Bitcoin (BTC) concluded the week at roughly $41,400, reflecting a 5.5% decline in comparison with the earlier week’s closing worth of round $43,800. The worth skilled a notable dip on Monday, reaching a weekly low of about $40,225 earlier than staging a robust restoration and surpassing the $43,000 threshold on Wednesday and Thursday. Over the weekend, damaging worth actions introduced the closing worth to round $41,400, with the downtrend persisting into Monday the 18th, as BTC broke under the $41,000 buying and selling stage.

This previous week marked the primary occasion of a weekly worth lower after eight consecutive weeks of worth appreciation, signalling anticipated market actions geared toward lowering market leverage. Roughly $345 million value of lengthy and quick positions have been liquidated through the week, with the vast majority of liquidations affecting lengthy positions, totalling round $235 million. Nonetheless, the sturdy uptrend worth actions witnessed at varied factors within the week additionally led to roughly $110 million in liquidation of quick positions.

Excessive volatility is a typical consequence following intervals of great uptrends and downtrends, triggering a cascade of liquidations that cut back market leverage and contribute to a extra sustainable worth motion and market surroundings. Merchants typically capitalize on moments of heightened volatility to draw liquidity and readjust their positions.

Bitcoin dominance, representing its market capitalization relative to your complete digital asset market, declined to 53.11% from 53.46% the earlier week, indicating the strong resilience of altcoins in comparison with the main digital asset through the current downtrend. This means energetic investor engagement, as this sample sometimes happens when traders swiftly allocate capital throughout varied altcoins seeking short-term profitability.

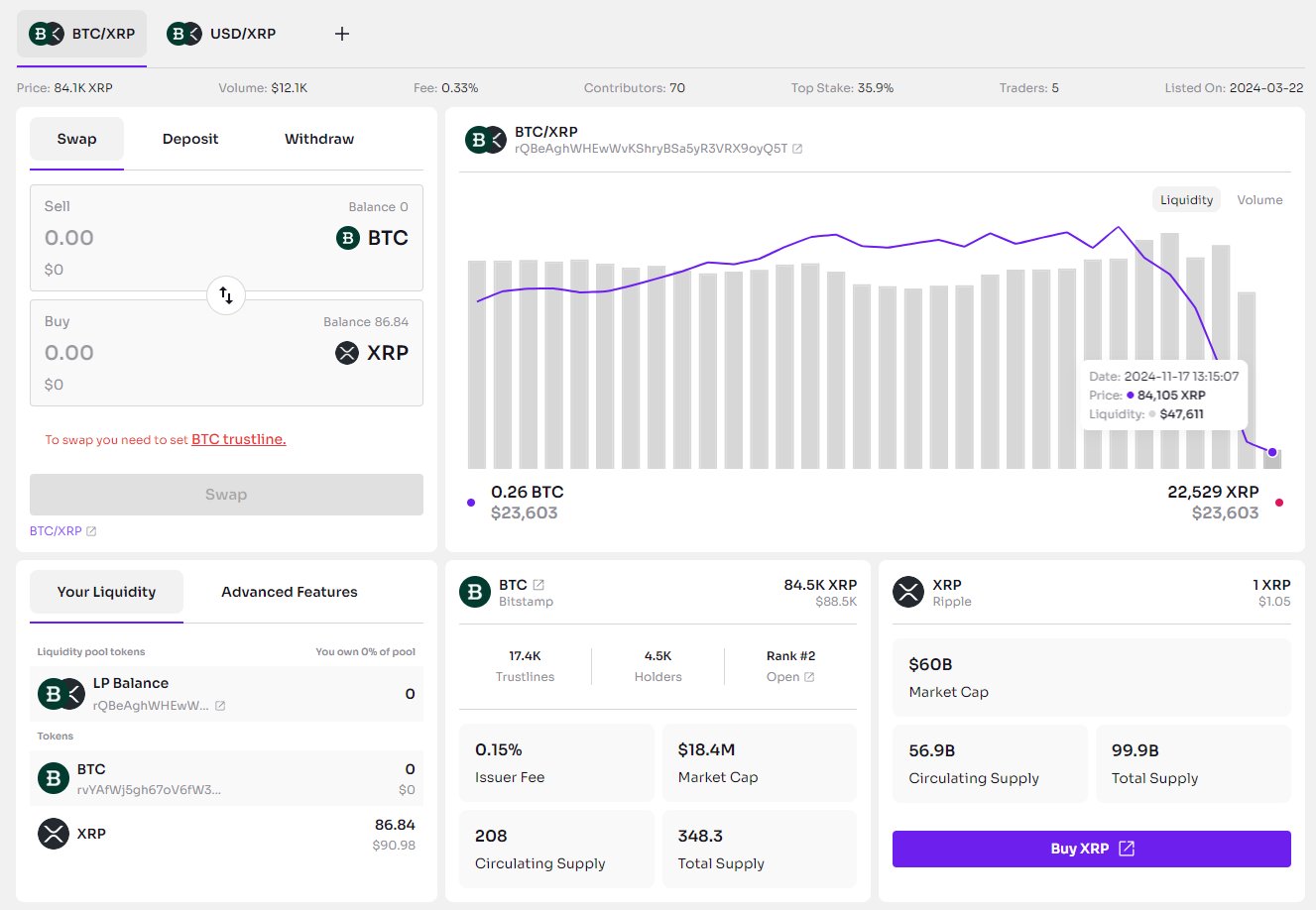

An evaluation of day by day quantity on centralized exchanges, measured over a 7-day interval from the eleventh to the seventeenth of November, revealed a day by day quantity exceeding $36 billion. This represents the best stage recorded since March 2023, affirming sturdy buying and selling exercise that contributes to elevated volatility.

Trying on the ETFs subject, the Grayscale Bitcoin Belief (GBTC) low cost and Grayscale Ethereum Belief (ETHE) keep a steady low cost, standing at 9.9% and 13.7%, respectively. This underscores the unchanged confidence amongst traders relating to the chance of ETF spot approval and the next conversion of Grayscale trusts to ETFs.

The ultimate deadline for the SEC choice on the 21Shares BTC Spot Submitting is scheduled for the tenth of January, with the remark window closing on the fifth of January. The 6-day window from the fifth to the tenth of January is when the SEC is predicted to offer a ultimate approval or rejection for the 21Shares submitting, coinciding with a cascade of approvals or rejections for different BTC filings. Analysts proceed to foretell a 90% likelihood of receiving a inexperienced gentle from the SEC.