John Clifton Davies, a convicted fraudster estimated to have bilked dozens of know-how startups out of greater than $30 million via phony funding schemes, has a model new pair of rip-off firms which can be busy dashing startup goals: A pretend funding agency referred to as Fairness-Make investments[.]ch, and Diligere[.]co.uk, a rip-off due diligence firm that Fairness-Make investments insists all funding companions use.

A local of the UK, Mr. Davies absconded from justice earlier than being convicted on a number of counts of fraud in 2015. Previous to his conviction, Davies served 16 months in jail earlier than being cleared on suspicion of murdering his third spouse on their honeymoon in India.

The rip-off artist John Bernard (left) in a current Zoom name, and a photograph of John Clifton Davies from 2015.

John Clifton Davies was convicted in 2015 of swindling companies all through the U.Okay. that have been struggling financially and in search of to restructure their debt. For roughly six years, Davies ran a collection of companies that pretended to supply insolvency providers. As an alternative, he merely siphoned what little remaining cash these firms had, spending the stolen funds on lavish automobiles, house furnishings, holidays and luxurious watches.

In a three-part collection printed in 2020, KrebsOnSecurity uncovered how Davies — wished by authorities within the U.Okay. — had fled the nation, taken on the surname Bernard, remarried, and moved to his new (and fourth) spouse’s hometown in Ukraine.

After eluding justice within the U.Okay., Davies reinvented himself as The Personal Workplace of John Bernard, pretending to be a billionaire Swiss investor who made his fortunes within the dot-com growth 20 years in the past and who was in search of non-public fairness funding alternatives.

In case after case, Bernard would promise to speculate tens of millions in hi-tech startups, solely to insist that firms pay tens of 1000’s of {dollars} price of due diligence charges up entrance. Nevertheless, the due diligence firm he insisted on utilizing — one other Swiss agency referred to as The Inside Data — additionally was secretly owned by Bernard, who would invariably pull out of the deal after receiving the due diligence cash.

Bernard discovered a relentless stream of latest marks by providing terribly beneficiant finders charges to funding brokers who might introduce him to firms in search of an infusion of money. Inside Data and The Personal Workplace each closed up store not lengthy after being uncovered right here in 2020.

In April 2023, KrebsOnSecurity wrote about Codes2You, a current Davies enterprise which purports to be a “full cycle software program improvement firm” based mostly within the U.Okay. The corporate’s web site not lists any of Davies’ identified associates, however the web site does nonetheless reference software program and cloud providers tied to these associates — together with MySolve, a “multi-feature platform for insolvency practitioners.”

Earlier this month, KrebsOnSecurity heard from an funding dealer who discovered his shopper had paid greater than $50,000 in due diligence charges associated to a supposed multi-million greenback funding provide from a Swiss concern referred to as Fairness-Make investments[.]ch.

The funding dealer, who spoke given that neither he nor his shopper be named, mentioned Fairness-Make investments started getting chilly ft after his shopper plunked down the due diligence charges.

“Issues began to go sideways when the investor purportedly booked a visit to the US to fulfill the group however canceled final minute as a result of ‘his pregnant spouse received in a automotive accident,’” the dealer defined. “After that, he was radio silent till the contract expired.”

The dealer mentioned he grew suspicious when he realized that the Fairness-Make investments area title was lower than six months outdated. The dealer’s suspicions have been confirmed after he found the due diligence firm that Fairness-Make investments insisted on utilizing — Diligere[.]co.uk — included an electronic mail deal with on its homepage for one more entity referred to as Ardelis Options.

A company entity within the UK referred to as Ardelis Options was key to displaying the connection to Davies’ former rip-off funding and due diligence companies within the Codes2You investigation printed earlier this 12 months.

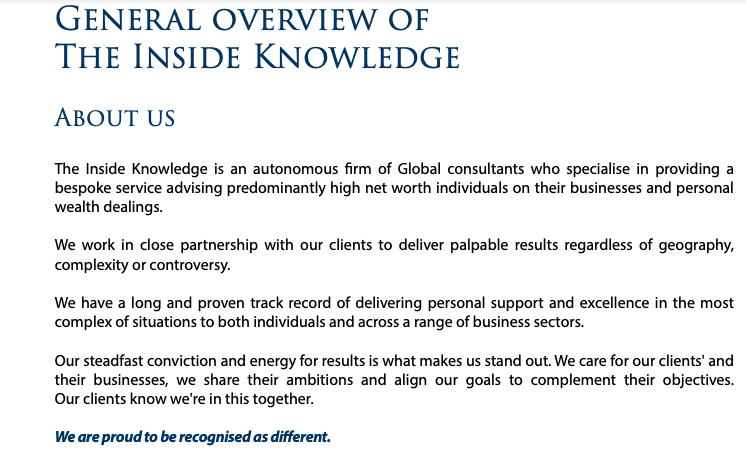

Though Diligere’s web site claims the due diligence agency has “13 years of experiance” [sic], its area title was solely registered in April 2023. What’s extra, nearly all the vapid corporate-speak printed on Diligere’s homepage is similar to textual content on the now-defunct InsideKnowledge[.]ch — the pretend due diligence agency secretly owned for a few years by The Personal Workplace of John Bernard (John Clifton Davies).

A snippet of textual content from the now-defunct web site of the pretend Swiss investor John Bernard, in actual life John Clifton Davies.

“Our steadfast conviction and vitality for outcomes is what makes us stand out,” each websites state. “We take care of our shoppers’ and their companies, we share their ambitions and align our objectives to enhance their goals. Our shoppers know we’re on this collectively. We work in shut partnership with our shoppers to ship palpable outcomes no matter geography, complexity or controversy.”

The copy on Diligere’s homepage is similar to that after on Insideknowledge[.]com, a phony due diligence firm run by John Clifton Davies.

Requests for remark despatched to the contact deal with listed on Diligere — data@ardelissolutions[.]com — went unreturned. Fairness-Make investments didn’t reply to requests for remark.