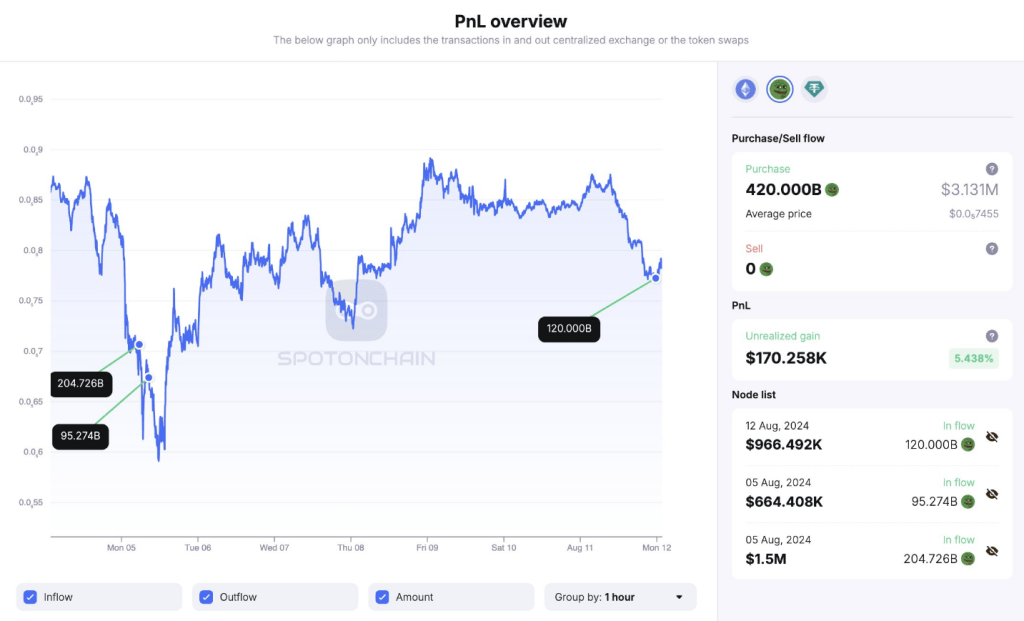

Throughout the previous week, an aggressive accumulation of 420 billion PEPE tokens in two transactions price 3.13 million USDT has been made by a crypto whale recognized as “cookislandstrust.eth”. This strategic transfer, beginning on the peak of the market dip on August 5, has returned a revenue of $170,000—equating to a 5.5% achieve.

Associated Studying

Whale’s Massive Urge for food

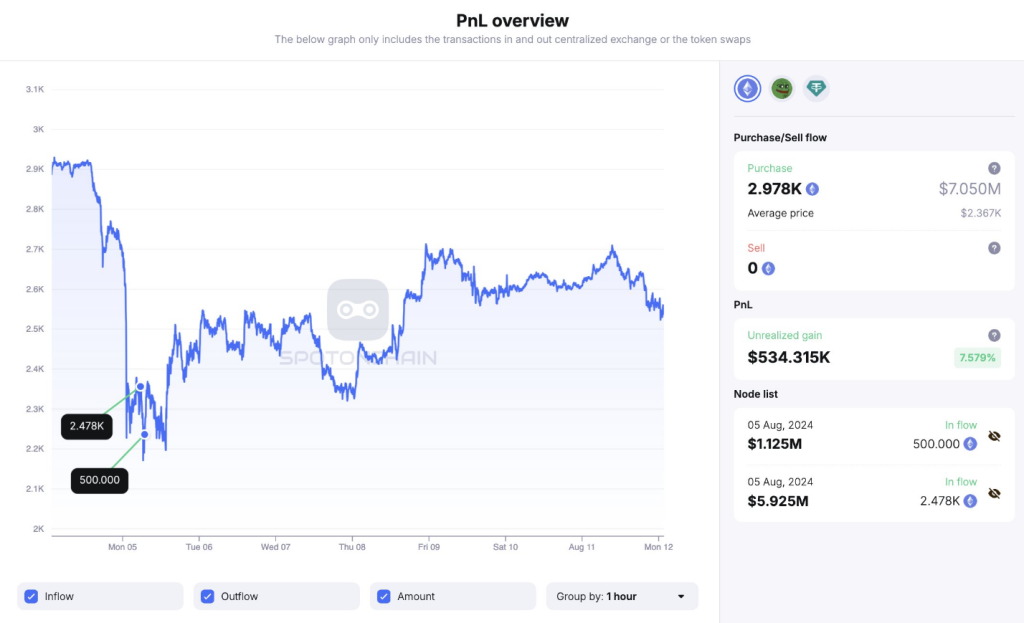

Nonetheless, the whale’s motion didn’t cease at PEPE. The identical day, they purchased practically 3,000 Ether in opposition to 7.05 million USDT through the market stoop for an unrealized revenue of $534,000, up 7.58%. This double funding in wildly fluctuating PEPE and extra secure Ethereum reveals how this whale exactly calculated its actions to generate essentially the most from turbulent market conditions.

A whale named “cookislandstrust.eth” is making an attempt to purchase $PEPE at dip once more!

Previously 7 days, the whale has spent a complete of three.13M $USDT to purchase 420B $PEPE on 2 events, together with the large dump on Aug 5 and a pair of hours in the past, now making $170K (+5.4%).

The whale additionally spent 7.05M $USDT… pic.twitter.com/QVnbW5AGYz

— Spot On Chain (@spotonchain) August 12, 2024

Clearly, this massive whale regards Ethereum as some type of fortress, particularly when turmoil happens inside the markets. The transfer displays a far higher sentiment the large guys have: Ethereum stays a secure wager, particularly when quakes are skilled out there. Now, this actually reveals how calculated this entire shift into numerous risky and secure belongings was on the a part of that whale.

Pepe: Market Response And Investor Sentiment

“Cookislandstrust.eth” loves aggressive shopping for and has bought the entire crypto group speaking. Usually, when whales begin to go upon bulk shopping for, individuals take it as a bullish sign. It merely denotes the truth that these big-time buyers are of the view that the costs will go up sooner or later.

Now, greater than ever, it’s within the fingers of the merchants and market lovers to critically observe the value of PEPE with the intention to see whether or not this might be simply the tip of the iceberg. Will the whale’s confidence begin a bigger development of accumulation?

Analyst Weighs In

PEPE’s efficiency within the current previous has been nothing near secure. The meme coin is kind of risky in its value swings, classifying it as one of many riskiest investments one could make. But it cautions a few of the largest buyers, who purchase into the hype or hypothesis.

Properly, only in the near past, Crypto Titans, a pseudonymous analyst, shared that PEPE could possibly be set for a big value transfer. The analyst famous that this fashioned a bullish pennant on the day by day chart, subsequently suggesting an extension of the uptrend. Extra so, a bullish flag sample was additional noticed on the 4-hour chart to point continuity of the momentum.

Crypto Titans imagine that if PEPE breaks out from each patterns, its value may dramatically skyrocket to $0.00000888 for a 100% enhance from its present degree. He additionally warned, although, that it may probably imply a retest of decrease help ranges if this higher development line doesn’t break, including a degree of uncertainty to the forecast. The actions of the whale imply that earnings may repay massive, however additionally they present the dangers concerned in timing the market.

Associated Studying

In a market downturn, analyst like cookislandstrust.eth will let you already know what the sentiment is. Whereas, definitely very dangerous, these great buys that this whale made in PEPE and Ethereum do make a case for quick trades. That’s the difficulty with the excessive volatility of crypto: what works for one whale doesn’t essentially match with what works for regular buyers.

Crypto Titans, however, stays optimistic about good points that PEPE would attain if sure patterns do materialize, however advises a level of prudence. On this crypto market, the timing and the evaluation are very important however not ample. One must be very cautious and do their very own analysis as a result of the methods could not work out with everybody.

Featured picture from X/@rarepepe_dao, chart from TradingView