Solana is without doubt one of the quickest rising cryptocurrency platforms because of its excessive pace and low prices. Launched in 2020, its native SOL token has seen huge appreciation.

Right here we analyze Solana’s value outlook for the longer term utilizing technical evaluation to offer an evidence-based Solana value prediction information.

What’s Solana (SOL)?

Solana is a extremely scalable decentralized blockchain created by Anatoly Yakovenko in 2017. It makes use of a novel proof-of-history consensus mechanism to realize excessive transaction speeds and low charges whereas sustaining safety.

The native cryptocurrency of the Solana community is SOL. It’s used to pay for executing transactions, interacting with sensible contracts, and staking on the blockchain.

Some key points of Solana embody:

Velocity

Solana can course of over 50,000 transactions per second, considerably sooner than Bitcoin or Ethereum.

Low charges

With excessive pace, Solana presents transaction prices as little as $0.00025 making it excellent for DeFi.

Proof-of-Historical past

This novel consensus mechanism coordinates timeline between nodes with out slowing issues down.

Programming

Solana helps programming languages like Rust and C++ to develop dApps.

Staking

SOL holders can stake tokens to assist validate transactions whereas incomes staking rewards.

Solana’s highly effective efficiency makes it a number one alternative for creating quick, scalable DeFi functions and companies.

Components Influencing Solana Worth

A number of core elements decide the value motion and progress potential of SOL:

Cryptocurrency Market Situations

Like most altcoins, Solana’s value relies upon considerably on Bitcoin and total crypto market tendencies. A rising market lifts SOL.

Adoption by Builders

As extra initiatives construct DEXs, NFT marketplaces, Web3 functions and many others on Solana, demand for SOL will increase.

Competitors From Rival Networks

Various scalability options like Avalanche, Polkadot or Cardano might fragment developer curiosity and diminish Solana’s progress potential in the event that they achieve traction.

Community Upgrades and Innovation

Upgrades to additional increase Solana’s pace and capabilities can increase developer demand, boosting SOL’s worth.

Staking Tendencies

Increased staking exercise reduces accessible SOL provide which can result in appreciation in token value.

Safety and Reliability

Community outages or vulnerabilities might injury confidence in Solana and depress SOL value. Easy efficiency boosts its status.

Main Historic Worth Developments

SOL’s value has seen big progress since launching, but in addition intervals of instability. Let’s take a look at key highlights:

2020 – Minimal Buying and selling After Launch

Solana launched the mainnet in March 2020 with SOL beginning off round $0.50 initially with minimal change availability and buying and selling. By December 2020, it reached $1.52 as buying and selling volumes steadily picked up.

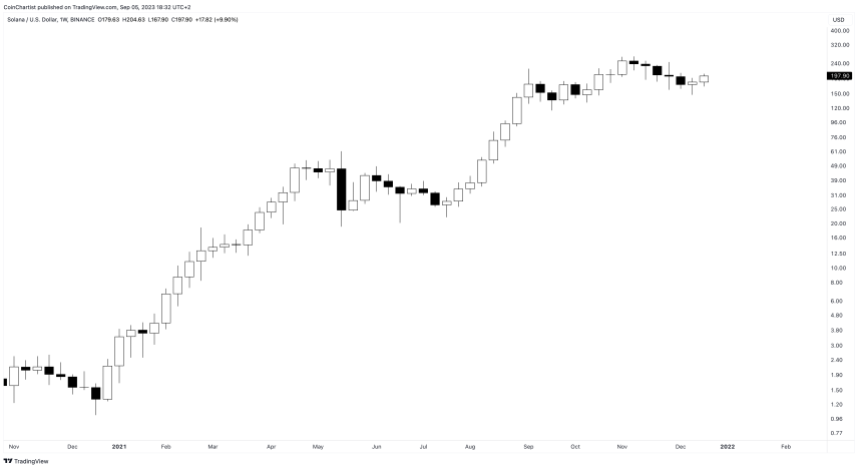

2021 – Large Breakout

The 2021 crypto bull run catapulted Solana into the limelight with SOL surging exponentially from $3 in January 2021 to a peak of $260 by November 2021 – an unbelievable 8700% return inside 10 months!

Driving this have been:

- Explosive progress of DeFi and NFT exercise on Solana, using the new tendencies.

Attracting builders on account of sooner speeds and decrease prices than Ethereum.

Main protocol enhancements and ecosystem funding.

Itemizing on Coinbase and Binance centralized exchanges.

This established Solana as a number one Ethereum competitor. However lack of maturity confirmed…

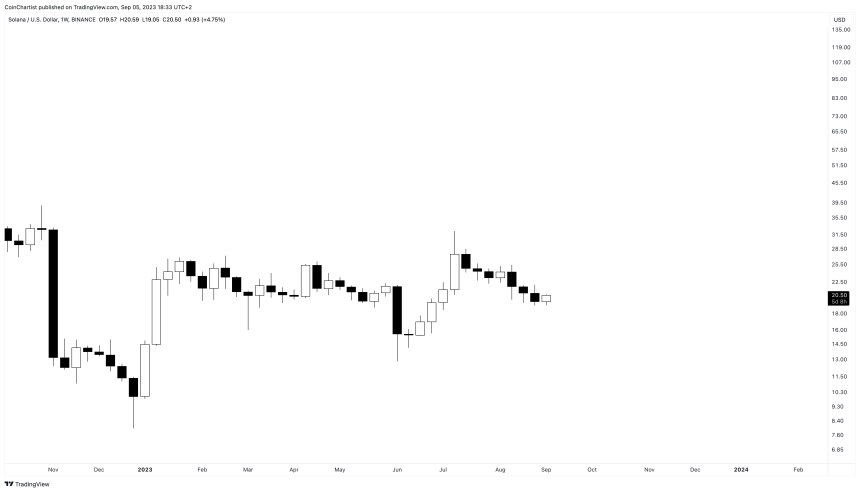

2022 – Crash and Outages

In 2022, the crypto downturn introduced SOL again down beneath $40 from its highs. Extra damaging have been community outages in 2022 that dented confidence in Solana’s stability. The ultimate days surrounding the FTX collapse, Solana additionally suffered, taking the cryptocurrency to a 2022 low of $8.

Whereas nonetheless early days for such a nascent mission, Solana wants to enhance reliability to achieve institutional belief. However its developer momentum continues unabated, with over 4000 initiatives constructed on Solana up to now.

Current SOL Worth Evaluation

Solana has been recovering all through 2023, however the US SEC hasn’t made it simple, attacking altcoins round each flip. Every time altcoins like SOL try to achieve momentum, the SEC recordsdata one other case in opposition to a crypto change. Previous filings embody naming Solana as a potential unregistered safety.

Nonetheless, it continues to be the selection for giant establishments equivalent to VISA, which is launching a secure coin cost system on Solana.

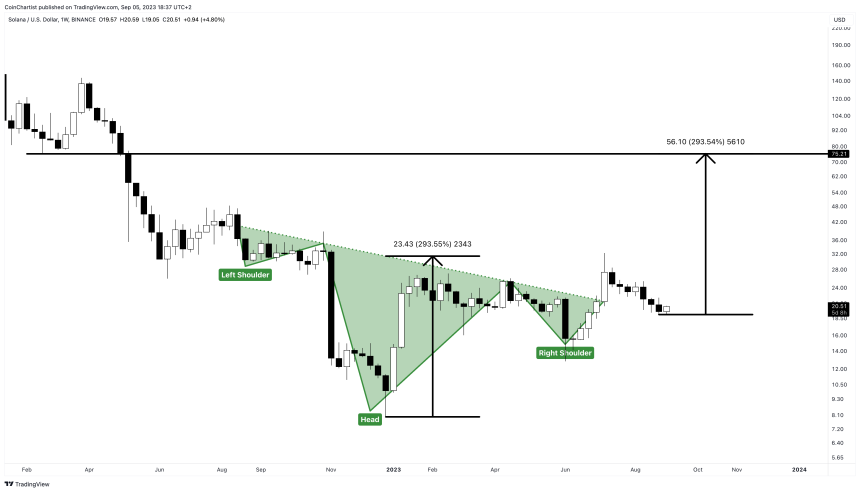

Brief-Time period Solana Worth Prediction for 2023

The newest bullish information that VISA is utilizing Solana for its secure coin funds might propel SOL greater and attain the goal of this inverse head and shoulders sample, with a goal of $75 per token.

Medium-Time period Solana Worth Prediction for 2024-2025

Solana very intently mimics the value motion of 2016 by 2020 Ethereum. If one other related rally follows in Solana prefer it did in Ethereum, SOL might strategy upwards of $1,000 per token.

Lengthy-Time period Solana Worth Prediction for 2030

Within the longest time period outlook, it turns into way more difficult to correctly predict what SOL would possibly do. It very a lot depends upon adoption of the SOL token, the Solana blockchain, and crypto itself. If SOL can keep its present imply trajectory, then it’s potential Solana could possibly be priced round $3,000 to $4,000 by the yr 2030 or past.

Conclusion: Solana Worth Outlook

Solana has demonstrated immense potential with its blazing quick speeds at low prices. However it nonetheless has a lot to show concerning stability and institutional-grade safety.

If Solana can construct on its developer momentum and quickly evolving ecosystem whereas bettering reliability, its long-term progress upside is immense. However execution dangers stay for this bold mission aiming to reshape decentralized finance.

Solana Worth Prediction FAQs

Let’s take a look at some frequent questions crypto traders have about SOL value evaluation:

What was Solana’s lowest ever value?

SOL sank to as little as $0.50 within the early days after its mainnet launch in 2020. Its 2022 low was round $8 amidst broader crypto market weak spot.

What was the best value for Solana?

Solana’s all-time excessive value stands at $260 reached in November 2021 throughout sturdy bullish momentum carrying crypto markets greater.

Is $500 life like for Solana?

SOL reaching $500 is achievable this decade if Solana fulfills its technological promise and sees excessive adoption because the main DeFi blockchain.

Can Solana crash to zero?

A whole collapse is unlikely given Solana’s sturdy fundamentals until essential flaws emerge in its core protocol. However prolonged weak spot might sink SOL beneath $10 till a restoration.

Why is SOL value risky?

As a comparatively new asset with restricted liquidity, Solana experiences excessive volatility from speculative buying and selling and sentiment shifts. As adoption will increase, volatility ought to stabilize.

When will Solana’s value stabilize?

Solana value swings could begin normalizing as soon as it builds a big person base and matures technically. However as a crypto asset, some volatility will all the time stay.

Funding Disclaimer: The content material supplied on this article is for informational and academic functions solely. It shouldn’t be thought-about funding recommendation. Please seek the advice of a monetary advisor earlier than making any funding selections. Buying and selling and investing includes substantial monetary danger. Previous efficiency just isn’t indicative of future outcomes. No content material on this website is a advice or solicitation to purchase or promote any securities or cryptocurrencies.