- Greatest general: Donorbox

- Greatest for fast and simple setup: PayPal

- Greatest for in-person donations and rising a donor base: Sq.

- Greatest for low charge charges: Helcim

- Greatest all-in-one, premium nonprofit resolution: iATS

- Greatest for speedy payouts: Stripe

Some nonprofit issues are very a lot in step with the usual challenges confronted by their profit-driven counterparts. And a few of their wants mirror these seen in state organizations within the public sector.

Living proof: accepting funds. Whereas the transactional mechanics are largely equivalent — cash is altering palms, transferring from one facet to the opposite — all the pieces else is completely different. Together with the terminology. It’s not a “buy” or a “sale”; it’s a “donation.” As such, non-profit organizations nonetheless want to make use of “service provider providers,” however may even want these providers to help a really completely different kind of transaction.

So, for these groups that want such an answer however don’t know the place to begin their search, we’ve compiled a round-up of prime contenders, an summary of their advantages and drawbacks, and a short breakdown of the optimum use circumstances for every.

Prime non-profit bank card processor comparability

Along with pricing, what’s value clarifying, and isn’t essentially intuitive at a look, is the excellence between cost processors and donation platforms. Processors are doubtless already acquainted to you — they’re those that deal with the trade of funds, or no less than take level on that course of. Donation platforms are completely different. Within the majority of circumstances, they don’t course of in any respect, however associate with one other model to offer these providers.

| Donorbox | ||||

| PayPal | ||||

| Sq. | ||||

| Helcim | ||||

| iATS | ||||

| Stripe |

Donorbox: Greatest general

Our score: 4.49

Let’s kick off our checklist with a transparent instance of a donation platform, so we are able to add extra clarification to that time.

Donorbox is a platform constructed to help and allow the operations of nonprofits. Just like how a CRM resolution would possibly cater to the wants of gross sales or help groups, donation platforms come loaded with bells and whistles curated for organizations that acquire funds with out exchanging a superb or service for them (in different phrases, the dictionary definition of “donation”).

Donorbox is a number one participant in that house, and whereas it doesn’t course of funds itself, it has loads of integration and interoperability choices. Backside line: in order for you an answer vendor that understands your use case effectively, already has foundational information of your typical wants, and provides tailored options that immediately deal with these wants, Donorbox is your greatest guess.

Why I selected Donorbox

Any time you might have a use case with very specific parameters, industry-specific instruments will likely be your greatest good friend. As a number one supplier of donation platform options, with constructive buyer suggestions and a formidable monitor document, Donorbox is a significant contender by any stretch.

One in all Donorbox’s standout options is recurring donations. The identical manner an ecommerce platform would possibly allow sellers to arrange month-to-month product subscriptions for his or her prospects, Donorbox can allow donations to be set on a repeating schedule. That manner, those that wish to give recurrently can set-it-and-forget-it, so to talk.

Pricing

- Commonplace: free (no month-to-month charge, simply platform and transaction charges).

- Professional: $139/month, plus 1.5% platform charge on every donation.

- Premium: customized; name for quote (plus 1.5% platform charge).

Options

- Superior performance like POS instruments, CRM options, and an in depth integration library.

- “Move-on charges,” the place donors can elect to pay for transaction prices, so that you obtain the complete worth of the donation.

- AI assistant, fundraising teaching, recurring donation help, and extra.

Execs and cons

| Execs | Cons |

|---|---|

|

|

PayPal: Greatest for fast and simple setup

Our score: 4.41

PayPal is clearly not a donation platform; it’s a extensively used cost resolution throughout the enterprise world, in addition to amongst shoppers. Regardless of this, it truly serves very effectively as an entry-level resolution for nonprofit organizations.

The familiarity and ease of PayPal’s interface are already big benefits, as is its no dedication, no month-to-month value, no hidden charges pricing construction. However, PayPal additionally provides lowered transaction charges for nonprofits, whereas nonetheless offering the identical reliable and reliable service that for-profit operations have relied on for years.

Why I selected PayPal

Once more, PayPal just isn’t a donation platform. It’s, nonetheless, some of the widespread processors utilized by donation platforms. So, if you happen to’re not fairly on the level but the place the superior performance and add-on options are well worth the funding, there’s a definite worth in slicing out the intermediary and lowering the variety of further charges that need to be paid every time a donation is made, no matter who picks up that individual tab.

And since PayPal has been round so lengthy, and so extensively adopted, it’s each an extremely acquainted person expertise, and simple to seek out suitable integrations for. In brief, there are few cost options that may get you up and working quicker.

Pricing

- No month-to-month subscription charges, simply transaction charges.

- Donations charges: 2.89% + “fastened charge,” or 2.99% relying on kind of on-line cost (e.g. Donate button, PayPal Checkout for Donations, and so on.)

- Further charge worldwide donations: 1.50%

- Charity transaction charge: 1.99% + “fastened charge” (discounted processing charge for 501c3 organizations)

- Further charge for worldwide charity transactions: 1.50%

*Word: the “fastened charge” is a predetermined charge primarily based on the foreign money acquired for cost.

Options

- Measurable reductions for charity transactions

- Extensively accepted and trusted cost platform

- “Donate button” makes it simple to facilitate accepting funds and inspiring notations.

Execs and cons

| Execs | Cons |

|---|---|

|

|

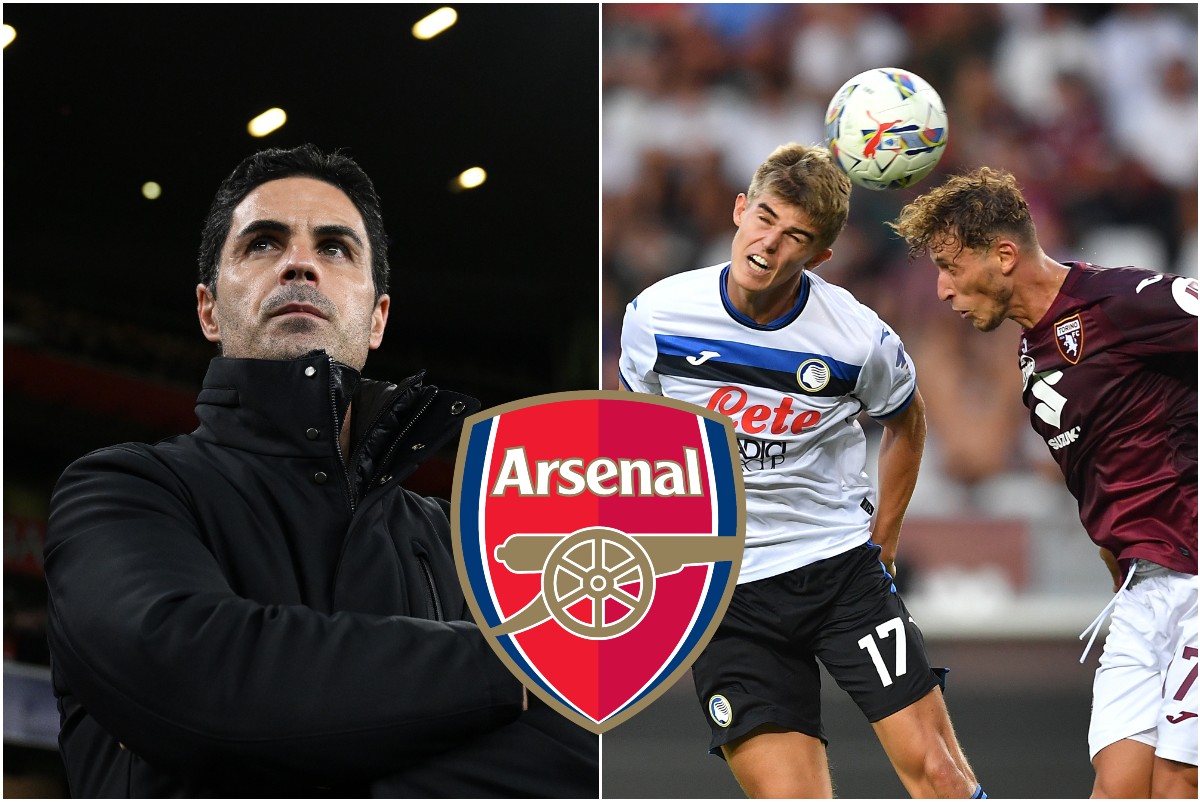

Sq.: Greatest for in-person donations and rising a donor base

Our score: 4.34

True to its repute as an {industry} pioneer in user-friendly POS options, Sq. is our choose for the best choice for accepting in-person donations. Like PayPal, Sq. isn’t a donation platform, or donor administration system. It’s, initially, a cost resolution, and the vast majority of what it has to supply falls below that umbrella. Regardless of this, it nonetheless has lots to supply nonprofit organizations.

In truth, past card readers, cost processing, and the like, Sq. provides a variety of adjoining options. Usually, these can be “enterprise providers,” however they will simply be repurposed for this use case. Their CRM performance, for instance, could be leveraged to ship newsletters, handle donor teams, acquire suggestions, monitor knowledge to assist determine points or fundraising tendencies, and extra.

Why I selected Sq.

Nonprofits thrive or wrestle primarily based on the help of their donor base. It follows, then, that the higher geared up you’re to develop and nurture your donor base, the more healthy your group will likely be in the long term.

For this reason I picked Sq.. Its POS {hardware} allows you to settle for donations in individual, encouraging you to combine and mingle with the folks, companies, and organizations that present the lifeblood of your mission. And their add-on providers, like their CRM device and payroll, can assist you run your nonprofit the best way a enterprise would.

Pricing

- Sq. POS: Free to make use of; 2.6% + $0.10 per transaction.

- E-mail advertising: beginning at $15/month.

- Textual content advertising: beginning at $10/month (plus messaging charges).

- Payroll: beginning at $35/month + $6/paid worker/month.

Options

- POS app is free to make use of; pay solely on transaction charges.

- Add-on providers like e-mail, textual content, donor listing, payroll, and so on. could make working the group simpler with out driving overhead to excessive.

- Get geared up to “promote” your group’s mission on to your donor base, and construct constructive repute and public picture the old school manner.

Execs and cons

| Execs | Cons |

|---|---|

|

|

Helcim: Greatest for low charge charges

Our score: 4.31

Within the non-profit house particularly, there will likely be circumstances the place value is probably the most impactful issue. For organizations that must profit from each donation greenback that is available in, Helcim is our choose to maintain these prices down so far as potential.

To begin, Helcim provides a number of the lowest commonplace charges within the enterprise, throughout all kinds of cost sorts. What’s extra, Helcim additionally provides pass-on charges, in order that donors will pay the price of making their donation. As a outstanding participant within the cost processor house, Helcim has loads of constructive factors to advertise right here. However the best way they assist nonprofits decrease the prices of accepting donations is probably the most important amongst them, in my view.

Why I selected Helcim

As alluded to above, few distributors within the cost processor house provide as many choices and alternatives to restrict prices and cut back charges. These figures can actually add up, relying on the associated fee construction of the platform you’re utilizing. Even options like charge caps can solely accomplish that a lot, particularly if a lot of your fundraising goals at amassing giant portions of smaller donations.

For these causes alone, Helcim is a strong choose, and all of their different options (a lot of that are corresponding to manufacturers like PayPal, Stripe, Sq., and so on.) are simply icing on prime.

Pricing

- No month-to-month charges. Solely pay for transaction/processing charges.

- Nonprofit reductions utilized for Mastercard and Visa community playing cards (requires correct registration and verification).

- “Interchange Plus” pricing: Helcim doesn’t cost flat charges, as an alternative including their revenue margin (0.40% + $0.08) as a flat charge to the interchange prices of a given cost methodology. It’s a barely extra advanced system designed to make sure the most important reductions are handed on to you.

- Card interchange charges as little as 0.65% + $0.15 for registered charities, for a complete processing charge of 1.05% + $0.23.

Options

- “Interchange Plus” pricing maximizes your financial savings by passing on the advantages of low interchange charges to you immediately.

- Move-on/donor-covered charge choices enable donors to decide on to cowl the charges for his or her donations, additional driving down prices.

- Accessible choices for POS {hardware}, add-on providers, and extra.

Execs and cons

| Execs | Cons |

|---|---|

|

|

Options

- Cost processor and donation administration in a single.

- Settle for funds on-line or in-person, via integrations with Salesforce, and extra.

- Companion cellular app for on-the-go POS performance.

- Superior fraud prevention (a important value-add within the nonprofit {industry}).

Execs and cons

| Execs | Cons |

|---|---|

|

|

Stripe: Greatest for speedy payouts

Our score: 4.12

Stripe, like PayPal and Sq., are main names within the cost resolution house. They primarily cater to companies however have a number of specific options geared toward nonprofits. And although a lot of their choices and advantages are comparable, every has no less than one side the place they’ve the sting over the others.

For Stripe, it’s the pace of supply of funds. Sure, it’s extremely customizable, simply tweaked to embed or combine into numerous channels, and provides loads of enterprise providers as add-ons. However commonplace payouts are every day after a two-day delay, and you may choose into prompt payouts for a nominal further charge.

Not everybody wants cash in hand as quickly because it’s despatched. However for many who do, Stripe is our advice.

Why I selected Stripe

In a nutshell: get your funds as quick as potential. It’s Stripes’ most spectacular and standout characteristic on this context, no less than in my view. Stripe additionally has industry-leading API and SDK documentation if you happen to want a customized donation web page, app, or checkout. Moreover, if you happen to settle for worldwide donations, Stripe is our top-recommended worldwide cost gateway.

For extra info, learn our full Stripe overview.

Pricing

- No subscriptions or month-to-month charges. Solely pay for cost processing.

- Commonplace processing fee is 2.9% + $0.30 (somewhat increased than common, however nonetheless higher than most).

- Reductions from the usual fee for nonprofits and charities (however you’ll need to name in for particulars).

Options

- Straightforward-to-understand pricing, add-on enterprise options, and numerous choices for lowering transaction charges.

- A number of the quickest supply speeds for funds within the enterprise.

- Superior fraud safety.

- Companions with, and integrates effectively with crowdfunding platforms that help nonprofit fundraising.

Execs and cons

| Execs | Cons |

|---|---|

|

|

How do I select one of the best bank card processing for my nonprofit?

Selecting know-how options can really feel rather a lot like selecting a automotive to purchase. The identical sorts of qualities and traits come into play every time; it’s only a matter of what the customer wants from the “car” at that time. Value, reliability, flexibility, customizability — you already know the drill.

So as an alternative, let’s discuss concerning the much less widespread stuff.

What sort of nonprofit are you working?

This issues to a stunning diploma. Most of the reductions are conditional on correctly registering and/or verifying nonprofit/charity standing. In different phrases, the place it’s a must to register, and whether or not or not your nonprofit qualifies can closely impression the prices utilized to the donations you acquire. So we advocate you examine the effective print (and perhaps even name in to get the nitty-gritty specifics).

Who’s your donor base?

Some options will likely be extra advantageous if you happen to acquire fewer donations with increased greenback values, whereas others are the alternative. Some offers you choices for high-volume reductions. Some offers you instruments to work in the direction of a bigger footprint within the public consciousness. Some will let you move on donor charges, and a few donors might not truly be keen on that (although that final one appears to be the exception, not the rule).

What we’re making an attempt to say is that this: the character of your donor base, who they’re, how a lot they donate, and the best way they work together along with your cost resolution all matter much more than they usually do for companies. In a nonprofit context, folks provide you with cash not as a result of they’re shopping for one thing however as a result of they imagine within the trigger and wish to assist. And even small points or inconveniences can generally be the distinction in securing the donation.

The place are your donations coming from (and the place are you receiving them)?

Numerous suppliers and options (together with some on this checklist) keep in mind whether or not donations are home or worldwide. They could even keep in mind the precise foreign money of origin. Relying in your circumstances, which will certainly markedly impression the figures on your group. So, if in case you have entry to that info, use it when vetting options to see if you happen to’ll be underserved by a given platform.

Methodology

I needed to do a bit of additional digging and analysis on this matter. That stated, in the long run, we constructed our checklist a lot the identical manner we all the time do. We began broad, appeared on the main gamers and ceaselessly talked about choices within the house, and whittled issues down from there. Then we graded stated shortlist, and assembled the related information into this text.

Our checklist, and our grading, was achieved primarily based on important core components, together with pricing, software program options, {hardware} choices, person expertise, and reliability. We consulted branded advertising, overview aggregator websites like G2, hands-on demos, and free trials, in addition to suggestions and evaluations from present and previous customers.

We paid specific consideration to areas of performance that had been non-standard, in the event that they had been talked about within the model’s advertising as an obtainable characteristic, and whether or not or not evaluations indicated it labored as described.

Right here’s the precise standards that had been thought of:

- Pricing (30%): Transaction charges, month-to-month minimums, charge transparency, cancellation and chargeback charges, and whether or not or not discounted charges are supplied for nonprofit organizations.

- Options (35%): Accepted cost sorts, built-in fundraising instruments, integrations with different techniques like accounting software program and web site builders, whether or not or not it could save cost info for recurring donations, and settle for worldwide donations.

- Person expertise (20%): How simple it’s to navigate the person interface, how shortly donations are paid out into your checking account, general account stability and reliability, and buyer help.

- Person evaluations (15%): Capterra and G2 rankings, in addition to general recognition.

It’s all the time tough to get a complete image of what a tech resolution has to supply, particularly while you’re not capable of subject take a look at each processor immediately or discover the way it performs in several area of interest use circumstances. We’ve achieved our greatest to shut that hole right here and “fumble in the dead of night” in your behalf, that can assist you keep away from doing the identical at a lot larger value to your group.