The digital property markets skilled a consecutive fourth week of inflows from institutional buyers. CoinShares information reveals {that a} portion of the momentum noticed might be attributed to an rising expectation for the authorization of a spot Bitcoin Change-Traded Fund (ETF) in america.

The combination worth of property below administration (AuM) has skilled a notable surge, reaching $33 billion, denoting a 15% development fee for the reason that starting of September. However, buyers are displaying a higher diploma of prudence in comparison with their response to Blackrock’s announcement in June.

The most recent inflow of funds, though presumably related to the potential introduction of a spot bitcoin ETF within the US, may be very modest compared to the inflows witnessed in June.

Coinshares: Digital asset funding merchandise noticed inflows for the 4th consecutive week totalling US$66m. Whole AuM has now risen to US$33bn.

Solana noticed an extra US$15.5m inflows final week, bringing year-to-date inflows to US$74m, making it the preferred altcoin this 12 months so…

— Wu Blockchain (@WuBlockchain) October 23, 2023

Bitcoin Leads Digital Belongings: $315 Million Inflows This Yr

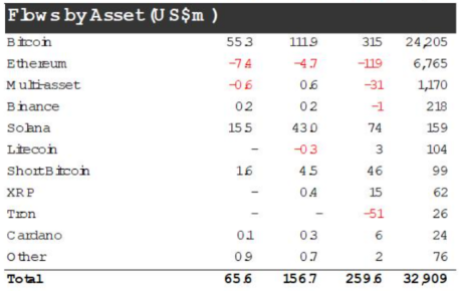

In accordance with the report, a good portion of the inflows seen within the earlier week amounted to $55.3 million, representing 84% of the overall. This inflow was particularly directed in the direction of funding merchandise associated to Bitcoin. In consequence, the cumulative inflows for Bitcoin merchandise in the course of the present 12 months have reached a complete of $315 million.

Solana skilled a further infusion of $15.5 million in the course of the earlier week, leading to a cumulative influx of $74 million for the 12 months. This notable efficiency positions Solana because the main different cryptocurrency so far within the present 12 months.

Supply: Coinshares

However, and amidst persisting issues, Ethereum confronted a difficult week because it noticed a major outflow of $7.4 million. Notably, Ethereum was the one altcoin to come across a decline in its monetary efficiency throughout this era.

Different altcoins equivalent to Cardano (ADA) and Binance Coin (BNB) noticed small inflows of $0.1 million and $0.2 million, respectively.

James Butterfill, the Head of Analysis at CoinShares, identified that the inflows noticed within the earlier week haven’t but achieved the identical magnitude as these witnessed earlier this 12 months when BlackRock initially submitted an software for a Bitcoin ETF.

Bitcoin barely under the $34K stage immediately. Chart: TradingView.com

Butterfill stated:

“Whereas the latest inflows are possible linked to pleasure over a spot Bitcoin ETF launch within the U.S., they’re comparatively low compared to the preliminary inflows following BlackRock’s announcement in June.”

Navigating The Digital Asset Panorama: Tendencies And Warning

Digital property have gotten increasingly fashionable, and many individuals are investing in them. Nevertheless, some buyers are being cautious about these property, and we don’t know if they’ll hold being cautious. We now have to attend and see if the market will change and convey new traits or probabilities for buyers within the subsequent few weeks.

The world of digital property is quickly rising, with increasingly folks placing their cash into cryptocurrencies and different digital investments. Regardless of this, some buyers are nonetheless being cautious and never dashing into issues.

We will’t predict whether or not this cautious strategy will proceed or if the market will shock us with new traits and alternatives within the weeks forward. It’s an thrilling time on this planet of finance, and we’ll need to hold a detailed eye on how issues develop.

(This website’s content material shouldn’t be construed as funding recommendation. Investing entails danger. While you make investments, your capital is topic to danger).

Featured picture from Ledger Insights