You might have heard the time period ‘Bitcoin ETF’ floating round in latest monetary information, particularly with the rising recognition of Bitcoin and different cryptocurrencies. Crypto ETFs turned an excellent greater matter after the long-awaited approval of spot Bitcoin ETFs by the U.S. Securities and Change Fee, particularly those from well-known funding managers and corporations like BlackRock or Constancy.

As a crypto person myself, I discover Bitcoin ETFs — in addition to any cryptocurrency ETFs, actually — extremely thrilling. I do know that’s a bizarre phrase to make use of for what is actually a monetary software, however ETFs could be the reply to creating crypto extra approachable to each regulators and traders. Let’s check out what they’re, what they’ve the potential to do sooner or later, and among the high Bitcoin ETFs in which you’ll be able to put money into 2024.

What Is a Bitcoin ETF?

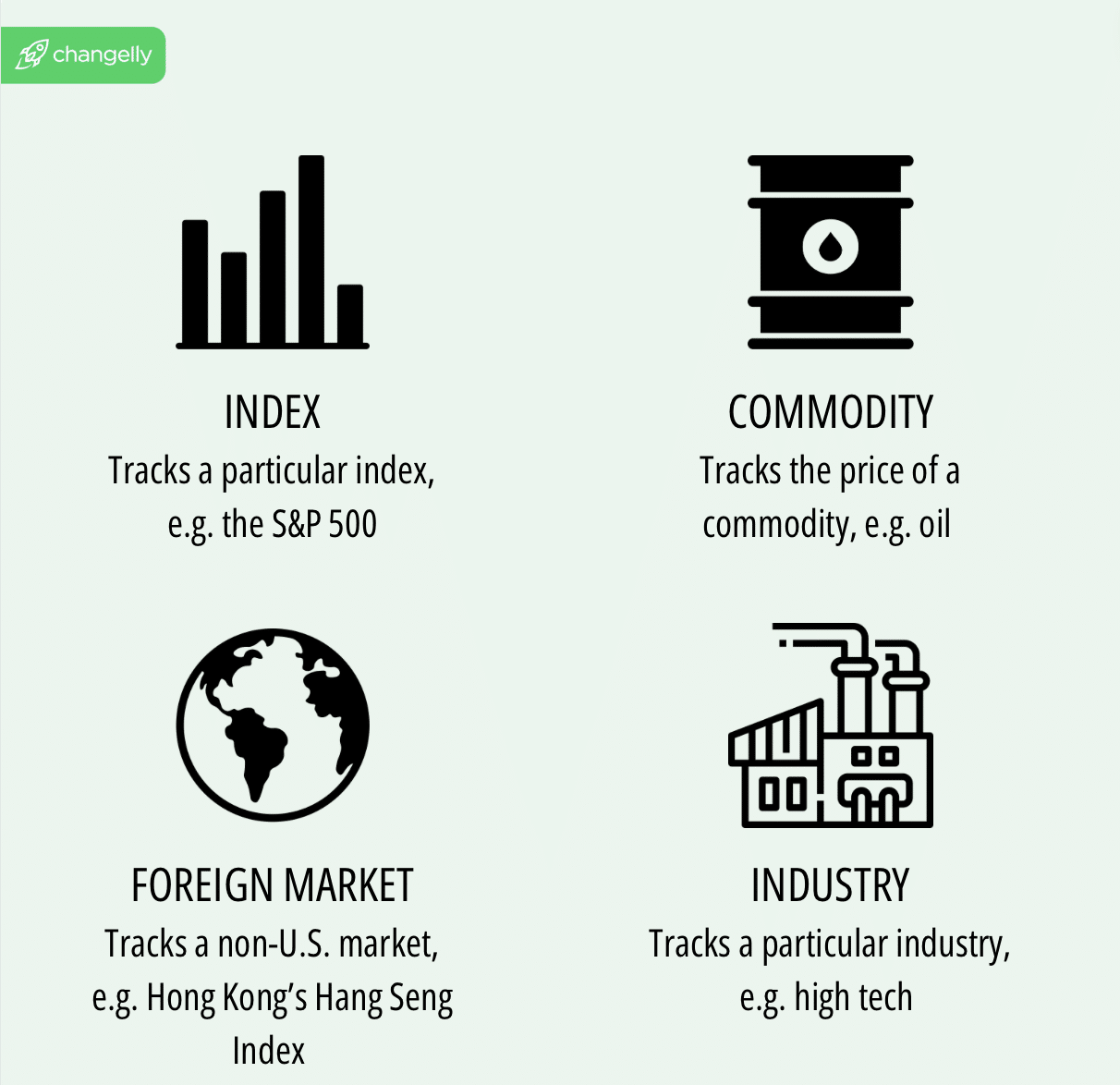

An exchange-traded fund, or ETF, is a kind of funding fund and exchange-traded product that tracks the worth of an underlying asset. A Bitcoin ETF, subsequently, is a fund that tracks the worth of Bitcoin. This permits traders to purchase into the ETF with out having to deal immediately with Bitcoin itself.

There are several types of Bitcoin ETFs, akin to Bitcoin futures ETFs, spot Bitcoin ETFs, and Bitcoin technique ETFs. A spot Bitcoin ETF tracks the “spot” or present value of Bitcoin, whereas a Bitcoin futures ETF invests in Bitcoin futures contracts. A Bitcoin technique ETF makes use of varied funding methods associated to Bitcoin, together with investing in corporations with vital Bitcoin holdings or actions.

It’s necessary to notice that crypto ETFs typically put money into a spread of underlying property, like direct holdings of cryptocurrencies, CME Bitcoin futures contracts, and shares of corporations concerned in blockchain expertise. This diversification permits traders to mitigate among the dangers related to the extremely risky nature of particular person cryptocurrencies.

Listed here are just a few phrases it’s essential know earlier than you begin investing in ETFs. I point out a few of them on this article.

- Expense Ratio. That is the price of managing and working the ETF, expressed as a proportion of the overall property. Decrease expense ratios are usually higher as they eat much less into your returns.

- Property Below Administration (AUM). That is the overall market worth of the property that an funding firm or a monetary establishment manages on behalf of traders. A bigger AUM can point out the ETF has a bigger market presence and doubtlessly better liquidity.

- Liquidity. This refers to how simple it’s to purchase or promote an ETF with out impacting its value. As extra steadily traded ETFs normally have higher liquidity, they’re simpler to purchase and promote.

- Buying and selling Value vs. Internet Asset Worth (NAV). Whereas shares commerce at market costs, an ETF’s NAV is the overall asset worth of the fund divided by the variety of shares. Discrepancies can happen between the buying and selling value and the NAV, which might imply shopping for an ETF at a premium or low cost.

Prime 5 Bitcoin ETFs to Put money into 2024

Listed here are the 5 most distinguished Bitcoin ETFs you may get in 2024.

BlackRock Spot Bitcoin ETF – The iShares Bitcoin Belief (IBIT)

Launched by BlackRock on January 11, 2024, the iShares Bitcoin Belief (IBIT) might be probably the most well-known Bitcoin ETF — and, judging by its buying and selling quantity (at the least on the time of writing), additionally the most well-liked. As a spot BTC exchange-traded fund, it may well immediately replicate the efficiency of the worth of Bitcoin.

For the primary 12 months from its launch, the ETF has a diminished sponsor’s price of 0.12% for the primary $5 billion in property, after which the price will likely be 0.25%. As of early February 2024, the fund’s property underneath administration (AUM) stood at roughly $2.2 billion, indicating robust investor curiosity. IBIT is understood for its comfort, high quality, and the convenience it brings to traders wanting publicity to Bitcoin with out the complexities of direct possession.

Grayscale Bitcoin Belief ETF (GBTC)

Grayscale Bitcoin Belief (GBTC) is without doubt one of the oldest funds on this checklist, and has at all times been a preferred manner for traders to achieve publicity to Bitcoin by means of a construction that mirrors an ETF, albeit it’s structured as a belief.

GBTC permits traders to put money into Bitcoin in a type that may be held in conventional funding accounts. Being one of many earliest funding automobiles for Bitcoin, GBTC has been carefully watched by traders for its efficiency relative to Bitcoin’s value and its premium or low cost to the underlying Bitcoin worth it holds.

It’s necessary to notice that GBTC operates in a different way from the newly authorized spot Bitcoin ETFs, because it was not structured underneath the ETF umbrella initially however has sought conversion to an ETF construction to supply higher liquidity and nearer monitoring to the web asset worth. As a result of this, in addition to its larger charges (its administration price is 1.5%), this belief has seen fairly a major outflow of property in early 2024.

Constancy Smart Origin Bitcoin Fund (FBTC)

Constancy’s Smart Origin Bitcoin Fund is designed to supply traders with direct publicity to BTC — the fund’s efficiency tracks the worth of Bitcoin as measured by the efficiency of the Constancy Bitcoin Index.

On the time of writing, it was one of the standard spot Bitcoin ETFs, with its complete property round $1.3B. This isn’t all that shocking, contemplating Constancy is without doubt one of the world’s largest funding managers and thus has a longtime status.

ARK 21Shares Bitcoin ETF (ARKB)

Similar to the opposite spot Bitcoin ETFs on this checklist, the ARK 21Shares Bitcoin ETF (a collaboration between ARK Make investments and 21Shares) goals to supply traders with direct publicity to Bitcoin and its value actions.

ARK Make investments is understood for its give attention to disruptive innovation and has been a vocal proponent of the potential of cryptocurrencies. The partnership with 21Shares, a frontrunner in offering cryptocurrency ETPs (exchange-traded merchandise), brings collectively experience in innovation-focused investing and digital asset administration. On the time of writing, its AUM was round $600M.

ProShares Bitcoin Technique ETF (BITO)

This was the primary Bitcoin ETF to get authorized for commerce within the U.S. markets — it entered the market in October 2021. On the time of writing, it had virtually $1.8B value of property underneath administration and an expense ratio of 0.95%.

The ProShares Bitcoin Technique ETF is an actively managed fund. Along with Bitcoin futures contracts, it could additionally maintain money and Treasury securities. It may be offered and purchased by means of a brokerage account.

How Do Bitcoin ETFs Work?

Bitcoin ETFs work very like some other ETFs. They’re listed on conventional exchanges, which makes them broadly accessible. Traders can purchase and promote shares of a Bitcoin ETF identical to they’d with an everyday inventory or ETF.

What makes Bitcoin ETFs distinctive is that they goal to trace the worth of Bitcoin. The ETF makes an attempt to copy the efficiency of Bitcoin by both holding Bitcoin immediately (within the case of a spot Bitcoin ETF) or by investing in Bitcoin futures contracts (within the case of Bitcoin futures ETFs). The objective of a Bitcoin ETF is to supply traders with publicity to Bitcoin’s value actions with out the complexities of shopping for, storing, and safekeeping Bitcoin themselves.

Bitcoin ETF Charges

Like all ETFs, Bitcoin ETFs cost charges to cowl their working bills. These charges, generally known as expense ratios, are a proportion of an investor’s property within the fund. The expense ratio covers the price of managing the ETF, together with administrative bills, compliance prices, and the price paid to the fund’s supervisor.

It’s necessary to notice that expense ratios for Bitcoin ETFs can fluctuate. Usually, they could be larger than conventional ETFs because of the extra complicated nature of Bitcoin as an underlying asset. That’s why traders should perceive and examine the charges of various Bitcoin ETFs earlier than committing any cash.

Bitcoin ETF vs. Bitcoin

Now, the large query is: Why would you need to put money into a Bitcoin ETF as a substitute of excellent ol’ BTC itself? Nicely, let’s discover among the variations (and similarities) between the 2.

Bitcoin ETFs and Bitcoin share a basic relationship: they’re each tied to the worth of Bitcoin, a number one digital asset within the cryptocurrency trade. Right here, we’ll spotlight their similarities and variations and talk about why an investor may lean in direction of one over the opposite.

Similarities

- Bitcoin Costs. Each Bitcoin and Bitcoin ETFs are influenced by Bitcoin’s value. The worth of a Bitcoin ETF is derived from the worth of Bitcoin itself as a result of it holds Bitcoin or Bitcoin futures contracts as its underlying asset.

- Funding Goal. Each Bitcoin and Bitcoin ETFs share the identical funding goal: to achieve publicity to the worth actions of Bitcoin. An investor in both is actually betting on the longer term value of Bitcoin.

Variations

- Securities Legal guidelines & Monetary Devices. Bitcoin is a digital asset, whereas a Bitcoin ETF is a monetary instrument regulated by securities legal guidelines. An ETF is much like mutual funds; it’s traded on a inventory trade and designed to trace the worth (web asset worth) of an underlying asset — on this case, Bitcoin.

- Administration Charges. Bitcoin ETFs, like all ETFs, contain administration charges, which might erode the returns in your funding over time. When shopping for Bitcoin immediately, there are transaction charges however no ongoing administration charges.

- Entry & Custody. Shopping for Bitcoin immediately requires a digital pockets and a sure diploma of technical information. Alternatively, shopping for a Bitcoin ETF is as easy as shopping for some other inventory on the trade, making it extra accessible to a wider viewers.

- Security & Regulation. Bitcoin ETFs are regulated monetary merchandise and should adjust to stringent securities legal guidelines, providing traders extra safety. Conversely, whereas the digital property trade has made strides in safety, holding precise Bitcoin can carry dangers like hacking or lack of personal keys.

Why Select One Over the Different?

Selecting between investing in Bitcoin or a Bitcoin ETF can largely depend upon particular person preferences and circumstances, like danger tolerance or anticipated funding return.

Somebody may desire a Bitcoin ETF if they need publicity to Bitcoin’s value actions however desire the familiarity and regulation of conventional monetary devices or in the event that they don’t need to deal with the custody of precise Bitcoin.

Alternatively, one may desire shopping for Bitcoin immediately if they’re snug navigating the digital property trade or in the event that they need to keep away from administration charges. Utilizing Bitcoin for its meant objective as a forex is also a cause for BTC purchases.

In each instances, potential traders ought to do thorough analysis and take into account market information, potential dangers, and their private funding objectives earlier than making a call.

How To Make investments In Crypto ETFs

Investing in crypto ETFs provides a bridge for people and institutional traders to achieve publicity to cryptocurrencies and blockchain expertise by means of regulated monetary devices. Crypto ETFs, akin to these monitoring Bitcoin, are interesting to those that desire the construction and regulatory atmosphere of conventional funding automobiles.

These funds can be found on main inventory exchanges and may be bought by means of brokerage accounts, which simplifies entry to the risky crypto markets with out the necessity for a devoted crypto trade account. An ETF ticker image represents every crypto ETF, permitting traders to simply commerce them identical to some other inventory or conventional ETF. That is significantly advantageous for retail traders new to crypto property as a result of it offers a well-known entry level into the burgeoning sector of digital currencies.

The Way forward for Bitcoin ETFs – Are They Price Investing in?

As we glance to the longer term, Bitcoin ETFs, or Bitcoin exchange-traded funds, are poised to achieve much more consideration as an rising asset class. They characterize a major step within the maturation of Bitcoin as a reputable monetary instrument, providing a extra accessible and controlled manner for conventional traders to faucet into the potential capital appreciation of Bitcoin.

Investing in a Bitcoin ETF might align with the funding targets of those that imagine within the long-term worth proposition of Bitcoin however desire the comfort and familiarity of the normal ETF construction. It’s necessary to recollect, although, that as with all investments, Bitcoin and cryptocurrency ETFs have inherent dangers and issues, together with Bitcoin’s value volatility and the comparatively nascent stage of the cryptocurrency market.

Crypto ETFs provide a compelling various to those that are cautious of the technical challenges and safety issues of immediately managing crypto property, like having to safe a digital pockets or handle personal keys. They entrust the custody of the underlying digital property to the funding agency managing the ETF, leveraging their experience and infrastructure to safeguard these property.

General, whether or not a Bitcoin ETF is a worthwhile funding will largely depend upon particular person funding objectives, danger tolerance, and broader perception in the way forward for Bitcoin and cryptocurrencies. As at all times, potential traders ought to train due diligence or seek the advice of a monetary advisor earlier than making funding selections.

Ultimate Ideas

Bitcoin ETFs provide a singular manner for traders to achieve publicity to Bitcoin with out proudly owning the cryptocurrency outright. Nonetheless, like every funding, they arrive with their very own set of dangers. All the time keep in mind that the worth of a Bitcoin ETF is derived from Bitcoin’s value, which may be extremely risky. All the time seek the advice of with a monetary advisor or do your personal analysis earlier than investing in a Bitcoin ETF.

Because the cryptocurrency market continues to evolve, it will likely be fascinating to look at how Bitcoin ETFs and their regulatory panorama, formed by our bodies just like the trade fee, develop. Whether or not it’s a Bitcoin futures ETF, spot Bitcoin ETF, or Bitcoin technique ETF, one factor’s sure: Bitcoin ETFs are enjoying a major function in bridging the hole between conventional finance and the thrilling world of cryptocurrency.

FAQ

Are there any ETF for cryptocurrency?

Sure, there are cryptocurrency ETFs. They provide a manner for traders to achieve publicity to digital property with out immediately proudly owning them by monitoring the efficiency of cryptocurrencies like Bitcoin or investing in corporations concerned within the cryptocurrency trade. Some examples embrace BlackRock’s iShares Bitcoin Belief and the ARK 21Shares Bitcoin ETF.

Are there any non-Bitcoin crypto ETFs?

There are additionally non-Bitcoin crypto ETFs that supply publicity to a spread of cryptocurrencies and blockchain expertise, not simply Bitcoin. These ETFs might put money into corporations that conduct enterprise operations within the crypto house, akin to crypto mining or blockchain expertise companies. Listed here are some examples: the Amplify Transformational Information Sharing ETF (BLOK) and the Siren NASDAQ Financial system ETF (BLCN).

The way to put money into cryptocurrency?

Lately, there are various alternative ways to put money into crypto. The everyday buy-and-sell possibility, HODLing a diversified crypto portfolio, mining, staking, and extra. One of many extra “conventional” methods to interact in cryptocurrency investing is thru ETFs.

To put money into a cryptocurrency ETF, you will have to get a conventional brokerage account, identical to for some other exchange-traded fund. Nonetheless, you need to keep in mind that though this methodology offers an easier and doubtlessly much less dangerous approach to put money into the crypto market, cryptocurrency remains to be a risky asset class, and you need to be cautious of the attainable dangers.

Disclaimer: Please word that the contents of this text should not monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25784220/247333_EOY_Package_Check_In_CVirginia_PODCASTS.jpg)