USDC skilled a notable lower in its circulating provide through the weekend, inflicting ripples of concern throughout the cryptocurrency market. In line with information from CoinGecko, the stablecoin’s circulating provide dwindled by over 2%, falling from $27.9 billion on June 30 to $27.3 billion in lower than 48 hours.

This sudden drop has intensified current worries relating to the soundness and long-term viability of stablecoins within the risky world of cryptocurrencies. For the reason that starting of the yr, the overall provide of USDC has exhibited a downward trajectory, plunging by a staggering 38%.

This steady decline raises questions concerning the underlying components contributing to the diminishing provide of USDC and its potential influence on the broader cryptocurrency ecosystem.

Declining Circulating Provide And Its Affect On USDC’s Worth

The lower in USDC’s circulating provide can have important implications for its value and total worth. As the provision of a stablecoin decreases, its shortage could end in elevated demand from traders and merchants. If the demand for USDC stays regular or rises, the diminished provide may probably push its value larger, following the essential ideas of provide and demand economics.

Nonetheless, this impact will not be linear, as different components resembling market sentiment, regulatory developments, and the general efficiency of the broader cryptocurrency market may affect USDC’s value actions.

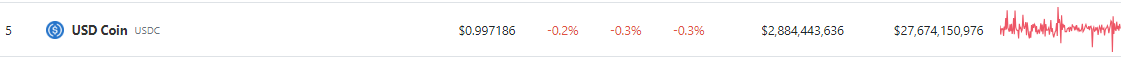

USD Coin in purple in all timeframes. Supply: Coingecko

Market Notion And Belief Considerations

The declining circulating provide of USDC may also set off questions relating to the underlying causes behind the discount. Traders and customers could query the transparency and credibility of the stablecoin’s issuer or the general well being of its backing reserves.

Any perceived lack of readability or uncertainty may result in diminished belief in USDC, inflicting some individuals to hunt different stablecoin choices and even exit the market altogether. Consequently, the trustworthiness and regulatory compliance of stablecoin issuers will come underneath elevated scrutiny, underscoring the necessity for larger transparency and accountability throughout the business.

As of immediately, the market cap of cryptocurrencies stood at $1.17 trillion. Chart: TradingView.com

Regulatory Scrutiny

The dwindling provide of USDC may additionally appeal to the eye of regulators and policymakers, who’re more and more preserving an in depth eye on the stablecoin house. Regulators have expressed considerations concerning the potential systemic dangers related to stablecoins, particularly these with a major market share.

A decline within the circulating provide may amplify these considerations and immediate regulatory our bodies to take extra aggressive actions to supervise and regulate stablecoin operations. Elevated regulatory scrutiny may introduce new compliance necessities, which can influence stablecoin issuers and the broader cryptocurrency market.

Notably in March, the stablecoin skilled a short lived detachment from its peg to the greenback, which occurred within the aftermath of a number of cryptocurrency financial institution failures. In response to potential liquidity challenges associated to US Treasury bonds, the corporate behind USDC, Circle, took proactive measures.

They made the strategic option to shift their funding focus in the direction of short-term maturity bonds. This resolution was aimed toward safeguarding the stablecoin’s worth and addressing considerations concerning the stability of its backing reserves.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing includes danger. If you make investments, your capital is topic to danger).

Featured picture from WorldCoin