The Reserve Financial institution of Australia (RBA) has as soon as once more rocked the boat with its rate of interest resolution by embracing a price hike of fifty foundation factors. The newest resolution was taken within the June financial coverage assembly and represents the second consecutive hike after Could. The RBA had beforehand raised the money price by 25 foundation factors amidst hovering inflation and better prices of dwelling.

Although an rate of interest hike was largely anticipated, the most recent hike has surpassed expectations and gripped debtors by the throat, as their reimbursement prices will rise considerably. The back-to-back price hikes are occurring for the primary time in over a decade, because the central financial institution needs to maneuver again to pre-pandemic settings. The central financial institution has additionally elevated the rate of interest on Change Settlement balances by 50 foundation factors to 0.75%.

Rising inflation has been the central financial institution’s prime concern over the previous couple of months. Moreover, world elements have elevated uncertainty, with cargo delays and supply-chain snags disrupting enterprise exercise.

ALSO READ: How does Labor plan to assist first dwelling consumers?

Why did the RBA flip hawkish?

Central banks throughout the globe are elevating their rates of interest to take away the extra stimulus supplied to the economic system through the pandemic. The RBA, very like many different central banks, had decreased the money price to near-zero ranges throughout lockdowns. Nonetheless, this extra stimulus is feeding into the already excessive degree of inflation within the economic system.

What To Count on From Australian Economic system As New Authorities Takes Cost?

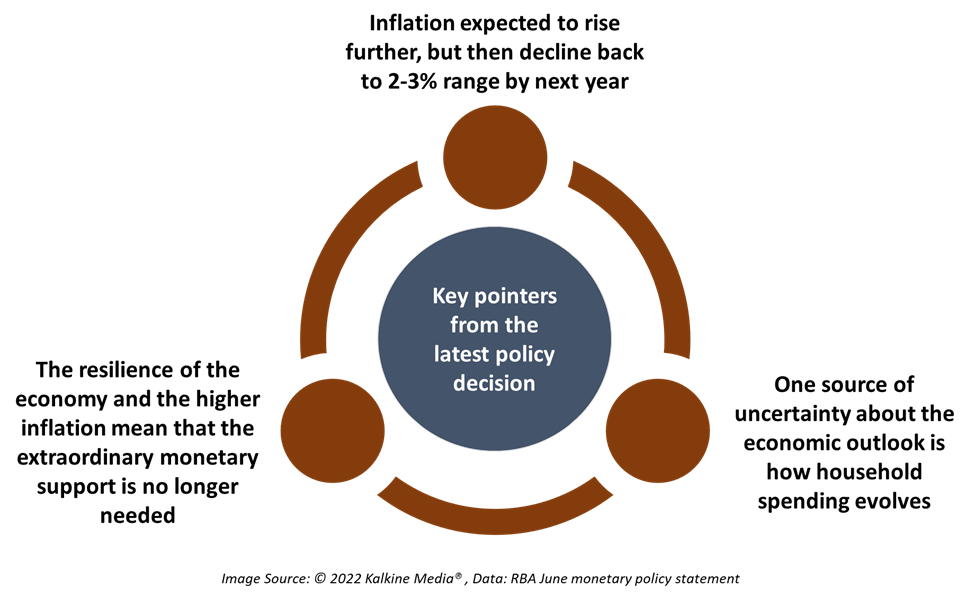

Given the resilience of the Australian economic system and the upper inflation, the RBA believes there isn’t any want for extraordinary assist now. Thus, it has determined to boost the rate of interest by 50 foundation factors within the newest resolution. The massive 4 banks had anticipated price hikes of solely as excessive as 40 foundation factors. One can say that the most recent resolution has been a shock for many.

In its earlier financial coverage minutes, the Reserve Financial institution highlighted that it had three choices for the dimensions of the speed hike: 15 foundation factors, 25 foundation factors and 40 foundation factors. Nonetheless, June’s price hike has exceeded all the present choices, paving a harder street forward for mortgage holders.

What are the important thing pointers mentioned on this month’s financial coverage meet?

- Home inflation decrease than different economies: The RBA highlighted that Australia’s inflation price is decrease than the speed seen in most different superior economies. Nonetheless, the present inflation price is increased than beforehand anticipated. Home elements comparable to capability constraints in sure sectors and a decent labour market are placing strain on costs.

- Additional will increase in inflation anticipated: Rate of interest hikes would take a while to point out full impact, and until then, inflationary pressures are anticipated to surge upwards. Increased gas and electrical energy costs have turn out to be the nation’s greatest level of concern. These increased vitality costs are prone to feed into ongoing inflation. Nonetheless, inflation might decline again to the 2-3% vary by subsequent yr.

- Family spending creating uncertainty: Family spending is the RBA’s space of concern within the present situation. Increased energy payments, hovering gas costs, and an uptick within the costs of shopper discretionary items may urge households to chop down on spending. Thus, financial exercise is feared to stay on the draw back within the coming months.

GOOD READ: Why is it exhausting to flee the unemployment lure?

What will be anticipated after the speed hike?

The speed hike is prone to curb shopper spending within the brief time period and additional dampen the demand for loans. With increased charges, international traders would possibly eye Australia as a possible marketplace for their investments.

The upper returns provided by the nation are anticipated to deliver international capital. In alternate, these international traders may demand Australian foreign money. Thus, the Australian greenback may respect additional. The identical phenomenon was seen because the Australian greenback flew increased as quickly as the speed hike announcement was made.

Besides for prime inflation, the RBA may have many extra causes to maintain elevating charges within the coming months.

ALSO READ: What does the most recent NSW voluntary assisted dying laws imply?