The cryptocurrency market has gone by a number of bull and bear cycles within the decade since its inception. Savvy buyers leverage each these cycles to optimize their funding portfolio, slightly than letting their feelings and intestine reactions information their funding. On this article, we evaluate key methods that savvy buyers use throughout a cryptocurrency bear market cycle.

A bear market happens when the costs of digital property fall greater than 20% from their current highs. Sometimes, a bear market has extra provide than demand, resulting in the autumn in costs. A number of the traits of a bear market embrace low liquidity, fall in buying and selling volumes, and lack of investor confidence.

Sensible buyers know the best way to use bearish situations to additional optimize their cryptocurrency portfolios. Let’s take a look at the methods that assist merchants survive and thrive within the bear market.

1. Shopping for the dip

This is among the methods that buyers leverage in bear market situations. They purchase digital property at low costs solely to promote them later when market situations turn into higher. Since it’s a long-term funding technique, merchants are unaffected by short-term volatility in cryptocurrency costs.

2. Going for blue chips

When a recession spreads, buyers take a look at their present positions and cut back publicity to probably the most risky property. Most of those cash often come from the trending sectors of the market like NFTs and meme cash. Reviewing portfolios is sweet apply in bullish situations as properly. By recurrently reviewing your portfolio, one can establish any weak spots and make changes to attenuate losses.

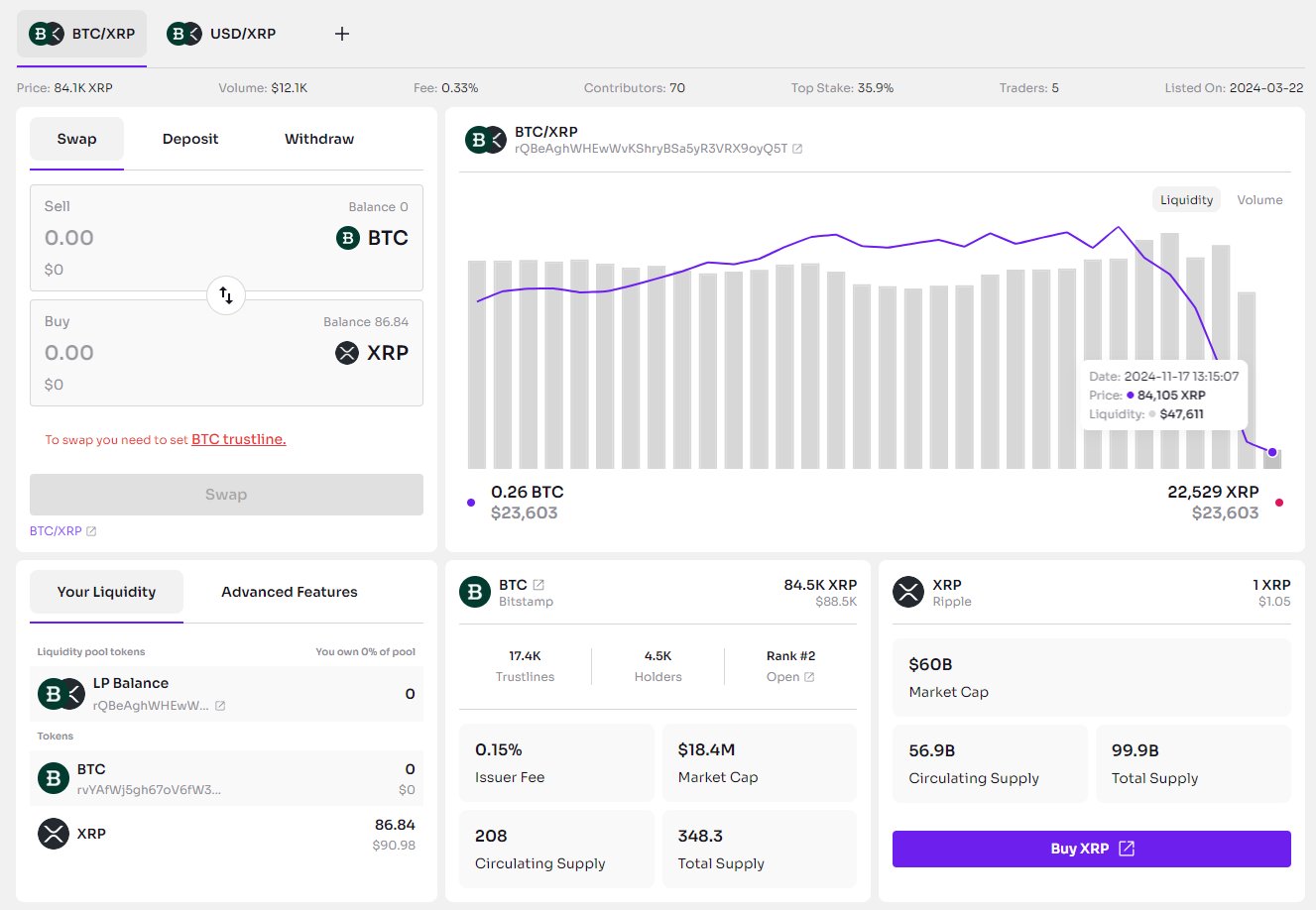

Sensible buyers know that their investments are protected with blue-chip digital property like Bitcoin. As an example, Bitcoin has, previously, dropped by almost 80% and recovered. Nonetheless, some altcoins that went down throughout the 2017 crash have but to recuperate.

3. Quick-selling

In a bear market, costs usually dramatically plummet from their ATH. Shorting is one technique that buyers leverage to come back out forward. That is betting in opposition to a coin’s worth by predicting that it’s going to go down additional.

Whereas it is among the methods for making earnings in a bear market, it is usually fairly dangerous and might simply result in losses if the market doesn’t transfer within the anticipated route. So at all times keep in mind the golden rule of investing: Solely make investments what you may afford to lose.

4. Diversify

One of many important guidelines of investing is to by no means put all of your eggs in a single basket. That is particularly necessary throughout a bear market, the place some property lose worth whereas others maintain regular or enhance in worth. To attenuate losses, one ought to unfold cash throughout completely different property. Traders are much less more likely to lose all the things if one asset class takes a nosedive by diversifying investments throughout completely different property.

5. Zoom out

Having a plan is important to your funding portfolio. It may be tempting to make rash choices when costs are falling. Nonetheless, rash choices often result in extra losses. So as an alternative, have a transparent plan to your method to the market and stick with it it doesn’t matter what.

It’s straightforward to get caught up within the day-to-day worth fluctuations, so it’s necessary to recollect long-term funding targets.

6. Stablecoins

Traders can swap their property into stablecoins in order that their funds are protected when the market recess goes additional. With this technique, buyers earn passive earnings from stablecoins by lending them in DeFi protocols.

7. Be affected person

Bear markets might be irritating for buyers, however it’s necessary to keep in mind that they’re usually simply momentary setbacks. Sensible buyers await the market to recuperate, so they are going to be higher positioned to benefit from the following bull market and make earnings down the street.

1. Panic promoting

This one is simpler mentioned than carried out. It’s necessary to keep in mind that correction markets are a standard a part of the investing cycle. They permit savvy buyers to make earnings, so panicking and promoting off your investments will solely result in losses in the long term. It may be tempting to promote all the things and get out of the market when costs fall. Nonetheless, promoting when costs are low results in lacking out on the rebound when costs rise once more.

2. FOMO or FUD

These are a number of the most important components driving crypto markets. FOMO (Concern of Lacking Out) and FUD (Concern, Uncertainty, and Doubt) affect market actions based mostly on worry and greed. Traders guided by FUD and FOMO sometimes get emotionally overwhelmed, ignore their buying and selling methods, and make poor judgments. That is extra widespread in bear markets. The one manner round FOMO and FUD is to give attention to long-term technique and hold your feelings in test.

It’s essential to have a strategic plan to successfully navigate a bull or bear market. Creating a robust mindset and strategic pondering is essential. Sensible buyers hold a cool head and at all times zoom out to thrive in any market situation.