Within the annals of crypto’s tumultuous historical past, few tales have gripped the market as intensely because the FTX crypto rip-off, orchestrated by Sam Bankman-Fried. This huge ponzi, characterised by deceit, manipulation, and a staggering breach of belief, has despatched shockwaves throughout the globe, profoundly affecting FTX traders and shaking the very foundations of the crypto market.

Understanding The FTX Rip-off

In a time the place crypto was gaining momentum, the FTX rip-off emerged as a sobering reminder of the volatility and vulnerability inherent within the burgeoning crypto sector.

The Rise Of FTX: A Crypto Empire’s Beginnings

FTX, below the management of Sam Bankman-Fried, was not simply one other participant within the crypto house; it was a behemoth that rapidly ascended to develop into the second-largest crypto trade on the earth by buying and selling quantity. This meteoric rise was characterised not solely by revolutionary monetary merchandise but additionally by a sequence of high-profile endorsements and partnerships that catapulted FTX into the general public eye.

Some of the sensational partnerships was with NFL famous person Tom Brady, in a deal price $55 million, which considerably boosted FTX’s visibility and credibility. Equally, NBA star Stephen Curry signed a $35 million endorsement deal, additional cementing FTX’s standing as a significant participant within the crypto trade market. These endorsements weren’t mere advertising and marketing stunts; they had been strategic strikes that showcased FTX’s ambition and attain.

Along with sports activities stars, FTX made a exceptional entry into the world of sports activities sponsorships by securing a 19-year, $135 million naming rights deal for the Miami Warmth’s area, a transfer that underscored its monetary muscle and ambition. The partnership with the Mercedes F1 Crew additional diversified its portfolio, indicating a method that transcended conventional crypto trade boundaries.

These high-profile partnerships and endorsements had been pivotal in constructing FTX’s fame as a dependable and forward-thinking trade. They performed a vital function in attracting an unlimited person base, as FTX’s visibility soared, luring traders and merchants who had been enamored by the platform’s affiliation with world icons.

Sam Bankman-Fried: The Face Behind The FTX Rip-off

Sam Bankman-Fried, usually abbreviated as SBF, emerged as a central determine within the crypto world, famend for his unconventional strategy and fast success. A graduate of MIT with a level in Physics, Bankman-Fried’s entry into the world of finance was marked by a stint at Jane Road Capital, a well-regarded quantitative buying and selling agency.

His foray into cryptocurrency started with the founding of Alameda Analysis, a quantitative cryptocurrency buying and selling agency, and finally led to the institution of FTX in 2019.

Bankman-Fried’s persona was a mix of a tech-savvy entrepreneur and a finance whiz, identified for his informal apparel and altruistic declarations. He rapidly grew to become a poster youngster for the crypto revolution, advocating for efficient altruism and pledging to donate a good portion of his wealth to charity.

His youth, mixed together with his dedication to philanthropy and a seemingly deep understanding of each cryptocurrency and conventional finance, made him a singular and revered determine within the monetary world.

Good Product, Unhealthy Religion

Because the CEO of FTX, Bankman-Fried championed transparency and innovation within the crypto trade market. Underneath his steerage, FTX launched a number of groundbreaking merchandise, together with derivatives, choices, and leveraged tokens, which attracted each retail and institutional traders. His strategy was seen as a refreshing change in an trade usually shrouded in complexity and jargon.

Nevertheless, behind this facade of innovation and success, there have been underlying points. Questions started to come up in regards to the relationship between FTX and Alameda Analysis, particularly relating to the usage of buyer funds and the solidity of FTX’s monetary practices. The unraveling of those considerations would later be on the coronary heart of the FTX scandal.

Decoding The FTX Rip-off: How It Unfolded

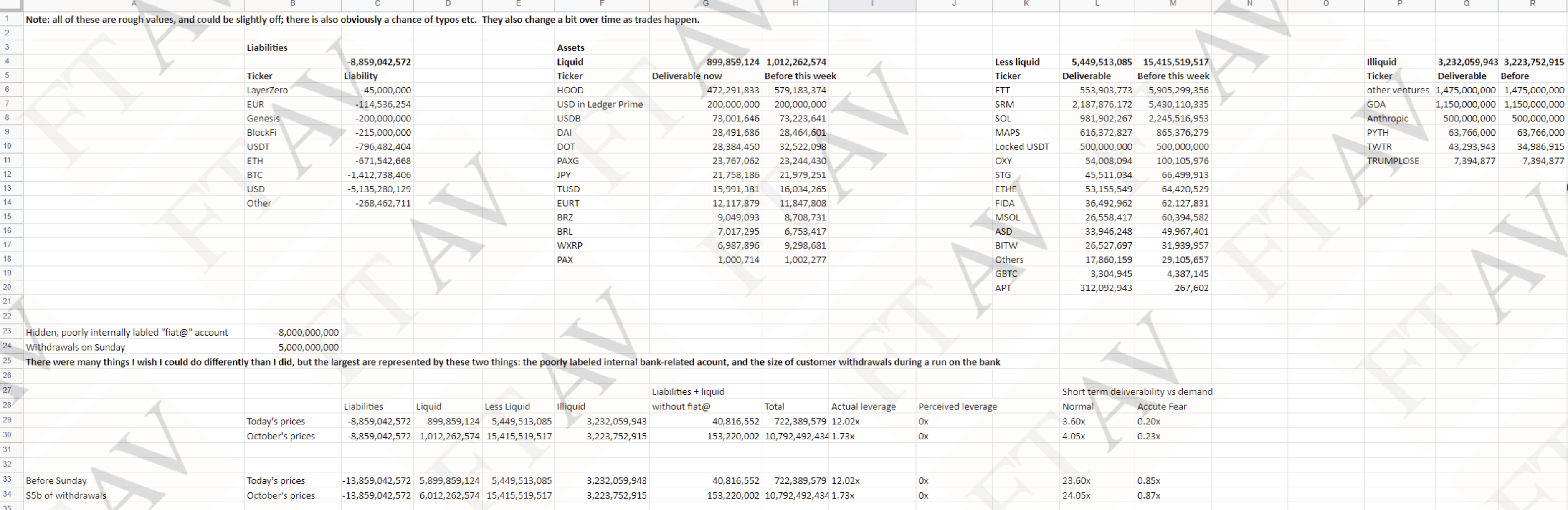

The unraveling of the FTX rip-off started with a seemingly innocuous revelation in regards to the steadiness sheets of FTX and Alameda Analysis. In November 2022, a report uncovered {that a} vital quantity of Alameda’s steadiness sheet was underpinned by FTT, the native token of FTX. This discovery set off alarm bells for the solvency and interdependence of each entities.

FTX Stability Sheet Evaluation: Purple Flag

A crucial examination of FTX’s steadiness sheet, significantly its proprietary buying and selling arm Alameda Analysis, revealed vital purple flags that contributed to its eventual downfall. In monetary studies dated June 30, it was famous that Alameda Analysis had $14.6 billion in belongings on its steadiness sheet, however alarmingly, its single greatest asset was $3.66 billion of “unlocked FTT”, FTX’s native token, and the third-largest “asset” was an extra $2.16 billion extra of “FTT collateral”.

This meant that just about 40% of Alameda’s belongings consisted of FTT, a coin that was created by Sam Bankman-Fried himself, reasonably than an independently traded stablecoin or token with a market worth or precise fiat in a good financial institution.

The intertwining of FTX and Alameda’s funds was additional highlighted by the unusually shut ties between the 2 entities. This interdependency was a crucial issue that led to the liquidity disaster and eventual chapter of FTX and its 160-plus enterprise models. The scenario reached a tipping level following a report by CoinDesk, which set off a series of occasions together with a public battle with Changpeng Zhao, CEO of Binance, and Alameda Analysis’s Caroline Ellison.

FTX Vs. Binance: The Battle Escalates

Tensions escalated when Changpeng Zhao (CZ), the CEO of the biggest crypto trade Binance and a former ally of SBF, signaled his intention to liquidate Binance’s place in FTT token. CZ tweeted:

As a part of Binance’s exit from FTX fairness final yr, Binance obtained roughly $2.1 billion USD equal in money (BUSD and FTT). As a result of latest revelations which have got here to gentle, we now have determined to liquidate any remaining FTT on our books. […] Concerning any hypothesis as as to if it is a transfer in opposition to a competitor, it isn’t.

Caroline Ellison responded: “In case you’re seeking to decrease the market influence in your FTT gross sales, Alameda will fortunately purchase all of it from you at present at $22!” Remarkably, the tweet didn’t calm the market, however reasonably additional unsettled it. The Twitter dialogue stirred the market, as CZ’s determination to dump FTT tokens prompted a precipitous drop within the token’s worth, signaling a insecurity in FTX’s monetary stability.

Within the midst of this public back-and-forth, particulars about SBF’s relationship with Caroline Ellison started to floor, suggesting a better private {and professional} connection that additional difficult the integrity of their companies’ operations. This relationship would later come below intense scrutiny as a part of the investigation into the mismanagement of funds.

A Liquidity Disaster

As the worth of FTT plummeted, a run on FTX ensued, with clients frantically making an attempt to withdraw their belongings. FTX’s liquidity disaster grew to become obvious, revealing that the agency didn’t have the capital to honor these withdrawals.

Following this, Binance’s CEO, Changpeng “CZ” Zhao, expressed preliminary curiosity in buying FTX by a nonbinding settlement. Nevertheless, after evaluating the scenario for a day, Binance withdrew, with Zhao indicating that FTX’s monetary challenges had been too extreme for an efficient decision. Concurrently, the SEC and CFTC started probing Alameda Analysis and FTX US for potential mismanagement of buyer funds.

This improvement made FTX’s monetary failure imminent. Sam Bankman-Fried endeavored to safe billions in emergency funding to salvage FTX, however with none keen traders to offer the required $9.4 billion, FTX declared chapter on November 11, 2022, resulting in Bankman-Fried’s resignation as CEO.

The subsequent day, FTX reported the disappearance of $1 to $2 billion in buyer funds, following the detection of considerable unauthorized fund transfers from FTX’s cryptocurrency wallets.

FTX Put up Chapter Submitting

After submitting for Chapter 11 chapter, FTX witnessed a management change, with John Ray III taking on as CEO following Sam Bankman-Fried’s resignation. The transition marked a crucial part for FTX because it aimed to get better from the liquidity disaster and tackle lacking buyer funds. Remarkably, John Ray III gained prominence for main Enron throughout its chapter and recovering over $828 million for collectors.

Regulatory investigations by the SEC and CFTC remained ongoing, creating uncertainty. Restoring investor confidence and implementing sturdy monetary controls had been paramount challenges for the trade. Moreover, FTX needed to navigate the aftermath of its failed acquisition try by Binance, which had additional difficult its monetary scenario.

The Function Of FTX Auditors In The Saga

Within the wake of FTX’s collapse, the function of FTX auditors has been scrutinized in depth, with questions raised about their oversight and the way they might have allowed the FTX rip-off to exist. The FTX auditor for the worldwide department, Prager Metis and the FTX auditor for FTX US, Armanino, are central to this scrutiny.

Prager Metis

Prager Metis is going through authorized motion from the SEC, accused of lots of of violations associated to its engagement with the now-bankrupt crypto trade FTX. The SEC’s lawsuit alleges FTX auditor independence violations, particularly relating to a template used for shopper engagements. The accounting and consulting agency added indemnification provisions to engagement letters for greater than 200 audits and different work between December 2017 and October 2020, which the SEC claims compromised the agency’s required independence.

The accounting agency has defended its practices, stating that the allegations are primarily based on historic template language that was by no means enforced, and that it at all times acted independently from purchasers. The SEC’s criticism in opposition to the agency seeks an injunction and penalties, and the investigation is ongoing.

Armanino

Armanino, FTX’s US auditor, defended its accounting work amidst the fallout. Chris Carlberg, Armanino’s chief working officer, acknowledged in an interview with the Monetary Occasions that the agency stands by its work for FTX US. Armanino gave FTX’s US department a clear invoice of well being after reviewing its funds in 2020 and 2021. Carlberg highlighted that the agency was not engaged to audit inner controls, a course of usually reserved for public corporations, and never required for personal firm audits.

Each Armanino and Prager Metis are being sued by FTX clients. In gentle of the altering market circumstances and the FTX scandal, Armanino has ceased its auditing and proof of reserve for crypto associated companies.

FTX Rip-off: The Affect On The Crypto Market

The FTX collapse had a profound influence on each traders and the broader crypto market. Bitcoin’s worth plummeted by over 30%, and the crypto market skilled a big drop in market capitalization, leading to billions of {dollars} in losses for traders. This sudden and extreme downturn within the crypto market despatched shockwaves by the complete trade, leaving traders reeling and questioning the steadiness of the ecosystem that they had come to belief.

FTX Buyers: A Path of Loss And Deception

FTX traders confronted a harrowing ordeal, with many reporting substantial monetary losses, some exceeding 50% of their invested capital. What made this loss much more painful was the revelation of deception and an absence of transparency inside the trade’s operations. Buyers had entrusted their belongings to FTX, solely to find that the trade had hid crucial data and misrepresented its monetary well being.

The FTX Meltdown: Penalties For The Crypto Market

The FTX meltdown had broader penalties for the complete crypto market. Market sentiment took a extreme hit as information of the trade’s collapse unfold. It raised critical considerations in regards to the stability and regulatory oversight of cryptocurrency exchanges, making traders cautious of the potential dangers related to their investments.

This momentary lack of confidence had a cascading impact on the broader crypto ecosystem, affecting numerous tokens and initiatives, because the FTX contagion results weren’t completely clear for a number of weeks. Following the FTX meltdown, liquidity on the complete Bitcoin and crypto market eroded, additional intensifying the bear market. Notably, the FTX crash marked the Bitcoin backside at $15,440 for the bear market, which was adopted by an extended interval of sideways motion for the BTC worth.

FTX Contagion: Ripples Throughout US Politics

The FTX contagion prolonged its attain into US politics, prompting regulatory alarms. US businesses just like the SEC and CFTC, as a result of FTX rip-off, intensified their scrutiny of crypto corporations, together with Binance, Coinbase, DCG, and Gemini. Lawmakers and regulators grew to become more and more involved in regards to the potential systemic dangers posed by crypto market instability. Requires stricter laws and oversight within the cryptocurrency trade gained momentum as policymakers grappled with the fallout from the FTX collapse.

The Sam Bankman-Fried Trial

The trial of Sam Bankman-Fried, a defining occasion within the crypto and monetary fraud panorama, commenced in Manhattan federal courtroom and concluded with a verdict on November 2, 2023. This month-long trial, which adopted FTX’s chapter submitting nearly a yr prior, centered round allegations of one of many largest monetary frauds in historical past.

Bankman-Fried confronted seven counts, together with fraud and conspiracy, ensuing from his administration of FTX and Alameda Analysis. The trial’s end result not solely underscored the extreme implications of economic mismanagement within the crypto trade but additionally dropped at gentle the vulnerabilities and regulatory gaps inside this quickly evolving sector.

FTX Ponzi Scheme Allegations: Authorized Insights

The trial of Sam Bankman-Fried, the founding father of the now-defunct cryptocurrency trade FTX, has been a big occasion within the monetary world, particularly inside the cryptocurrency neighborhood. Discovered responsible on all seven counts he confronted, together with fraud and conspiracy, Bankman-Fried’s trial revealed the intricate particulars of some of the intensive monetary frauds on document.

The prosecutors within the case painted an image of Bankman-Fried as somebody who looted $8 billion from FTX customers out of sheer greed, resulting in a swift company meltdown and the chapter of FTX. This verdict has not solely marked the downfall of a once-celebrated crypto determine but additionally highlighted the potential vulnerabilities inside the crypto trade.

Throughout the trial, it was argued that Bankman-Fried diverted funds from FTX to his crypto-focused hedge fund, Alameda Analysis. This motion was in direct contradiction to his public claims of prioritizing buyer fund security. Reportedly, the usage of the funds different, together with funds to Alameda’s lenders, loans to executives, speculative enterprise investments, and vital political donations aimed toward influencing cryptocurrency laws.

Notably, Bankman-Fried took the stand in his personal protection, testifying over three days. He maintained that he didn’t steal buyer funds and that he believed the monetary preparations between FTX and Alameda had been permissible. He additionally admitted to errors in operating FTX, equivalent to not establishing a threat administration workforce.

Key Revelations From The Sam Bankman-Fried Trial

The trial of Sam Bankman-Fried, former founding father of FTX, introduced forth a number of startling revelations, significantly by the testimonies of Caroline Ellison, ex-CEO of Alameda Analysis and Bankman-Fried’s former romantic accomplice. As Bitcoinist reported, key moments revelations embrace:

- “Secret Exemption” From FTX Liquidation: Alameda Analysis had a “secret exemption” from FTX liquidation protocols, in line with FTX’s new CEO John J. Ray III. Alameda’s privileged standing prolonged to a “secret software program change” on FTX, exempting it from automated asset sell-offs. Court docket paperwork additionally revealed that FTX allowed Alameda to borrow $65 billion for buying and selling.

- Bitcoin Value Manipulation: Ellison admitted to coordinating with Bankman-Fried to maintain Bitcoin’s worth under $20,000, a method aimed toward attracting traders.

- Bribery In China: Bankman-Fried allegedly bribed Chinese language officers with $100 million to unfreeze $1 billion in Alameda Analysis funds. This included contentious discussions and the usage of unconventional strategies to navigate Chinese language monetary methods.

- Concentrating on Saudi Royalty: Ellison talked about Bankman-Fried’s plans to solicit funds from the Saudi Crown Prince to repay FTX clients, although particulars stay unclear.

- Methods Towards Binance: Ellison revealed efforts by Bankman-Fried to affect US politicians and businesses with the purpose to start out regulatory actions in opposition to Binance, aiming to spice up FTX’s market place.

- Substantial Monetary Losses Due To Safety Lapses: Alameda Analysis reportedly misplaced $190 million because of safety oversights, together with a $100 million loss from a dealer activating a malicious hyperlink and a $40 million loss from an unverified blockchain platform.

The Future Of FTX Put up Sam Bankman-Fried

The way forward for FTX, following the tumultuous downfall of Sam Bankman-Fried, is taking a brand new route with plans to relaunch the platform. The initiatives are being spearheaded by the chapter directors and the brand new administration below CEO John Ray.

Relaunch Plans And Timeline For FTX Worldwide

FTX’s directors have outlined a plan to doubtlessly restart the FTX.com platform, specializing in non-US clients. Varied lessons of collectors suggest organizing this rebooted trade, which may allow one class of claimants, particularly offshore clients, to relaunch FTX with the help of third-party traders.

The corporate is actively assessing the feasibility of this relaunch, aiming to file a restructuring plan by the third quarter of 2023, with the hope of getting judicial affirmation for this plan by the second quarter of 2024. The precise timeline for the relaunch stays unsure, as FTX should first persuade the chapter decide that the relaunch serves one of the best curiosity of its collectors.

Particular Regional Focus: Japan

FTX Japan anticipates a extra fast restart, the place sturdy shopper safety legal guidelines have enabled it to keep up a separate account system for its customers.This distinctive place permits FTX Japan to doubtlessly reopen earlier than different regional entities of FTX. CEO John J. Ray III has been in talks with Japanese officers relating to the reopening, which might mark a big step ahead within the relaunch course of.

US Market Challenges

The relaunch within the US presents distinctive challenges because of stringent securities laws. Presently, US clients have entry to FTX US, a separate entity from the primary FTX trade. The choice to merge these platforms or keep them as separate entities should think about compliance with US legal guidelines, doubtlessly complicating the relaunch course of within the US.

Incentives For Former Prospects

To encourage former clients to return to the platform, FTX’s new administration is contemplating providing stakes within the firm. This might contain issuing fairness within the new firm or offering choices to buy shares at a particular worth sooner or later. Such incentives would enable former clients to take part in any future development or income of the relaunched trade.

In the meantime, the way forward for the FTX token (FTT) within the relaunch stays unclear. Whereas FTX holds a big quantity of FTT tokens, suggesting a vested curiosity within the token’s restoration, administration has not introduced concrete plans for FTT’s function within the potential relaunch. Any engagement with FTT will doubtless entice regulatory scrutiny, particularly within the US, the place crypto belongings are topic to securities legal guidelines.

FAQ: The FTX Rip-off And Sam Bankman-Fried

What Was the FTX Rip-off?

The FTX rip-off concerned the misappropriation of billions of {dollars} from FTX customers. Sam Bankman-Fried, the founding father of FTX, and his associates at Alameda Analysis used buyer funds for numerous functions, together with private investments and political donations, opposite to their commitments to prioritizing person fund security.

Who Is Sam Bankman-Fried?

Sam Bankman-Fried, usually referred to as SBF, is the founding father of FTX, a cryptocurrency trade. He rose to prominence within the crypto trade earlier than his fall from grace as a result of FTX scandal.

Had been FTX Buyers Conscious Of The Rip-off?

Most FTX traders weren’t conscious of the fraudulent actions inside the firm. The operations proceeded with an absence of transparency, leading to widespread shock and shock when the corporate’s monetary troubles grew to become public.

What Was the Function Of FTX Auditors In The Rip-off?

The function of FTX auditors within the rip-off is unclear. Efficient auditing ought to have recognized discrepancies in FTX’s financials, elevating considerations in regards to the thoroughness and integrity of the auditing processes concerned.

How Was The FTX Stability Sheet Manipulated?

The manipulation of the FTX steadiness sheet aimed to cover the misuse of buyer funds. This included overstating the worth of sure belongings and failing to reveal the numerous monetary relationship between FTX and Alameda Analysis.

Was the FTX Operation A Pre-Deliberate Ponzi Scheme?

Whether or not FTX was a pre-planned Ponzi scheme is topic to authorized interpretation. Nevertheless, it exhibited traits typical of a Ponzi scheme, utilizing new traders’ funds to pay out others.

What Induced The FTX Meltdown?

A mix of economic mismanagement, misuse of buyer funds, and a lack of market belief brought about the FTX meltdown, leading to a liquidity disaster.

How Did The FTX Contagion Have an effect on Crypto Markets?

The FTX contagion deeply affected crypto markets, resulting in a lack of investor confidence and market instability. As a key participant within the crypto trade sector, FTX’s meltdown resulted in decreased market liquidity and elevated volatility, affecting a variety of crypto belongings and corporations related to FTX.

Are There Authorized Proceedings Towards FTX And Sam Bankman-Fried?

Sure, there are authorized proceedings in opposition to FTX and Sam Bankman-Fried. A courtroom discovered Bankman-Fried responsible of fraud and conspiracy expenses associated to the FTX scandal.

Will FTX Buyers Be Made Entire?

The potential for making FTX traders complete stays unsure. The restructuring and potential relaunch of FTX goal to reimburse traders, however it’s unclear if and to what extent this can occur.

Featured pictures from Shutterstock