Intuit QuickBooks is probably the most well-known accounting software program on the planet — however it has sure drawbacks, together with a really excessive beginning value. In consequence, many companies ponder switching to an alternate similar to Sage Accounting, which is one other widespread accounting software program for small companies.

That will help you resolve which one is true on your wants, we’ll evaluate Sage Enterprise Cloud Accounting and QuickBooks On-line on this evaluate.

Soar to:

What’s Sage?

Sage makes accounting and enterprise administration software program for companies of all sizes. Sage technically provides three separate accounting merchandise: the Sage Enterprise Cloud Accounting service, the Sage 50 “cloud-enabled” desktop product and the Sage Intacct enterprise accounting software program. For the needs of this evaluate, we will likely be evaluating Sage Enterprise Cloud Accounting to QuickBooks On-line to supply probably the most correct comparability.

What’s QuickBooks?

Intuit QuickBooks is a enterprise accounting software program firm that gives bookkeeping software program and different accounting and finance options, together with payroll. Just like Sage, QuickBooks additionally provides a number of accounting merchandise: QuickBooks On-line and QuickBooks Desktop. It additionally provides an elective payroll add-on, referred to as QuickBooks Payroll. Whereas the payroll instrument is past the scope of this comparability, you may be taught extra about it in our QuickBooks Payroll evaluate.

Sage vs. QuickBooks: Comparability desk

| Options | Sage | QuickBooks |

|---|---|---|

| Beginning value | $10/mo. | $30/mo. |

| Invoicing | Sure | Sure |

| Accounts payable and receivable | Sure | Sure |

| Stock administration | Sure | Sure |

| Reporting templates | 20+ | 50+ |

1

QuickBooks

QuickBooks from Intuit is a small enterprise accounting software program that permits corporations to handle enterprise wherever, anytime. It presents organizations with a transparent view of their earnings with out guide work and supplies sensible and user-friendly instruments for the enterprise.

Study extra

2

Paycor

Payroll could be a time-consuming, administrative activity for HR groups. Paycor’s resolution is an easy-to-use but highly effective instrument that offers you time again in your day. Rapidly and simply pay staff from wherever you might be and by no means fear about tax compliance once more. Key options like common ledger integration, earned wage entry, AutoRun, worker self-service and detailed reporting simplify the method and assist make sure you pay staff precisely and on time.

Study extra

3

Justworks

Justworks Payroll is a light-weight resolution that simplifies Payroll and HR operations so you may concentrate on what issues most – operating your corporation. Our user-friendly navigation, paired with dependable assist, helps you monitor and keep compliance, onboard and handle your groups, and navigate the advanced world of payroll with confidence.

Designed for at the moment’s wants and tomorrow’s ambitions, our adaptable options will elevate your operations & present the instruments for your corporation to thrive.

Study extra

Sage vs. QuickBooks: Pricing

Sage pricing

Sage Enterprise Cloud Accounting has solely two plans:

- Sage Accounting Begin: Prices $10 per 30 days and contains entry for one person.

- Sage Accounting: Prices $25 per 30 days and helps limitless customers.

Sage usually provides a 30-day free trial. It additionally has frequent gross sales that apply solely to its extra superior plan. Reductions will be as deep as 70% for six months, which lowers the annual Sage Accounting value by greater than $100.

QuickBooks pricing

QuickBooks On-line provides 4 totally different pricing tiers to select from:

- QuickBooks Easy Begin: Prices $30 per 30 days with entry for one person.

- QuickBooks Necessities: Prices $55 per 30 days with entry for as much as three customers.

- QuickBooks Plus: Prices $85 per 30 days with entry for as much as 5 customers.

- QuickBooks Superior: Prices $200 per 30 days with entry for as much as 25 customers.

As a first-time QuickBooks buyer, you may select to discover QuickBooks with out committing to a plan by signing up for a 30-day free trial. You may as well skip the free trial in favor of locking in 50% off on your first three months — however you may’t select each.

Sage vs. QuickBooks: Function comparability

Bill administration

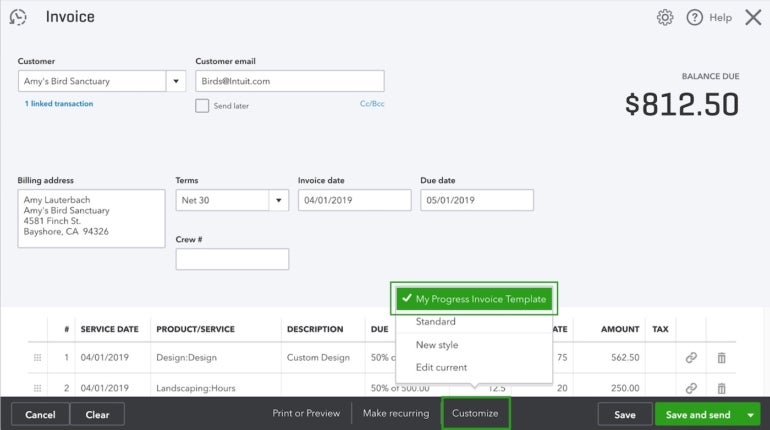

In QuickBooks, you may create customized invoices (Determine A) with logos and colours that match your corporation branding. You’ll be able to arrange recurring invoices to auto-send day by day, week, month or yr so that you don’t should generate them from scratch. When you’ve submitted the bill, QuickBooks tracks when your prospects have considered, paid and deposited them.

Determine A

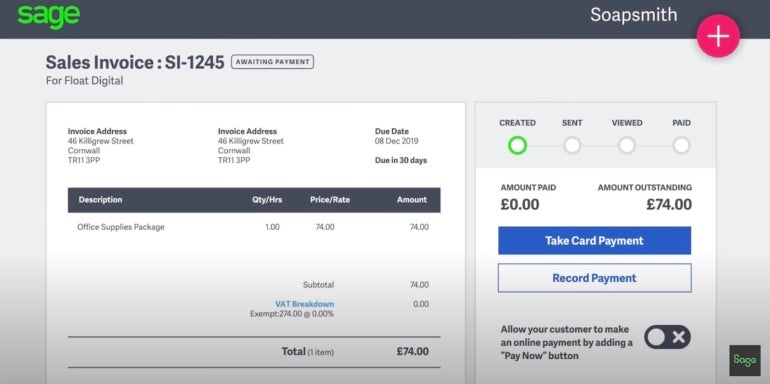

Sage Accounting additionally lets you create customizable invoices (Determine B) and arrange recurring invoices. You may as well convert quotes to invoices with only one click on and nudge slow-paying prospects with reminders about excellent invoices as effectively. Plus, Sage Accounting connects to your financial institution and different programs so the whole lot flows collectively seamlessly.

Determine B

Invoice funds

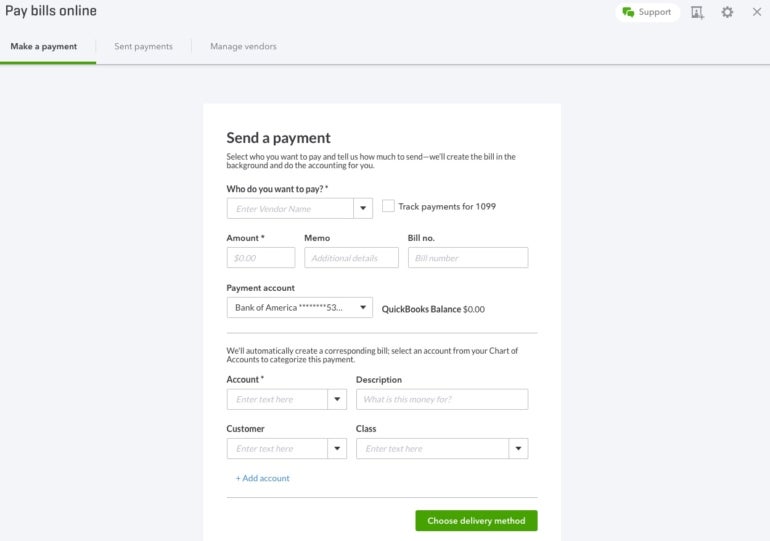

QuickBooks provides three options for invoice pay: QuickBooks Invoice Pay, Invoice Pay powered by Melio and Invoice Pay powered by Invoice.com. Relying on which one you will have, you may schedule full and partial invoice funds (Determine C) and think about or edit your vendor’s cost data. Your distributors will likely be notified once you schedule a invoice cost so that they know when the cash is coming in.

Determine C

Sage’s invoice cost capabilities allows you to pay an bill or vendor instantly, enter prepayments and replace job value bills. Linked banking and automatic knowledge seize considerably cut back paperwork and busy work and makes it straightforward to flag a dispute or create a credit score word. Money stream experiences allow you to see what cash goes out and in at a look.

Stock monitoring

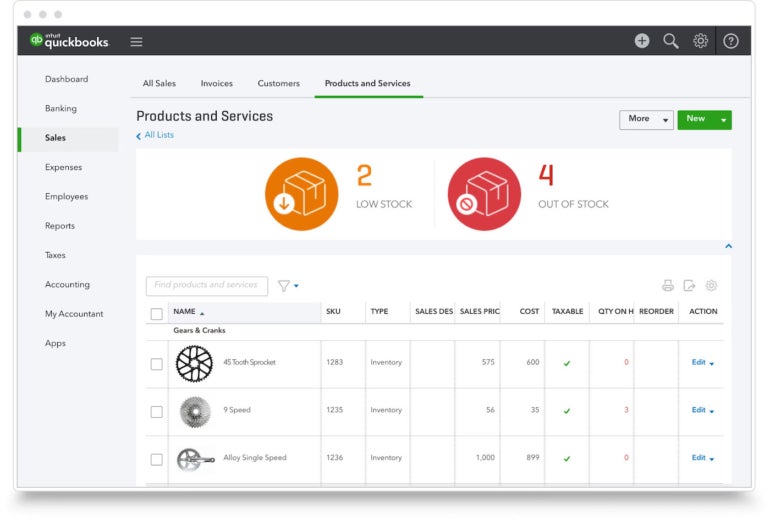

The QuickBooks Plus and Superior plans supply stock monitoring (Determine D) so you may see what gadgets and supplies you will have on time. QuickBooks may even provide you with a warning when it’s time to restock and supply analytic insights on what you purchase and promote. You’ll be able to even add companies or non-inventory gadgets in order that the whole lot is centralized in a single system.

Determine D

Sage’s stock administration instrument provides each real-time visibility and forecasting so you may see the standing of your inventory each now and sooner or later. And with barcoding, you may cut back how lengthy it takes to trace stock, whereas reporting helps you make higher enterprise selections about which merchandise and portions to inventory.

Enterprise reporting

QuickBooks is thought for its glorious experiences, and even the entry-level plan comes with greater than 50 report templates so that you can use. The dashboard comprises all of the high-level stats you’ll wish to verify regularly, whereas particular person experiences allow you to drill down deep on particular matters. Stories will be personalized to indicate precisely the information you want, and you’ll preserve your accountant and different stakeholders up to the mark with e mail updates.

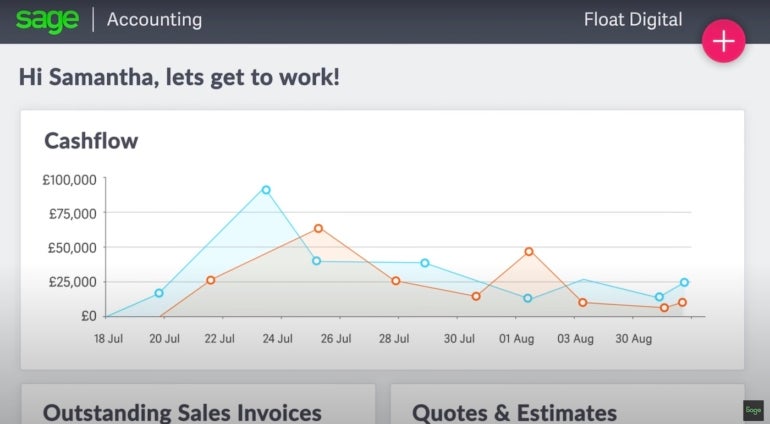

Sage’s dashboard (Determine E) additionally places important data, similar to money stream and stability sheet knowledge, multi function straightforward to learn place. Rapidly share experiences and summaries together with your accountant or crew to maintain them updated. Sage Enterprise Accounting contains about 20 pre-built report templates, which is a pleasant quantity however nowhere close to the identical quantity as QuickBooks.

Determine E

Sage execs and cons

Execs of Sage

- Extra reasonably priced than QuickBooks.

- Help for a lot of totally different currencies.

- Wonderful stock monitoring.

- Limitless customers on Sage Accounting plan.

Cons of Sage

- No native mileage or time monitoring options.

- May use extra integrations.

- Should improve to Sage Account and get AutoEntry add-on for receipt seize.

QuickBooks execs and cons

Execs of QuickBooks

- Greater than 750 integrations.

- 50+ experiences on the entry-level plan alone.

- Very straightforward to share data together with your accountant.

- Receipt monitoring accessible on all plans.

Cons of QuickBooks

- Dearer than Sage Accounting and most opponents.

- Every plan limits the variety of customers.

- Studying curve will be irritating.

Methodology

To match Sage Enterprise Cloud Accounting and QuickBooks on-line, we thought of options similar to invoicing, accounts payable and receivable, stock monitoring and reporting templates. We additionally weighed components similar to pricing, ease of use and buyer assist accessibility. Whereas penning this evaluate, we consulted product documentation, learn person evaluations and considered demo movies.

Ought to your group use Sage or QuickBooks?

Each Sage and QuickBooks are a few of the greatest accounting software program choices available on the market, however every software program has its personal listing of benefits and disadvantages.

In case you are a small enterprise on the lookout for a budget-conscious possibility — and don’t want superior options like time and mileage monitoring — then Sage Accounting is the appropriate selection for you. We additionally like that Sage provides limitless customers on all plans, so that you received’t be pressured to improve to a costlier plan simply since you want extra seats. You additionally get to benefit from the free trial and no matter introductory supply is operating, whereas QuickBooks makes you select one or the opposite.

When you do want that extra superior performance, then QuickBooks is a more sensible choice due to its extra complete function set. Nonetheless, you must be prepared to pay for these further options, particularly if you happen to want a number of customers to entry the software program. QuickBooks’ costliest plan is eight instances the price of Sage’s costliest plan, and the QuickBooks Superior plan nonetheless caps you at 25 customers.

Nonetheless not satisfied that both Sage Accounting or QuickBooks is true on your wants? Try our listing of the very best accounting software program for small companies to see what different choices are on the market.

1

QuickBooks

Go to web site

QuickBooks from Intuit is a small enterprise accounting software program that permits corporations to handle enterprise wherever, anytime. It presents organizations with a transparent view of their earnings with out guide work and supplies sensible and user-friendly instruments for the enterprise.

Study extra about QuickBooks

2

Paycor

Go to web site

Payroll could be a time-consuming, administrative activity for HR groups. Paycor’s resolution is an easy-to-use but highly effective instrument that offers you time again in your day. Rapidly and simply pay staff from wherever you might be and by no means fear about tax compliance once more. Key options like common ledger integration, earned wage entry, AutoRun, worker self-service and detailed reporting simplify the method and assist make sure you pay staff precisely and on time.

Study extra about Paycor

3

Justworks

Go to web site

Justworks Payroll is a light-weight resolution that simplifies Payroll and HR operations so you may concentrate on what issues most – operating your corporation. Our user-friendly navigation, paired with dependable assist, helps you monitor and keep compliance, onboard and handle your groups, and navigate the advanced world of payroll with confidence.

Designed for at the moment’s wants and tomorrow’s ambitions, our adaptable options will elevate your operations & present the instruments for your corporation to thrive.

Study extra about Justworks