Fast Take

With the countdown to the Bitcoin halving occasion of April 2024 underway, the digital asset ecosystem is witnessing notable monetary shifts.

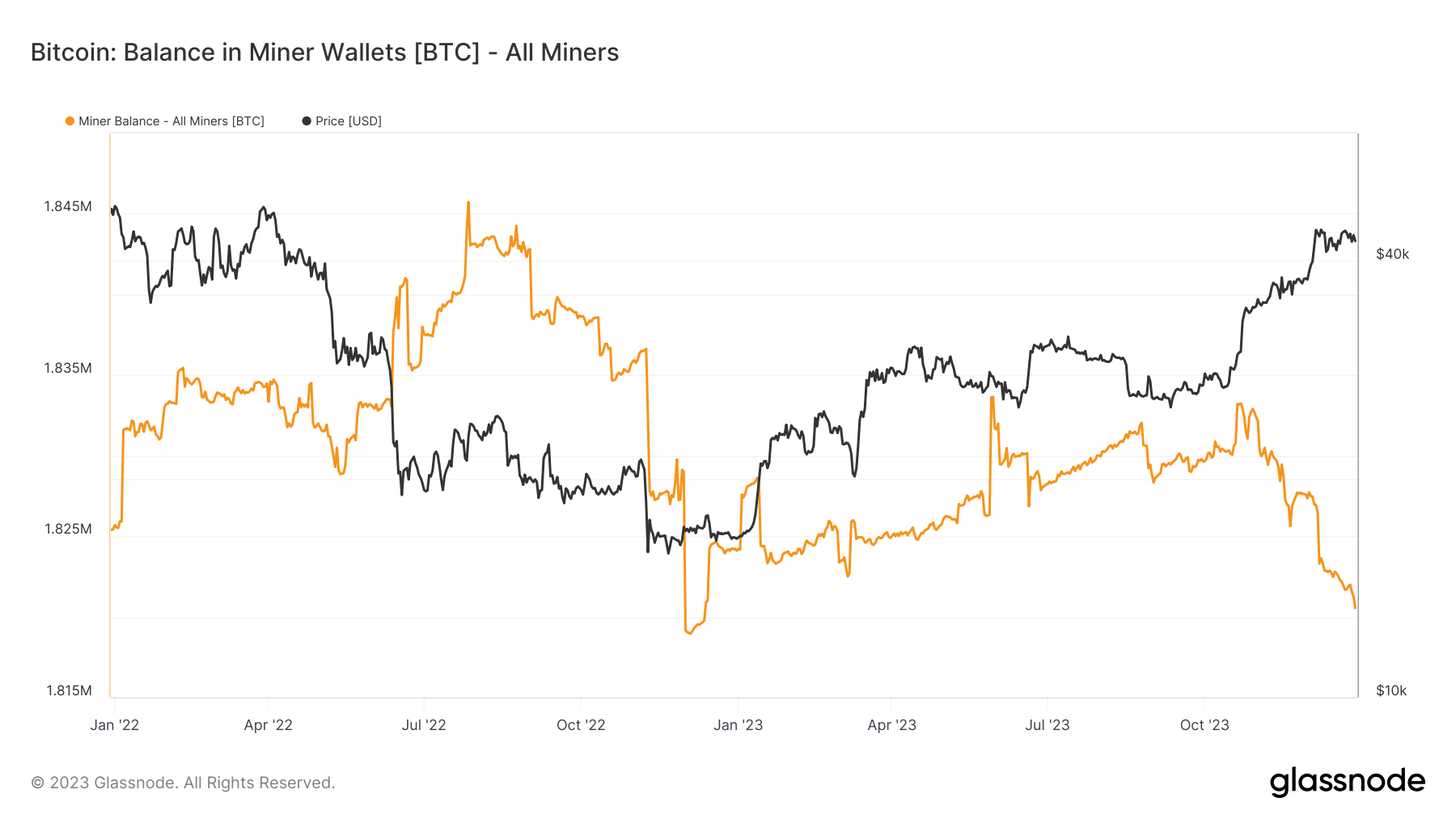

The halving, designed to scale back block rewards by half, is already sparking modifications within the miner steadiness. From an preliminary 1.833 million Bitcoin held in miner addresses, the steadiness has dwindled by 13,000 Bitcoin to 1.820 million previously few months, harking back to the state through the FTX collapse in November 2022.

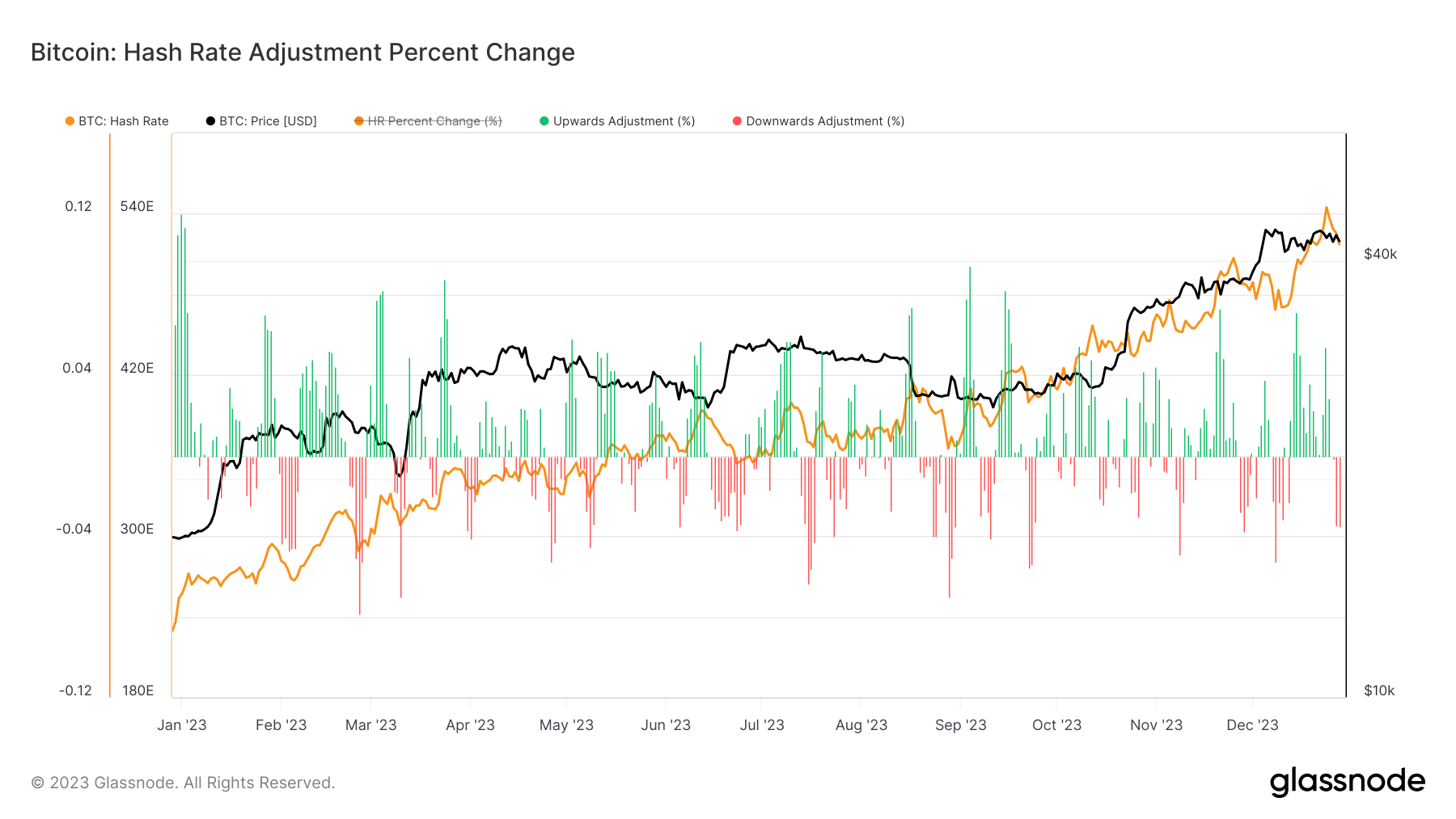

Whereas this drop might recommend a sell-off, there’s no clear indication that miners have offloaded their Bitcoin holdings, because the miners-to-exchanges switch stays at an area low. Nonetheless, the seven-day transferring common (7 DMA) for the hash price presents a special narrative, declining from 544 exahashes per second (eh/s) to 517 eh/s.

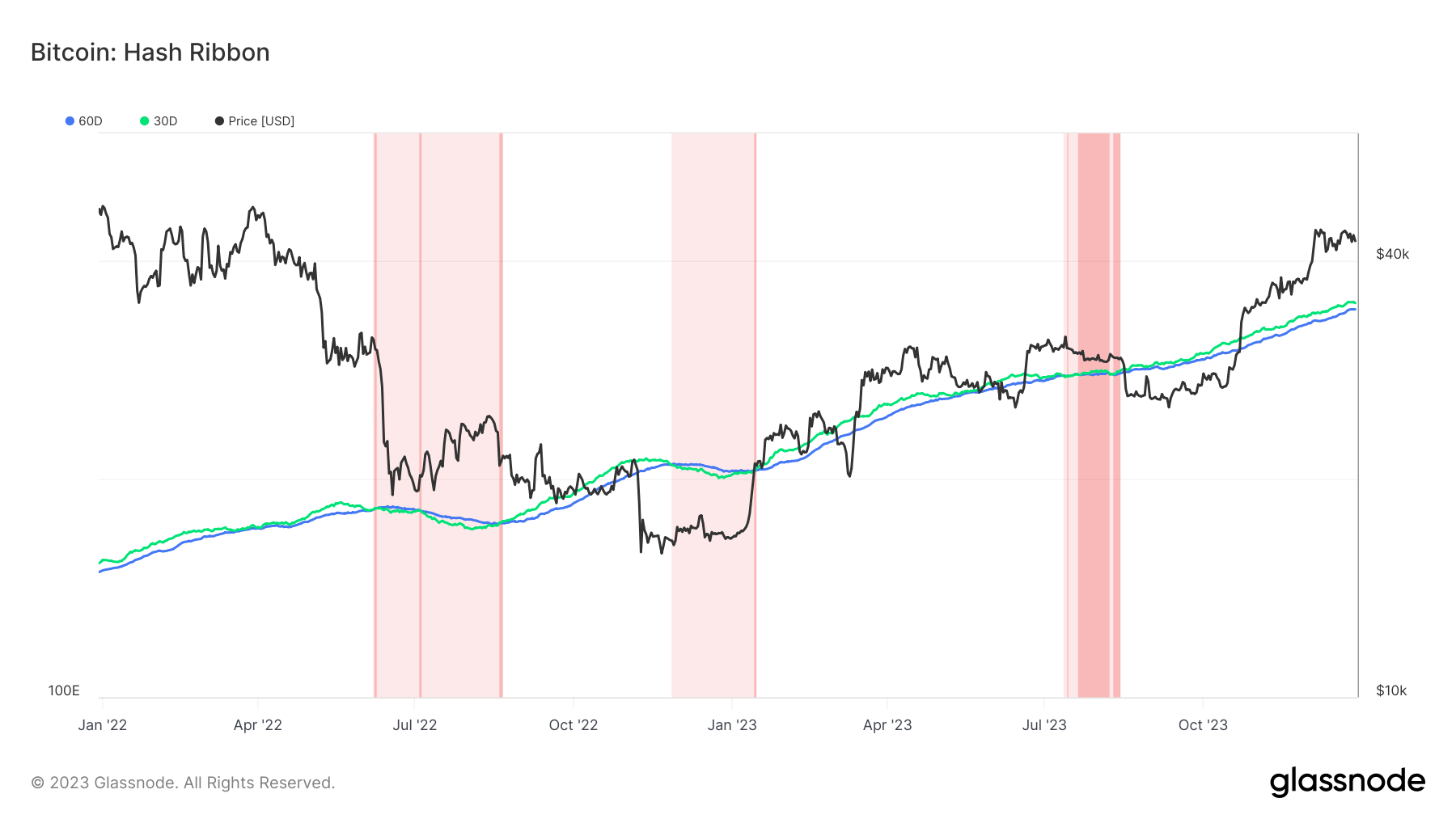

These shifts convey into focus the hash ribbon metric, a market indicator that indicators a possible miner capitulation when Bitcoin mining prices outweigh profitability. A optimistic shift happens when the hash price’s 30-day transferring common (MA) surpasses the 60-day MA (indicated by a change from mild pink to darkish pink areas). Traditionally, a subsequent value drop happens when such a shift coincides with a value momentum change from detrimental to optimistic.

The publish The top-of-year decline in hash price sparks debate over miner sell-offs appeared first on CryptoSlate.