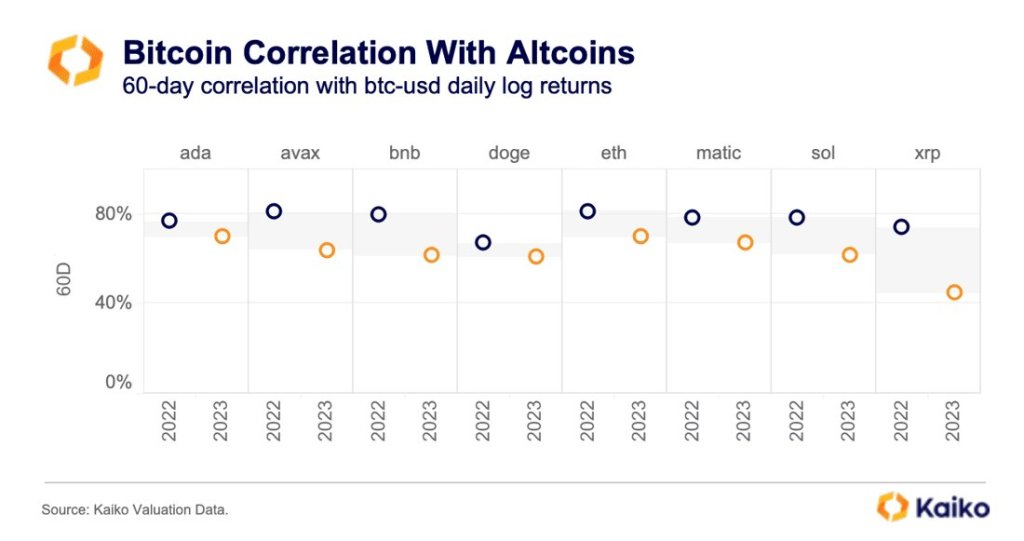

Within the final two months, Bitcoin (BTC), the world’s most dear cryptocurrency, has been more and more decoupling from XRP, the native forex of the XRP Ledger (XRPL), and BNB, the coin priming the broader Binance ecosystem. Whereas this pans out, Dogecoin (DOGE) and Cardano (ADA) stay principally correlated with Bitcoin.

XRP, BNB Decoupling From Bitcoin

Whereas rising de-correlation means that the market is maturing and changing into extra subtle, secondary components might make among the prime altcoins decouple and chart their programs away from the tight grasp of Bitcoin.

Sharing data from Kaiko, a blockchain analytics agency, @cryptobusy on X notes that the correlation between Bitcoin, XRP, and BNB has been contracting within the final two months. In the meantime, BTC, Dogecoin, and Cardano costs have been transferring in sync regardless of elementary components of every undertaking impacting value motion over this era.

The drop in correlation signifies that altcoins are more and more gaining extra market share from Bitcoin. This drop in Bitcoin dominance occurs particularly every time sure altcoins transfer independently and should not influenced by how Bitcoin developments.

Most often, prefer it has been the case in This fall 2023, a spike in Bitcoin costs triggers altcoin demand, lifting them because of this. Apart from Cardano and Dogecoin, as an illustration, Solana (SOL) and Tron (TRX) are two altcoins which were rallying and monitoring Bitcoin.

Moreover, the drop in correlation might imply the altcoin scene is maturing, and extra traders are eager on choosing out initiatives that supply extra utility, not simply BTC proxies. With extra traders, altcoins are usually extra liquid, drawing much more capital.

BNB, XRP, BTC Impacted By Elementary Elements

Even so, there could possibly be extra that explains the decoupling, particularly with BNB and XRP. Seismic elementary occasions have impacted BTC, XRP, and BNB ecosystems within the final two months.

The US Securities and Trade Fee (SEC), as an illustration, is more likely to approve a number of spot Bitcoin ETFs filed by a number of heavyweights, together with BlackRock and Constancy, within the coming weeks. Hopes of the regulator authorizing these derivatives monitoring spot BTC costs have catalyzed demand, lifting the coin to new 2023 highs.

In the meantime, a United States court docket dominated in favor of XRP being a utility when bought to retailers. The case initially pressured costs increased, however the coin tracked decrease all through late Q3 2023 and 2024, solely steadying as BTC rallied.

On the similar time, BNB was negatively impacted by Changpeng Zhao, the founding father of Binance, resigning in November 2023. The Division of Justice additionally fined Binance with a $4.3 billion penalty as a settlement.

Characteristic picture from Canva, chart from TradingView