In an evaluation shared by way of X, famend crypto analyst Ted (@tedtalksmacro) has offered compelling proof to assist his assertion that the present Bitcoin bull run is way from over. Ted’s insights are based mostly on 4 crucial indicators associated to conventional finance and crypto liquidity, every pointing to sustained progress within the close to future. Right here’s a breakdown of his evaluation:

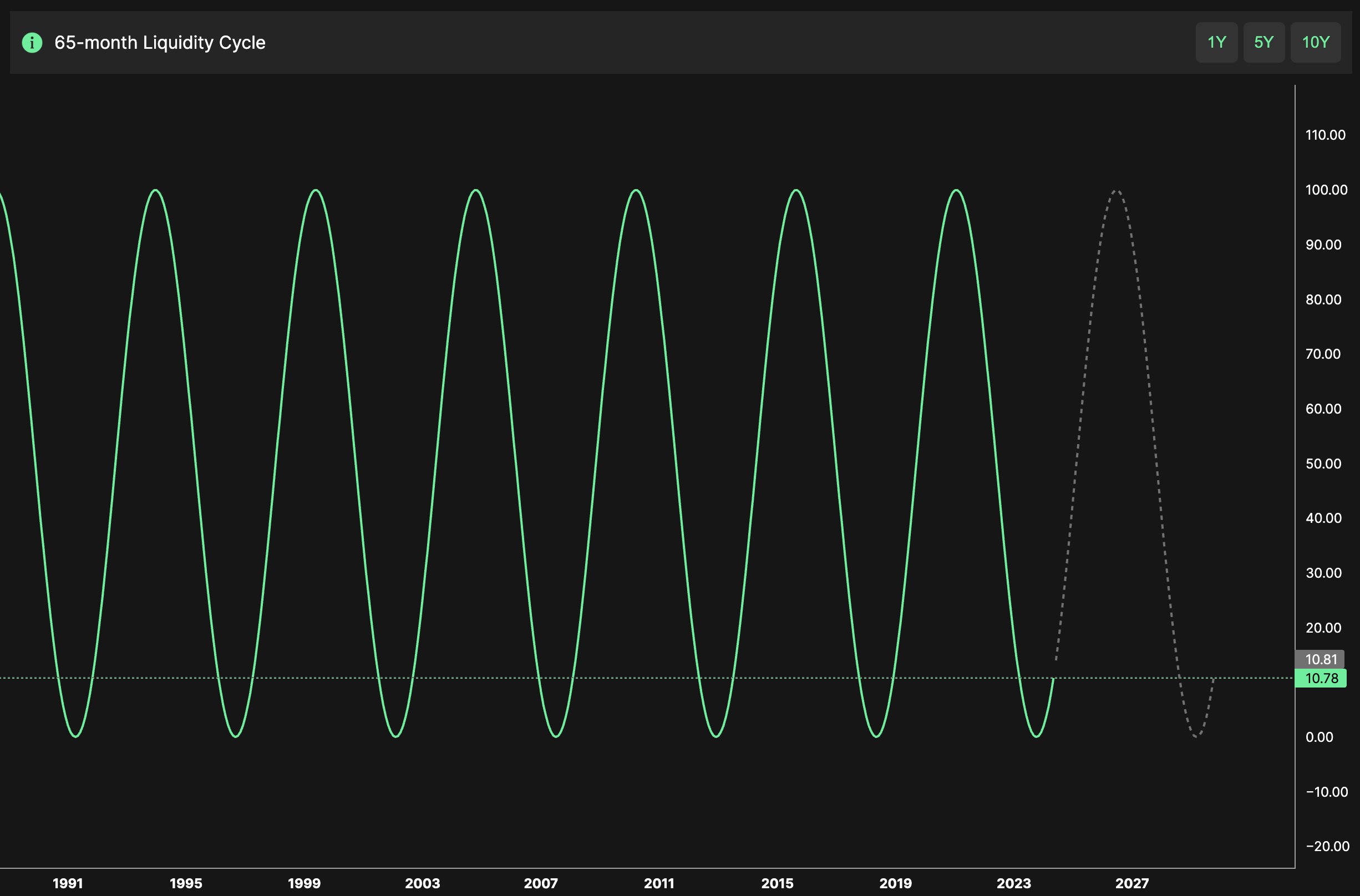

#1 65-Month Liquidity Cycle

Ted highlights the 65-month liquidity cycle, a historic sample that marks the ebb and move of liquidity in monetary markets. In accordance with his evaluation, this cycle bottomed out in October 2023, signaling the start of a brand new enlargement section.

“We are actually within the enlargement section, which is predicted to peak in 2026,” Ted said. This projection aligns with the anticipated easing by central banks in response to slowing financial knowledge over the following 18 to 24 months. Traditionally, elevated liquidity has been a precursor to bull markets in varied asset lessons, together with Bitcoin and the broader crypto ecosystem.

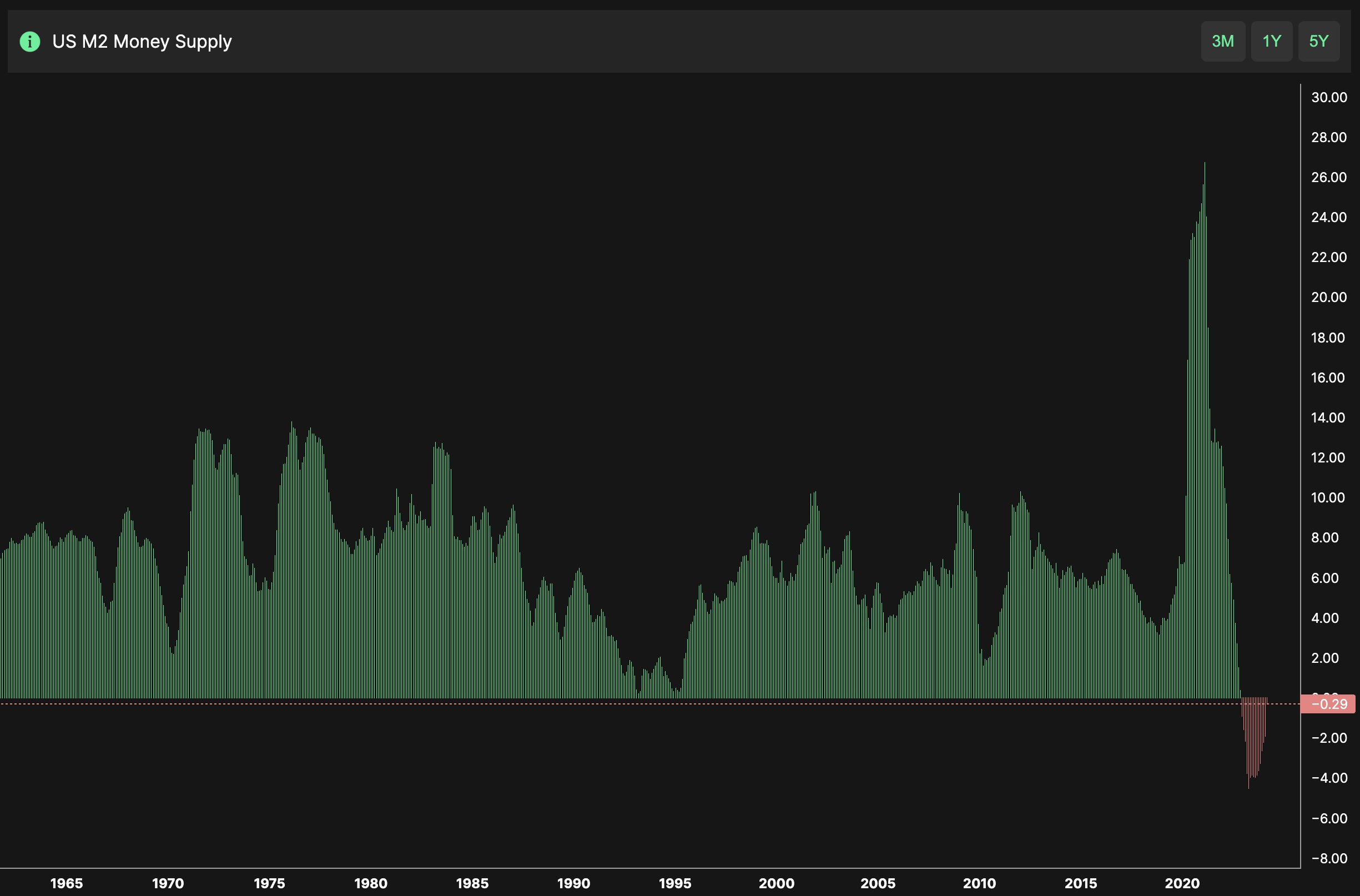

#2 M2 Cash Provide

The M2 cash provide, which incorporates money, checking deposits, and simply convertible close to cash, is one other essential indicator, if not a very powerful indicator of worldwide liquidity. Ted notes that the speed of enlargement within the M2 cash provide is at its lowest for the reason that Nineteen Nineties.

“There may be loads of room to the upside for alleviating liquidity situations,” he defined. As central banks doubtlessly ease financial insurance policies to stimulate economies, elevated M2 progress might result in extra capital flowing into threat property like Bitcoin.

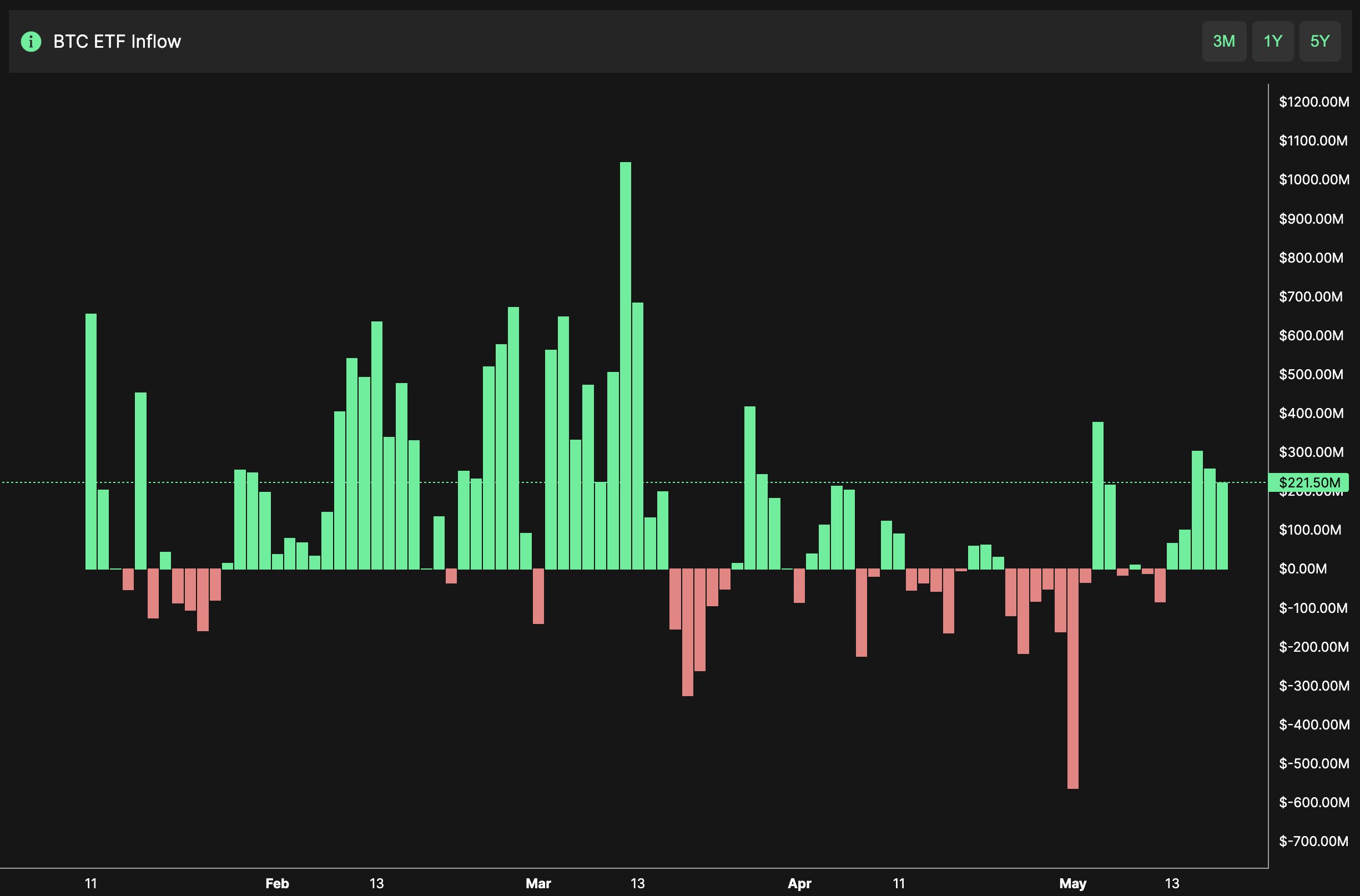

#3 Crypto Liquidity

Whereas liquidity has returned to the crypto markets, significantly with the introduction of spot Bitcoin ETFs, Ted factors out that the speed of inflows has not but reached the degrees seen at cycle tops. “The rate of influx has not but seen a manic section in keeping with cycle tops,” he famous.

Associated Studying

This implies that whereas curiosity and funding in Bitcoin are rising, the market has not but reached the speculative frenzy that sometimes precedes a serious correction. This section of measured influx can present a extra steady basis for continued value will increase.

#4 Spot Bitcoin ETF Flows

The US based mostly spot Bitcoin ETFs have seen vital inflows, with final week alone witnessing $950 million flowing into spot Bitcoin ETFs within the US, the most important web influx since March. Ted expects these inflows to extend as Bitcoin’s value rises and conventional finance traders regain confidence within the asset.

“Count on these to solely improve as value drifts larger and tradFi as soon as once more renew religion within the asset,” he said. The rising acceptance and funding from institutional traders by way of ETFs are a powerful bullish indicator for Bitcoin’s continued ascent.

Every of those elements factors to a sustained and sturdy bull marketplace for Bitcoin. Ted’s evaluation, grounded in conventional monetary indicators and crypto-specific knowledge, offers a complete outlook on the present and future state of the Bitcoin market. As central banks doubtlessly ease financial insurance policies and institutional curiosity continues to develop, the situations seem ripe for Bitcoin’s bull run to increase nicely into the approaching years.

At press time, BTC traded at $66,602.

Featured picture created with DALL·E, chart from TradingView.com