Over the previous few days, the worth of Cardano has been in a downward development. This has led to the strengthening of bearish sentiment. Within the final 24 hours, ADA skilled a dip of roughly 4.2%. Over the previous week, the altcoin depreciated by near 10%.

These value fluctuations have raised considerations about buyers’ curiosity in Cardano. The identical is mirrored within the low shopping for energy and accumulation noticed on the charts. Cardano finds itself trapped inside a variety, missing a transparent value route, steadily eroding purchaser confidence.

The bears have gained energy, inflicting an vital help stage to be breached and subsequently remodeling right into a resistance stage for the altcoin. For Cardano to regain its earlier value ceiling, patrons should reenter the market.

Moreover, the broader market situations, together with Bitcoin’s consolidation across the $27,000 zone, have prevented many main altcoins, together with Cardano, from surpassing their quick resistance ranges. For ADA to beat its nearest resistance, it depends closely in the marketplace’s total energy. There was a decline in market capitalization, additional emphasizing the rise in promoting energy.

Cardano Value Evaluation: One-Day Chart

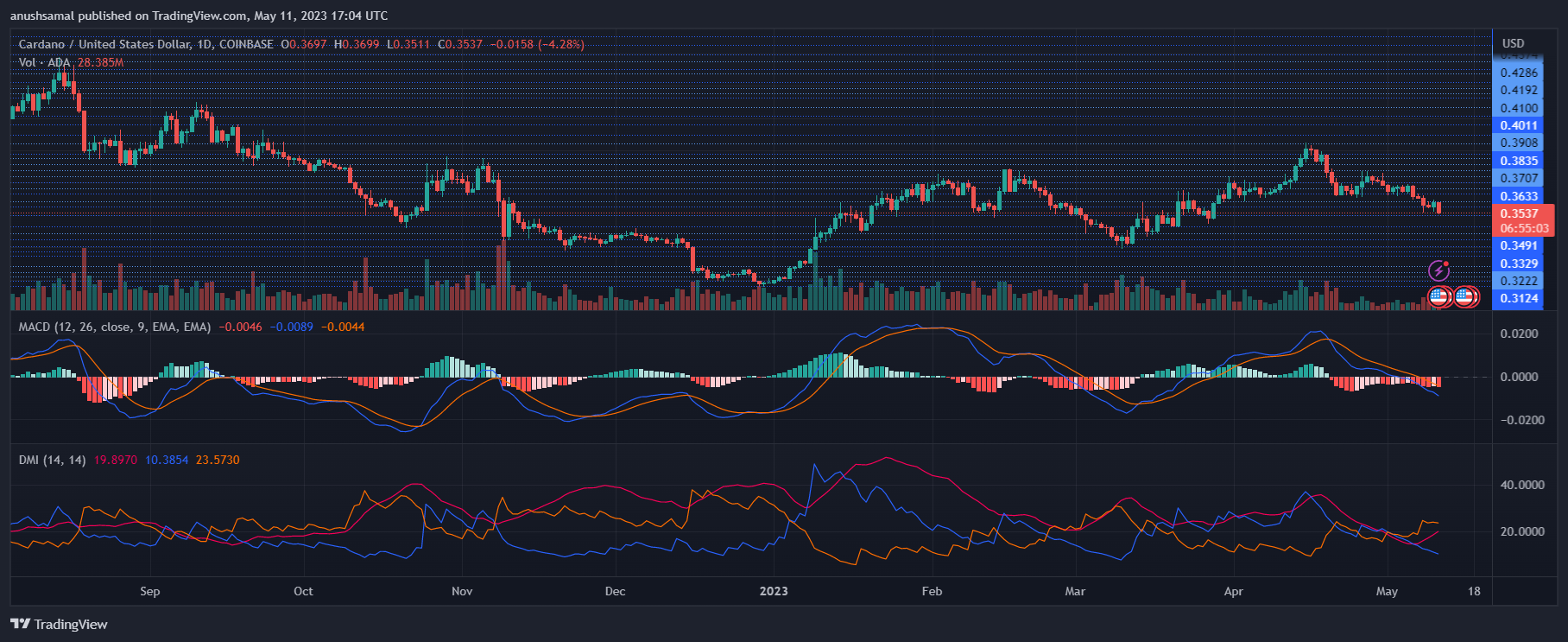

On the time of writing, the worth of ADA stood at $0.35, and it’s approaching a major native help stage that has performed an important function prior to now.

The closest help line is $0.34, whereas the overhead value ceiling is $0.36. The altcoin’s means to reclaim the resistance stage largely will depend on the bulls’ means to defend the worth above the quick help stage.

If the present stage experiences a decline, the coin is prone to first drop to $0.34, and if the promoting strain persists, it could additional decline to $0.33. It’s value noting that the amount of Cardano traded over the last session has decreased, indicating a decline in shopping for energy.

Technical Evaluation

Since ADA dropped beneath the $0.38 value stage, its shopping for energy has didn’t rebound. The Relative Energy Index (RSI) is beneath the 40-mark, indicating that ADA is nearing oversold territory on the every day chart.

Moreover, the asset’s value has fallen beneath the 20-Easy Shifting Common line, which means that sellers have taken management of the market’s value momentum.

ADA has generated promote alerts primarily based on varied indicators, suggesting a attainable decline in value. The Shifting Common Convergence Divergence (MACD) indicator, which reveals value momentum and reversals, displayed pink histograms related to promote alerts for the altcoin.

Moreover, the Directional Motion Index (DMI), answerable for indicating value route, confirmed a unfavorable development with the -DI line (orange) positioned above the +DI line (blue). This suggests a bearish sentiment out there.

The Common Directional Index (ADX) additionally tried to maneuver above the 20 mark. Nevertheless, it signifies a scarcity of energy within the present value development.

Featured Picture From UnSplash, Charts From TradingView.com