In a publish shared on X on January 26, crypto analyst BitQuant forecasts that Bitcoin (BTC) will recuperate from the present downtrend and surge previous its all-time excessive of $69,000 to over $250,000 earlier than the upcoming Bitcoin halving in April.

Bitcoin To $250,000 Earlier than Halving?

From the chart shared, BitQuant notes that Bitcoin remains to be trending inside a rising channel. Out of the multi-year uptrend that the coin is in, this channel’s subsequent “contact” is projected to be at round $250,000.

For now, if the pattern line guides, Bitcoin has instant resistance at about $80,000. This degree ought to be the following key goal for bulls to retest. In keeping with BitQuant, it’s seemingly that Bitcoin will float above this line to $250,000 by April earlier than the community mechanically halves block mining rewards.

Extrapolating from the analyst’s preview, the Bitcoin uptrend stays legitimate till the higher restrict outlined by the rising pattern line is “touched.” Even so, when this degree might be breached isn’t specified.

As soon as this line is examined, putting the coin at over $250,000, it is going to seemingly comply with its historic sample by cooling off. The depth of this retracement isn’t additionally outlined however is anticipated to be deep since BitQuant mentioned the coin will “die.”

BitQuant defined that this “dying” interval refers to Bitcoin’s worth going under its earlier all-time excessive. The retracement might be anticipated. That is widespread after halving since provide tends to extend as demand for the coin softens. Regardless of this short-term setback, BitQuant stays assured that BTC will regain momentum and proceed its long-term upward pattern.

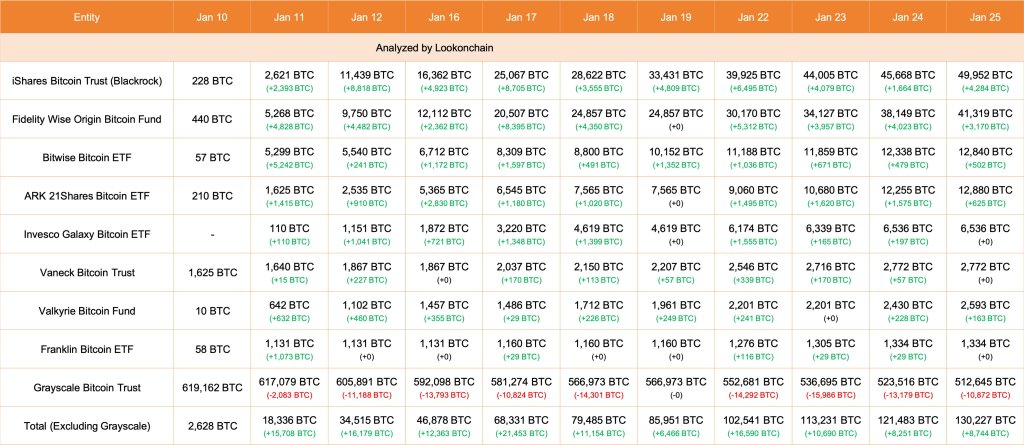

Although the analyst stays bullish, it’s unclear how costs will pan out for now. America Securities and Change Fee (SEC) not too long ago authorised a number of spots for Bitcoin exchange-traded funds (ETFs).

Although issuers have been ramping up purchases, Grayscale Investments have liquidated their Grayscale Bitcoin Belief (GBTC), promoting shares and dumping cash through exchanges.

Latest data from Lookonchain reveals that GBTC lowered 10,872 BTC value over $447 million on January 25. In the meantime, eight spot Bitcoin ETF issuers added 8,744 BTC, with BlackRock including 4,284 BTC. On January 24, GBTC lowered 13,179 BTC with Constancy Investments, one other spot Bitcoin ETF issuer, shopping for 4,023 BTC.

With BTC discovering demand, costs have began stabilizing, trying on the growth within the day by day chart. The coin is regular above $39,500, rejecting the extraordinary promoting strain of January 22.

Function picture from Canva, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site completely at your individual danger.