It may be robust for online game studios to get enterprise capital because the market is already mature and extremely aggressive, there’s additionally no solution to assure that the sport you make will probably be a success or stand out from the group.

So if you happen to’re a studio that should elevate some cash what are you able to do? On this visitor submit, co-founder and normal accomplice at enterprise capital agency F4 Fund, David Kaye shares 4 methods to beat investor scepticism to fight content material danger.

It’s extremely exhausting to boost enterprise capital for video games. The most important cause?

Content material danger.

Right here is how VCs prefer to suppose they make selections:

- A founder articulates her imaginative and prescient of how the product she is constructing will create, increase or remodel a market in some ideally world-changing means.

- She explains why she is the right individual to do that, and the distinctive insights she has uncovered that give her an unfair benefit.

- She describes how she is going to take this new product to market, and provides the VC a tantalising glimpse of the trajectory the corporate is already on in the direction of changing into a multi-billion greenback behemoth that can make the founder and VC outrageously wealthy.

- The VC fastidiously examines these assumptions, the founder’s expertise, the product and the technique and reaches a deeply thought-about unbiased conclusion about whether or not to speculate.

Protecting this framework in thoughts, let’s unpack what VCs imply by content material danger.

It’s notoriously exhausting to evaluate whether or not any sport will probably be a success, particularly on the earliest phases of growth.

Deciding what to greenlight has historically been the bailiwick of gatekeepers at specialised organisations we name publishers, that are structured to fund a portfolio of bets and exploit the hell out of the few which might be profitable.

Even these specialists can’t do that reliably, which is why the Xbox workforce dismissed what turned out to be one of many greatest hits of 2023 as a “second-run Stadia PC RPG” that might be value paying about $5M for.

Nonetheless, all this sounds a bit like what a enterprise capitalist does, so what’s the difficulty?

First, the background of your typical VC (credentialed, danger averse, enterprise oriented) makes them way more snug assessing “regular” enterprise concepts than pre-product sport ideas.

Virtually all VCs you discuss to about your sport will fall into considered one of two classes:

- They are going to do not know what you might be speaking about and no solution to arrive at a judgement about its deserves as a result of they lack the related expertise.

- They are going to have related expertise – they may even be former sport builders – however that can make them even much less assured of their means to evaluate the chance of your sport’s success from a pitch deck.

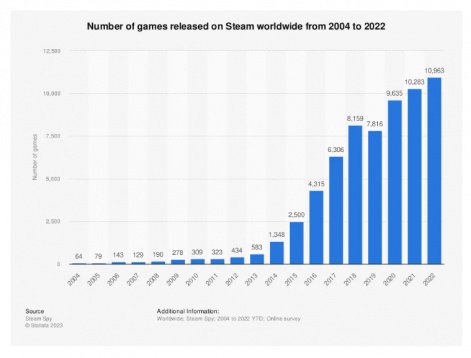

What’s extra, the percentages of your sport being profitable worsen annually as the quantity of latest releases retains rising.

these odds, providing you with tens of millions of {dollars} to make your sport is plainly irrational.

So what do you, a sport developer who wants cash, do about this?

make us consider

Keep in mind: VCs hate danger, they usually particularly hate content material danger, so it’s important to give us different causes to consider you can be profitable. Listed below are just a few methods to do it.

Technique #1: Present proof of demand

Plenty of founders are pissed off by this. How are we alleged to show folks need what we’re constructing with out the cash to create even an preliminary product that might get our viewers excited, they ask.

Powerful. You determined to begin an organization within the face of near-impossible odds, so it’s your job to determine this out.

There are a lot of types of proof, some higher than others. Sadly, the commonest one I see in developer pitches can also be the least convincing: survey information, income of comparable titles and so forth. These are virtually irrelevant, and most traders will dismiss them.

You’ll want to present proof of demand for the precise factor you might be constructing, not stuff that’s considerably related.

On cellular, this usually comes within the type of cohort retention and engagement information from an early model of the product launched in a check market. A number of cohorts are higher than a single cherry picked one (we see these quite a bit), and bigger cohorts are clearly higher than a golden cohort of fifty of your family and friends.

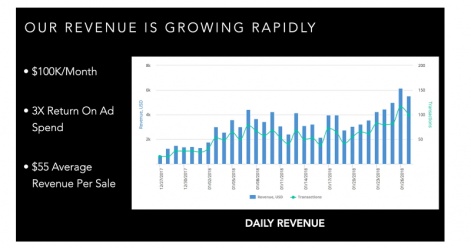

On PC, there are many methods to inform a ‘demand’ story. Within the case of my earlier startup, we arrange an internet retailer for our sport and did every kind of loopy advertising and marketing experiments to generate a constant stream of pre-orders. This allowed us to place the next graph in our pitch deck, regardless that we didn’t have a product but:

Technique #2: Put a designer founder on the workforce

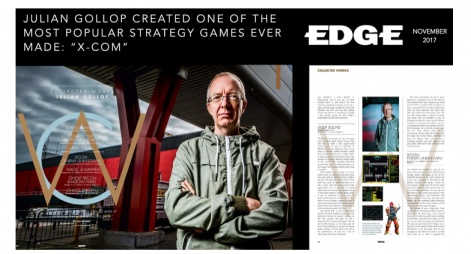

If considered one of your founding workforce was straight liable for a extremely profitable sport, traders will probably be extra more likely to consider they’ll do it once more. I don’t suppose that is an particularly good cause, and I don’t suppose it’s ample by itself, however I’ve repeatedly seen this play an vital function in offers getting accomplished.

Technique #3: Persuade us you might have a tailwind

VCs are largely danger averse fits who spend lots of time fascinated by enterprise, so discuss to us in a means that positions what you might be doing as profiting from an trade tailwind reasonably than one other suicide mission into the jaws of the content material meat grinder.

There are a lot of methods to do that, however probably the most highly effective is thru the clever software of positioning – it’s important to contextualise what you might be doing in a means that places your technique in the absolute best mild.

Particularly, you need to place your self atop a wave the investor believes will remodel the trade and assist carry you to success (there’s all the time one thing).

Right here is how we did that after we pitched Phoenix Level again in 2018:

Executed correctly, positioning rides the road between rhetorical sleight-of-hand and a reliable articulation of your technique (hopefully the latter, however let’s not cut up hairs).

Preserve your eye on the prize: to get traders to neglect about content material danger and dream in regards to the upside.

Am I embarrassed to share this after I know we solely achieved 10% of the tremendous bold plan we pitched? Sure. Did that plan assist us to get traders enthusiastic about what we had been doing? Additionally sure.

Technique #4: Create a differentiated go to market technique

So many sport builders are extremely inventive in terms of sport design however totally pedestrian in terms of their go to market.

I might write a complete submit on this subject, however I’ll depart you with a single piece of recommendation that can level you in the suitable course: don’t simply have a look at what different sport builders are doing – steal from different industries.

In that vein, I’ll depart you with some distinctive recommendation from Wade Foster, founding father of Zapier:

David Kaye is co-founder and Normal Accomplice at F4 Fund. If you’re elevating for a pre-seed or seed-stage video games or know-how firm, please attain out. Getting an intro from a founder we all know is greatest, however a well-written chilly electronic mail works too.

Subscribe to the Recreation Stuff substack to learn future essays on startups.

Edited by Paige Cook dinner