newbie

Due to their risky nature, crypto property are not any strangers to crashes. Generally, cash and tokens handle to bounce again and get better their worth: Bitcoin is the perfect instance right here. Many cryptocurrencies, nevertheless, by no means get better — and whereas these are sometimes smaller tokens with tiny market caps, this destiny may befall greater tasks. In any case, all of us bear in mind the Terra crash.

So, why do these crashes occur? On this article, I’ll check out the potential causes for crypto crashes in addition to at 5 examples of cryptocurrencies shedding a giant proportion of their worth.

What Can Trigger a Crypto Crash?

A cryptocurrency crash, much like a inventory market crash, is a sudden and important drop within the worth of digital property within the crypto market. A number of components can set off such an occasion:

Regulatory Scrutiny. Cryptocurrencies function in a decentralized system primarily based on blockchain know-how, largely exterior of conventional financial insurance policies. A sudden enhance in regulatory scrutiny by governments can spook crypto buyers and lead to a sell-off.

Cyber Assaults. The crypto market operates primarily on digital platforms or crypto exchanges. Any main safety breach within the largest cryptocurrency exchanges may cause panic and escalate right into a market crash.

Market Manipulation. Given the comparatively younger and unregulated nature of the crypto market, it’s prone to manipulation. For example, a pump-and-dump scheme can result in a man-made increase adopted by a crash.

Investor Sentiment. Like all funding, cryptocurrencies are topic to investor sentiment. Any unhealthy information or fears about the way forward for digital currencies can create a domino impact, culminating in a market crash.

Why Is the Cryptocurrency Market Down As we speak?

All the cryptocurrency market could be down for a number of causes. As we speak’s decline could possibly be a results of unfavourable information affecting investor sentiment, akin to a possible regulatory clampdown, a serious hack of a crypto change, or just market correction after a interval of great features.

It’s additionally necessary to keep in mind that cryptocurrencies are thought of dangerous property. Institutional buyers could resolve to scale back their publicity to riskier property in instances of financial uncertainty, which might affect digital currencies.

Prime 5 Greatest Crypto Crashes in Historical past

Listed here are 5 of the largest crypto crashes the business has seen.

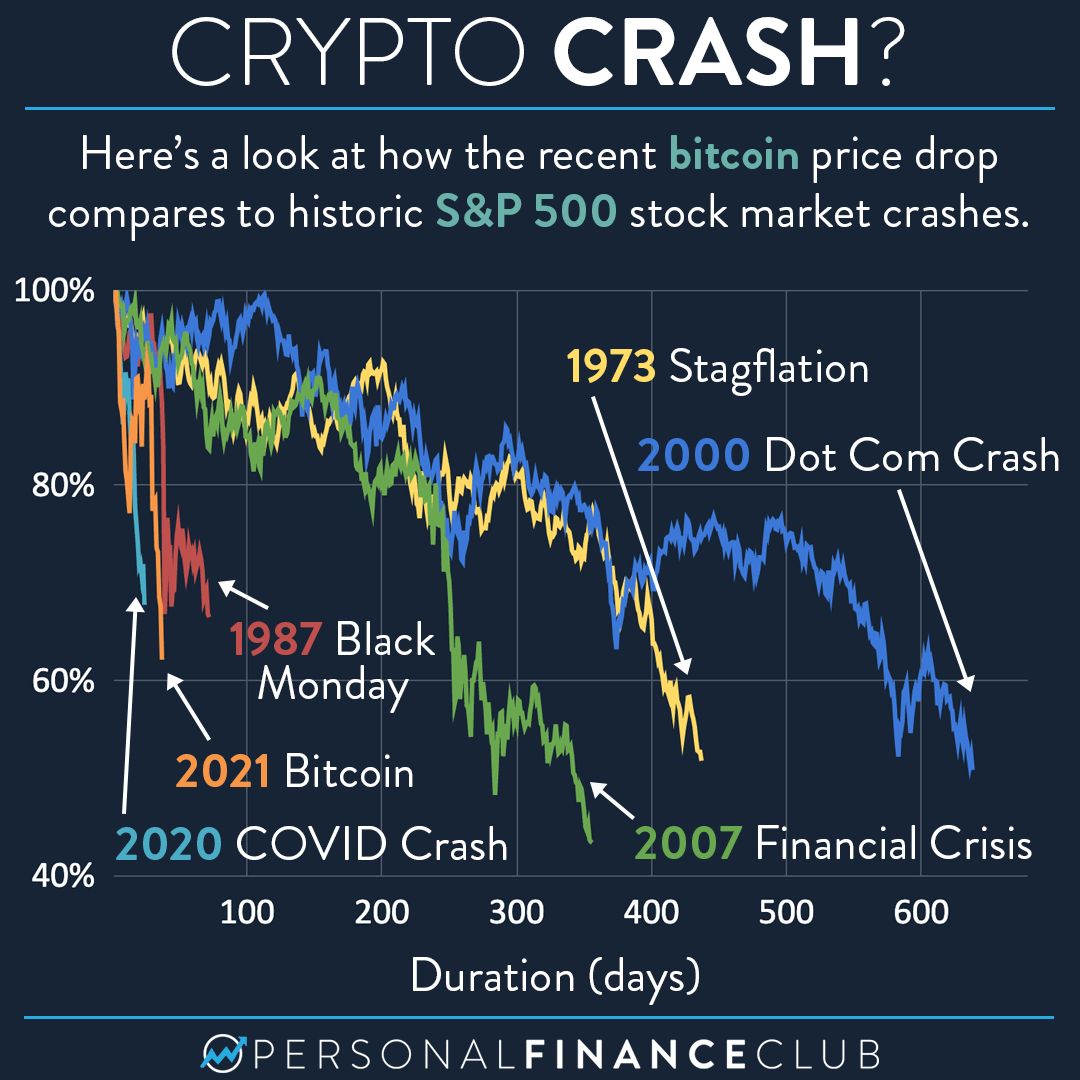

- December 2017–December 2018. Bitcoin, the primary and largest of all cryptocurrencies, reached an all-time excessive of practically $20,000 in December 2017. Nevertheless, what adopted was an enormous crash that noticed the worth of Bitcoin tumble by over 80% inside a yr.

- Black Thursday, March 2020. Amid the worldwide panic brought on by the COVID-19 pandemic, the crypto market was not spared. On March 12, 2020, Bitcoin’s worth dropped by virtually 50% in a single day.

- Could 2021. Triggered by Elon Musk’s announcement that Tesla would now not settle for Bitcoin on account of environmental considerations and China’s crackdown on crypto corporations and providers, Bitcoin and different standard cryptocurrencies skilled a big drop. This crash worn out greater than $1 trillion from the whole crypto market.

- Could 2022. In only a few days, each terraUSD (UST), a stablecoin, and LUNA, the cryptocurrency that was meant to stabilize its worth, misplaced virtually all of their worth. Following this crash, UST digital tokens ceased to exist, and neither the unique LUNA, which was renamed Luna Basic (LUNC), nor the brand new one had been capable of retake the coin’s earlier highs ever once more.

- November 2022. The token of the cryptocurrency change FTX (FTT) went from being price over $20 to lower than a greenback following the leak of the change’s stability sheet. The fallout from this crypto crash left an enduring affect on the entire crypto business.

What Are the Most Unstable Cryptocurrencies?

Whereas all cryptocurrencies are identified for his or her volatility, some stand out greater than others:

- Bitcoin (BTC). As the primary and most vital cryptocurrency, Bitcoin typically experiences substantial worth swings. Any main fluctuation in Bitcoin’s worth can have an effect on the whole crypto market.

- Ethereum (ETH). Ethereum, being the second-largest cryptocurrency, can be identified for its volatility. Nevertheless, it’s price noting that Ethereum’s blockchain know-how, which helps good contracts and the creation of decentralized purposes, holds important promise.

- Smaller Market Cap Cash and Tokens. Cryptocurrencies with smaller market caps, together with quite a few altcoins, crypto tokens, and non-fungible tokens (NFTs), could be extraordinarily risky. Their costs can dramatically fluctuate primarily based on hype, hypothesis, and investor sentiment.

Whereas volatility can current funding alternatives, it additionally comes with elevated danger. Crypto buyers ought to train due diligence earlier than investing in these digital property.

FAQ

What number of cryptocurrencies are there?

As of mid-2023, there are greater than 10,000 totally different cryptocurrencies. These digital property function on a variety of blockchain networks and serve varied capabilities. Some, like Bitcoin, perform as digital cash, whereas others, like Ethereum, present the infrastructure for decentralized purposes.

As crypto fans and firms develop new blockchain-based tasks, the variety of cryptocurrencies continues to develop. Though some cryptocurrencies, having gained appreciable traction, are extensively used now, many others have solely restricted adoption.

Will Bitcoin crash?

Predicting the way forward for Bitcoin or any digital asset is difficult. Inherently risky, crypto markets are influenced by a variety of things, from technological developments to regulatory adjustments launched by federal securities legal guidelines and central banks. For example, a extreme Bitcoin scandal or stringent rules might probably set off a crypto collapse.

Nevertheless, it’s additionally potential for the crypto sector to proceed rising, notably as extra individuals and companies undertake digital currencies. It’s essential for buyers to do their analysis and maybe seek the advice of with monetary advisors earlier than making any important investments in Bitcoin or another cryptocurrency.

Can a cryptocurrency get better after a crash?

Sure, a cryptocurrency can get better after a crash. Historical past has proven that whereas crypto costs can plummet in periods generally known as “crypto winter,” in addition they have the capability to rebound. For instance, after Bitcoin’s important drop in 2018, it managed to get better and even attain new highs within the following years.

That mentioned, restoration will not be assured for all cryptocurrencies, particularly for these from a smaller crypto firm or these with much less widespread adoption. Due to this fact, it’s necessary to diversify your portfolio by investing in additional than a single digital asset and to keep away from investing greater than you may afford to lose. Moreover, components akin to the power to execute Bitcoin withdrawals from an change also needs to be taken under consideration when investing.

Disclaimer: Please notice that the contents of this text usually are not monetary or investing recommendation. The data offered on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.