On-chain information reveals the Aptos (APT) buying and selling quantity has continued to be extraordinarily excessive after the rally, a potential signal that extra beneficial properties could also be coming.

Aptos Social Dominance Calms Down, However Buying and selling Quantity Stays Elevated

Yesterday, information got here out that tech big Microsoft has partnered up with Aptos Labs to work on blockchain-based AI instruments. This large announcement naturally prompted a response available in the market, as the corporate’s token, APT, noticed a really sharp 17% leap.

The token had neared the $8 degree on the peak of this surge, however since then, it has noticed some decline and has retreated in direction of the $7.3 mark. The beneath chart shows how the asset’s worth has modified lately.

Seems to be like the worth of the asset has noticed a pointy leap throughout the previous day | Supply: APTUSD on TradingView

Regardless of the pullback, although, Aptos continues to be carrying beneficial properties of round 9%. These income make it by far one of the best performer amongst at the least the highest 100 belongings by market cap.

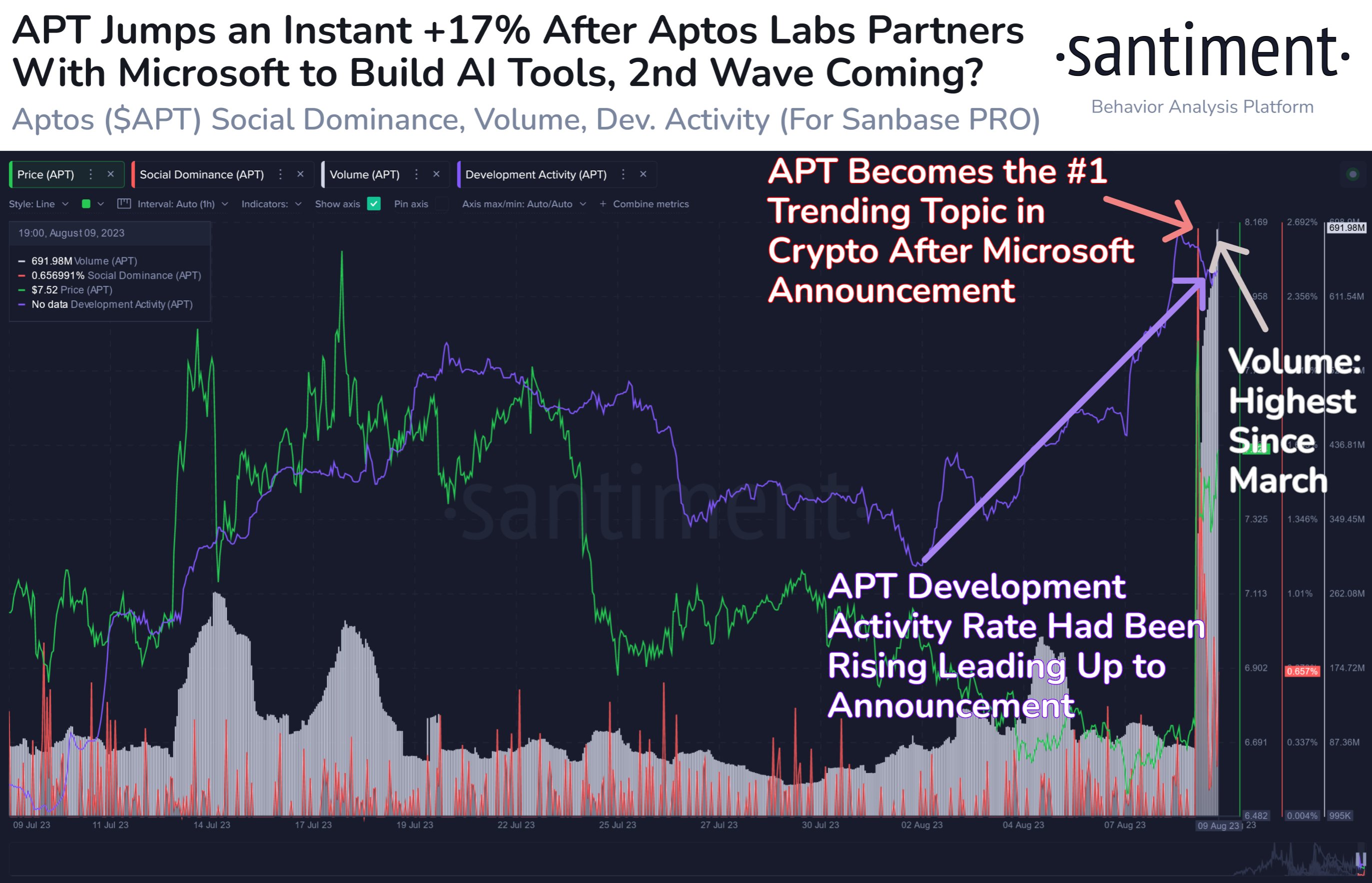

As for why the retrace might have occurred, information from the on-chain analytics agency Santiment may present some hints. As displayed within the beneath graph, the social dominance of APT had noticed a really massive spike because the rally had taken place.

The information for the totally different metrics associated to APT | Supply: Santiment on X

The “social dominance” mainly tells us how a lot dialogue associated to the highest 100 belongings on social media is coming from talks associated to Aptos alone. When the information had damaged out, social media dialogue across the coin had naturally blown up, as a lot of customers had develop into within the asset.

Whereas such pleasure may help gas a rally, an excessive amount of of it may possibly even have the other impact. It will seem that the FOMO spiking available in the market is what contributed to the rally topping out and the worth decline.

Since then, although, the social dominance has calmed down a bit, implying that hype has returned to more healthy ranges. On the similar time, the APT buying and selling quantity (that’s, the measure of the full variety of tokens being moved round on the blockchain) has solely gone up and has hit its highest level since March.

This means that traders have solely continued to commerce extra of the cryptocurrency even after the rally’s pullback. Typically, a excessive quantity of quantity is required to maintain any important transfer within the worth, as such strikes require a considerable amount of gas. For the reason that buying and selling quantity has solely been rising, it may be one of many first hints that the Aptos rally isn’t over simply but.

Within the chart, Santiment has additionally hooked up the info for one more indicator, the event exercise. This metric retains monitor of the work that the builders have been doing on the venture’s public GitHub repositories.

From the graph, it’s seen that this metric had been continuously rising within the buildup to the announcement because the builders might have been making ready for the partnership.

Featured picture from iStock.com, charts from TradingView.com, Santiment.internet