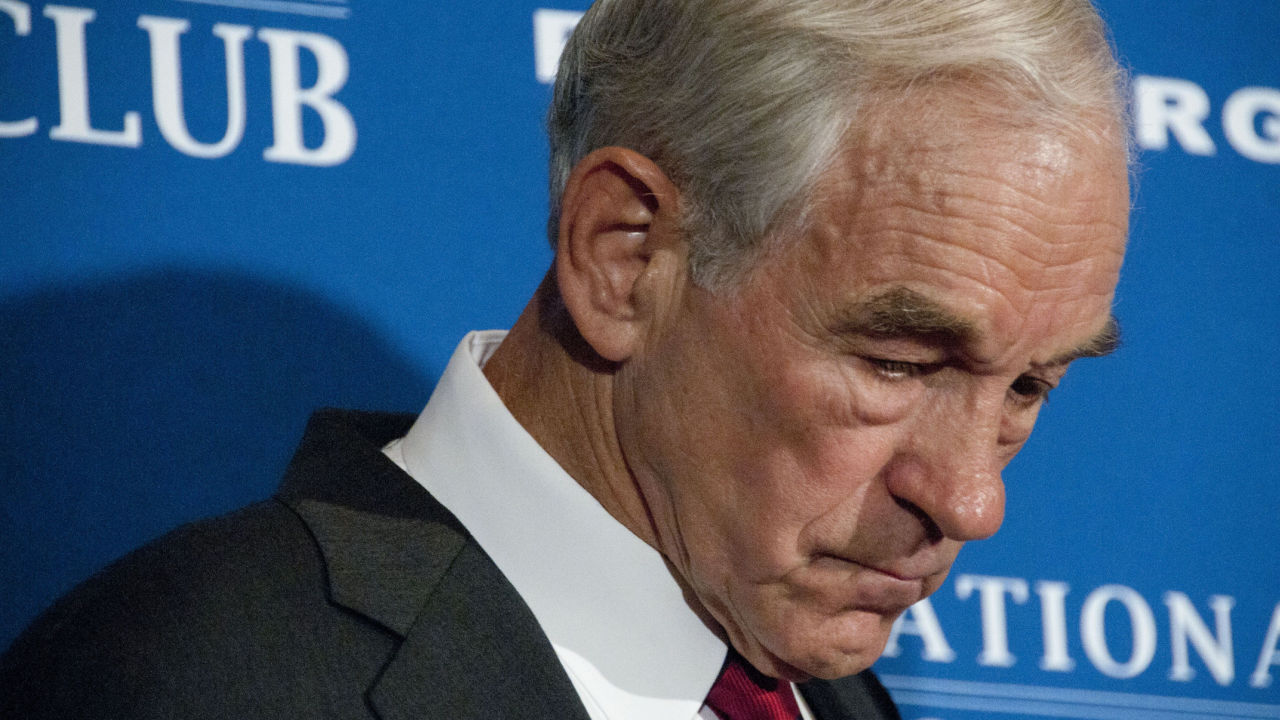

Former Home Consultant Ron Paul has introduced his stance in relation to the monetary disaster that the U.S. is at present going through. Paul said that the continued software of quantitative easing (QE), a coverage used to extend the cash provide, and the many years of virtually null rates of interest, are what nurtured the present monetary disaster the U.S. is going through.

Ron Paul Believes Federal Reserve’s Insurance policies Created As we speak’s US Monetary Disaster

Ron Paul, former consultant and presidential candidate, has not too long ago talked concerning the monetary disaster the U.S. is going through. In response to him, the insurance policies that the Federal Reserve utilized to keep up a welfare state at the price of creating deficits have created at this time’s monetary hardships for the nation.

Paul stated:

As we speak’s monetary hardships stem from the Fed’s decade of close to 0% charges and quantitative easing (QE). These created a decade’s price of uneconomic investments. Each dangerous thought conceivable obtained funding.

Paul criticized unfastened financial insurance policies he says allowed dangerous debt to be created with credit score going to non-profitable investments, and this case is now changing into unsustainable to the tightening of financial circumstances. Paul defined that “as a lot as a ‘hangover’ after the consumption of an excessive amount of alcohol is painful, so is it painful when a faux prosperity crashes with financial actuality.”

‘The Fed Is Unconstitutional’ however A part of the Resolution

Paul, a longtime critic of the validity of the existence of the U.S. Federal Reserve and its schools, praised the motion of the establishment that’s at present making an attempt to rein in inflation by elevating rates of interest, even when this has affected the banking system based on authorities spokespersons.

On this, Paul remarked:

Rising rates of interest beneath Powell are the remedy and highway again to some type of financial sanity. The Fed shouldn’t exist. It’s unconstitutional and immoral. However rising charges are usually not the supply of our issues. The large blunder was 0% charges and QE.

Paul has been alerting the general public concerning the development of the de-dollarization course of and the consequences that dropping reserve foreign money standing may need on the U.S. Whereas he believes that the de-dollarization course of has not too long ago accelerated, with the latest actions of the BRICS bloc, he said it will possible take longer than some predictions point out and that there is no such thing as a established timeline for this to occur.

What do you consider Ron Paul and his opinion concerning the function of the Federal Reserve within the U.S. monetary disaster? Inform us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Al Teich / Shutterstock.com

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss triggered or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.