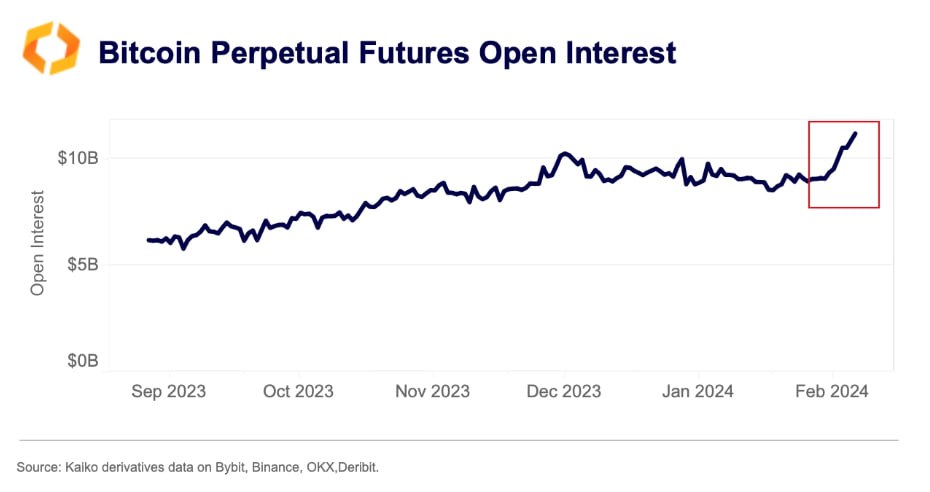

Bitcoin’s open curiosity has surged previous $11 billion for the primary time in over two years. This uptick comes when the world’s most respected coin surges, not too long ago easing previous $51,000, the best stage since December 2021.

Surging Open Curiosity And Order E-book Imbalance

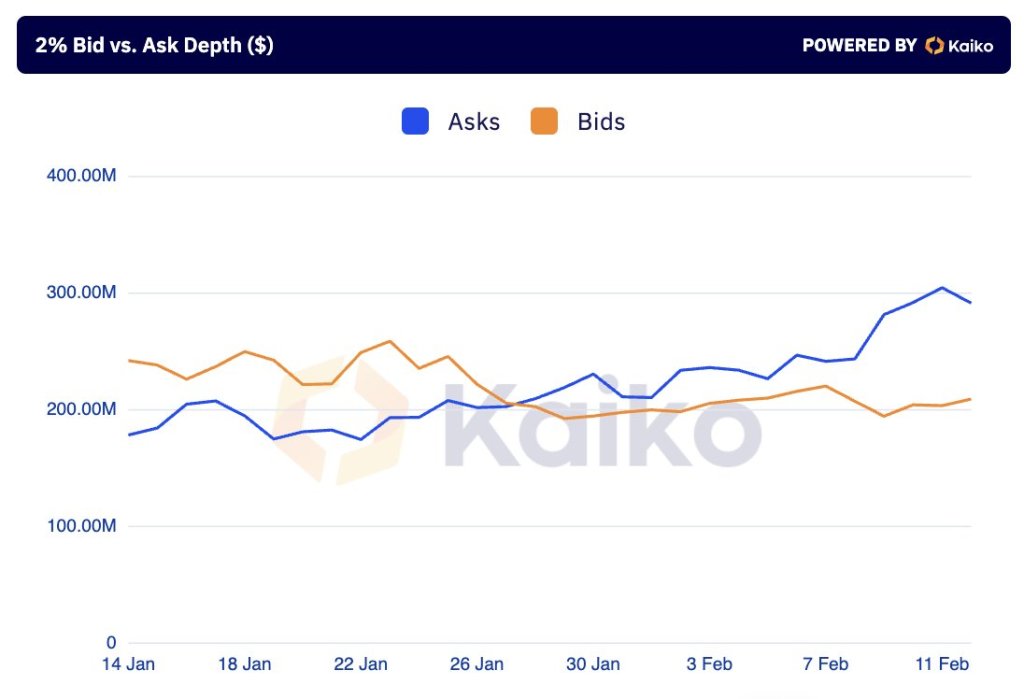

In accordance with Kaiko, a number one crypto analytics supplier, this upswing in open curiosity comes at a vital time for the coin. When costs zoomed previous $48,000 on February 11, there was an order e-book imbalance. Then, Kaiko noticed there have been $100 million extra bids than asks.

Technically, every time there may be an order e-book imbalance with extra bids than asks, it means that patrons are extra keen and enthusiastic to buy at spot charges than sellers are keen to liquidate. Following this imbalance, costs shot greater the next days, breaking above the $50,000 psychological quantity to over $51,500 when writing on February 14.

Surging open curiosity, particularly because the market developments greater, is bullish. It implies that extra individuals are keen to take part out there, hopeful of using the pattern. Subsequently, their participation interprets to a extra liquid market, charging the upside momentum.

Bitcoin is racing greater in the back of sturdy inflows into spot Bitcoin exchange-traded funds (ETFs). Over the previous few weeks, spot Bitcoin ETF issuers have been quickly accumulating the coin. The most important up to now is BlackRock’s IBIT, proudly owning over 70,000 BTC.

Consequently, costs are edging greater, reflecting the excessive demand pinned on to institutional participation. This optimistic sentiment and expectations of much more worth positive aspects, translating to greater open curiosity, is regardless of the continued liquidation of the Grayscale Bitcoin Belief (GBTC). Following courtroom approval, GBTC is transformed into an ETF, becoming a member of others like Constancy, who additionally provide an identical product.

Genesis Trying To Promote GBTC; Will Bitcoin Rally In March?

Even with the excessive optimism, a possible cloud hangs over the Bitcoin market. Genesis, a crypto lender below chapter safety, desires the courtroom to permit them to promote over $1.4 billion of GBTC.

If the courtroom green-lights this transfer, BTC may have extra liquidation strain, probably unwinding latest positive aspects. To this point, the FTX property bought their GBTC, estimated to be price over $1 billion, coinciding with Bitcoin dropping to as little as $39,500 in January.

Moreover these Bitcoin-specific occasions, the market is intently watching how the financial coverage scene in the USA will evolve within the subsequent few weeks. The US Federal Reserve is anticipated to slash charges in March, a probably useful transfer for BTC.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site completely at your individual danger.