This story is a part of So Cash (subscribe right here), a web-based group devoted to monetary empowerment and recommendation, led by CNET Editor at Massive and So Cash podcast host Farnoosh Torabi.

What’s occurring

Financial headwinds are prompting questions on whether or not the US is headed right into a recession.

Why it issues

Intervals of monetary volatility and financial decline can drive individuals to panic and make expensive errors with their cash.

What’s subsequent

Inspecting what’s occurring now — and evaluating it with the previous — can present essential context for buyers and shoppers considering their subsequent step.

A majority of Individuals expect unhealthy instances within the 12 months forward. And who can blame them?

Costs for on a regular basis necessities have been rising throughout the nation, mortgage charges are going up, the worth of fuel is sky-high and shares are falling, with no reduction in sight. US households have widespread issues over quickly declining dwelling requirements, in keeping with the newest Surveys of Shoppers index from the College of Michigan. Similar to bleak instances in the course of the 1980 recession, client sentiment is at an all-time low.

Quite a few financial consultants are elevating the risk of a recession, or perhaps a coming interval of stagflation, outlined by rising charges, excessive unemployment and sluggish financial progress. The ripple impact is actual: Incomes, saving and investing cash change into tougher, resulting in monetary stress and panic.

At a time like this, we must always think about what occurs in a recession, have a look at the info to find out whether or not we’re in a single and determine methods to keep up some historic perspective. It is also price mentioning that down intervals are momentary and that, over time, each the inventory market and the US financial system bounce again.

I do not imply to attenuate the gravity and hardship of the instances. However it may be helpful to evaluation how the financial system has behaved prior to now to keep away from irrational or impulsive cash strikes. For this, we are able to largely blame recency bias, our inclination to view our newest experiences as essentially the most legitimate. It is what led many to flee the inventory market in 2008 when the S&P 500 crashed, thereby locking in losses and lacking out on the next bull market.

“It is our human tendency to mission the instant previous into the long run indefinitely,” mentioned Daniel Crosby, chief behavioral officer at Orion Advisor Options and creator of The Legal guidelines of Wealth. “It is a time-saving shortcut that works more often than not in most contexts however will be woefully misapplied in markets that are usually cyclical,” Crosby instructed me through e mail.

Earlier than you make a knee-jerk response to your portfolio, hand over on a house buy or lose it over job insecurity, think about these chart-based analyses from the final three a long time. We hope this data-driven overview will provide a broader context and a few impetus for benefiting from your cash at this time.

What’s occurring with mortgage charges?

30-year fixed-rate mortgage averages within the US

Present situations: Because the Federal Reserve continues its rate-hike marketing campaign to chill spending and tame inflation, the speed on a 30-year fastened mortgage has jumped yearly by almost 3 share factors to nearly 6%. In actual {dollars}, that signifies that after a 20% down cost on a brand new house (let’s use the common sale worth of $429,000), a purchaser will roughly want an additional $7,300 a 12 months to afford the mortgage.

The context: Three years in the past, homebuyers confronted comparable borrowing prices and, on the time, charges had been characterised as “traditionally low.” And if we expect borrowing cash is pricey at this time, let’s not overlook the early Eighties when the Federal Reserve jacked up charges to never-before-seen ranges on account of hyperinflation. The typical charge on a 30-year fixed-rate mortgage in 1981 topped 16%.

The upside: For homebuyers, a possible profit to rising charges is downward strain on house costs. As the associated fee to borrow continues to extend, properties will possible expertise fewer provides and costs could fall. In truth, almost one in 5 sellers dropped their asking worth throughout late April by means of late Could, in keeping with Redfin.

What concerning the inventory market?

Dow Jones Industrial Common inventory market index for the previous 30 years

Macrotrends.web

Present situations: 12 months-to-date, the Dow Jones Industrial Common — a composite of 30 of essentially the most well-known US shares reminiscent of Apple, Microsoft and Coca-Cola — is about 14% beneath the place it began in January. Relative to the broader market, expertise shares are down rather more. The Nasdaq is off greater than 21% for the reason that begin of the 12 months. Earlier this month, the benchmark S&P 500 recorded a 20% drop from January, bringing us formally right into a bear market. As staff return to the workplace and other people transfer away from digital again towards in-person experiences, analysts say the bubble is bursting for corporations like Amazon and Netflix whose income ballooned in the course of the pandemic.

The context: Immediately’s losses aren’t almost as swift and steep as we noticed in March 2020, when panic over the pandemic drove the DJIA down by 26% in roughly 4 buying and selling days that month. The market, nonetheless, reversed course the next month and commenced a bull run lasting greater than two years, because the lockdown drove large consumption of services tied to software program, well being care, meals and pure fuel.

Previous to that, in 2008 and 2009, a deep and pervasive disaster in housing and monetary providers sank the Dow by almost 55% from its 2007 excessive. However by fall 2009, it was off to one in every of its longest successful streaks in monetary historical past.

The upside: Given the cyclical nature of the inventory market, now shouldn’t be the time to leap ship.* “Instances which are down, you a minimum of need to maintain and/or take into consideration shopping for,” mentioned Adam Seessel, creator of The place the Cash Is. “During the last 100 years, American shares have been the surest approach to develop rich slowly over time,” he instructed me throughout a current So Cash podcast.

*One caveat: If you happen to’re nearer to or dwelling in retirement and your portfolio has taken a large hit, it could be price speaking to an expert and reviewing your number of funds to make sure that you are not taking over an excessive amount of threat. Goal-date funds, a preferred funding car in lots of retirement accounts that auto-adjust for threat as you age, could also be too dangerous for pre- or early retirees.

What can we learn about inflation?

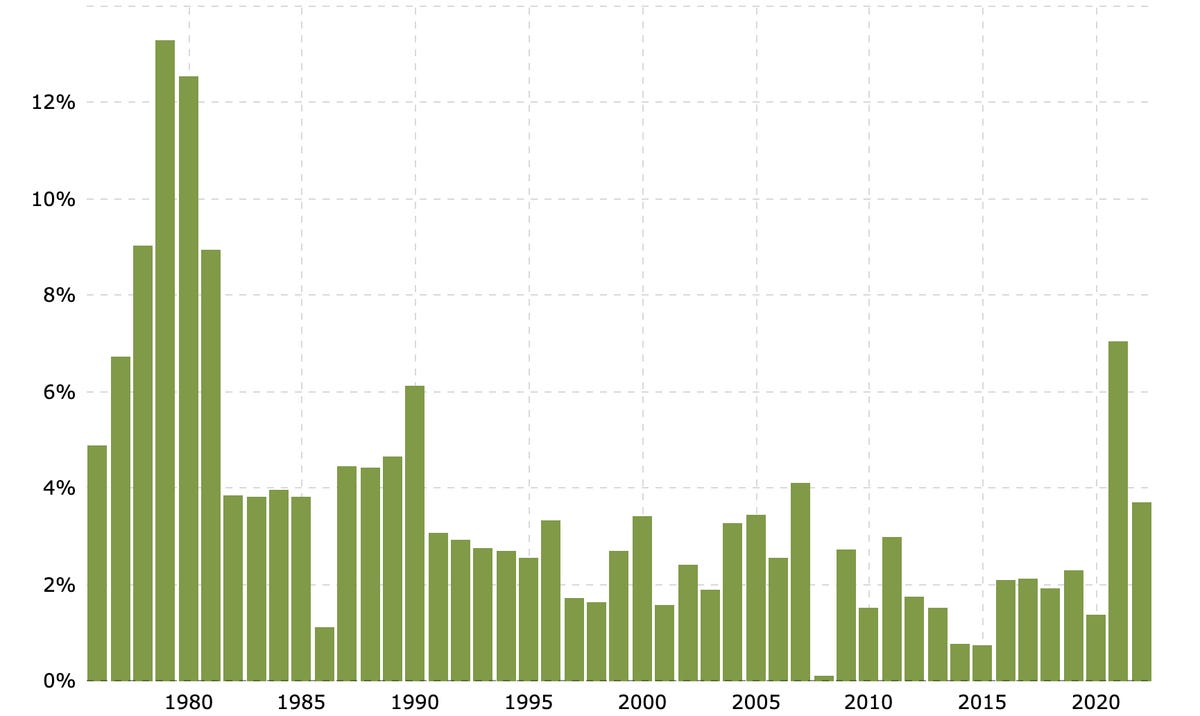

Historic inflation charge by 12 months

Macrotrends.web

Present situations: The US is experiencing the highest charge of inflation in 4 a long time, pushed by world provide chain disruptions, the injection of federal stimulus {dollars} and a surge in client spending. In actual {dollars}, the 8.6% rise in client costs is including over $300 extra per 30 days to family budgets.

The context: Policymakers think about 2% to be a “regular” inflation goal. The nation’s now experiencing 4 instances that determine. It’s the largest soar in annual inflation since 1980 when the inflation charge tapped 13.5% following the prior decade’s oil disaster and excessive authorities spending on protection, social providers, well being care, training and pensions. The Federal Reserve elevated charges to stabilize costs and, by the mid-Eighties, inflation fell to beneath 5%.

The upside: As general charges soar, the silver lining could also be that we’ll see private financial savings charges inch increased. Financial institution accounts are beginning to provide extra enticing yields, whereas I bonds — federally backed accounts that kind of observe inflation — are attracting savers, too.

What does unemployment inform us?

US unemployment charges

Present situations:. The Could jobs report exhibits unemployment holding regular at 3.6%, effectively above the lows seen in February and March of 2020. The Nice Resignation of 2021, the place tens of millions of staff give up their jobs over burnout, in addition to unsatisfactory wages and advantages, has left employers scrambling to fill positions. In some ways, it’s a job-seeker’s market.

The context: The rebound within the unemployment charge is an financial hallmark of the previous two years. However the ongoing rate of interest hike could weigh on company income, resulting in extra layoffs and hiring freezes. Particularly, the tech sector is one to look at. After benefiting from speedy progress led by client demand within the pandemic, corporations like Google and Fb could also be in for a “correction.” The layoff monitoring web site Layoffs.fyi exhibits that near 70 startups and tech companies downsized in Could.

The upside: If you happen to’re anxious about shedding your job as a result of your employer could also be extra weak in a recession, doc your wins in order that when evaluation season arrives, you are able to stroll your supervisor by means of your top-performing moments. Supply methods for how you can climate a possible slowdown. All of the whereas, evaluation your reserves to see how far you’ll be able to stretch financial savings in case you are out of labor. Remember the fact that within the earlier recession, it took a median of eight to 9 months for unemployed Individuals to safe new jobs.