The Queensland authorities’s determination to extend the decade-old tax charges on coal has come beneath heavy criticism.

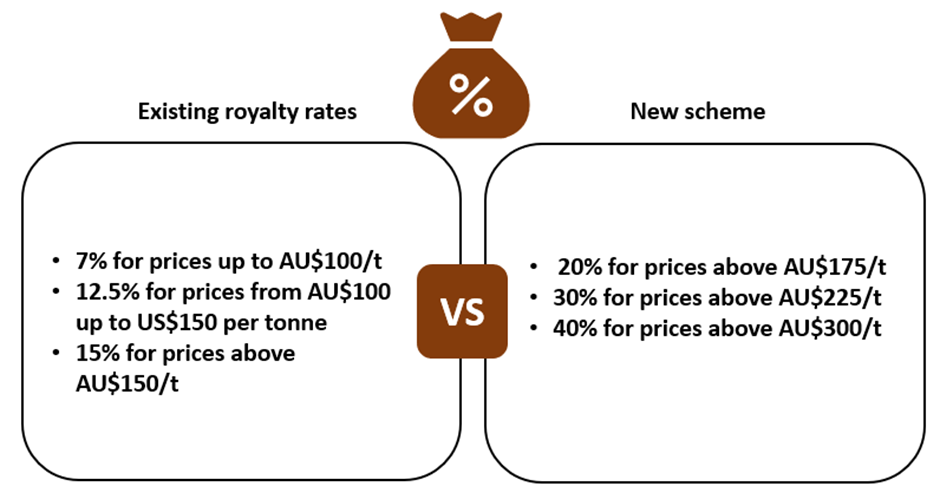

The brand new scheme has added three tiers to the royalty system. Primarily based on the brand new system, if coal costs are above AU$175/tonne, miners might be required to pay a 20% royalty, whereas new charges might be 30% and 40% for costs above AU$225/tonne and AU$300/tonne, respectively. The tax charges are relevant solely on the costs above the edge set by the federal government.

Associated learn: Meet this ASX coal producer whose share worth zoomed up 300% in a 12 months

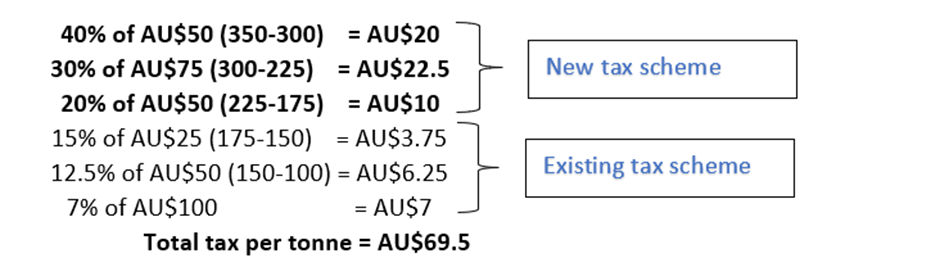

As an example, coal is buying and selling at AU$350/tonne. On this case, the coal miner can be required to pay a 40% tax royalty solely on the final AU$50/tonne, not on the entire AU$350.

Allow us to study how a lot would it not price the business with the brand new tax regime, contemplating coal costs to be AU$350/tonne.

Within the new system, coal miners might be required to pay AU$69.5/tonne in taxes if coal costs maintain round AU$350/tonne, i.e. round 20%.

Within the current (outdated) royalty system, the utilized tax fee was flat at 15% for costs above AU$150/tonne, 12.5% for costs between AU$100-150/tonne and seven% for the primary AU$100/tonne. So, for coal costs at AU$350/tonne, miners had been required to pay AU$43.25/tonne as royalties. That is almost 60% decrease than the brand new tax scheme.

The above figures recommend why the business is making a lot noise concerning the new scheme. With the brand new system implementation, the business will see a substantial drop within the income.

Copyright © 2022 Kalkine Media ®

From one angle, it might look punitive for the business. As coal costs are anticipated to extend within the close to future, the Australian miners would even be required to pay larger tax quantities to the Queensland state authorities.

Lately, Germany determined to fireside up its coal-based energy crops as pure gasoline provide dwindles as a result of Russia-Ukraine battle. India can also be present process a extreme coal shortfall for its energy crops. Market analysts are optimistic that the costs may transfer additional north from right here.

From one other level, plainly the federal government is making preliminary strikes to make coal mining much less engaging to attain its emission targets. The brand new federal authorities has already raised its carbon emission discount goal to 43% by 2030. Larger tax revenue may present extra flexibility to the federal government to revamp the Australian business for a extra sustainable future.

Associated learn: How reaching web zero carbon emission goal is an enormous problem for Australia?

How did the business react?

The federal government has stored the present tax charges unchanged and launched new taxes on coal costs above US$175/tonne. The brand new scheme is anticipated to ship an extra US$1.2 billion to the state coffers.

The primary response got here from the Chief Govt of the Queensland Assets Council Ian Macfarlane, who labelled the brand new tax scheme as ‘misguided. He highlighted that the brand new system would make the Queensland mining business much less aggressive on the worldwide stage.

CEO of Anglo American Australian operations Nick Barlow stated the brand new royalty scheme would price almost 60% of the income. This may put large burden on coal miners. Anglo American operates a number of mines throughout the Queensland area.

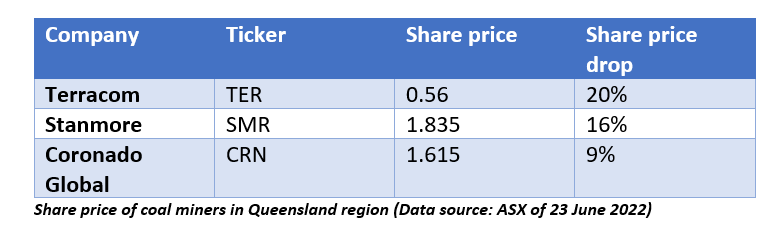

After the information broke out, coal firms operational within the Queensland area witnessed a large swing of their intraday commerce on 21 June 2022.

Within the final two days, many coal shares noticed a major drop of their costs.

Associated learn: What’s the way forward for coal? 6 ASX-listed coal shares in focus

In line with Treasurer & Minister for Commerce and Funding, Cameron Dick, the brand new royalty charges would help new investments within the state’s healthcare system. He added that the present royalty doesn’t justify excessive coal costs.