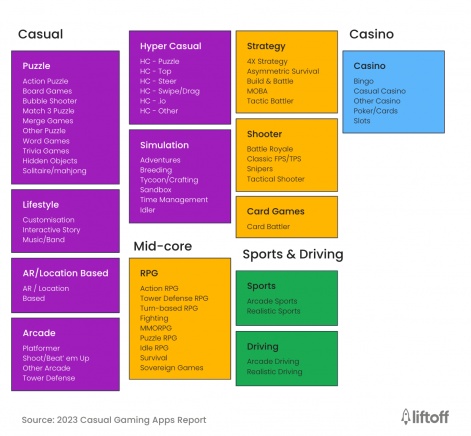

Over the previous few months query marks have begun to look concerning hypercasual’s longevity. Now, by way of a report from LiftOff the proof seems to point out that the style is actually in decline.

In accordance with the new report the hypercasual market has seen a 20% decline in set up share. From 50% in Q1 2021 to 30% in Q1 2023. That is partially attributed to IDFA, which impacted the advert monetization fashions utilized by many of those video games. As with many others nonetheless, LiftOff predicts that hybridcasual would be the means of the long run and factors to Voodoo’s Mob Management with its mixture of IAA (in-app advertisements) and IAPs as an thought of how this style will discover success.

The strolling hypercasual useless

Hypercasual’s fall from grace just isn’t fairly as dramatic as it could sound. The straightforward reality is that the ad-based monetization was sure to take a knock when IDFA kicked in. Hybridcasual manages to avert this by together with extra critical monetisation choices, akin to in-app purchases. Not solely that however the design and due to this fact improvement expertise and classes discovered from hypercasual can simply be introduced over to a hybridcasual title with solely minimal modifications to facilitate an extended life-cycle.

As LiftOff factors out with Mob Management, Voodoo has been slowly scaling their monetisation. Together with elevating the bar by including gacha mechanics and even battle-pass seasons, all of which would appear utterly at odds with the accepted notions of hypercasual recreation design. The growing variety of the style displays the precise mixture of sub-genres which drive cell gaming.

Competing priorities

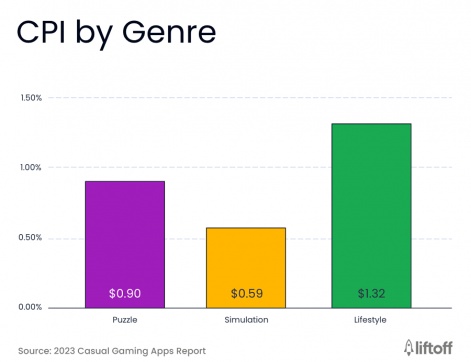

Different insights embrace CPI remaining low for Android at solely $0.63, however iOS being practically triple that at $2.23. Aggressive occasions additionally appear to be large winners, as the highest ten highest grossing informal video games all featured some type of aggressive play.

LiftOff offers the instance of Royal Match for the success of aggressive parts, the place key participant motivations that ranked extremely have been “pondering & fixing” and “finishing milestones.” Nonetheless, it additionally scored a lot larger than common on the “competing towards others” class for its style.

Mini-game insanity

One attention-grabbing part notes that minigames are ample, with 20% of the highest 200 grossing video games together with them. In fact not all of those are minigames as we would anticipate in main titles, with some being short-term and a few even being added to adjust to promoting requirements.

LiftOff identifies 4 core approaches. UA creatives that are “slapped on” and often are put in to adjust to promoting, UA inventive as a mode which provides them in as everlasting, minigame-events with short-term minigames and at last everlasting minigames designed to fluctuate core gameplay.

Is match3 oversaturated?

Match3 is notable for having one total dominating presence, which is the timeless eldritch monolith that’s Sweet Crush Saga. It was the title that arguably sparked the whole match3 craze to start with, and it stays probably the most common cell video games and hottest match3 titles to at the present time.

LiftOff notes solely two conventional match3 video games, BTS Island (themed after the megapopular Kpop boyband) and Backyard Affairs have managed to be succesful within the final two years. Merge video games, in accordance with them, are the style to observe by way of rising traits. With match3 dealing with stagnation it could simply be that this style finds a brand new Sweet Crush, whether or not from current titles or a brand new launch. As all the time, adaptation is essential.

As famous by head of analytics at GameRefinery (a LiftOff firm) Joel Hulkunen: “If cell recreation builders are to reach this aggressive panorama, it’s necessary to faucet into revenue-driving traits which might be proving to be a success with informal players. By adopting the newest traits, akin to hybrid parts and aggressive occasions, informal recreation builders can proceed to spice up engagement and retention whereas offering attractive alternatives for advertisers.”

Total, whereas the cell market is in a wholesome place, issues are positively altering. Whereas IDFA has succeeded in handing Apple extra management of its ecosystem, continued excessive CPI prices will probably squeeze builders and publishers. Nonetheless, the challenges offered and innovation essential to cope with the hypercasual recession will probably result in extra classes discovered throughout the whole thing of cell, not simply the emergence of the brand new hybridcasual style.