Are you a newbie who desires to discover what the inventory market has to supply or an skilled dealer trying to discover the most effective inventory market app to take your buying and selling journey to the subsequent stage? Then, you’ve come to the precise place. On this article, I’ll checklist the entire greatest apps for inventory buying and selling and investing. Which one is your favourite?

What Is the Greatest Inventory Market App?

Charles Schwab, Constancy, and Interactive Brokers are all among the many greatest inventory buying and selling apps available on the market. All in all, nevertheless, there are numerous nice inventory market apps and on-line brokers accessible on the market for passive and energetic merchants alike.

It doesn’t matter what type of investments you like, you could find one thing that can swimsuit you — the issue is discovering inventory buying and selling apps which are each dependable and have nice charges and low charges. Listed here are a few of the greatest inventory apps you get proper now.

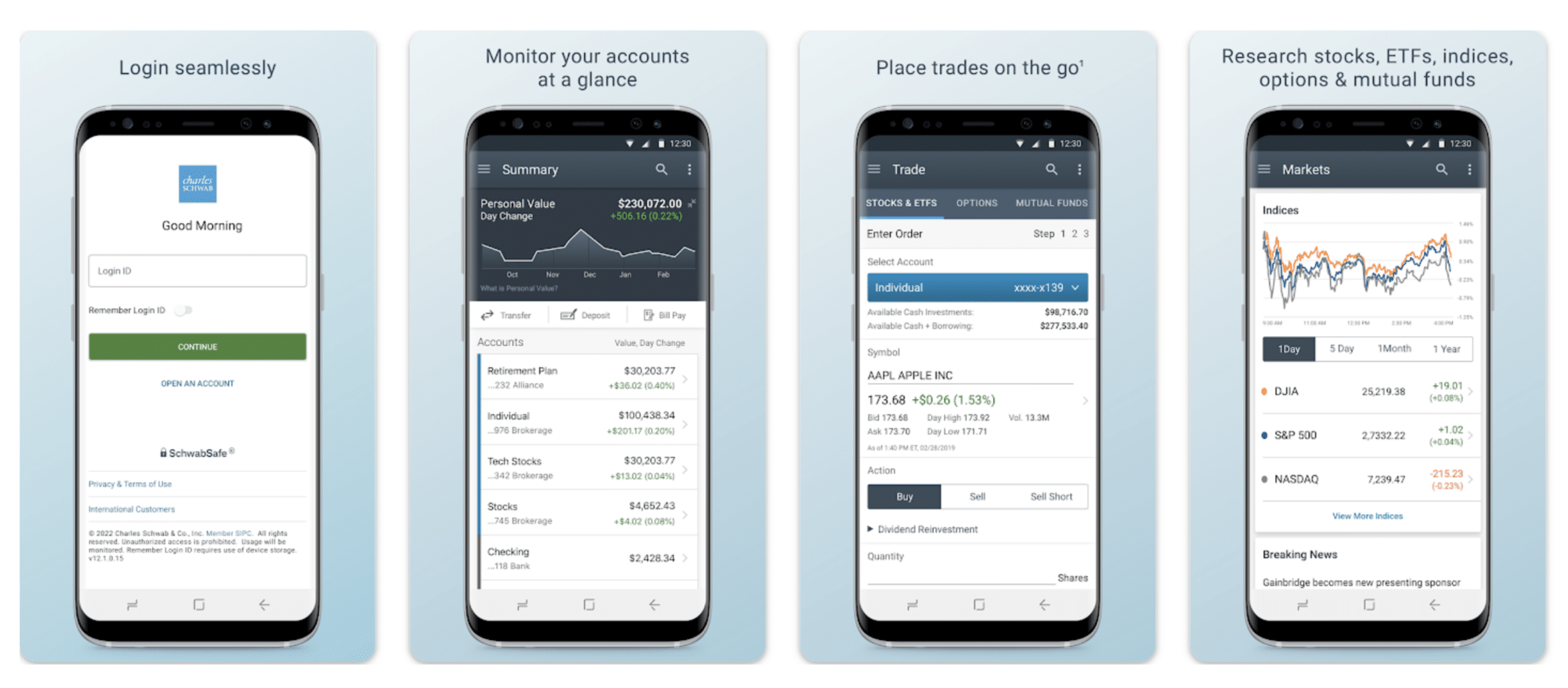

Charles Schwab

The Charles Schwab cell buying and selling app is extensively thought-about among the finest all-around choices for energetic merchants. As probably the most respected and trusted on-line brokers within the business, it has earned a fantastic status that can be backed up by the options and charges that it affords.

In 2020, Charles Schwab acquired TD Ameritrade, one other widespread buying and selling platform specializing in energetic buying and selling (it supported futures buying and selling, foreign exchange, and crypto buying and selling). In consequence, all TD Ameritrade person accounts had been moved to the Schwab platform.

Key Options

- Massive Fund Choice: Includes a huge array of funds with low expense ratios and no transaction charges.

- Superior Buying and selling Instruments: Attracts energetic merchants with $0 commissions on inventory and ETF trades.

- Academic Sources: Ultimate for newbies who want steerage on funding.

- Intensive Analysis: Gives each Schwab’s personal fairness scores and third-party analyses.

Professionals

- Gives 4 buying and selling platforms with out minimal charges.

- Nice cell app for buying and selling on the go.

- $0 price: Charles Schwab affords commission-free buying and selling on shares and ETFs.

- Complete analysis instruments for knowledgeable buying and selling choices.

- All kinds of commission-free inventory, choices, and ETF trades.

Cons

- The low rate of interest on uninvested money is likely to be a downside for some customers.

Charles Schwab is appropriate for each newbie buyers on the lookout for instructional assets and superior merchants looking for refined instruments and in depth analysis choices. It’s additionally a fantastic selection for these serious about accessing a big selection of funds with out transaction charges.

On the time of writing, Charles Schwab additionally had the Schwab Investor Reward program, which affords as much as $2,500 if you open and fund an eligible account with a qualifying web deposit of money or securities.

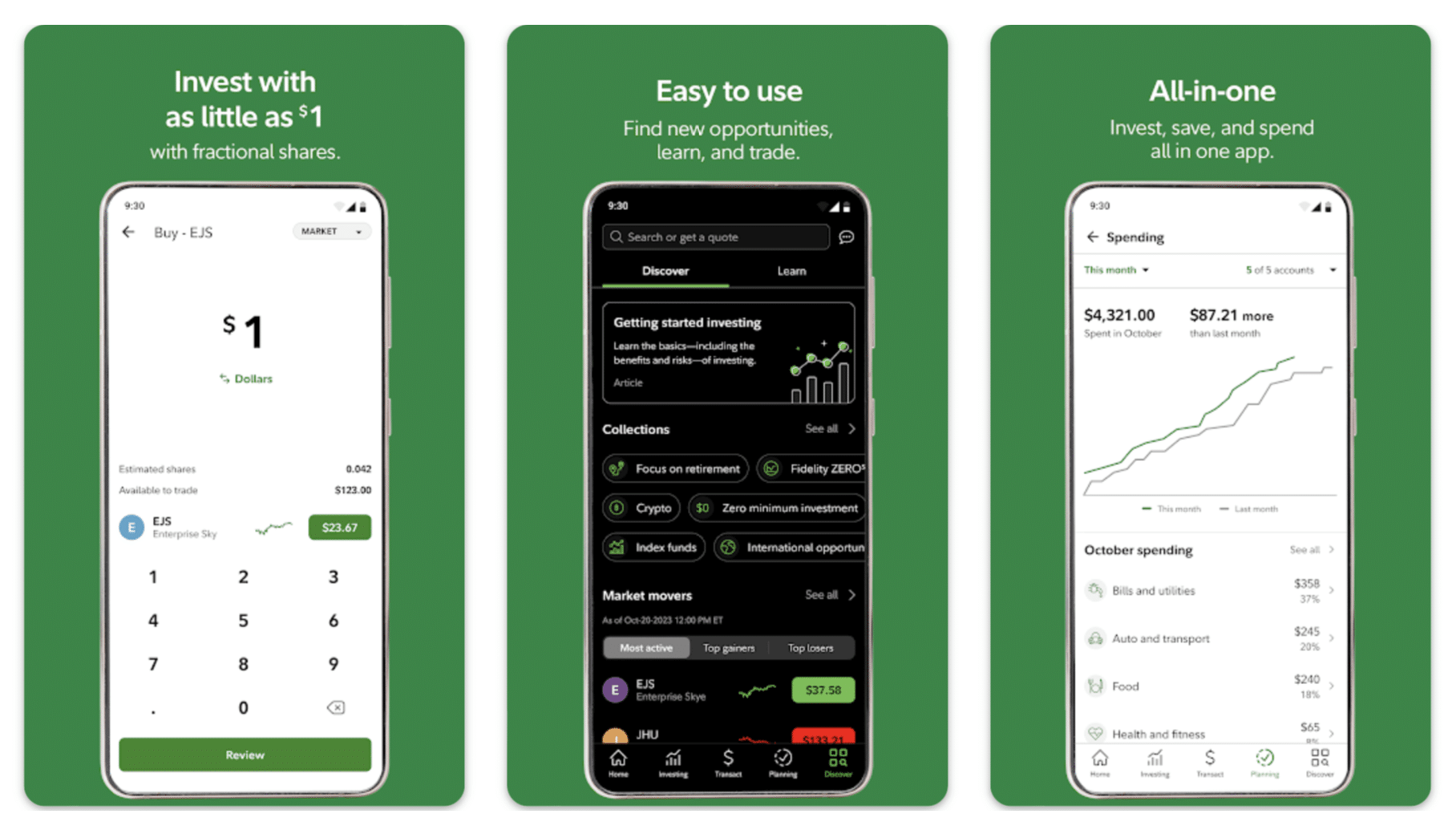

Constancy

Constancy is one other well-known and respected buying and selling platform that gives all kinds of various funding instruments. It stands out for its complete suite of companies, sturdy analysis instruments, and powerful buyer assist, making it a stable selection for buyers of all ranges of expertise.

Key Options:

- Fee-Free Trades: Gives $0 buying and selling commissions on shares, exchange-traded funds (ETFs), and choices.

- Analysis and Instruments: Entry to a broad vary of analysis suppliers and a top-notch cell app and instruments.

- Buyer Service: Identified for sturdy customer support.

- Index Funds: Offers expense-ratio-free index funds.

Professionals:

- Massive number of greater than 3,300 no-transaction-fee mutual funds.

- An excellent cell app with a excessive App Retailer score that makes buying and selling accessible and environment friendly.

- Excessive rate of interest on uninvested money, helpful for money administration.

Cons:

- Dealer-assisted commerce charges are on the upper facet, which is likely to be a consideration for merchants requiring private help.

Constancy is nice for newbies on account of its complete assets. Lively buyers may additionally respect its $0 fee trades and superior buying and selling platform. Its in depth mutual fund choices and no-expense-ratio index funds make it a horny possibility for long-term buyers as effectively.

SoFi Make investments

SoFi Make investments is a inventory buying and selling app that stands out for its dedication to offering a user-friendly and complete buying and selling expertise, particularly for these new to investing. Its concentrate on instructional assets and buyer assist additional provides to its enchantment for newbies.

Key Options:

- Fee-free trades: SoFi Make investments affords commission-free trades on shares, ETFs, and fractional shares.

- Good for all sorts of buyers: The platform is praised for its user-friendliness and powerful cell app expertise.

- Nice funding choice: Along with all the same old choices, it additionally supplies distinctive entry to IPOs, free monetary counseling, and no account minimums.

- Mutual funds: In 2024, SoFi added mutual funds to its line-up, enhancing its enchantment as a well-rounded funding platform.

Professionals:

- No buying and selling commissions and no account minimums make it accessible for newbies.

- Gives fractional shares, permitting funding in high-value shares with much less capital.

- Entry to free monetary counseling and IPO investments.

Cons:

- The rate of interest on uninvested money is taken into account low in comparison with some opponents.

SoFi Make investments is good for brand spanking new buyers looking for a simple entry level into buying and selling with the comfort of commission-free trades and a robust assist system that features monetary counseling. The addition of mutual funds and entry to IPOs makes it a extra full platform appropriate for a broader vary of funding methods.

On the time of writing, SoFi Make investments was providing as much as $1,000 in free inventory to customers who join through the cell app. This promotion is topic to phrases and may very well be a horny incentive for brand spanking new customers to discover the platform.

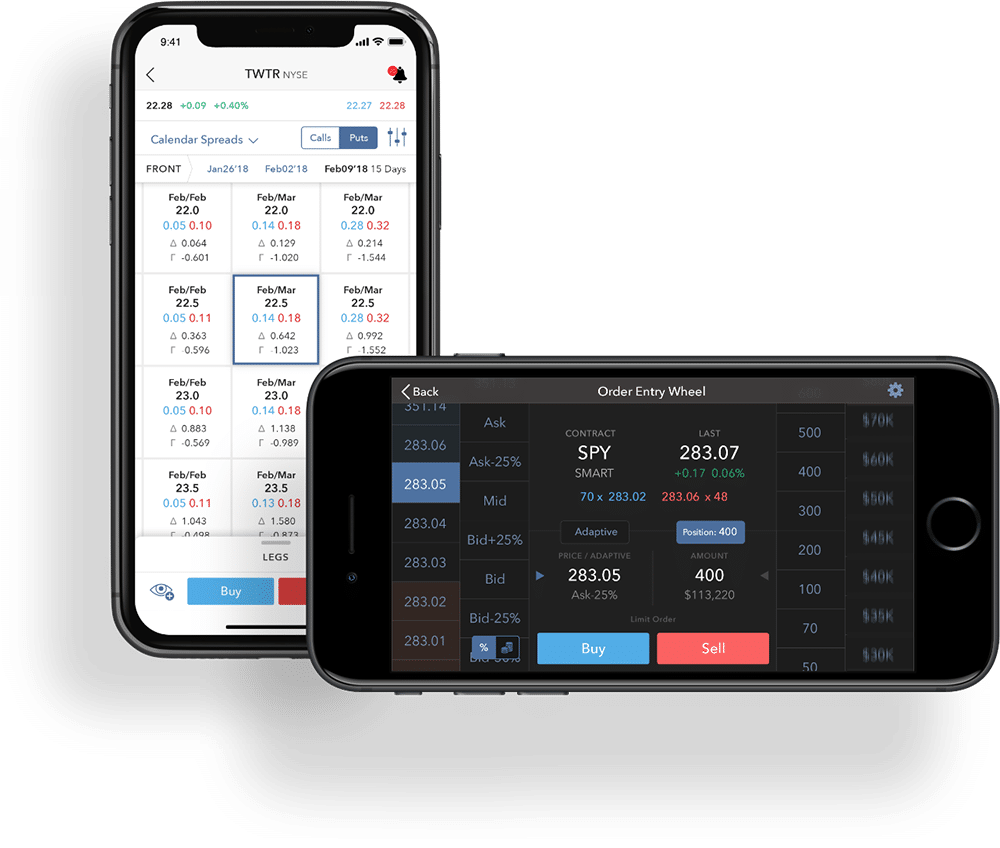

Interactive Brokers

Interactive Brokers is acknowledged for its superior buying and selling instruments and aggressive charges, catering to each novice and skilled merchants. Whereas the platform’s complexity could also be formidable to newbies, the wealth of options and funding choices may be extremely helpful to these keen to navigate its studying curve.

Key Options:

- Intensive Entry to International Markets: As one of many main on-line brokerages, Interactive Brokers supplies entry to over 135 markets in 33 international locations.

- Aggressive Margin Charges: Gives a few of the lowest margin charges within the business, making margin buying and selling extra accessible and cost-effective for merchants trying to leverage their investments.

- Complete Information Feeds and Analysis: This contains real-time knowledge, market evaluation, and forecasts to assist merchants make knowledgeable choices.

Professionals:

- Aggressive low buying and selling charges and excessive curiosity on money balances.

- Broad vary of funding merchandise throughout world markets.

- Low Minimal Funding Requirement.

- Entry to a big selection of analysis instruments and assets.

- Excessive-quality order execution.

- No inactivity price and low withdrawal charges.

Cons:

- The account opening course of and desktop platform may be complicated for newbies.

- Customer support would possibly really feel understaffed at instances.

IBKR fits energetic merchants who worth a strong buying and selling platform with superior options and aggressive charges. It’s additionally a robust possibility for these serious about worldwide buying and selling and a variety of funding choices. Learners might discover the platform complicated, however the potential studying curve is worth it for accessing highly effective funding instruments.

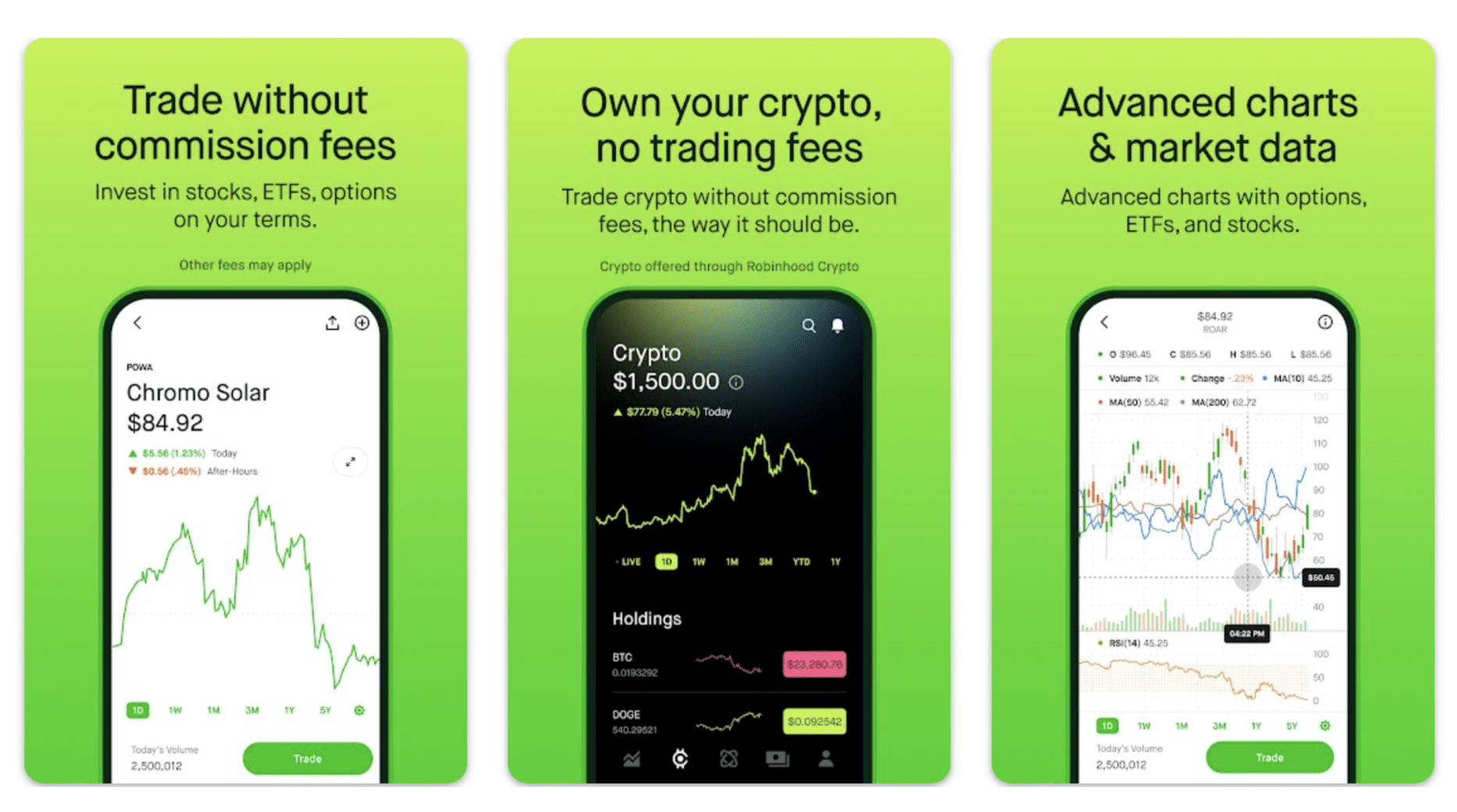

Robinhood

The one which, arguably, began all of it: Robinhood was the entry level for lots of informal merchants.

Robinhood’s strategy to democratizing investing has considerably impacted the brokerage business, prompting many to supply related zero-commission buying and selling choices. Whereas it has opened the doorways for a lot of new buyers, it’s important to weigh its options, professionals, and cons in opposition to particular person funding targets and techniques.

Key Options:

- Fee-Free Trades: Robinhood is legendary for pioneering commission-free trades in shares, ETFs, choices, and cryptocurrency.

- Fractional Shares: Robinhood helps fractional share buying and selling, permitting buyers to purchase a bit of a inventory or an ETF with as little as $1.

- Nice for New Buyers: The platform is widely known for its simplicity and intuitive cell app design, making it very user-friendly for newbies.

- Entry to Cryptocurrency Buying and selling: Distinctive amongst many on-line brokerages, Robinhood affords the power to make cryptocurrency trades alongside conventional funding choices.

Professionals:

- Zero fee for trades, together with cryptocurrency and choices buying and selling.

- No minimal deposit requirement.

- Offers fractional shares, enabling funding in high-value shares with much less capital.

- Gives an IRA with a 1% match on contributions, encouraging retirement financial savings.

Cons:

- Buyer assist is reported to be restricted, which may probably have an effect on person satisfaction.

- Has confronted reliability points prior to now, together with outages and commerce restrictions throughout risky market durations.

Robinhood is most helpful for brand spanking new buyers trying to dip their toes into investing with out hefty charges or for buy-and-hold buyers preferring a hands-off, minimalist strategy to managing their portfolios. Its intuitive app design and simplified buying and selling course of also can enchantment to cell customers who prioritize comfort and ease of use over superior buying and selling instruments and analysis capabilities.

The platform’s strategy to funding, which emphasizes ease over detailed evaluation, makes it a horny possibility for newcomers however might fall brief for these looking for in-depth analysis instruments or a wider vary of funding choices.

The right way to Spend money on Shares

Investing in shares is a wonderful solution to construct wealth over time, interesting to everybody from the passive investor to the superior investor.

Earlier than diving in, it’s essential to know the fundamentals of the inventory market and the totally different investing methods accessible. One of many first steps is to decide on a good brokerage service that aligns along with your funding targets and expertise stage. These platforms provide entry to a wide range of funding choices, together with shares, bonds, ETFs, and IPO investing. Additionally they present important instruments like real-time market knowledge, which is significant for making knowledgeable choices.

When beginning your funding journey, it’s necessary to contemplate how a lot you’re keen to speculate. Many on-line brokerages now provide a low and even no funding minimal, making it simpler for newbies to get began.

Nevertheless, it’s not nearly how a lot you make investments but additionally the way you make investments. Diversifying your funding portfolio is vital to managing danger and reaching regular progress. Whether or not you’re a passive investor trying to set and overlook your investments or a sophisticated investor looking for to leverage complicated methods, there’s a spot for you out there. It could even be helpful to seek the advice of with monetary planners or make the most of assets supplied by your brokerage to reinforce your understanding of the market.

Listed here are some suggestions that will help you begin investing in shares:

- Begin Small. Start with an quantity you’re snug with, even when it’s low, to get a really feel for the market. Many platforms enable buying fractional shares, making it simpler to start out small.

- Educate Your self. Reap the benefits of instructional assets supplied by brokerage companies and unbiased platforms. Understanding investing methods, market developments, and the mechanics of IPO investing can considerably enhance your funding choices.

- Make Use of Expertise. Don’t hesitate to make use of apps and platforms that present real-time market knowledge and analytics. This may also help you make extra knowledgeable choices and keep up to date on market actions.

- Diversify Your Portfolio. Unfold your investments throughout totally different asset lessons to mitigate danger. Together with shares from varied sectors, bonds, ETFs, and even exploring IPO investing can present balanced progress.

- Contemplate Your Monetary Objectives. Align your funding selections along with your long-term monetary targets. Whether or not saving for retirement, shopping for a home, or accumulating wealth, your targets ought to affect your investing methods and danger tolerance.

Bear in mind, investing is a marathon, not a dash. Persistence, steady studying, and staying knowledgeable are key to navigating the inventory market efficiently.

FAQ

What’s the greatest inventory market app for newbies?

Robinhood is among the greatest inventory market apps for newbie buyers. There’s a motive why numerous customers obtained launched to the inventory market by way of it: in some ways, this app democratized inventory market buying and selling. Robinhood is extremely regarded for its simple interface, making it easy for newcomers to commerce shares and even simply purchase shares of inventory.

The perfect app for a newbie is one which balances simplicity with the depth of options, providing superior instruments when the person is able to progress, all whereas preserving a finger on the heart beat of market information.

The right way to discover shares to purchase?

Discovering shares to purchase requires a mix of analysis, technique, and the precise instruments. Begin by defining your investing methods and targets. Are you a passive investor on the lookout for long-term progress, or are you extra aggressive, serious about IPO investing or high-volatility shares for short-term positive factors? Make the most of brokerage companies that provide complete real-time market knowledge and superior instruments for evaluation.

Cellular buying and selling apps like Constancy are famend for his or her in-depth market information, analytics, and academic assets, serving to buyers determine promising shares of inventory. These platforms enable for an in depth examination of inventory efficiency, firm fundamentals, and market developments. Moreover, participating with monetary planners or utilizing instructional assets supplied by these apps can provide insights into market dynamics and funding alternatives, guiding your decision-making course of.

What are the most effective funding apps?

On the subject of the most effective funding apps, the main target is on versatility, providing a variety of companies from cell platforms to superior instruments for each newbies and superior buyers. Apps like Charles Schwab and Interactive Brokers excel by offering a complete funding account expertise, together with entry to a variety of funding choices, real-time market knowledge, and personalised recommendation from monetary planners.

These platforms stand out among the many greatest inventory buying and selling app choices on account of their potential to cater to a broad spectrum of funding wants, from easy inventory trades to complete portfolio administration, all accessible by way of cell apps for on-the-go buying and selling and investing.

What’s the most secure inventory funding app?

The most secure inventory funding app is one which, moreover sturdy safety features and dependable customer support, is backed by a good monetary establishment. For inventory merchants on the lookout for safety and peace of thoughts, apps like Constancy and Charles Schwab are sometimes thought-about among the many greatest inventory buying and selling apps. They supply in depth safety measures, together with two-factor authentication, fraud safety companies, and encryption of private and monetary info. These platforms are well-regarded within the business, making certain that customers have a safe setting for buying and selling shares.

What is an efficient free inventory buying and selling app?

A very good free inventory buying and selling app is one that mixes zero fee charges with a user-friendly interface and a stable vary of funding instruments. Robinhood is well known as the most effective inventory buying and selling app for these trying to commerce shares with out incurring hefty buying and selling charges. It’s designed with newbies in thoughts, providing a simple platform for inventory merchants to purchase and promote shares with out the trouble of additional prices. Moreover, Robinhood supplies entry to real-time market knowledge, making it a well-liked selection for buyers looking for a cheap and environment friendly buying and selling expertise.

Disclaimer: Please word that the contents of this text should not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native rules earlier than committing to an funding.