Over the previous few weeks, the worth of Tron (TRX) has skilled an upward motion. Nonetheless, it has struggled to interrupt by a vital resistance stage for a big time frame.

Within the final 24 hours, TRX noticed a 1% improve, whereas on the weekly chart, it recorded a 3% achieve. The bullish momentum has been maintained since surpassing the $0.68 worth stage. The technical outlook suggests a possible shift in direction of bullish affect.

Demand and accumulation indicators have proven enchancment within the day by day timeframe. Whereas Tron has managed to withstand the broader market sentiments affecting different altcoins, it stays weak to fluctuations within the Bitcoin worth.

To maintain its day by day features, it’s essential for TRX to surpass the quick resistance stage. Failure to take action might lead to a reversal of its upward pattern. The rise within the TRX market capitalization signifies that demand has began to revisit the market.

Tron Value Evaluation: One-Day Chart

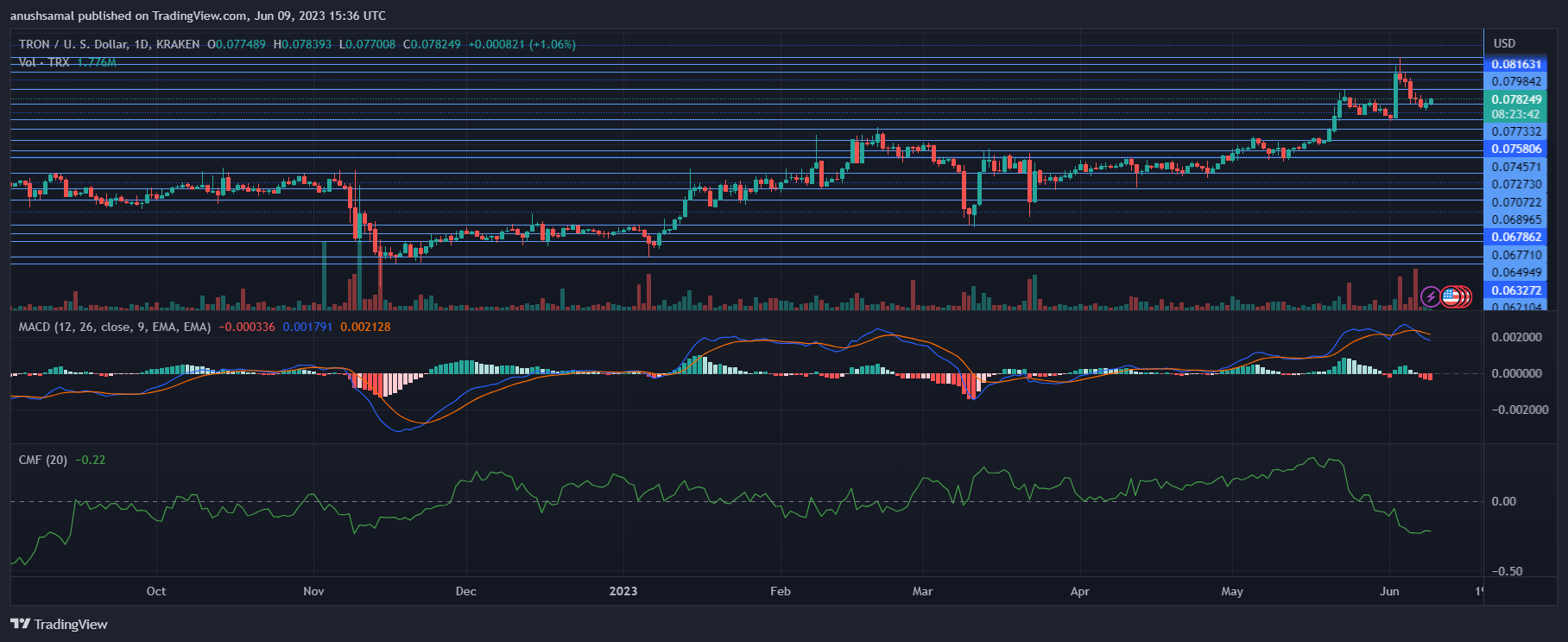

On the time of writing, Tron (TRX) was buying and selling at $0.078. The altcoin confronted overhead resistance at $0.079, and a profitable transfer above this stage would seemingly propel TRX above the $0.080 mark. Nonetheless, whether it is rejected at $0.079, the coin might expertise a big decline.

It’s price noting that TRX has beforehand confronted rejection on the $0.083 stage, which can function an necessary resistance. On the draw back, the closest assist for Tron is situated at $0.074.

If TRX fails to carry above this assist stage, it could drop additional to $0.068. The buying and selling quantity of TRX within the final session was inexperienced, suggesting that patrons have began to ascertain management over the worth.

Technical Evaluation

Following a interval of decreased investor curiosity earlier this month, Tron (TRX) is presently displaying indicators of restoration by way of demand on the day by day chart. The Relative Energy Index (RSI) signifies that patrons are exerting dominance out there, as it’s above the half-line. This means a optimistic sentiment and elevated shopping for strain.

Moreover, the worth of TRX has moved above the 20-Easy Shifting Common (SMA) line, indicating that patrons are in charge of the worth momentum out there.

This additional helps the notion that purchaser dominance is prevailing. To maintain this purchaser momentum, it’s essential for TRX to interrupt previous the $0.079 resistance stage. If TRX efficiently surpasses this stage, it could proceed its upward motion

Opposite to rising demand, TRX has maintained promote indicators on the day by day chart based mostly on the Shifting Common Convergence Divergence (MACD) indicator.

The MACD histogram shaped purple bars, indicating promote indicators for the altcoin. This means a possible decline in worth if TRX fails to maneuver above the quick resistance stage.

Moreover, the Chaikin Cash Circulation (CMF), which measures capital inflows and outflows, is under the half-line. The upcoming buying and selling periods might be essential for TRX to find out its future path.

Featured Picture From UnSplash, Charts From TradingView.com