The Bitcoin bull run could not begin correctly till this on-chain ratio reverses the trajectory it’s at present entering into.

Bitcoin RHODL Ratio Is At present Exhibiting A “Lifeless Cat Bounce”

As analyst James V. Straten defined in a put up on X, the BTC RHODL ratio could comprise hints about when the cryptocurrency’s subsequent bull run could possibly be coming.

The “Realized HODL ratio” (RHODL) right here refers to an indicator that retains observe of the ratio between the worth held by the buyers holding since 6 months and three years in the past and that held by the 1 day to three months previous holders.

These former buyers make up a section of the bigger “long-term holder” (LTH) group. Extra particularly, this a part of the group could also be termed the “single cycle LTHs” since their holding vary is contained in the span of a BTC cycle (sometimes 4 years).

The opposite buyers, these holding since 1 day and three months in the past, symbolize the youngest members of the “short-term holder” (STH) cohort. Your entire STH group has its cutoff on the six-month mark, the place the LTH group naturally begins.

Because the RHODL ratio compares the worth held by these two cohorts, its pattern can present hints about how the rotation of capital happens out there.

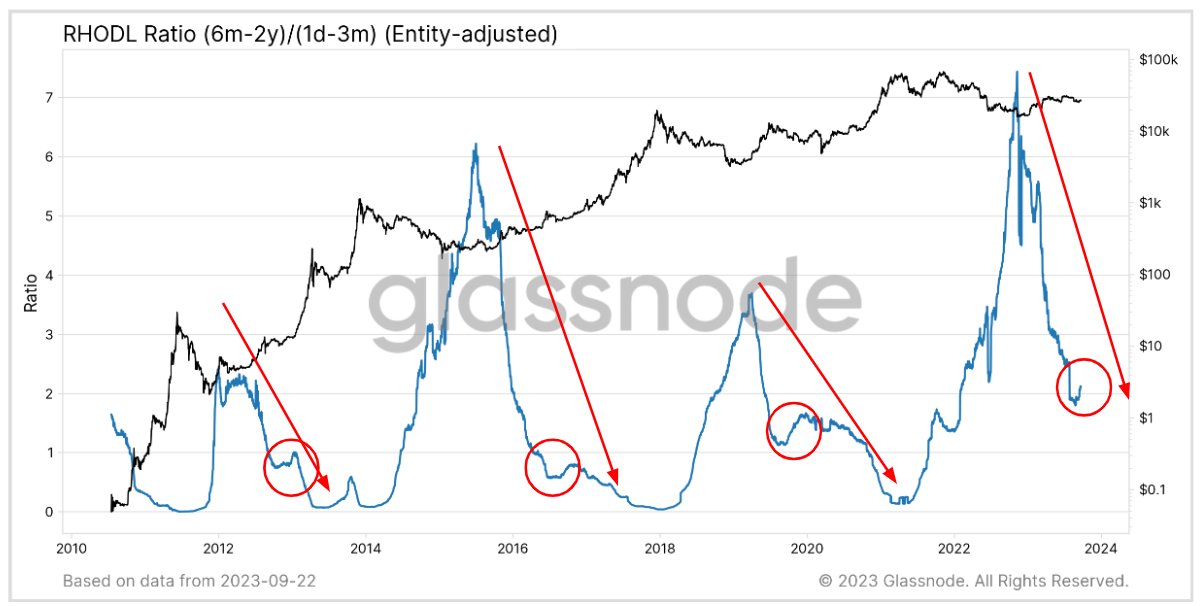

Now, here’s a chart that reveals the pattern within the Bitcoin RHODL ratio over the historical past of the cryptocurrency:

The worth of the metric appears to have sharply gone down in latest months | Supply: @jimmyvs24 on X

The above graph reveals that the Bitcoin RHODL ratio has adopted an identical sample in every Bitcoin cycle. The metric at all times hits a backside throughout bull run tops and begins heading up.

This enhance represents a rotation of capital in the direction of the LTHs, because the bear market setting in results in the STHs giving up on the asset and exiting, whereas the persistent holders left behind accumulate extra on the decrease costs.

This accumulation from the LTHs continues till the bear market backside. The graph reveals that the RHODL ratio has at all times seen its prime coincide with the cyclical bottoms within the value.

As a result of reduction rally following the worst bear market stage, STHs return to the market and develop their holdings, whereas some LTHs promote their cash to take their earnings.

Within the graph, Straten has highlighted that the indicator has been sharply happening through the previous few months, identical to it did within the buildup to previous bull markets.

As famous by the circles, although, the indicator typically experiences a form of useless cat bounce on the best way down. The indicator has lately turned in the direction of the upside, doubtlessly implying that this identical useless cat bounce sample is once more forming.

Traditionally, true bull markets have adopted when the Bitcoin RHODL ratio has once more reversed its path following this sample and has resumed its downtrend. An analogous reversal can also be the one to observe for this time, because it may lead in the direction of the subsequent bull run.

BTC Worth

Bitcoin has continued to maneuver sideways because the drop yesterday as its value continues to commerce across the $26,600 mark.

Seems like BTC has gone down lately | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, Glassnode.com