TLDR

- Bitcoin broke out of a possible bear market in response to realized value cohorts.

- Document-breaking BTC choices expired on Friday.

- On March 14, the U.S. authorities bought 9,861 BTC, and roughly 41,490 BTC stays.

- U.S. PCE knowledge is available in barely decrease than anticipated

- E.U core inflation hits all-time excessive

- UK home costs undergo the largest decline since 2009

- Deposit flight slows out U.S financial institution accounts

US

Financial institution panic slows

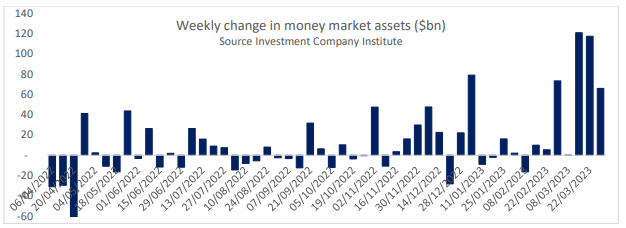

It’s been over two weeks for the reason that collapse of Silicon Valley Financial institution, and we’ve seen the ripple results it has brought on on different regional banks. However we’ve got but to see the complete extent of the fallout and potential contagion.

Up to now two weeks, depositors took out virtually $240 billion of deposits and moved them into treasuries/cash market funds to make sure a better yield. Nevertheless, this week deposit outflows have been diminished to $66 billion, which can sign panic is lowering.

PCE knowledge lowers barely

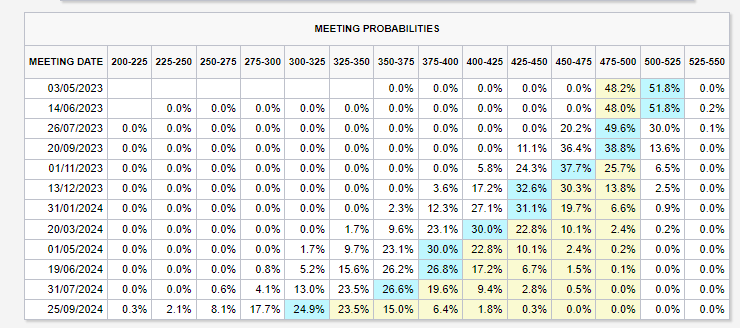

U.S. core PCE knowledge got here in beneath expectations. Nevertheless, it’s nonetheless thought of scorching and probably too scorching for the Fed’s liking. The following FOMC assembly will not be till Could 3, and it’s a 50/50 break up for a pause or a 25bps price hike. Many macro indicators are nonetheless to come back earlier than this assembly, together with; unemployment knowledge and CPI.

EU

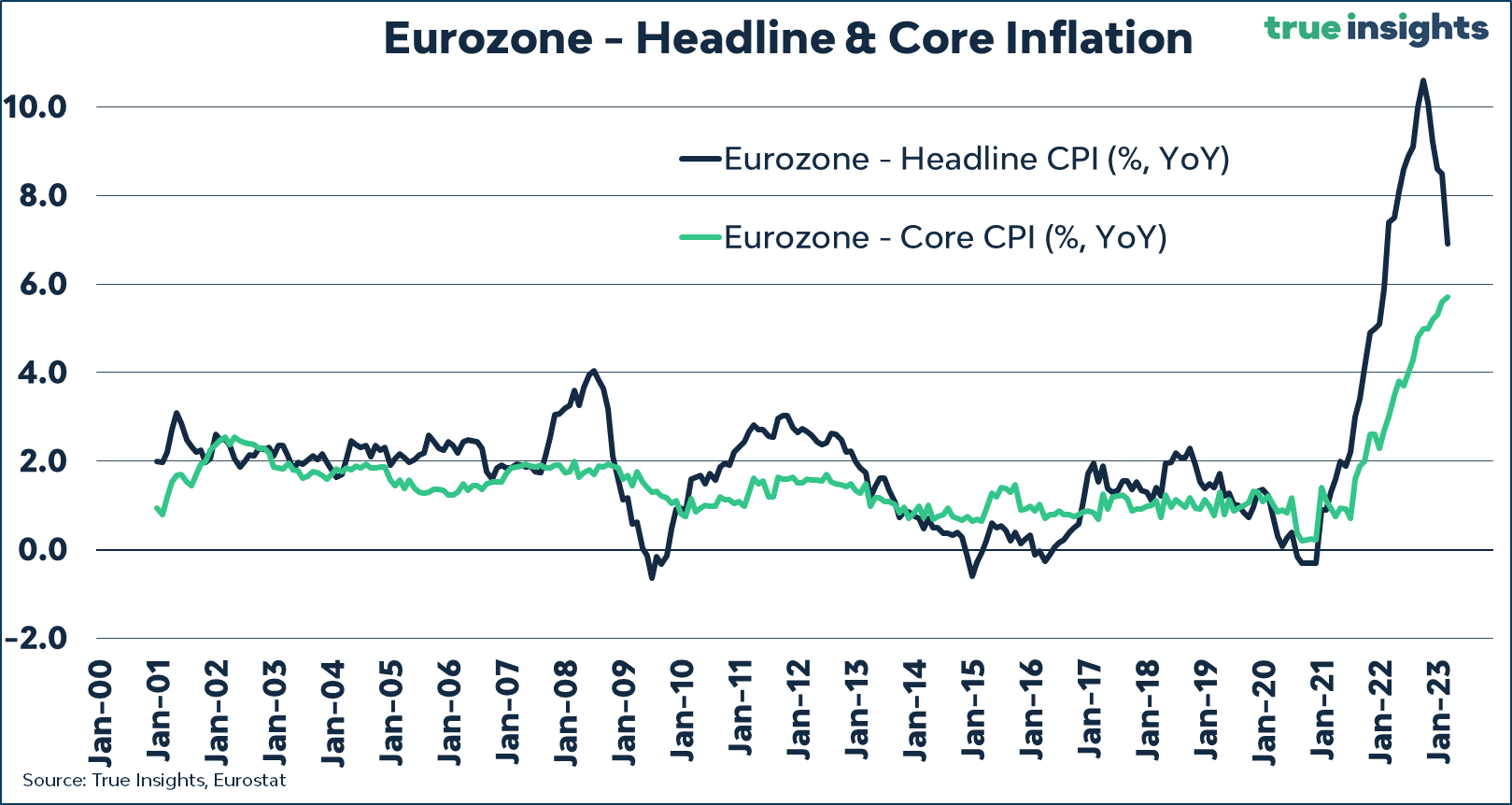

Sticky core inflation

CryptoSlate has mentioned this week that core inflation might be a lot tougher to carry down than CPI/headline inflation. E.U core inflation hit an all-time excessive of 5.7%. On the identical time, headline inflation fell to six.9% beneath expectations. Declining headline CPI vs. sticky core CPI would be the narrative for the quick time period.

UK

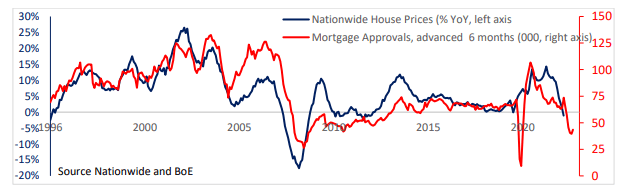

Housing is beginning to flip

UK home costs suffered the largest annual decline since 2009, with additional headwinds within the property market. Some causes embrace; growing rates of interest, double-digit inflation, and additional tax implications for buy-to-let landlords with an growing old inhabitants.

Downward pressures have occurred for nearly a yr within the property sector, with a 14-year low within the RICS survey, pointing to extra hassle forward.

Nevertheless, U.S. housing is beginning to stabilize, with the typical price on a 30-year mortgage coming down to six.45%. Nevertheless, the U.Ok. predominately on short-term charges, normally two or five-year mortgages. You need to anticipate to see a divergence between these two housing markets.

Bitcoin

Cussed Bitcoin and a few Q1 highlights

- Bitcoin hash price continues to impress with a new-all time excessive.

- A file quantity of stablecoins leaving exchanges and being transformed into Bitcoin

- Self-custody has elevated for the reason that collapse of SVB.

- ETH/BTC broke all the way down to new lows

- Choices contracts hit all-time highs, whereas futures contract makes new lows.

- Dwindling order books raises liquidity issues.

- A flurry of liquidations as buyers continued to get on the unsuitable aspect of Bitcoin

- The introduction of Ordinals has given Bitcoin a brand new lease on life

My Q1 ideas

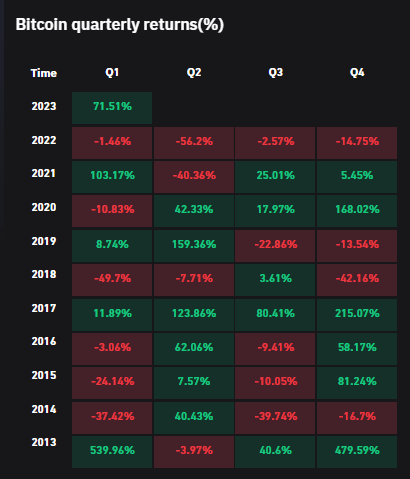

Bitcoin finishes off Q1 2023 up 70% with a value of over $28,000. That is amid a particularly difficult setting of continuation of price hikes, banking turmoil, and new liquidity packages being developed by the central banks.

The fed will hold charges elevated for so long as attainable till one thing almost definitely breaks whereas offering the market with as a lot liquidity as attainable. As we’ve realized, Bitcoin is probably the most susceptible to liquidity and stability sheet growth.

The basics of Bitcoin and the person have been examined to the max; we’ve seen file hash price, 1GB mempool, the explosion of Ordinals, and a mini banking disaster. On-chain factors to an imminent bull market, and the macro setting’s volatility will solely worsen. Bitcoin will thrive off this setting in the long run as belief will proceed to interrupt down between authorities/central banks and other people.