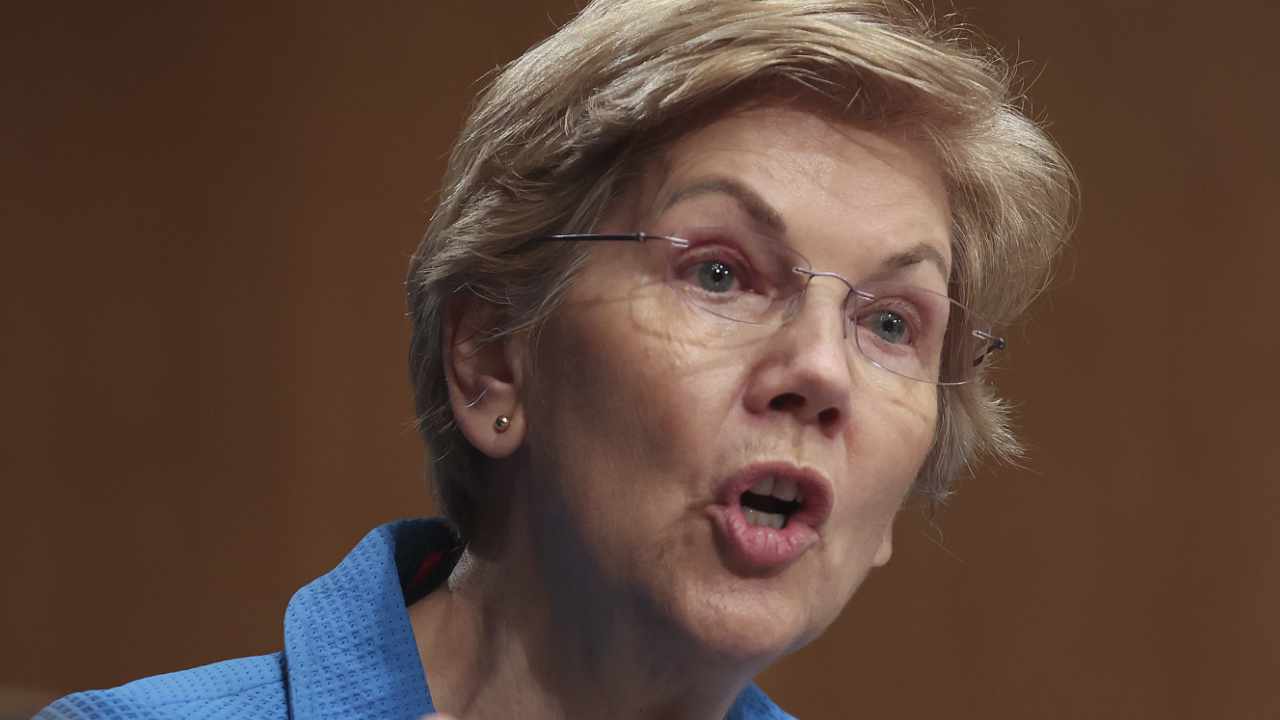

U.S. Senator Elizabeth Warren says that “too many crypto corporations have been capable of rip-off clients and depart odd traders holding the bag whereas insiders make off with their cash.” She careworn the necessity for stronger guidelines, urging the Securities and Alternate Fee (SEC) and Congress to take motion on crypto regulation.

U.S. Senator Says Crypto Wants Stronger Regulation

U.S. Senator Elizabeth Warren (D-MA) voiced her issues about cryptocurrency investing in an interview with Yahoo Finance Reside final week after a number of crypto corporations filed for chapter safety.

Calling on the U.S. Securities and Alternate Fee (SEC) to behave, she emphasised:

Congress must act, however the SEC has a accountability to make use of its authorities to place guardrails in place and crack down on crypto actors that break the principles.

“I’ve been ringing the alarm bell on crypto and the necessity for stronger guidelines to guard customers and monetary stability,” the senator added.

Final week, crypto lender Celsius Community filed for chapter safety after freezing withdrawals. Per week prior, one other crypto lender, Voyager Digital, filed for chapter safety. The corporate cited contagion in crypto markets and bankrupt crypto hedge fund Three Arrows Capital‘s mortgage default as the explanations.

Warren careworn:

Too many crypto corporations have been capable of rip-off clients and depart odd traders holding the bag whereas insiders make off with their cash.

SEC Commissioner Hester Peirce expressed issues in Could that the securities watchdog has dropped the ball on the regulation of cryptocurrencies. “We are able to go after fraud and we will play a extra optimistic position on the innovation facet, however now we have to get to it, we’ve acquired to get working … I haven’t seen us prepared to do this work up to now,” she opined.

Gary Gensler, the chairman of the SEC, has been criticized for taking an enforcement-centric strategy to crypto regulation. In Could, the securities watchdog stated it can virtually double the scale of its enforcement division’s crypto unit. Final week, Gensler outlined what traders can anticipate from the SEC on the crypto regulatory entrance.

Senator Warren has been urgent Gensler to step up crypto oversight on a number of events. In July final 12 months, she warned of the rising dangers of cryptocurrency buying and selling, calling on the securities regulator to “use its full authority to handle these dangers.” She additionally stated decentralized finance (defi) is essentially the most harmful a part of crypto, urging regulators to clamp down on stablecoins and defi platforms “earlier than it’s too late.”

In Could, she demanded solutions from monetary providers agency Constancy Investments concerning the corporate’s resolution to permit bitcoin investments in 401K plans. Constancy’s transfer has troubled the Labor Division. “We have now grave issues with what Constancy has completed,” stated Ali Khawar, Performing Assistant Secretary of the Labor Division’s Worker Advantages Safety Administration. The senator has additionally repeatedly bashed bitcoin’s environmental impression.

What do you consider the feedback by U.S. Senator Elizabeth Warren? Tell us within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss prompted or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.