Bitcoin’s value retreated beneath $51,000 to retest important help ranges on Feb. 17 regardless of holding robust after stronger-than-expected CPI information over the previous few days.

The flagship crypto was buying and selling at $50,856 as of press time after touching a low of $50,625.

The lower marks a 2.81% drop during the last 24 hours, with Bitcoin’s market capitalization now near $997.31 billion, barely beneath the $1 trillion mark.

Combined sentiment

The latest value motion comes amid a backdrop of each bullish and bearish sentiments amongst buyers.

Evaluation from Changelly means that the market sentiment has been predominantly bullish, with a 76% bullish sentiment towards a 24% bearish outlook, underpinned by a Worry & Greed Index rating of 77, indicating a prevailing sense of greed out there.

Regardless of this optimism, Bitcoin has skilled vital value volatility over the previous month, with 19 out of the final 30 days closing within the inexperienced.

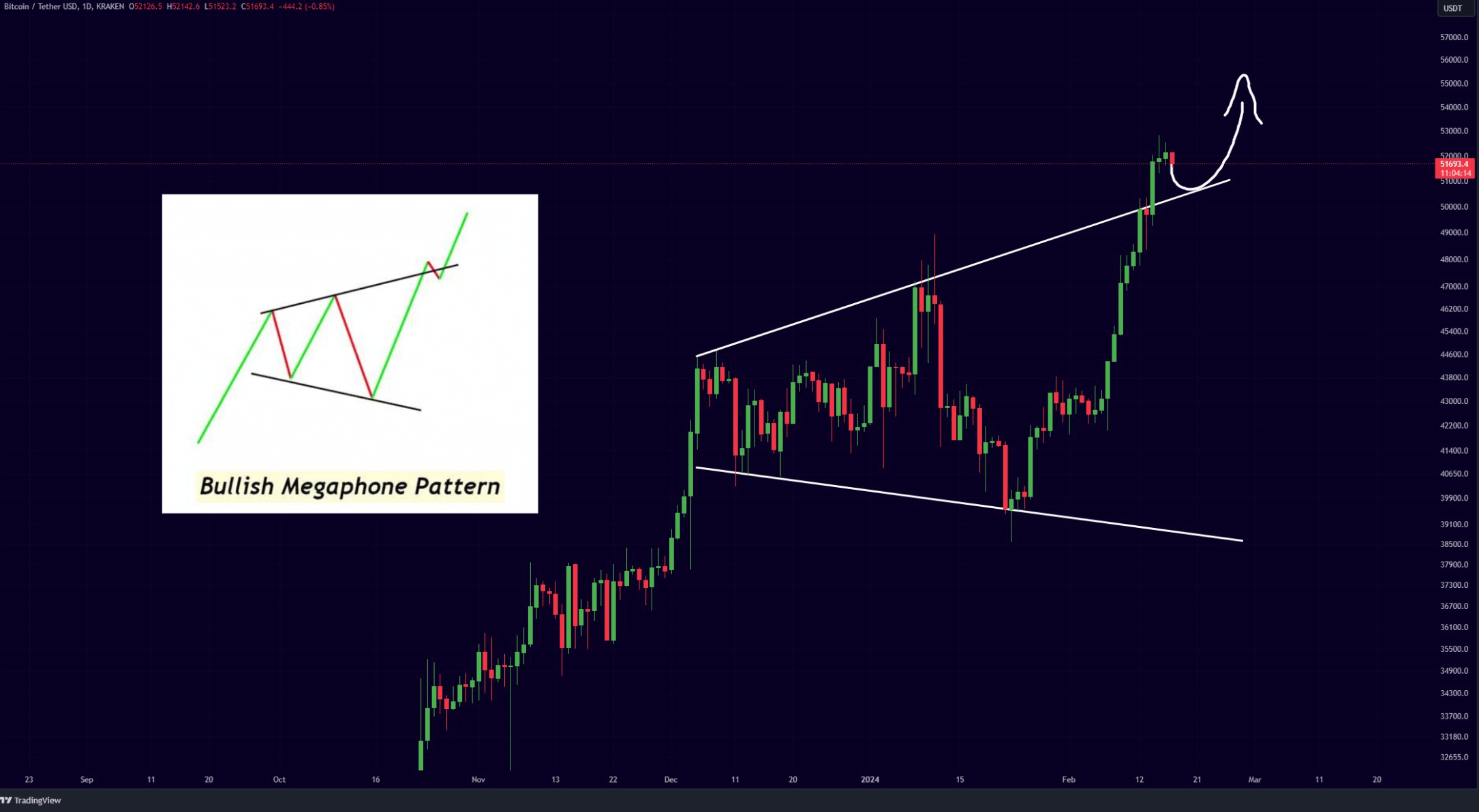

Bitcoin bulls recommend the worth is testing help earlier than surging to yearly highs, because it has already damaged out of a important value ceiling to kind a bullish megaphone sample.

Point of interest of dialogue

Bitcoin, the world’s first decentralized crypto, continues to be a focus of dialogue amongst buyers, policymakers, and most of the people. Its vitality consumption, safety features, and potential for adoption as a authorized tender in numerous international locations stay scorching matters.

The crypto’s journey from being perceived as a dangerous funding to changing into a major reserve asset for main companies like MicroStrategy and Bitcoin ETFs issued by main asset managers illustrates its rising acceptance and the altering attitudes towards digital currencies.

Moreover, the authorized and political landscapes round Bitcoin are evolving. Nations like El Salvador have adopted Bitcoin as authorized tender, a transfer that has spurred discussions on the adoption of cryptocurrencies by different nations.

In the meantime, environmental considerations associated to Bitcoin mining proceed to spur debates on the sustainability of cryptocurrencies and their influence on international vitality consumption.