The Zig Zag indicator and Fibonacci retracements are standard technical evaluation instruments which will assist determine the market development and spot potential optimum entry factors. When merchants mix these devices, they may improve the accuracy of the evaluation and make knowledgeable buying and selling choices. So let’s check out how one can commerce with Zig Zag indicator and Fibonacci retracements combo.

The way to Commerce with Zig Zag Indicator?

In case you are already acquainted with this device and may confidently apply totally different Zig Zag indicator settings by yourself, be at liberty to skip this half and transfer on to the following part. Nevertheless, should you haven’t used the Zig Zag buying and selling indicator earlier than, right here’s a short overview of its most important options.

The Zig Zag indicator could also be helpful in figuring out the general market development. It focuses on main value swings, filtering out short-term value fluctuations. This permits merchants to see the larger development that is probably not seen instantly and select the optimum second to take motion.

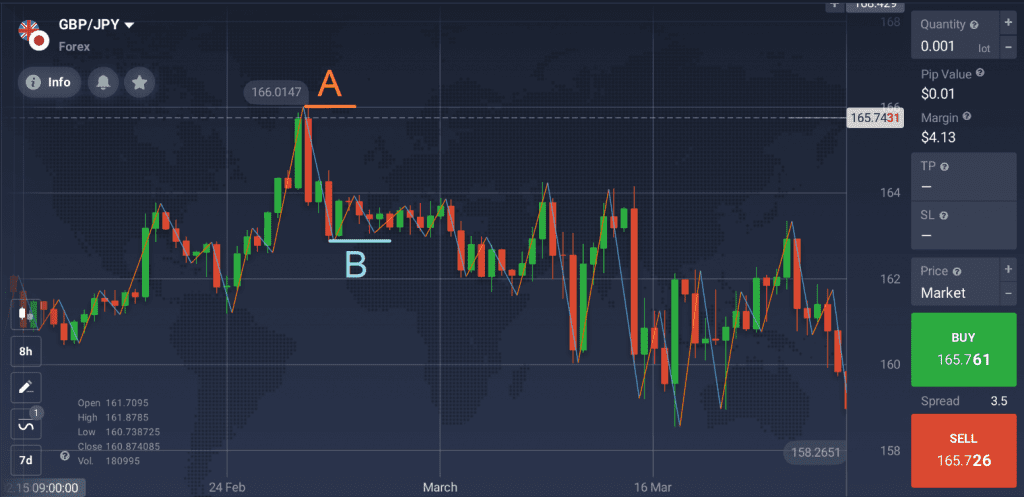

The indicator strains comply with the worth actions on the chart, transferring between swing excessive (mark A) and swing low (mark B).

When the worth change reaches a sure proportion, the Zig Zag indicator will draw a line to attach the earlier excessive and the following low factors. This creates a sequence of strains on the chart.

☝️

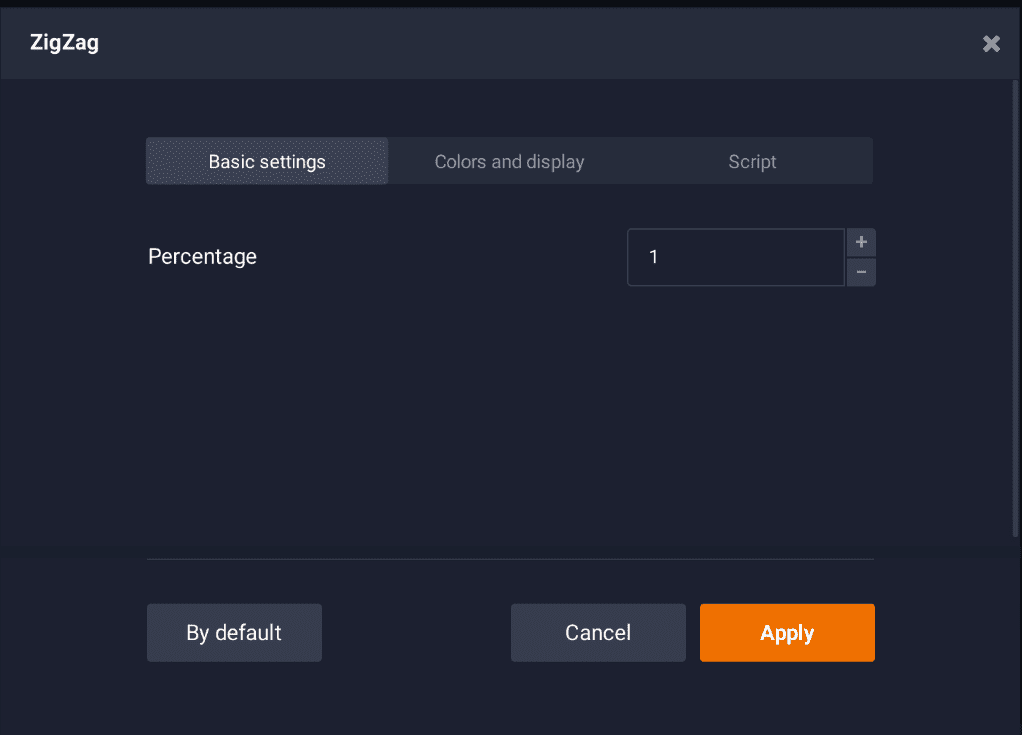

The default Zig Zag indicator setting on IQ Choice is 1%. Which means the indicator is not going to present value adjustments beneath 1%, filtering out minor value fluctuations. You could select the Zig Zag indicator settings based mostly in your private buying and selling strategy and desired accuracy.

To be taught extra about this device and its settings, please seek advice from the article Zig Zag: an Indicator to Remove Noise.

Buying and selling with Fibonacci Retracements

Fibonacci retracements current as a number of horizontal strains usually used to decide potential help and resistance ranges and determine upcoming development reversals.

Help and resistance ranges could also be thought of as limits that the worth would possibly take a look at whereas transferring within the general development course. When approaching one of many ranges, the development could also be anticipated to both proceed its motion or bounce again and reverse.

☝️

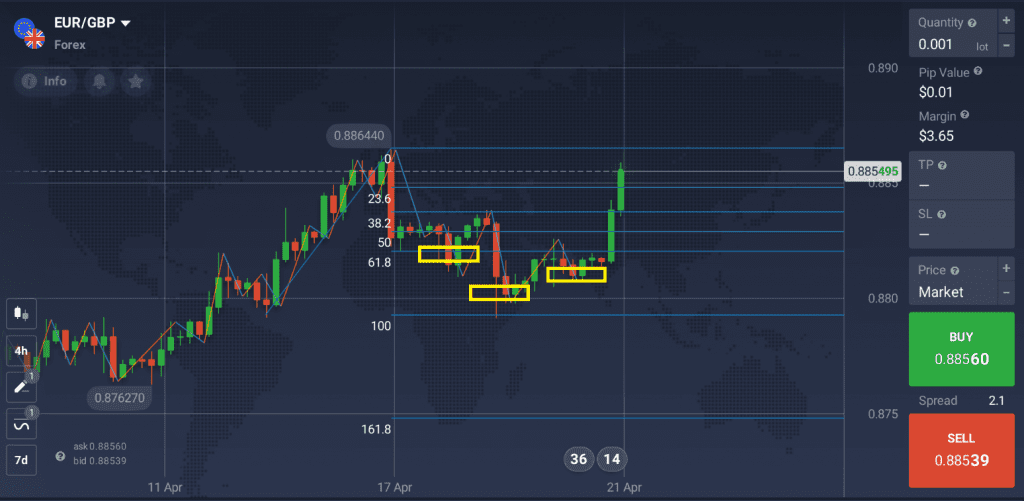

The primary thought of buying and selling with Fibonacci retracements is that the worth might typically bounce again to a earlier stage earlier than transferring in the primary development course. So merchants would possibly use this chance to open an extended (BUY) or brief (SELL) place throughout a retracement.

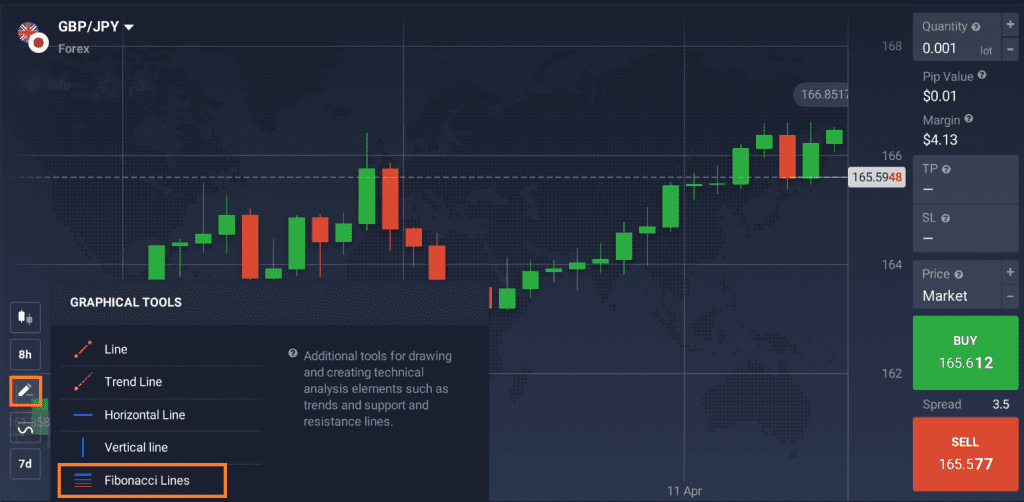

To make use of the Fibonacci retracements in buying and selling, go to the ‘Graphical instruments’ part of the IQ Choice traderoom and select the ‘Fibonacci Strains’ device. You’ll be able to choose the colour of the strains, in addition to their width.

To start out buying and selling with Fibonacci retracements, discover current excessive and low factors on the chart. For downtrends, click on on the swing excessive and drag the cursor to the newest swing low. For uptrends, do the alternative: click on on the swing low and drag the cursor to the newest swing excessive.

To be taught extra about this technical evaluation device, take a look at this text: The way to Commerce with Fibonacci Retracements.

The way to Commerce with Zig Zag Indicator and Fibonacci Retracements?

Although each technical instruments could also be used individually, merchants would possibly select to mix them to attempt to obtain extra correct outcomes. By making use of the Zig Zag buying and selling indicator and Fibonacci retracements collectively, it’s possible you’ll determine the optimum entry and exit factors to your offers.

- Decide the general market development utilizing the Zig Zag indicator. You could select totally different indicator settings relying in your targets. Remember that the upper the share, the decrease the accuracy.

2. Apply the Fibonacci strains device as defined within the earlier part to detect potential retracements.

3. Search for retracements, when the worth strikes in the other way to the general development.

For example, the general development recognized by the Zig Zag indicator is bullish (upward). On this case, merchants might look ahead to the worth to bounce again to the earlier stage and take this chance to open an extended (BUY) place.

Remember that no indicator can assure 100% exact outcomes. You could apply different technical instruments, such because the RSI or candlestick patterns, to verify your readings. Don’t overlook about risk-management instruments to guard your funds from unpredictable market circumstances.

In Conclusion

The Zig Zag buying and selling indicator and Fibonacci Retracements could also be thought of a robust and efficient combo for technical evaluation. By making use of these instruments, merchants might determine the primary development and spot retracements which may current buying and selling alternatives. You could select particular Zig Zag indicator settings to check totally different approaches and discover the very best buying and selling setup for you.