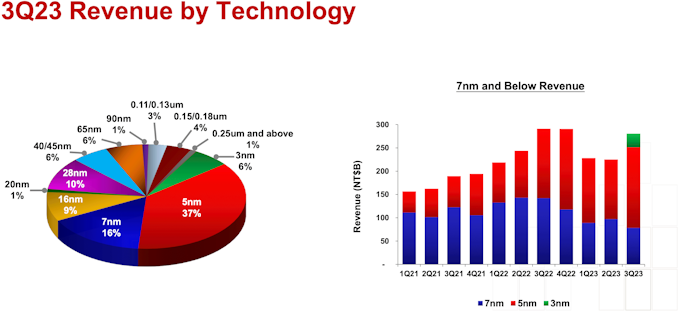

Though Taiwan Semiconductor Manufacturing Co. formally began manufacturing of chips utilizing its N3 (3nm-class) course of know-how again in late 2022, the corporate didn’t acknowledge any significant N3 income in Q1 and Q2. This week as a part of the corporate’s Q3 earnings announcement, the foundry lastly acknowledged its first N3-related income, with N3 accounting for six% of TSMC’s Q3 income. In the meantime, superior nodes now account for 59% of TSMC’s earnings.

For his or her first quarter of great 3nm income, TSMC booked roughly $1.03 billion in earnings for the brand new node. To place the quantity into generational context, TSMC acknowledged its first N5 income in Q3 2020, the place again then the know-how accounted for $0.97 billion in income making 5nm-class chips – or about 8% of TSMC’s income share.

The sturdy begin to N3 income was not sudden, if solely because of the ever-rising costs that TSMC is assumed to cost for his or her cutting-edge wafers. Nonetheless, even with a billion greenback quarter, TSMC is simply getting began; the corporate beforehand warned that its 3nm ramp would take a while.

Going ahead, TSMC’s long-term plans for the 3nm node name for the corporate to ultimately provide a number of variations on the method. TSMC’s baseline N3 (aka N3B) node makes use of as much as 25 EUV layers, some with costly EUV double-patterning, permitting greater transistor density however at greater prices – and few prospects. Extra purchasers have opted for the extra cost-efficient N3E course of know-how with as much as 19 EUV layers, no EUV double-patterning, providing decrease logic density, however higher yields and a wider course of window. TSMC is about to start to ramp up N3E in This fall 2024 and with this model its 3nm-class course of know-how is anticipated to shine.

“Our enterprise within the third quarter was supported by the sturdy ramp of our industry-leading 3nm know-how and better demand for 5nm applied sciences, partially offset by prospects’ ongoing stock adjustment,” mentioned C.C. Wei, chief government of TSMC, on the convention name with analysts and buyers. “N3 is already involving manufacturing with good yield, and we’re seeing a powerful ramp within the second half of this 12 months, supported by each HPC and smartphone functions. […] N3E has handed qualification and achieved efficiency and yield targets and can begin quantity manufacturing in fourth quarter of this 12 months. “

TSMC’s complete income Q3 2023 hit $17.28 billion, a 14.6% lower year-over-year, however a ten.2% enhance from the earlier quarter. In the meantime, the corporate’s internet earnings elevated 16.1% quarter-over-quarter to $6.521 billion, whereas gross margin for the quarter was 54.3%