay