Each enterprise, from sole proprietorships to multinational companies, wants an correct technique to report, categorize and monitor funds. Common ledgers (GLs) are the great accounting doc that helps you do all the above — however how do GLs work, and what’s the simplest technique to create one in your personal enterprise?

We reply these questions and extra in our article beneath.

|

As a substitute of recording guide journal entries and constructing a common ledger by hand, automate your monetary recording processes with accounting software program. Free software program choices like Wave Accounting make common ledger creation as straightforward and easy as doable. |

Soar to:

Featured Companions: Accounting Software program

What’s a common ledger?

A common ledger (GL) is a complete doc comprised of particular person accounts that catalog every monetary transaction in the middle of your group’s existence.

Preserving a common ledger is foundational to what you are promoting’s monetary success. It tells you the way a lot cash you’ve gotten at any given second, the place your money is flowing and what your key bills are. It comprises all the data it is advisable to generate essential accounting experiences, together with your stability sheet, revenue assertion and money movement assertion.

Since common ledgers present a precise report of each monetary transaction going down at what you are promoting, they’re additionally important to catching potential accounting errors that would end in huge monetary (and even authorized) penalties for what you are promoting. An correct ledger can be a superb safeguard in opposition to points like embezzlement and fraud.

How does a common ledger work?

Common ledgers are the cornerstone of double-entry accounting. With this accounting technique, every monetary transaction is posted to the final ledger twice: As soon as as a credit score and as soon as as a debit. Coming into every transaction twice helps you catch errors and guarantee accuracy. Moreover, since a transaction is at all times debited from one account and credited to a different, this technique exhibits you the place your cash comes from and the place it goes.

Common ledgers are organized into accounts with every account representing a unique kind of transaction. (We speak extra about the most typical common ledger accounts beneath.)

Particular person transactions are recorded within the common ledger as “journal entries.” You may create journal entries by hand and enter them into your GL manually, or you should use an automatic accounting program that syncs along with your checking account and bank cards to routinely generate journal entries with every transaction.

|

Why do corporations use common ledger accounts?

Checking what you are promoting checking account offers you a fast take a look at precisely how a lot cash you’ve gotten at a selected second in time — however that’s the one actual info it offers you.

In distinction, a common ledger breaks down precisely how a lot cash what you are promoting makes, showcases the way you spend that cash and paperwork how a lot you owe your collectors and the way a lot is owed to you in return.

Plus, because the common ledger is crucial to double-entry bookkeeping, it helps corporations guarantee monetary accuracy. Recording every transaction twice in two separate accounts exhibits you precisely the place your cash comes from and the place it goes, however it additionally retains you from overspending or operating up a stability you may’t really afford.

Common ledgers are additionally essential for producing monetary paperwork that present you, your shareholders and different stakeholders in what you are promoting how nicely you’re performing financially. These paperwork embody the next:

- Revenue statements, also called revenue & loss statements, which record your revenue (earnings) and bills (losses) over a selected time interval.

- Stability sheets, which lay out a snapshot of your property and legal responsibility at a given second in time.

- Money movement statements, which define the place money is flowing into what you are promoting and the place it’s flowing out of what you are promoting.

With out these foundational accounting experiences, you’ll battle to glean insights into points like the place it is advisable to minimize prices and which operations it is best to make investments extra in to extend your revenue margins. And since they provide a fast overview of what you are promoting’s monetary standing, these monetary experiences are pivotal to making use of for a enterprise mortgage and sustaining transparency along with your shareholders.

|

Kinds of common ledger accounts

Common ledgers are made up of (and arranged by) accounts, or subsections that categorize monetary transactions by kind. The accounts in flip might embody sub-accounts or sub-ledgers, which report extra exact particulars about every transaction.

Every enterprise customizes its accounts to its particular wants, so you could or might not have all the accounts listed beneath in your common ledger. Nonetheless, these are the most typical forms of common ledger accounts:

- Asset accounts, which might embody money accounts and accounts receivable.

- Legal responsibility accounts, which might embody accounts payable and loans.

- Fairness accounts, which might embody inventory and retained earnings.

- Working income accounts, which might embody gross sales and charges.

- Working expense accounts, which might embody salaries and gear depreciation.

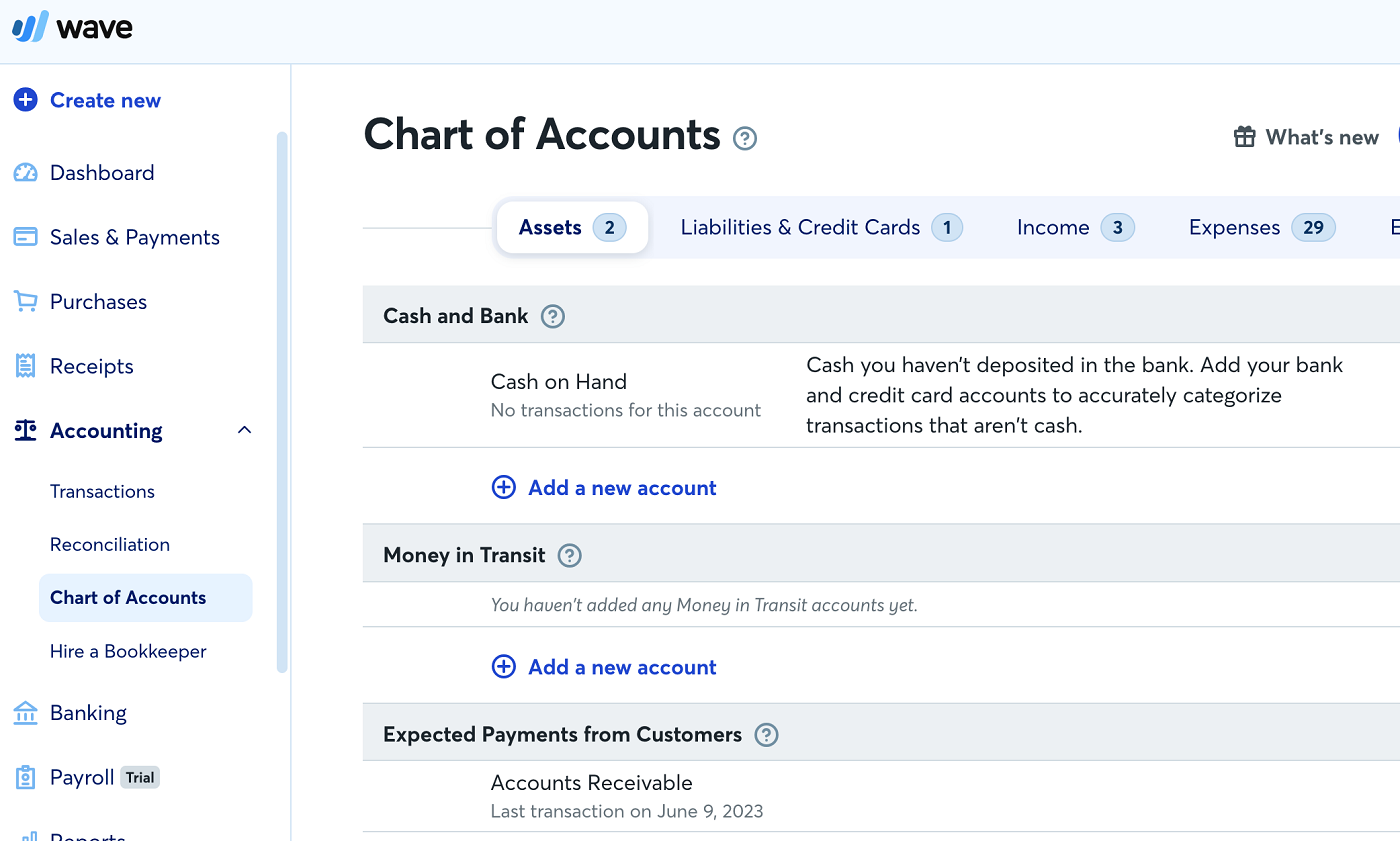

For probably the most half, common ledgers included with accounting software program come pre-built with the most typical account sorts (Determine A). Relying on the software program and plan, you can too add customized accounts distinctive to your particular enterprise.

Common ledger reconciliation course of

What’s GL reconciliation?

Common ledger reconciliation is the method of constructing positive your GL is correct. You (or your accountant) will test the transactions recorded in your common ledger in opposition to main paperwork like receipts, tax paperwork, invoices and different data. You’ll make sure that each transaction is correct and has been accurately recorded as each a credit score and debit within the applicable accounts.

Advantages of common ledger reconciliation

This course of ought to reveal any monetary errors and make it easier to catch transactions you forgot to report (or recorded incorrectly). Crucially, it also needs to offer you — and different stakeholders in what you are promoting, like lenders and co-owners — peace of thoughts, understanding you may belief the data you employ to make important enterprise selections.

Reconciling your common ledger is corresponding to balancing a checkbook. Put as merely as doable, you wish to make sure that your whole accounts are balanced, that means your debits and credit are completely weighted.

4 steps to common ledger reconciliation

If you happen to use accounting software program, the software program itself ought to information you thru the method of reconciliation. (If you happen to work with an accountant, they’ll carry out the identical course of utilizing whichever accounting software program their agency works with.) Typically talking, you’ll comply with these steps to reconcile your ledger.

- Collect monetary paperwork like your bank card assertion, financial institution statements, buyer invoices, payments and some other data of transactions since your final common ledger reconciliation.

- Undergo your common ledger account by account, beginning with asset accounts, and confirm that every transaction has been recorded accurately.

- If you happen to discover incorrect transactions, generate correcting journal entries to deliver your books again into stability.

- When you’ve verified that every little thing is correct and have mounted any errors, you may shut the books, that means formally finish this monetary recording interval and begin the subsequent.

Ideally, it is best to reconcile your common ledger as soon as a month. It’s a lot simpler to reconcile transactions once they’re nonetheless contemporary in your thoughts, which they received’t be for those who postpone reconciling your books every year for tax season.

Easy methods to discover common ledger software program

Most accounting software program applications are pre-programmed with a common ledger and chart of accounts, together with free software program like Wave Accounting. Accounting software program automates a few of the most tedious elements of common ledger reconciliation, akin to routinely producing journal entries and streamlining financial institution reconciliation.

Not all accounting applications embody all accounts, although. For example, QuickBooks On-line solely consists of accounts receivable and payable with its higher-tier plans.

Moreover, not all plans supplied by the identical accounting firm embody common ledgers. For example, not like FreshBooks’ higher-tier plans, its least expensive plan (FreshBooks Lite) doesn’t embody double-entry accounting. Whilst you can undoubtedly monitor revenue and bills with FreshBooks Lite, you may’t break down transactions by account and also you received’t have a common ledger to reconcile.

Study extra about the right way to discover and select the most effective GL software program for you by studying our full information to accounting software program. You may as well minimize proper to the chase by trying out our prime accounting software program suggestions beneath.

Plan and pricing info updated as of 11/30/2023.

Steadily requested questions

What’s a common ledger in easy phrases?

A common ledger is a grasp accounting report utilized by companies to doc and categorize their monetary transactions. Common ledgers are a vital part of double-entry accounting. Common ledgers are organized into accounts, or forms of transactions, that are listed within the common ledger’s chart of accounts.

What objects are within the common ledger?

A common ledger data transactions. Together with greenback quantities, the GL consists of transaction particulars just like the date the transaction occurred. Most common ledgers are organized into 5 essential forms of accounts: Property, liabilities, proprietor’s fairness, working bills and working revenues.

Learn subsequent: What Are Typically Accepted Accounting Rules? (TechRepublic)