CryptoQuant has revealed in its newest report that the Bitcoin market cap may rise by as a lot as $1 trillion after launching the spot ETFs.

Bitcoin May See A 165% Rise When The Spot ETFs Launch

Yesterday, faux information of the permitted iShares Bitcoin spot ETF took the sector by storm, as all cryptocurrencies noticed sharp rallies. On the peak of this surge, BTC had approached the $30,000 stage.

Nevertheless, when the market realized the reality in regards to the announcement, the asset shortly retraced to the degrees it was at earlier than the rally. Whereas the beneficial properties have been solely transient, the rally nonetheless offered a glimpse into the robust response that the market may see to the launch of an actual ETF.

This was only one spot ETF; nevertheless, a number of others are ready in line to be permitted. How would the market appear like when all these ETFs have launched? In its new report, the on-chain analytics agency CryptoQuant has mentioned exactly that.

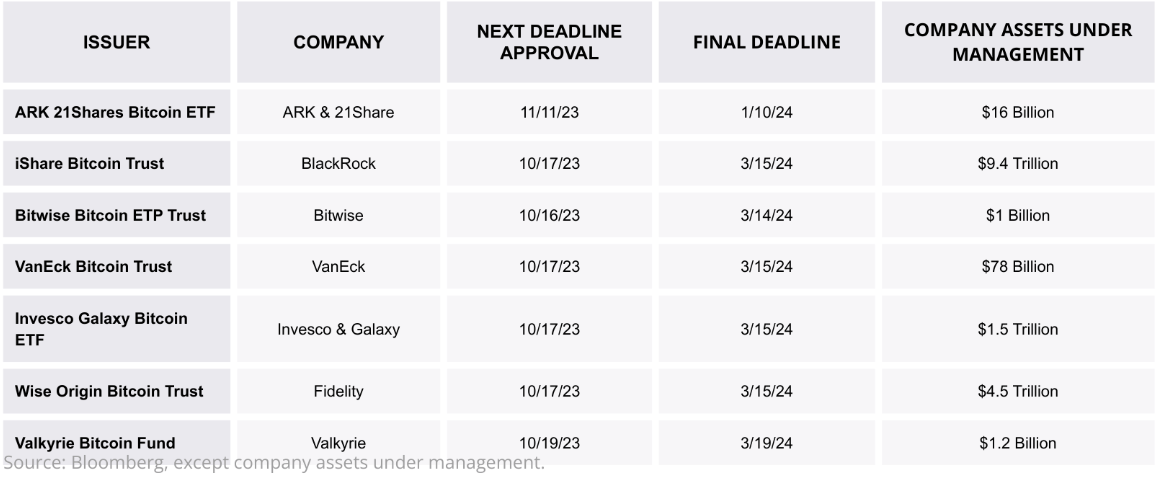

The property underneath administration of the varied corporations ready for ETF approval | Supply: CryptoQuant

The above desk exhibits details about the varied corporations ready to be permitted for the Bitcoin spot ETF, together with the whole dimension of their property underneath administration (AUM).

“Though these ETFs aren’t anticipated to be permitted this yr, the chance that they are going to be permitted by the ultimate deadline (March 2024) has been rising on account of favorable courtroom rulings for Grayscale (GBTC Fund) and XRP of their respective authorized combat towards the SEC,” says the agency.

In complete, these corporations’ AUM are round $15.6 trillion. In the event that they put simply 1% of this quantity in direction of BTC, it could imply inflows of a whopping $155 billion for the asset. “To place it in context, these quantities signify virtually a 3rd of the present market capitalization of Bitcoin,” notes CryptoQuant.

Now, how this capital influx may have an effect on the market cap of BTC isn’t precisely easy to say. Typically, the market cap will increase by extra than simply the uncooked capital getting into the cryptocurrency.

The agency has used the “realized cap” metric to evaluate this relationship. The realized cap is a capitalization methodology for BTC that calculates its complete worth by assuming that the worth of every coin is identical as the worth at which it was final transacted on the blockchain.

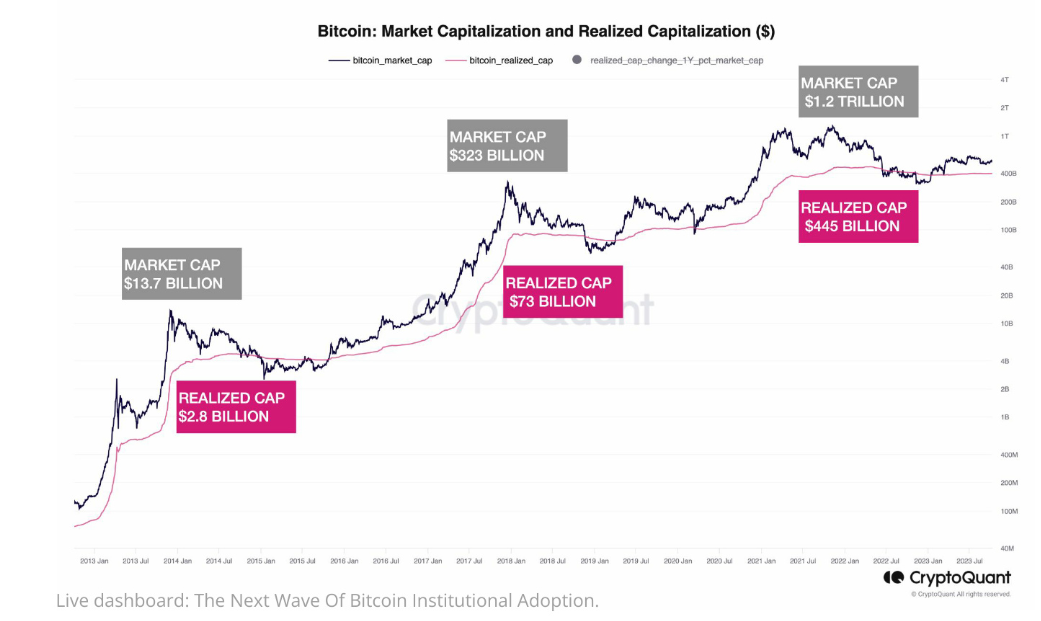

The realized cap may be imagined as the whole funding made by the traders, accounting for the costs at which every purchased their cash. The chart beneath exhibits how this realized cap has in contrast with the market over time.

The comparability between the developments of the realized cap and market cap | Supply: CryptoQuant

The graph exhibits that the market cap and realized cap normally have noticeably completely different progress charges, as they’ve at all times adopted fairly completely different paths.

CryptoQuant has calculated the ratio between the annual growths of the 2 caps and has discovered that for a lot of the asset’s historical past, the market cap has grown by 3 to six occasions sooner than the realized cap.

If the realized cap grows by $155 billion when the spot ETFs get permitted and the asset managers allot 1% of their AUM to Bitcoin, the market cap may develop by between $450 and $900 billion.

The report notes this determine implies “the market cap would enhance between 82% and 165% from the present stage and that Bitcoin worth may attain between $50K and $73K on account of these inflows of contemporary cash.”

BTC Value

Bitcoin has loved some uptrend over the previous few days because the asset has now climbed above the $28,500 stage.

BTC has seen some progress not too long ago | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, CryptoQuant.com