It is fairly exhausting to say whether or not the PC market is really again or not given ongoing international geopolitical uncertainties, however the indicators are pointing in direction of restoration. Intel beat its income expectations in its newest monetary report, whereas AMD fortunately shared information from Mercury Analysis that confirmed it gained some wholesome slices of unit and income share within the x86 processor market.

As famous by Jeremy in his current article, Intel’s This fall 2023 revenues jumped by round 10% over the identical quarter in 2022. That is a wholesome quantity, however its forecast for the present quarter is for an 8% progress in income. That was sufficient to ship traders scrambling for the exit, driving Intel’s share value down by over 11% during the last month. Fairly powerful crowd that Wall Road lot.

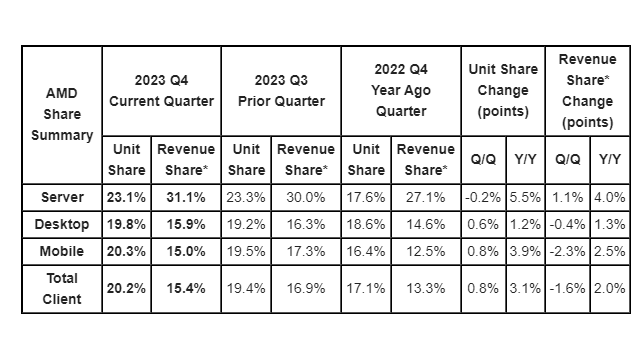

Intel has a bullish roadmap although, and it might nicely want it. AMD’s market share grew in This fall or 2023 with sturdy ends in the server market particularly, whereas it recorded beneficial properties within the cell and desktop markets too.

The server market is the place AMD goes gangbusters in the meanwhile, recording a 5.5% 12 months on 12 months achieve in unit share to carry it to 23.1% of the server market. Mercury Analysis’s information exhibits AMD took in report earnings within the server market. That is a testomony to the strengths of its newest EPYC processors.

It made smaller, however nonetheless notable beneficial properties within the cell market, with a 3.9% 12 months on 12 months unit share achieve. That noticed it crack 20% of the cell CPU market. AMD’s Phoenix and Dragon Vary… vary of cell processors little question contributed to this achieve. This helped it to attain a 2.5% year-on-year income achieve in This fall of 2023.

The desktop facet of issues was extra muted, with AMD falling simply shy of an total 20% of the desktop market. That is nonetheless a 1.2% achieve over the earlier 12 months, and it noticed a return to income progress of 1.3%.

So, with AMD on a progress trajectory, Intel bullish on its product roadmap, Home windows 12, rising demand within the reminiscence market and—who can overlook—an anticipated avalanche of edge AI {hardware}, and the indicators look good for the general PC market in 2024.

Oh, and on a really associated observe, we will anticipate AMD’s RDNA 4 and Nvidia’s Blackwell graphics card households someday this 12 months, that means players will start one other improve cycle too. AMD faces a a lot more durable combat within the graphics card market although, because it retains struggling to make beneficial properties in opposition to the behemoth that’s Nvidia.