Bitcoin has been caught inside a good vary in August. Glassnode lead on-chain analyst Checkmate highlighted that the unfold between the higher and decrease Bollinger Bands for Bitcoin has shrunk to 2.9%, its third-tightest ever.

Sometimes, durations of low volatility are adopted by a spread growth. The longer the time spent inside a spread, the stronger the eventual breakout from it. The one drawback is that it’s troublesome to time the breakout with certainty. Subsequently, merchants needs to be watchful. In any other case, they could miss out on the chance to trip the following trending transfer.

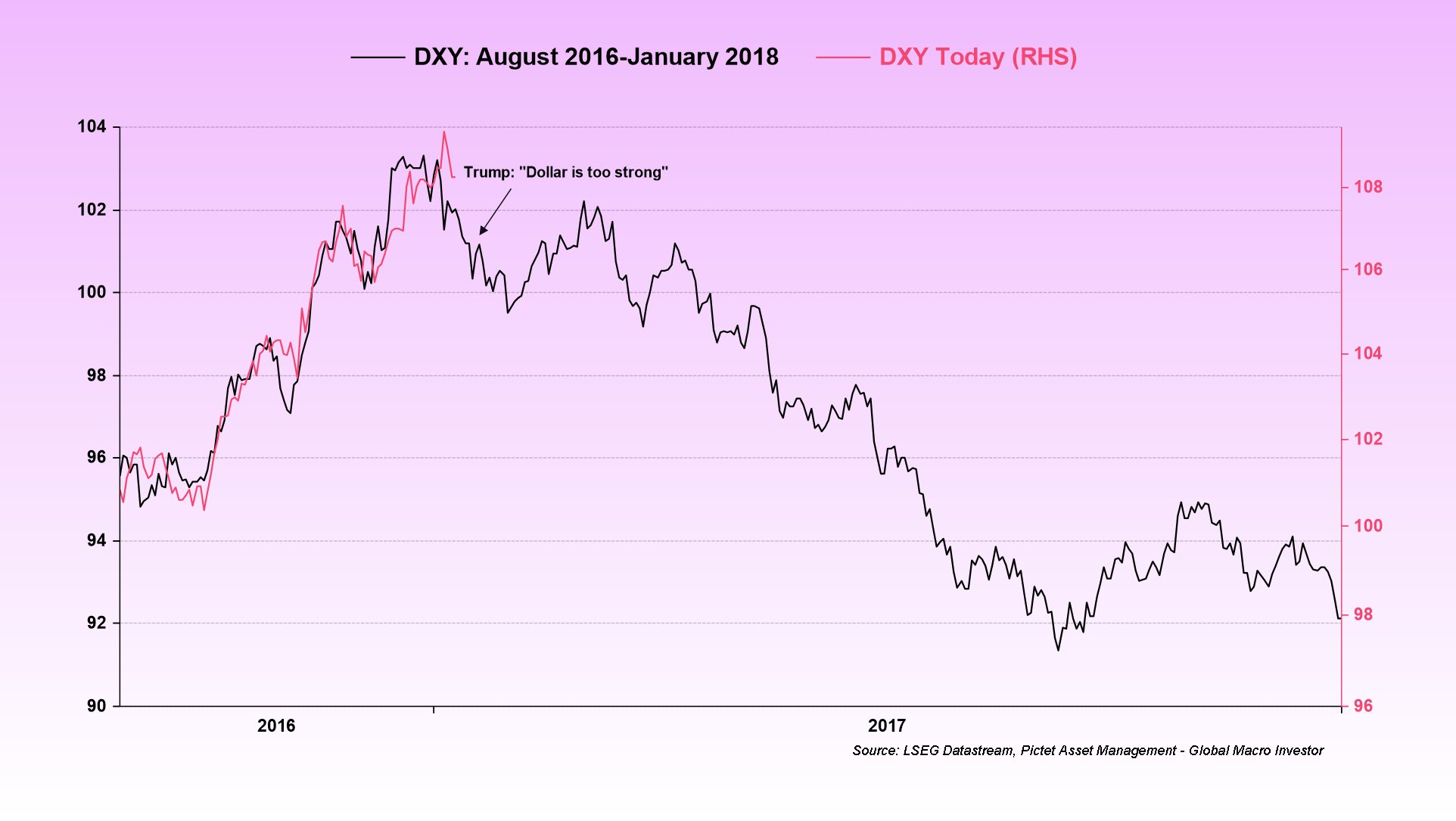

One motive that threat belongings could also be weighed down is the power of the U.S. Greenback Index (DXY), which has risen for 4 consecutive weeks.

In distinction, United States equities markets entered a corrective section prior to now few days. The S&P 500 Index (SPX) and the Nasdaq Composite have each pulled again for the previous two weeks, indicating profit-booking by short-term merchants.

What are the essential help and resistance ranges to look at for in Bitcoin (BTC) and altcoins? Let’s analyze the charts to search out out.

S&P 500 Index value evaluation

The S&P 500 Index dipped beneath the 20-day exponential transferring common (EMA) of 4,497 on Aug. 3, and since then, the bears thwarted a number of makes an attempt by the bulls to push the worth again above this stage.

The worth bounced off the 50-day easy transferring common (SMA) of 4,443 on Aug. 14, indicating that the bulls are guarding this stage with all their may. Patrons will attempt to sustain the momentum and shove the worth again above the 20-day EMA. In the event that they succeed, the index might begin its journey to 4,607 and subsequently to 4,650.

If bears wish to seize management, they should defend the 20-day EMA and tug the worth beneath the 50-day SMA. That might begin a deeper correction to 4,300 and later to 4,200.

U.S. Greenback Index value evaluation

The U.S. Greenback Index held help on the 20-day EMA ($102) on Aug. 4 and once more on Aug. 10, indicating a change in sentiment from promoting on rallies to purchasing on dips.

The index has reached the downtrend line, which is prone to act as a formidable resistance. If the worth turns down from the downtrend line however rebounds off the 20-day EMA, it’s going to recommend that the development stays bullish. That may improve the prospects of a rally above the downtrend line. The index might then soar towards the overhead resistance at 106.

This optimistic view will invalidate within the close to time period if the worth tumbles beneath the 20-day EMA. There’s minor help at 101.74, but when this stage provides manner, the index might drop to 100.82.

Bitcoin value evaluation

Bitcoin slipped beneath the 20-day EMA ($29,458) on Aug. 13, however the bears couldn’t construct upon this benefit and sink the worth to the important help at $28,585. This means an absence of aggressive promoting at decrease ranges.

The flattish 20-day EMA and the relative power index (RSI) close to the midpoint point out a steadiness between patrons and sellers. This means that the BTC/USDT pair might proceed to consolidate contained in the vary between $28,585 and $30,350 for some time longer.

The following trending transfer is prone to start after the worth escapes this vary. If the worth turns down and plunges beneath the $28,585 help, it might begin a descent to $26,000. Conversely, a rally above $30,350 might improve the prospects of a rally to the overhead resistance zone between $31,500 and $32,400.

Ether value evaluation

Ether (ETH) has been clinging to the 20-day EMA ($1,853) for the previous few days, indicating that the bulls have maintained their shopping for stress however the bears have held their floor.

The 20-day EMA is flattening out and the RSI is close to the midpoint, indicating that the promoting stress could possibly be decreasing. If bulls thrust the worth above the transferring averages, the ETH/USDT pair might rally to $1,930 after which to $2,000.

If bears wish to preserve their management, they should defend the transferring averages. If the worth turns down from the 50-day SMA ($1,877), the pair might skid to the sturdy help at $1,816. This is a vital stage for the bulls to be careful for as a result of a break beneath it might sink the pair to $1,700.

BNB value evaluation

BNB (BNB) has been buying and selling beneath the transferring averages for the previous three days, however the bears haven’t been capable of sink the worth to the help line of the symmetrical triangle.

If the worth doesn’t break above or beneath the triangle throughout the subsequent few days, then it’s going to invalidate the sample. The flattish transferring averages and the RSI slightly below the midpoint sign that the uninteresting value motion might proceed for some extra time.

A break and shut above the triangle would be the first signal that the uncertainty has resolved in favor of the bulls. The BNB/USDT pair might then rally to the overhead resistance at $265.

Then again, a break and shut beneath the triangle might sink the pair to the essential help at $220.

XRP value evaluation

XRP (XRP) has been swinging between the transferring averages for the previous few days, indicating shopping for close to the 50-day SMA ($0.62) and promoting on the 20-day EMA ($0.65).

Though patrons have held the 50-day SMA, the downsloping 20-day EMA and the RSI within the unfavourable territory point out that bears have the sting. A shallow bounce off the present stage will enhance the prospects of a drop beneath the 50-day SMA. If that occurs, the XRP/USDT pair might stoop to $0.56.

Opposite to this assumption, if the worth climbs above the 20-day EMA, it’s going to point out strong shopping for at decrease ranges. The pair might then transfer as much as $0.74.

Cardano value evaluation

Cardano (ADA) has been correcting inside a descending channel sample for the previous few days. This means an absence of aggressive shopping for by the bulls.

The primary signal of power will probably be a break and shut above the resistance line of the channel. That might open the doorways for a potential rally to $0.34. If this stage is scaled, the ADA/USDT pair might retest the July 14 intraday excessive at $0.38.

The bears are prone to produce other plans. They may attempt to promote the rallies to the resistance line of the channel. If the worth turns down from this stage, it’s going to sign that the pair might proceed to descend contained in the channel. The essential help to look at on the draw back is $0.26.

Associated: Bitcoin teases new volatility as BTC value faucets 4-day excessive close to $29.6K

Dogecoin value evaluation

Dogecoin’s (DOGE) restoration was rejected on the downtrend line on Aug. 13, indicating that the bears are fiercely defending this stage.

The worth has reached the help line of the ascending channel, which is a vital stage to control. If the worth plummets beneath the help line, the DOGE/USDT pair might tumble to $0.07.

Contrarily, if the worth turns up from the present stage and breaks above the downtrend line, it’s going to sign that the bulls stay patrons at decrease ranges. The pair might first rise to $0.08 and later to the resistance line of the channel at $0.09.

Solana value evaluation

Solana (SOL) is buying and selling contained in the vary between $22.30 on the draw back and $26 on the upside. A minor benefit in favor of the bulls is that the worth is buying and selling above the 20-day EMA ($24.09).

If the present bounce sustains, the bulls will attempt to drive the SOL/USDT pair above the overhead resistance at $26. In the event that they succeed, the pair might choose up momentum and climb to $29.12 and later to $32.13.

Alternatively, if the worth turns down from $26, it’s going to recommend that the pair might prolong its keep contained in the vary for a number of extra days. The bears should yank the worth beneath $22.30 to come back out on high.

Polygon value evaluation

The bulls are discovering it troublesome to push Polygon (MATIC) above the 20-day EMA ($0.69), however a optimistic signal is that they haven’t ceded floor to the bears.

The transferring averages are flattening out and the RSI is slightly below the midpoint, indicating a steadiness between provide and demand. This steadiness might tilt in favor of the bulls in the event that they propel the worth above the 50-day SMA ($0.70). The MATIC/USDT pair might then try a rally to $0.80.

Quite the opposite, if the worth turns down from the 50-day SMA, it’s going to sign that bears are energetic at greater ranges. That will preserve the pair caught inside a spread for a number of days. The bears should sink and maintain the worth beneath the help close to $0.65 to realize the higher hand. The pair might then slide to $0.60.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.