Over three billion in worth was erased from the stablecoin financial system through the previous 30 days. The development occurred regardless of the variety of tethers in circulation rising by 2.2% final month. On Oct. 1, 2022, tether’s market capitalization was roughly $67.95 billion, and it’s risen to $69.36 billion since then. Circle’s usd coin, however, had a valuation of round $47.20 billion 30 days in the past and right this moment, the market cap is $42.54 billion, after the stablecoin undertaking’s variety of tokens in circulation dropped by 10.3%.

Stablecoin Economic system’s Provide Tightens

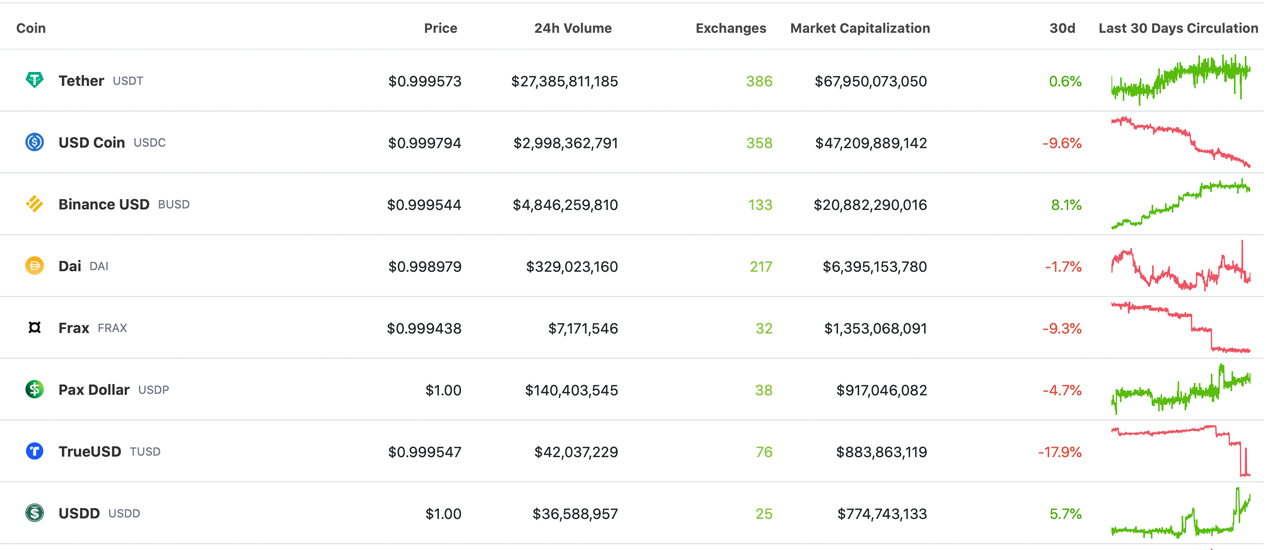

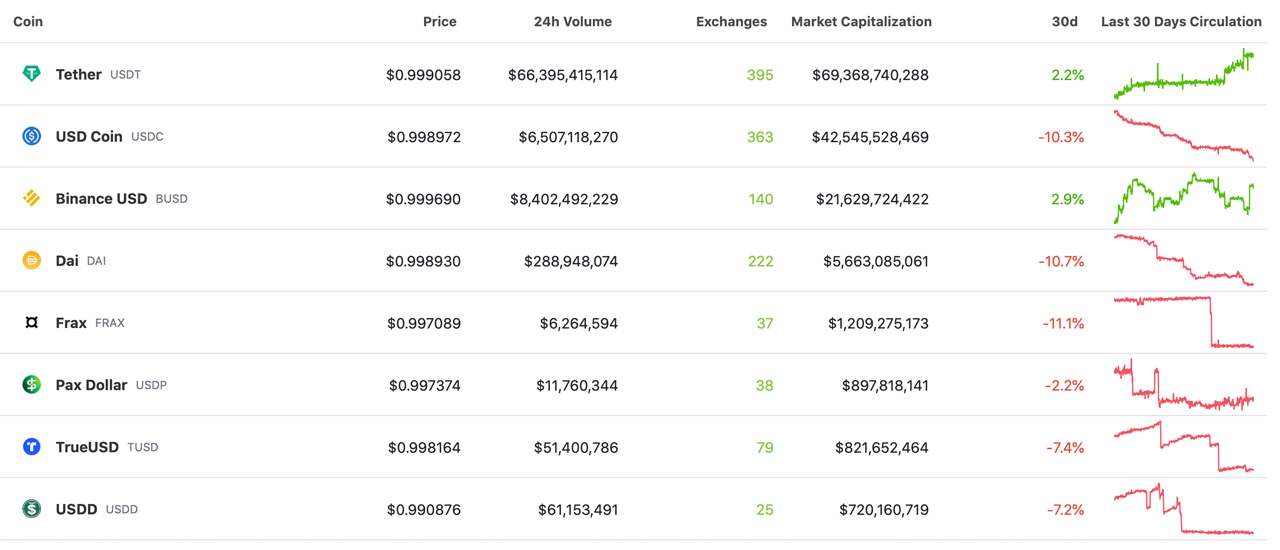

The stablecoin financial system has misplaced roughly 3.32 billion in nominal U.S. greenback worth through the previous 30 days, in line with statistics recorded on Nov. 2, 2022. Many of the motion derived from the highest two stablecoins (USDT & USDC), as usd coin’s (USDC) variety of stablecoins in circulation slid 10.3% decrease since final month. Archived data present, that whereas the stablecoin undertaking’s provide misplaced 9.6% the month earlier than, USDC’s market cap dropped from $47.20 billion to $42.54 billion via the month of October.

Data printed on Oct. 1, 2022, additional present that the month prior, tether’s (USDT) variety of cash in circulation was up roughly 0.6%. All through the month of October, USDT’s cash in circulation, in line with coingecko.com statistics, point out the availability has risen by 2.2% since then. On the time, 30 days in the past, tether’s market capitalization was roughly $67.95 billion and on Nov. 2, 2022, USDT’s market cap is presently valued at $69.36 billion. Though, USDC was not the one stablecoin that recorded 30-day provide drops because the first of October, as a myriad of stablecoins noticed provide reductions.

The stablecoin DAI, issued by the Makerdao undertaking, has seen a ten.7% discount since final month. Frax (FRAX) noticed an 11.1% slide downward and pax greenback (USDP) dipped by 2.2%. The variety of trueusd (TUSD) declined by 7.4%, and Tron’s USDD stablecoin provide lowered by 7.2% over the past 30 days. Whereas BUSD’s provide jumped 8.1% larger on the finish of September, BUSD’s total variety of cash in circulation elevated by 2.9% this previous month.

BUSD’s market cap is now greater than half of USDC’s valuation, because the variety of BUSD cash in circulation represents 50.82% of the USDC provide. One other attention-grabbing issue that came about inside the stablecoin financial system was the current HUSD depegging occasion.

Three days in the past, Bitcoin.com Information reported on HUSD sliding to report lows and now it’s buying and selling effectively under that quantity right this moment. HUSD is presently exchanging arms for $0.324 per unit on Nov. 2, 2022. HUSD slid to an all-time low at $0.283, and it’s presently 14.4% larger than that all-time low, however the token’s present worth isn’t even near the $1 parity it as soon as held on Oct. 1, 2022.

What do you concentrate on the stablecoin motion over the past 30 days? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, coingecko.com stablecoin web page

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss brought about or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.