Appropriately establishing your payroll is totally important for guaranteeing correct payroll calculations and compliances with federal, state and native legal guidelines. On this information, we’ll stroll you thru arrange your payroll and payroll software program and the knowledge it’s good to run payroll for the primary time.

Bounce to:

What’s the simplest option to do payroll?

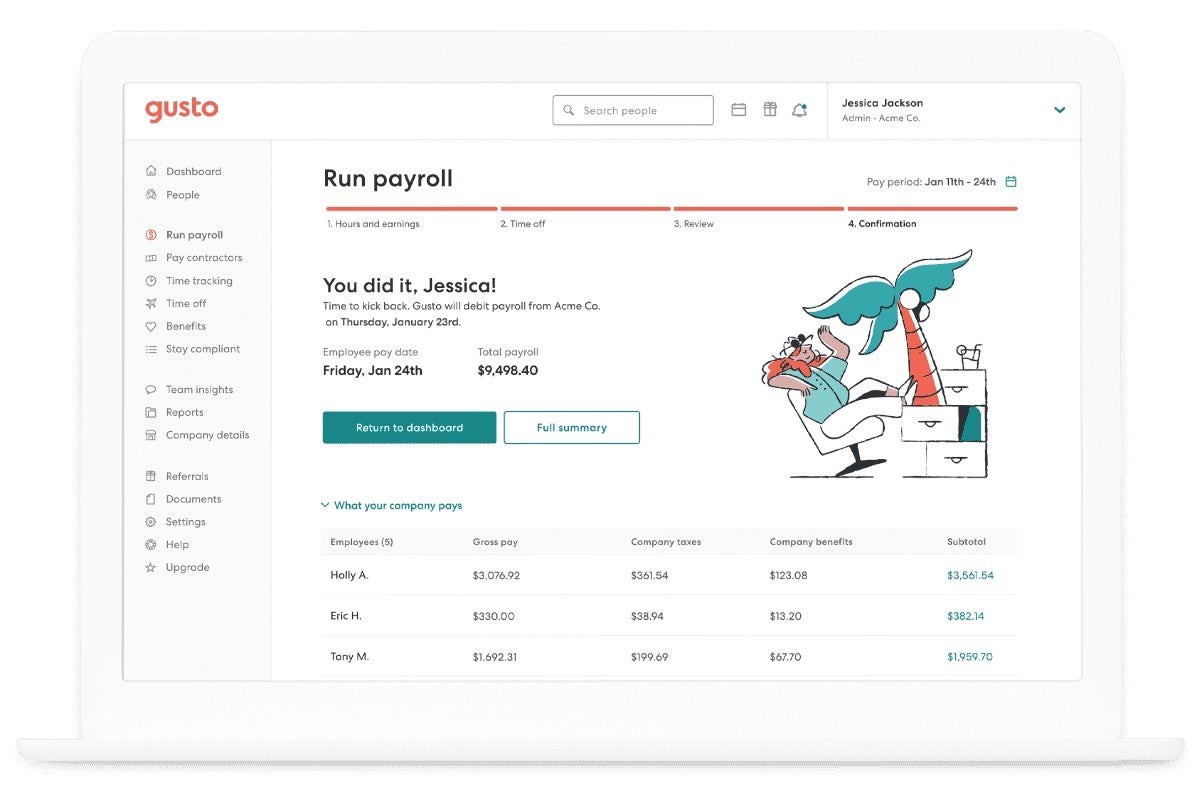

You’ll be able to calculate payroll manually, however that may be extraordinarily time consuming. It will also be vulnerable to human error, which exposes you to potential legal responsibility. Fortunately, there are a variety of free and low-cost payroll platforms on the market, reminiscent of Gusto (Determine A), to suit each want and funds.

Determine A

Even in case you are a really small enterprise that isn’t seeking to spend some huge cash on payroll, utilizing a payroll software program can prevent each money and time in the long term. In the event you haven’t already, check out some payroll software program to resolve which platform is true to your wants.

Need to be taught extra? Take a look at our deep dive into how payroll software program works.

arrange payroll

1. Get an employer identification quantity

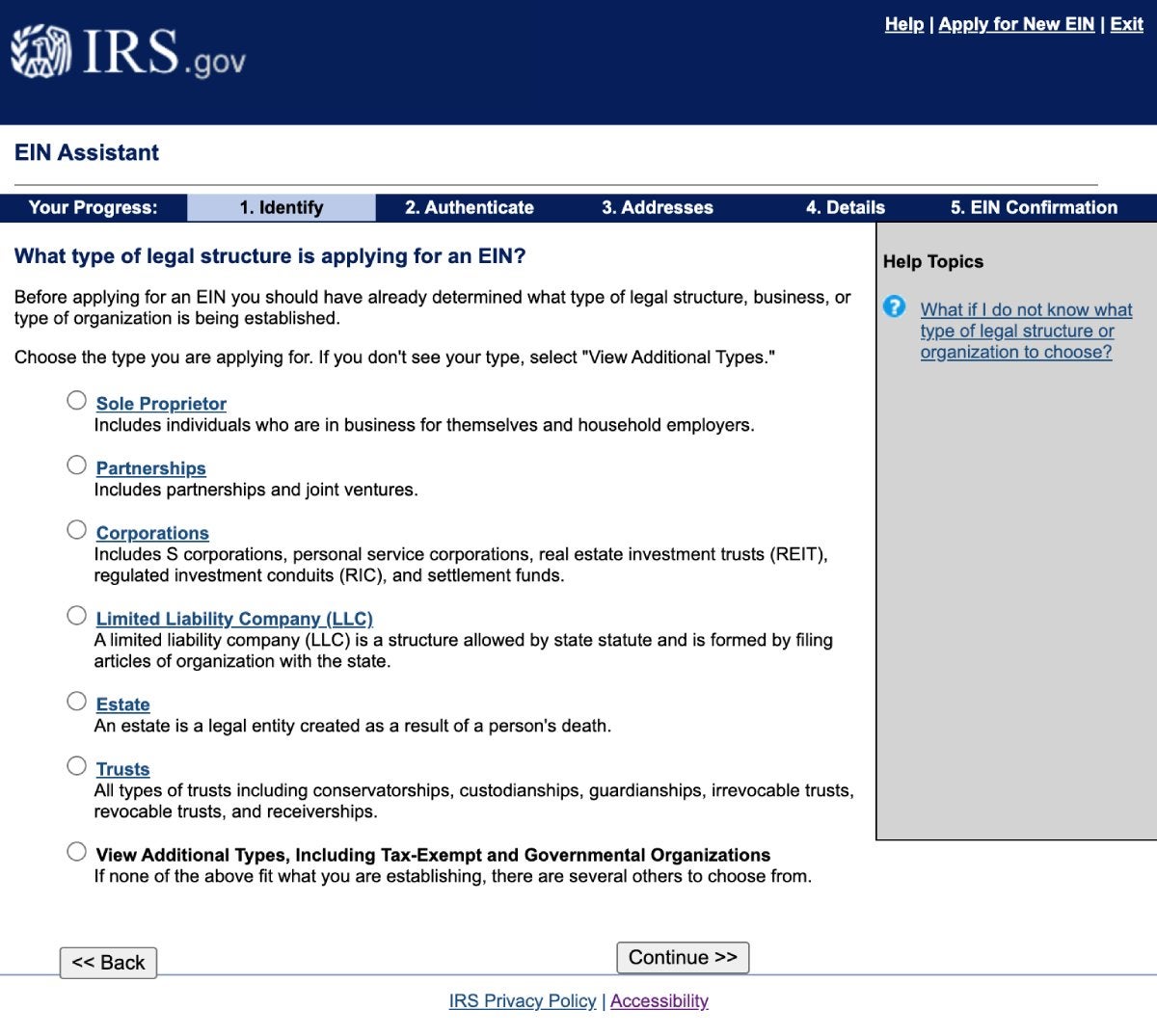

An employer identification quantity (EIN) is utilized by the IRS to determine your organization for tax submitting functions. If your corporation is situated within the U.S. or U.S. territories, you’ll be able to apply for an EIN at no cost on the IRS web site (Determine B). After your validations are accomplished, you’ll instantly obtain your EIN so you’ll be able to transfer ahead with establishing payroll.

Determine B

2. Get a neighborhood or state enterprise ID

In addition to the federal EIN, you may additionally want a state enterprise ID relying on whether or not or not the state prices gross sales tax. Your state authorities’s web site will specify if it’s good to register for a enterprise ID. You may also need to seek the advice of a neighborhood accountant or legal professional about native necessities for state withholding and unemployment insurance coverage accounts.

3. Classify your workers

You’ll calculate and withhold taxes relying on whether or not or not you intend to rent unbiased contractors or workers. You sometimes don’t must withhold or pay taxes on behalf of unbiased contractors as they’re accountable for caring for it themselves. You must work out accurately classify every individual you pay earlier than shifting onto the following step.

SEE: The Finest Payroll Apps of 2023

4. Collect worker paperwork

When you correctly classify your workers, it’s good to collect all of the documentation you’ll have to pay them. You’ll need the next data from every worker earlier than you run payroll:

- Full authorized identify.

- Date of beginning.

- Present handle.

- Employment begin or termination date.

- Tax submitting quantity (Social Safety quantity or EIN).

- Pay price and compensation particulars.

- Kind I-9 to confirm workers’ eligibility for employment within the U.S.

- A W-4 for workers or a W-9 for unbiased contractors.

5. Buy employee’s compensation insurance coverage

Relying on the place you reside, you might be required to buy employee’s compensation insurance coverage — even in case you are solely paying one worker. Test federal, state and native legal guidelines to find out whether or not or not it’s good to maintain employee’s compensation insurance coverage to rent and pay workers.

6. Decide about advantages

In the event you resolve to supply advantages, then you’ll virtually definitely have to withhold some cash from every worker’s paycheck to cowl their portion of the advantages. In the event you haven’t already decided your profit program, the time to do it’s earlier than you run your first payroll.

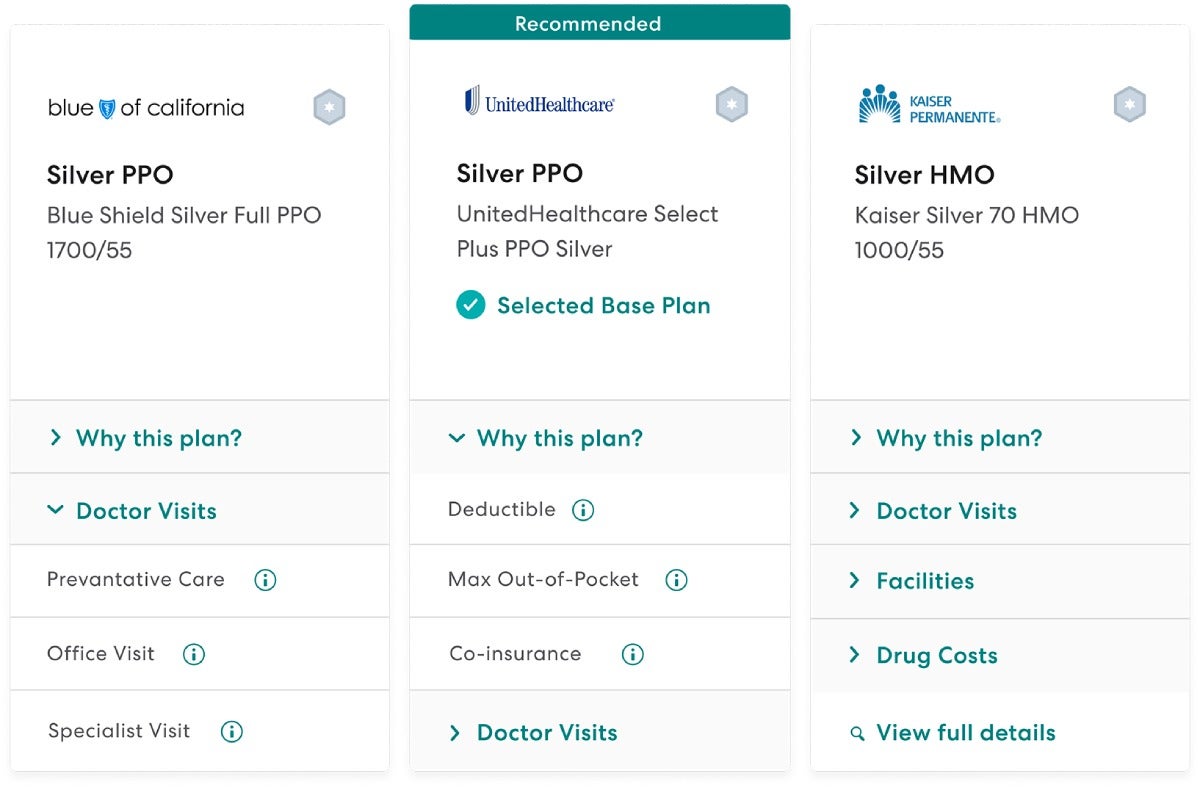

Many payroll platforms additionally supply profit administration options that assist you resolve what plans to supply (Determine C). As soon as workers make their alternatives, that data flows proper into the payroll software program and deductions are robotically calculated and withheld with every pay interval.

Determine C

SEE: The Finest Payroll Software program for Enterprises in 2023

7. Choose a pay interval

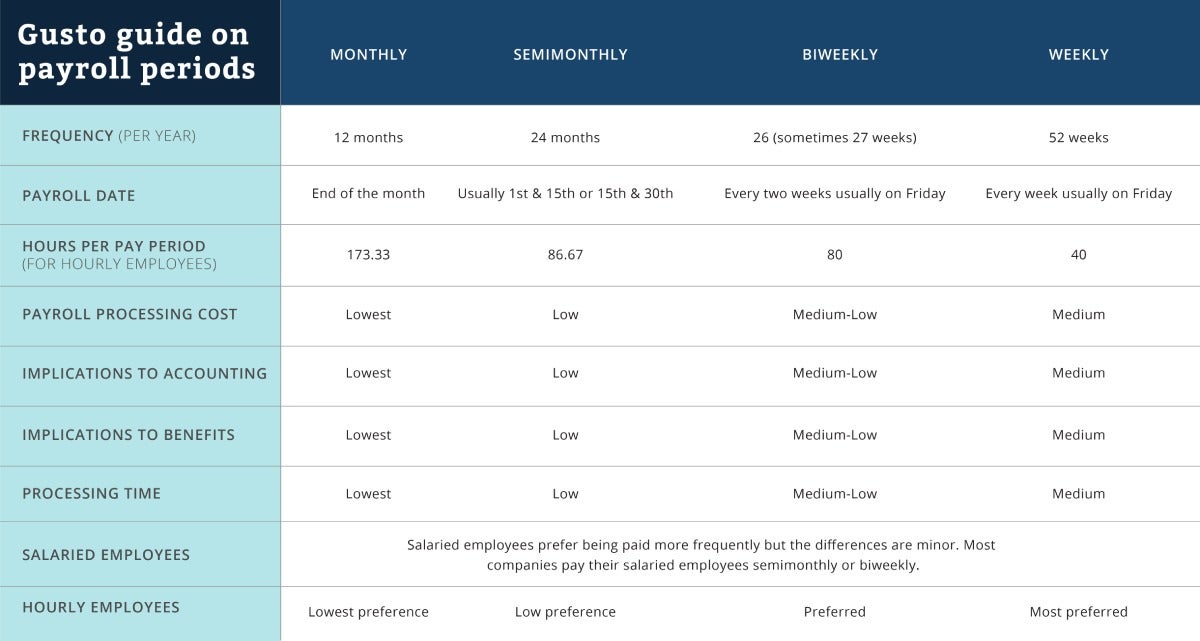

Earlier than you run payroll, it’s good to resolve how usually you’ll pay your workers. There are 4 major payroll schedules to select from (Determine D):

- Weekly: Workers are paid each single week — this schedule is widespread in eating places, manufacturing and development.

- Biweekly: Workers are paid each different week — this schedule is widespread in retail jobs.

- Semimonthly: Workers are paid twice a month on the identical dates, usually on the first and fifteenth of every month — that is the most well-liked pay schedule.

- Month-to-month: Workers are paid as soon as a month, usually on the primary or final enterprise day of the month — this schedule is widespread in very high-paying jobs.

Earlier than finalizing your pay interval choice, be sure you seek the advice of each federal and state legal guidelines to just be sure you stay compliant with all necessities.

Determine D

8. Create an worker handbook

After you have determined in your pay schedule, it’s good to create an worker handbook or payroll coverage that spells out when and the way workers needs to be paid. The handbook also needs to cowl the rest that may have an effect on payroll and worker funds, reminiscent of the corporate insurance policies for holidays, paid break day and the withholding for advantages.

This handbook needs to be offered to each worker and they need to signal an official kind acknowledging that they’ve obtained and browse the coverage.

9. Open a payroll checking account

You’ll need a devoted enterprise checking account to pay workers. Many corporations additionally use a separate checking account for payroll in order that the cash doesn’t get blended in with different accounts. Work along with your financial institution to arrange that account and put together it to your first payroll run.

10. Determine who will handle payroll

In the event you haven’t already, it’s good to resolve who will handle payroll. Even in case you have an exterior accountant or bookkeeper, you continue to want somebody on the corporate facet to assessment and approve payroll every pay interval. In lots of small companies, this would be the CEO or founder. In bigger companies, a number of workers throughout HR and finance will work collectively to deal with payroll.

SEE: The Finest Payroll Software program for Your Small Enterprise in 2023

11. Select software program and assessment the software program setup information

Now that you already know what your schedule will probably be and the way your workers are categorised, it’s time to decide on your payroll software program. Whereas wanting, be aware of how usually you’ll be able to run payroll with every resolution. For instance, if a software program prices per payroll run and also you run weekly payroll, you may be greater prices.

There are additionally extra contractor-focused payroll plans and instruments. So, if your corporation depends totally on contractors, you might need to particularly look into these options. And naturally, you’ll need to assessment software program options and integrations to make sure you’re getting the precise match for your corporation.

After choosing a software and signing up, the very first thing it is best to do is assessment the payroll setup information and another directions offered by your payroll software program. Whereas many payroll platforms comply with a reasonably customary setup process, it’s all the time a good suggestion to assessment the documentation they supply so that you’re conscious of any quirks within the course of.

12. Add the whole lot into the payroll software program

In case you have by no means used a payroll software program earlier than, most of them — together with Gusto — can have a guided setup course of that may stroll you thru including the whole lot we outlined above. You’ll enter your EIN and your state enterprise ID, add every worker to the system, choose a pay interval and add your checking account particulars.

In case you have beforehand used a unique payroll software program and are switching platforms, verify along with your new software program to see if they’ve any pre-built import instruments. To make switching as painless as attainable, many payroll software program present instruments to import your payroll data into the brand new system out of your previous system.

Relying on what tier of service you pay for, you may additionally get setup help out of your account rep to hurry up the method.

Prepared to seek out new payroll software program? Take a look at our picks for the perfect payroll software program of 2023 to encourage your search.

Featured payroll options