Este artículo también está disponible en español.

Bitcoin (BTC) has been on a tear lately, hitting a number of all-time highs (ATH) ranges since Donald Trump emerged victorious within the 2024 US presidential elections. Though the highest cryptocurrency has witnessed a slight pullback previously 24 hours, rebounding to an earlier worth stage may spell bother for the bears.

Bitcoin Bears Might Be Beneath Bother

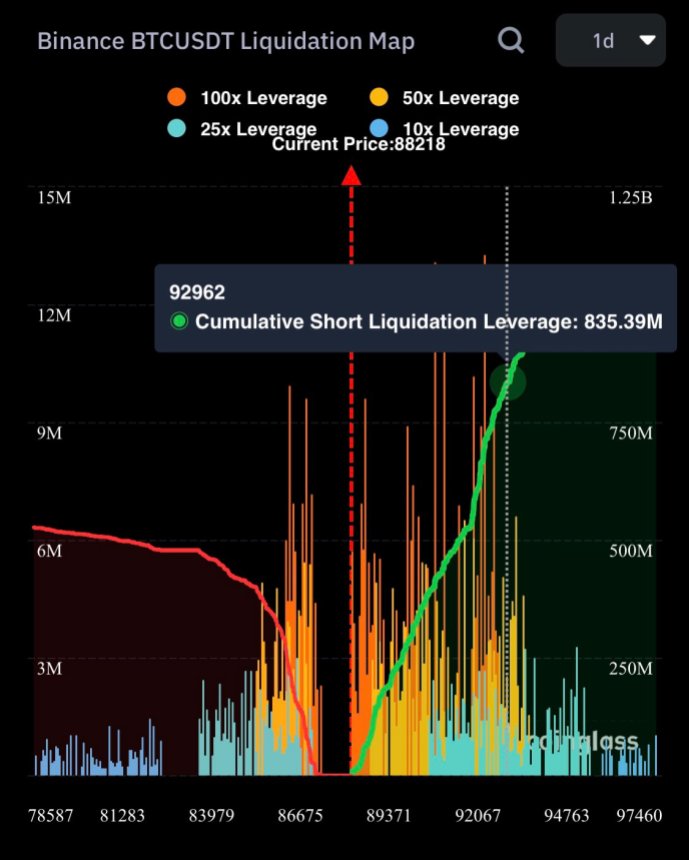

In response to evaluation shared by crypto analyst Ali Martinez on X, greater than $800 million is prone to liquidation if the flagship digital asset reclaims the $93,000 worth stage. Notably, BTC’s present ATH stands at $93,477.

Associated Studying

On the time of writing, BTC is buying and selling at $89,480, down 1.9% previously 24 hours. On the 4-hour chart, BTC’s subsequent outstanding assist stage seems to be across the $86,000.

The digital asset has already examined this assist stage 3 times, and an extra dip to this worth may ship BTC tumbling towards $81,600, its subsequent main assist. If BTC fails to carry above $81,600, a decline to $79,700 could comply with.

Whereas a decrease BTC worth would favor the bears, a reclaim of the $93,000 stage may severely damage them. Such a transfer would threat over $800 million in liquidations, doubtlessly forcing bearish merchants to capitulate.

Information from Coinglass reveals that contracts price greater than $508 million have been liquidated previously 24 hours. Of this, $355 million have been lengthy, whereas $153 million have been brief.

A current evaluation by outstanding crypto analyst @CryptoKaleo suggests that Martinez’s warning for bears could also be justified. In response to @CryptoKaleo, BTC may retrace to $86,000 earlier than embarking on one other rally to set new ATHs – presumably past $100,000. The analyst acknowledged:

Just a bit dip and a bit extra ranging then ship to $100K+. Actually suppose that is the most effective case state of affairs for alts if we by some means get it. Would search for outperformance whereas BTC is accumulating round $90K.

What’s Behind BTC’s Run?

A number of components have contributed to BTC’s historic worth motion, together with the halving earlier this 12 months, the approval of Bitcoin exchange-traded funds (ETFs), and rising institutional adoption of the digital asset.

Associated Studying

Nonetheless, Trump’s win within the 2024 US presidential elections – a consequence seen as pro-crypto – served as a significant catalyst for BTC’s surge. Since Trump’s victory on November 5, BTC has climbed from round $69,000 to a excessive of $93,000, recording positive factors of greater than 30% in simply 10 days.

Regardless of this spectacular worth rally, consultants recommend that BTC could have additional room to develop. As an example, a current analysis report predicts that BTC’s bullish momentum may proceed till mid-2025 when it’s anticipated to peak.

Moreover, comparatively low profit-taking throughout this bull run may additional propel BTC to new heights. Nonetheless, bulls ought to stay cautious of a major CME hole across the $78,000 stage, which could possibly be a magnet for worth correction.

On the time of writing, the overall cryptocurrency market capitalization stands at $2.904 trillion, reflecting a 3.7% decline over the previous 24 hours. In the meantime, Bitcoin dominance is at 60.97%, underscoring BTC’s continued energy available in the market.

Featured picture from Unsplash, Charts from X, Coinglass, and Tradingview.com