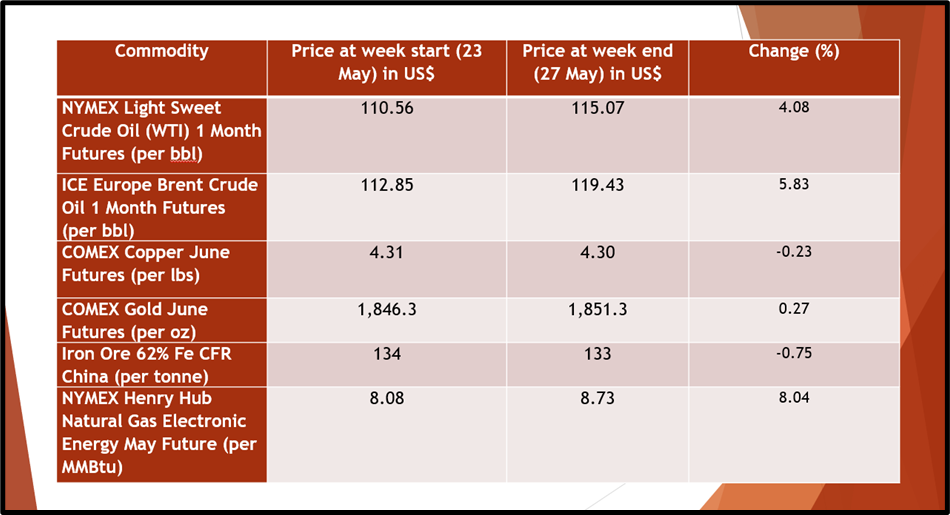

Costs of many of the commodities recovered final week. The benefit in COVID-19 associated restrictions in China, coupled with strengthening market fundamentals and sturdy demand for commodities in opposition to a tightening market backdrop has triggered a rally within the world commodity market.

Within the vitality area, the costs of Brent crude oil benchmarks gained greater than 4% whereas WTI crude oil futures logged a weekly soar of 5.83%. Each crude oil benchmarks exchanged arms over US$115/bbl on Friday. A major soar in each crude oil benchmarks was witnessed as traders weighted an anticipated demand restoration in China. Not solely crude oil, pure fuel costs additionally surged as a lot as 8.04% final week resulting from sturdy demand and decrease inventories.

Additionally Learn: Crude oil surges to 14-year highs on delays in Iranian talks

Picture supply: © 2022 Kalkine Media®

The benchmark Newcastle coal futures additionally consolidated close to US$406/tonne on Friday, supported by a robust demand in opposition to a tightening market backdrop. Although the costs of coal dropped 2.4% over the past week, the commodity has recorded substantial positive aspects currently resulting from growing demand within the energy technology sector.

Moreover, uranium costs gained greater than 2% within the final week on the expectation of demand restoration resulting from an ease in COVID-19 curbs in China.

Should Watch: As Russia-Ukraine Battle Intensifies, Commodities Additionally Soars

Speaking about valuable metals, the costs of each gold and silver logged a second straight weekly acquire. Comex gold futures gained 0.27% final week as a result of continued softness of the US greenback. Moreover, the demand for valuable metals has been rising as a safe-haven asset resulting from persistent geopolitical tensions and slower financial development.

The costs of base metals together with copper, aluminium, and iron ore costs tumbled considerably within the final week as COVID-19 restrictions in China and aggressive tightening coverage from central banks sparked considerations associated to weaker financial development.

On the flip facet, industrial steel zinc gained considerably within the final week. Moreover, the costs of battery metals lithium and nickel additionally gained marginally final week.

In opposition to this backdrop, let’s skim by a couple of commodities that had been common amongst merchants up to now week.

Information Supply: Eikon Refinitiv

Listed here are a couple of important commodities that recorded substantial volatility over the last week.

Pure Fuel

Final week noticed US pure fuel futures rise greater than 8% resulting from decrease inventories. The US Vitality Data Administration knowledge states that the present stock ranges are 15.3% beneath the 5-year common. The worth of the contract has greater than doubled for the reason that begin of 2022, supported by larger cooling demand within the US and sturdy worldwide demand.

Crude oil

Picture supply: © 2022 Kalkine Media®

Crude oil costs gained greater than 4.08% within the final week, recording the second straight weekly acquire. The costs reached their highest degree within the final three months on the prospects of upper demand in China after an ease in COVID-19 associated curbs. The costs had been additionally buoyed by rising considerations over future provide amid the European Union’s plan to ban Russian oil imports.