The preferred Stablecoin, Tether(USDT) presently, seems to be in a deep soup because the market cap after shrinking always has reached a 6-month low. Then again, the USD Coin (USDC) gained enormous reputation whereas the quantity is recording an enormous leap previously couple of days. Subsequently with the current momentum, the USDC might even surpass USDT to grow to be the third largest asset after Bitcoin and Ethereum very quickly.

USDT had misplaced its peg quickly after the UST de-peg occasion when the merchants dumped enormous quantities of USDT falling into FUD. The platform rapidly jumped in motion and burnt 3 billion tokens to stabalize the peg. Little doubt, the peg was stabilized however by no means regained its worth at $1 since then. Subsequently, as many merchants, presently simply had been to get out of USDT, USDC now seems to have grow to be the protected heavens for the merchants.

Additionally Learn: After Terra(LUNA), Celsius Community(CEL) & 3AC, Babel Finance in Deep Waters

So whether or not USDC reserves are presently safer than USDT?

It’s a recognized indisputable fact that Tether is essentially the most traded crypto asset every day out there. However now, with a drastic fall, USDT may very well be de-throned shortly. The USDC market cap is consistently elevating for the reason that time when USDT tumbled. Presently, it’s at an all-time excessive degree of above $55 billion and wanting one other $14 billion to grow to be the highest third asset.

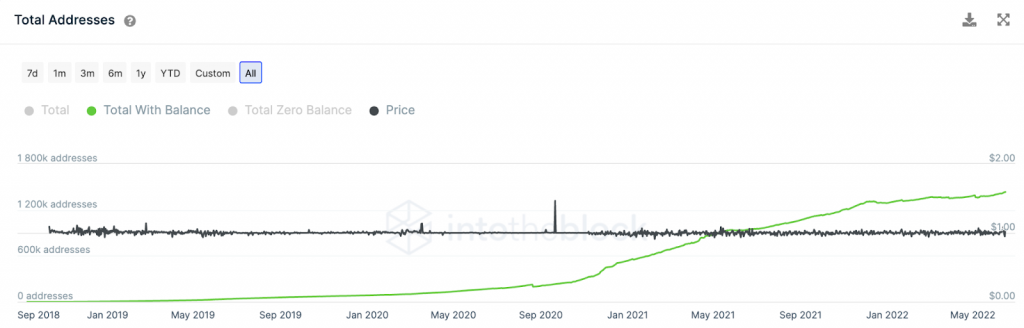

Then again, the on-chain studies counsel that USDC might obtain this milestone in a short time. The brand new addresses and the energetic addresses just lately spiked excessive with the overall energetic addresses presently on the ATH ranges, indicating a swelling consumer adoption.

Collectively, USDT’s dominance seems to have been threatened by rising stablecoins like USDC and BUSD. Primarily attributable to the truth that USDC & BUSD are totally backed to USD reserves whereas USDT nonetheless lags readability. Subsequently within the upcoming days, USDC might achieve enormous dominance because the platform has now introduced a Euro-backed USDC to be rolled out by the tip of June 2022.

Additionally Learn: Within the Center of the Bear Market, Bitcoin(BTC) costs Challenge A 15% Upswing to Hit $24,000