A dealer on Aave, a decentralized liquidity protocol working on a number of platforms, together with Ethereum and OP Mainnet, has begun promoting wrapped Bitcoin (WBTC) to repay excellent debt, information on October 13 reveal. WBTC is a tokenized model of Bitcoin issued on Ethereum that permits holders to have interaction in decentralized finance (DeFi) actions.

Dealer Promoting WBTC To Repay Debt On Aave v2

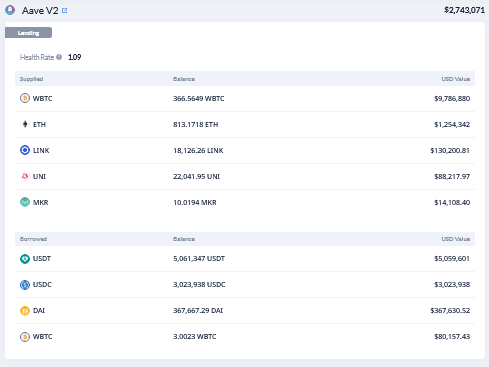

In line with Lookonchain information, the unidentified dealer marked with tackle “0x47ab” borrowed roughly $8 million value of a number of stablecoins, together with USDC, USDT, and DAI, Maker’s stablecoin, on Aave v2 after depositing numerous belongings, together with WBTC, Maker (MKR), and Ethereum (ETH) value roughly $11 million.

When writing, the well being issue of borrowed belongings stands at 1.09, teetering near liquidation. In line with Aave’s paperwork, the well being issue is a metric that compares the protection of collateral and borrowed loans to the underlying worth. Technically, the upper it’s, the safer the funds are from liquidation. If the well being issue exceeds $1, deposited collateral will likely be liquidated to borrow excellent loans.

Aave is a well-liked decentralized finance (DeFi) protocol the place token holders can select to produce liquidity and earn passive revenue. On the similar time, customers can deposit collateral and borrow overcollateralized loans, which they will repay at any time, supplied the well being issue is round 1. Since loans are overcollateralized, the collateral is often larger than the borrowed quantity.

Risky Bitcoin Costs To Blame?

As it’s, the dealer, Lookonchain exhibits, has began promoting WBTC to repay excellent debt. An enormous chunk of what the dealer provided is in WBTC, standing at 366.56 WBTC, value roughly $9.1 million at spot charges.

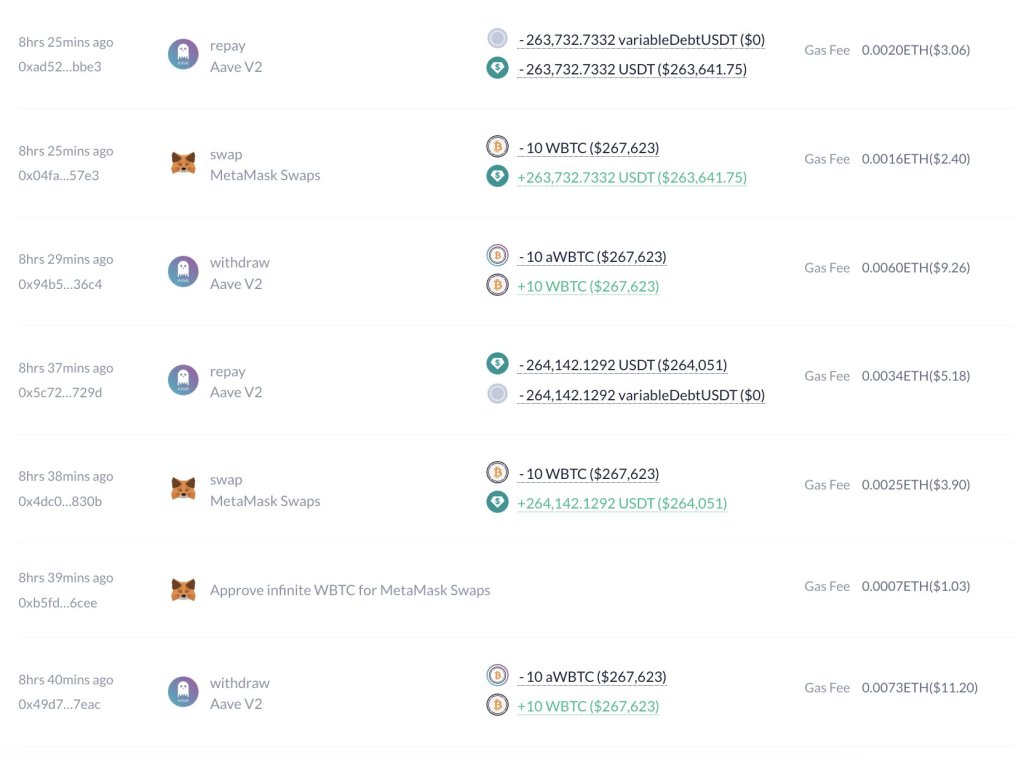

Nevertheless, contemplating market costs have fluctuated just lately, the contraction has impacted the well being issue, growing the danger of collateral liquidation. To counter this, the dealer offered 3 WBTC for roughly $80,000.

The tackle nonetheless owes Aave V2 roughly $8.08 million, principally in USDT, at round $5 million. There are $3 million of USDC and round $368,000 of DAI. It’s unclear whether or not the dealer will search to borrow extra, particularly if Bitcoin costs enhance.

The tackle stays lengthy on MKR, the governance token of the MakerDAO protocol; Uniswap’s UNI; Chainlink’s LINK; and Ethereum. Moreover WBTC, the dealer’s second-largest holding is in ETH, whereas the smallest is MKR. Satirically, MKR has been one of many top-performing belongings, rallying by over 160% in H2 2023 alone. The token peaked at $1,600 in early October earlier than cooling off to identify charges.

Function picture from Canva, chart from TradingView