Within the quickly evolving panorama of blockchain expertise, Neon EVM, a sensible contract on Solana (SOL) has emerged as a frontrunner by introducing a landmark parallel processing structure on its mainnet.

This method has enabled Neon EVM to attain a rise in efficiency, scalability, and effectivity, in accordance with a press launch share with NewsBTC.

Neon EVM Dominates Transaction Processing

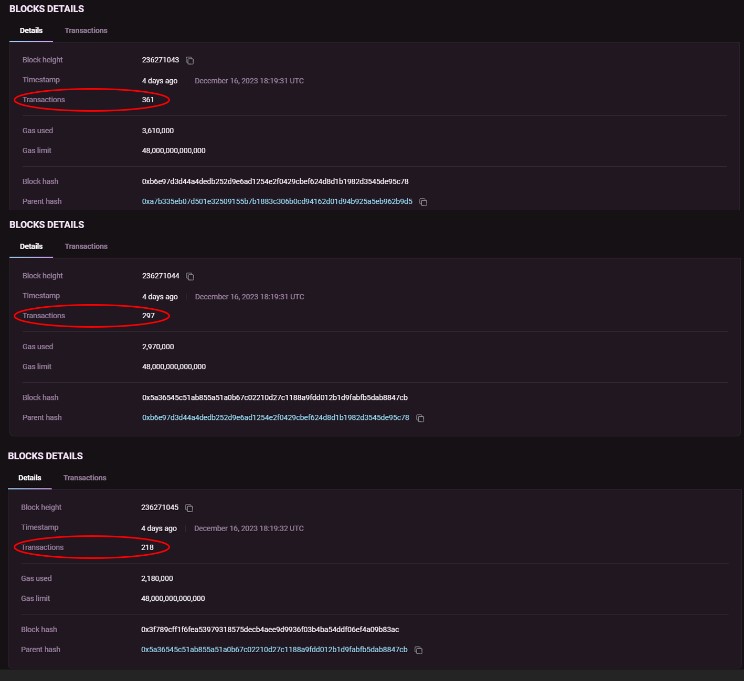

Neon EVM, the primary parallel Ethereum Digital Machine (EVM) on mainnet, has achieved a record-breaking 730 Transactions Per Second (TPS) on its mainnet. Notably, this is the primary time such excessive tps has been achieved on an EVM mainnet.

The milestone was reached on December 16, 2023, when Neon EVM’s mainnet showcased its transaction processing capabilities. Whereas many blockchains exhibit excessive tps on testnets, Neon EVM’s has standout by bettering its scalability.

Neon EVM, which went reside on the mainnet in July 2023, operates as a totally Ethereum-compatible atmosphere on the Solana blockchain. Since its launch, Neon EVM has garnered investor curiosity, leading to a number of listings on platforms equivalent to ByBit, Crypto.com, and Gate.io.

Given these developments, the utility token NEON has skilled exceptional development, with its worth surging from $0.67 to $1.45 in simply three days, representing a 116% enhance.

Neon EVM’s success comes when there’s rising curiosity in high-speed, parallelized processing blockchains. At present, Neon EVM stands as the one parallel processing EVM reside on the mainnet, showcasing its tps capabilities in comparison with different blockchain networks.

Outshining Ethereum’s Transaction Velocity

The basic distinction between Neon EVM and blockchains like Bitcoin and Ethereum lies of their transaction processing method. Whereas Bitcoin and Ethereum course of transactions sequentially, Neon EVM permits for simultaneous processing of a number of transactions, facilitating elevated throughput and decreasing the probability of congestion in periods of excessive demand.

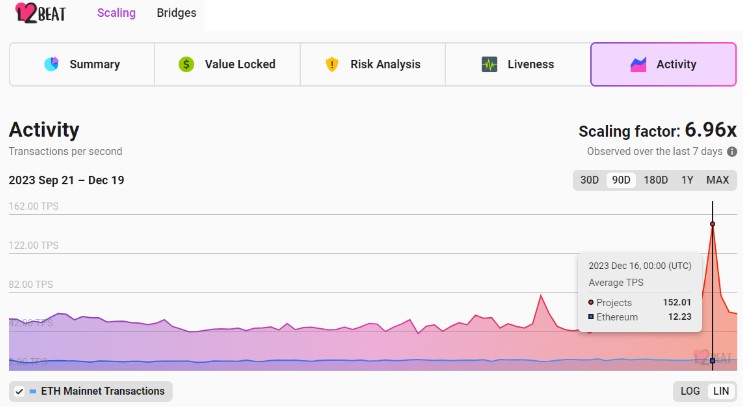

In a notable comparability, Neon EVM’s parallel processing structure outperformed the mixed tps of the whole Ethereum ecosystem on December 16, as reported by L2Beat.

The venture’s dedication to Ethereum compatibility on the Solana blockchain and its high-speed transactions and low-cost advantages positions Neon EVM as an attention-grabbing venture as a brand new Bull Cycle emerges.

Layer 2 Scaling Options On The Rise

Polygon, the layer 2 scaling resolution that operates alongside the Ethereum blockchain, has additionally demonstrated its transaction processing pace capabilities.

In a latest publish on X (previously Twitter), Sandeep Nailwal, the founding father of Polygon, shared notable statistics highlighting the community’s efficiency. In response to Nailwal’s publish, Polygon’s Proof of Stake (PoS) chain seamlessly dealt with over 16 million transactions in a single day, showcasing its scalability and effectivity.

In the course of the peak interval, the Polygon PoS chain achieved a throughput of 255 tps. This determine is roughly 2-3 instances larger than the mixed throughput of the whole Ethereum ecosystem.

Furthermore, the validators on the Polygon community generated roughly 1 million in transaction charges in a single day, reflecting the community’s excessive degree of exercise. Nonetheless, it’s value noting that fuel charges skilled a spike throughout this era, which is a broader situation impacting the whole Ethereum ecosystem.

By way of rewards for validators, the block rewards on the Polygon community amounted to over 155,000 MATIC tokens. This interprets to substantial income for validators, totaling round 1.2 million in a single day. These rewards incentivize validators and contribute to the general safety and stability of the PoS chain.

The spike in transactions in each of those Layer-2 networks showcase the rising significance of scalability options. Within the coming months, hundred of recent customers might onboard the crypto market through both of those options hinting at a possible profit for his or her underlying tokens.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site totally at your individual threat.