Highlights

- Penny shares proceed to draw traders regardless of excessive dangers.

- In Australia, small-cap shares underneath AU$1 are termed penny shares.

- Rising inflation, battle disaster, growing crude costs, and different components have jolted sentiments for fairness markets.

In Australia, if a selected inventory is offered at a market worth decrease than AU$1, it’s termed penny inventory. In depth analysis and due diligence of the enterprise should be carried out earlier than investing in penny shares as they’ve a better risk-to-reward ratio.

From the assets business, a number of small to mid-cap corporations are engaged within the exploration and improvement of marginal fields.

Associated learn: 92E, RMI, FTZ: ASX penny shares that gained over 100% on a yearly foundation

Exploration is a dangerous enterprise. It includes vital funding and time to delineate assets from the earth’s crust. A few of these explorers find yourself unlocking substantial assets, whereas many should abandon their initiatives or licences in the event that they fail to hit a business grade.

The businesses working such marginal fields or licences usually have low market cap and restricted funds to burn on exploration and improvement.

The continuing turmoil within the fairness market because of inflation has eaten up a big capital of traders. A number of shares are at the moment buying and selling at their multi-year low worth. Some market analysts imagine that is the suitable time to make an entry in a selected inventory as they’re obtainable at comparatively decrease costs, whereas many imagine the market hasn’t bottomed but, and traders ought to watch for somewhat longer earlier than making any choice.

Few issues traders have to ask themselves earlier than deciding to take a position their hard-earned revenue:

- How a lot threat are they keen to take if their funding plan doesn’t work out?

- How a lot cash might they spend money on a penny inventory to restrict draw back dangers?

- At what level to make entry and exit?

- Ought to they spend money on low-risk blue chip corporations and earn reasonable returns or take dangers and earn multi-fold returns?

- Which commodity to focus on if investing within the assets business?

There aren’t any proper or unsuitable solutions to all these questions. It completely is dependent upon traders’ risk-taking capability and market tendencies.

There’s a well-known saying by Voltaire, ‘historical past doesn’t repeat itself, man all the time does’. So, in case you have invested in penny shares and made some earnings, it’s fairly sure that you’ll spend money on them once more.

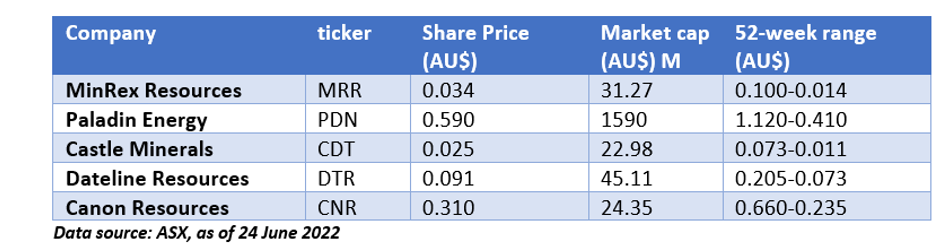

On this article, the subsequent part will record 5 penny shares from the assets business which might be buying and selling at a reduction of greater than 50% from their 52-week highs.

MinRex Sources Restricted (ASX:MRR)

MinRex Sources is a diversified mineral explorer centered on battery metals, gold, silver, and copper.

The corporate operates lithium-tin-tantalum initiatives within the Pilbara area. Its technique is to carry substantial exploration grounds within the Tier-1 mining jurisdiction with multi-commodities sort deposit.

MinRex at the moment holds 352,213 ounces of gold assets at its Sofala Gold Venture in New South Wales.

Paladin Vitality Ltd (ASX:PDN)

Paladin Vitality is an ASX-listed uranium participant with its operations in Namibia. The corporate holds a 75% curiosity within the Langer Heinrich mine, which has produced over 43Mlb of U3O8 thus far.

The corporate just lately executed a completely underwritten AU$200 million institutional placement and accomplished a share buy plan to lift as much as AU$15 million. The funding will help the corporate in creating and restarting its Namibian mine, which was suspended in 2018 because of decrease uranium costs.

Fortress Minerals Restricted (ASX:CDT)

Fortress Minerals is one other diversified ASX-listed explorer. The corporate operates battery metals, base metals and gold initiatives in Australia and Ghana. its asset portfolio consists of graphite, lithium, gold, lead and zinc.

The corporate just lately launched a drilling marketing campaign at its flagship Kambale graphite challenge in Ghana.

Dateline Sources Restricted (ASX:DTR)

Dateline is gold-focused mineral explorer with operations in america. The corporate has signed an offtake settlement for 100% gold focus produced from its Gold Hyperlinks Mine in Colorado.

Dateline has produced 40 tonnes of saleable gold focus that may include gold and silver valued at AU$1.5 million.

Canon Sources Restricted (ASX:CNR)

Canon Sources is engaged in nickel exploration and improvement operations. The corporate has two nickel initiatives in Western Australia, the Fisher East and Collurabbie nickel initiatives.

The Fisher East Nickel Venture at the moment has mineral assets of 116.3kt of contained nickel. One of many prospects on the challenge, Muskel, has proven potential for platinum group components (PGEs).