Many freelancers discover themselves spending lengthy hours doing their accounting by hand however aren’t positive if it’s price the price to spring for accounting software program. Fortuitously, there are lots of reasonably priced accounting software program for freelancers obtainable, together with some ceaselessly free choices.

On this buying information, we’ve rounded up the six finest accounting software program for freelancers of every kind.

QuickBooks

Staff per Firm Dimension

Micro (0-49), Small (50-249), Medium (250-999), Massive (1,000-4,999), Enterprise (5,000+)

Micro (0-49 Staff), Small (50-249 Staff), Medium (250-999 Staff), Massive (1,000-4,999 Staff)

Micro, Small, Medium, Massive

Options

API, Basic Ledger, Stock Administration

Acumatica Cloud ERP

Staff per Firm Dimension

Micro (0-49), Small (50-249), Medium (250-999), Massive (1,000-4,999), Enterprise (5,000+)

Micro (0-49 Staff), Small (50-249 Staff), Medium (250-999 Staff), Massive (1,000-4,999 Staff)

Micro, Small, Medium, Massive

Options

Accounts Receivable/Payable, API, Departmental Accounting, and extra

High accounting software program for freelancers comparability

Moreover pricing, there are lots of totally different options to think about when making an attempt to determine on one of the best accounting software program for freelancers along with your wants.

| Beginning value | Eternally free plan | Expense monitoring | Native time monitoring | Stock administration | ||

|---|---|---|---|---|---|---|

| FreshBooks | $19/mo. | No | Sure | Sure | Sure | Strive FreshBooks |

| Xero | $15/mo. | No | Sure | Sure | Sure | Strive Xero |

| Wave Accounting | $0/mo. | Sure | Sure | No | No | Strive Wave |

| Zoho Books | $15/mo. | Sure | Requires integration with Zoho Expense | Sure | Sure | Strive Zoho Books |

| QuickBooks On-line | $30/mo. | No | Sure | Sure | Sure | Strive QuickBooks |

| Sage 50 Accounting | $58.92/mo. | No | Sure | No | Sure | Strive Sage |

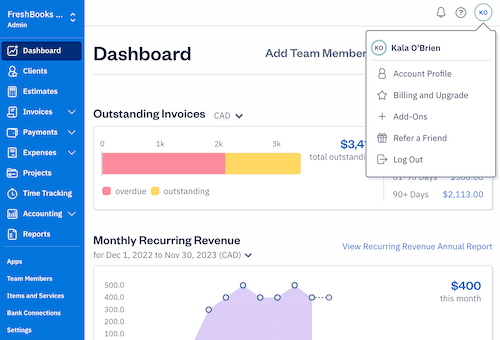

FreshBooks: Greatest total

Our star score: 4.1 out of 5

FreshBooks is commonly billed as a extra reasonably priced different to QuickBooks, and it’s simple to see why: FreshBooks contains comparable options however begins at practically half the price. The extra reasonably priced entry-level plan will enchantment to freelancers that simply want fundamental accounting options, and the bill creation software is particularly useful for freelancers. Greater-tier plans embrace options like cell receipt seize, recurring billing and accountant entry.

Pricing

- Lite: $19 per 30 days billed month-to-month or $204 billed yearly. Permits customers to invoice 5 purchasers per 30 days.

- Plus: $33 per 30 days billed month-to-month or $360 billed yearly. Permits customers to invoice 50 purchasers per 30 days.

- Premium: $60 per 30 days billed month-to-month or $660 billed yearly. Contains limitless billable purchasers.

- Choose: Customized quote pricing for enterprises.

Options

- Simple bill creation software.

- Convert estimates and proposals to invoices.

- Expense monitoring and cell receipt seize.

- Native time and expense monitoring.

Professionals

- Clear, reasonably priced pricing plans.

- Payroll integration with Gusto and SurePayroll.

- Intuitive, user-friendly interface.

- Extremely rated cell apps.

Cons

- Expenses $11 per 30 days for added customers.

- Expenses $20 per 30 days for Superior Funds characteristic.

- Solely 5 purchasers are allowed on the Lite plan.

- Might use extra third-party integrations.

For extra info, learn the total FreshBooks evaluate.

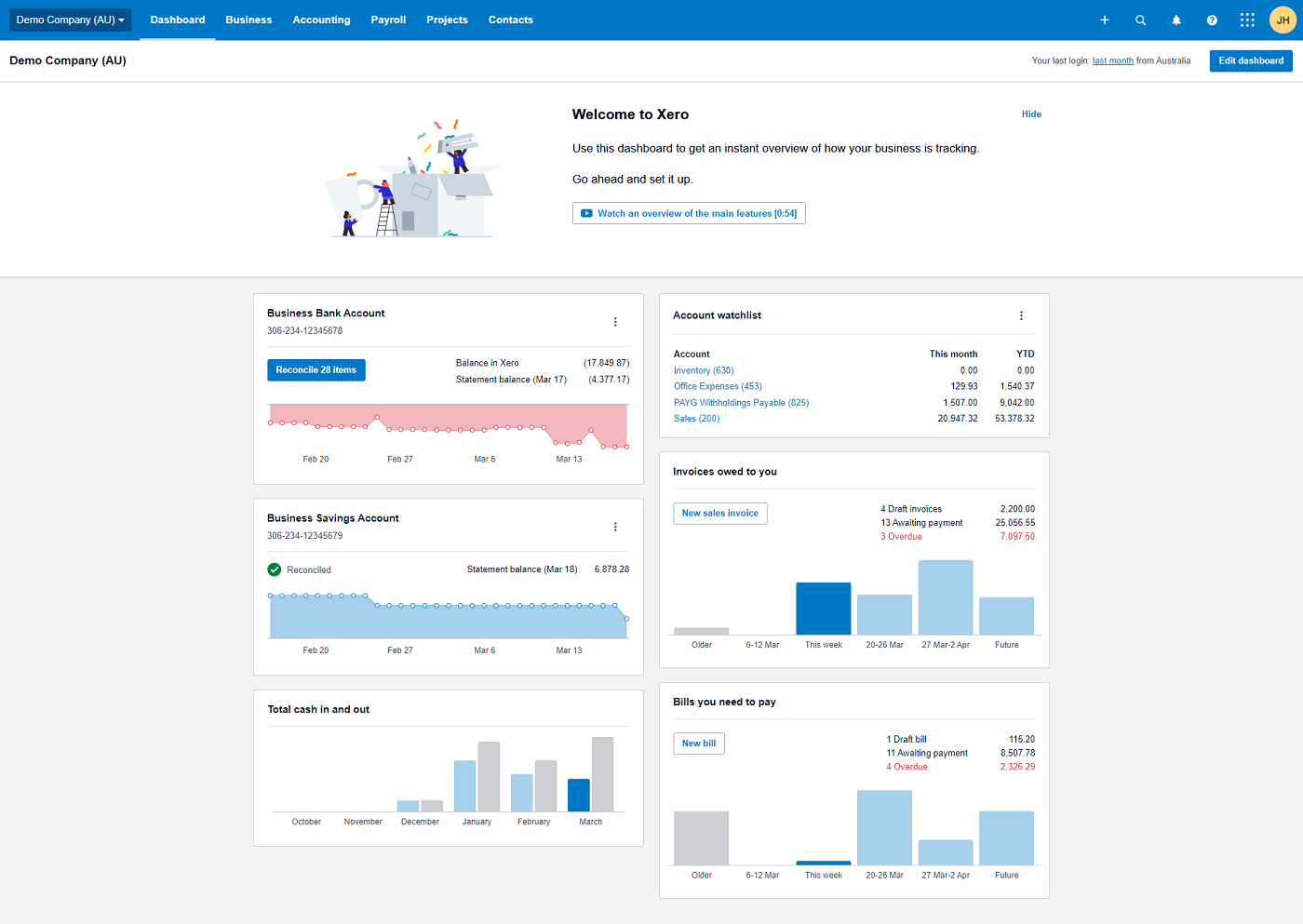

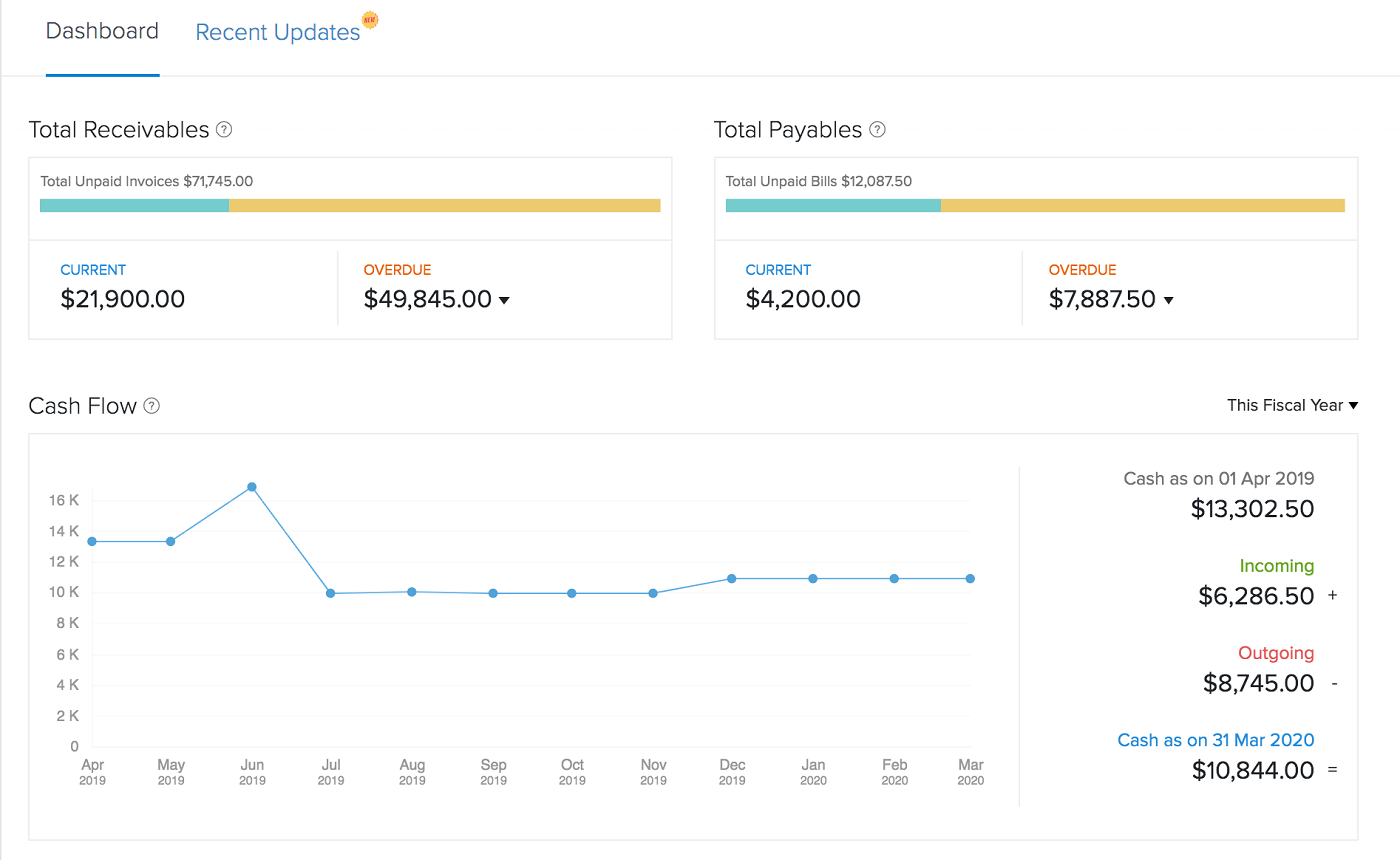

Xero: Greatest for product-based companies

Our star score: 4.4 out of 5

Xero Accounting’s cloud-based double-entry accounting software program options native stock administration options, making it an awesome alternative for product-based companies. Not solely can you retain observe of your inventory ranges and see what’s promoting, Xero may also mechanically populate invoices and orders with objects you promote. Xero’s pricing plans are additionally reasonably priced, which is able to enchantment to solo operations that gained’t break the financial institution.

Pricing

- Early: $15 per 30 days.

- Rising: $42 per 30 days.

- Established: $78 per 30 days.

Options

- Observe stock and create orders.

- Generate monetary and accounting studies.

- Hook up with a number of fee gateways and monetary establishments.

- Cell app for expense administration.

Professionals

- Limitless customers on all plans.

- Guided setup course of.

- Payroll integration with Gusto obtainable.

- Challenge and time monitoring included in some plans.

Cons

- Early plan restricted to twenty invoices and 5 payments per 30 days.

- Just one group allowed per account.

- A number of options restricted to the costliest Established plan.

- No phone assist supplied.

For extra info, learn the total Xero evaluate.

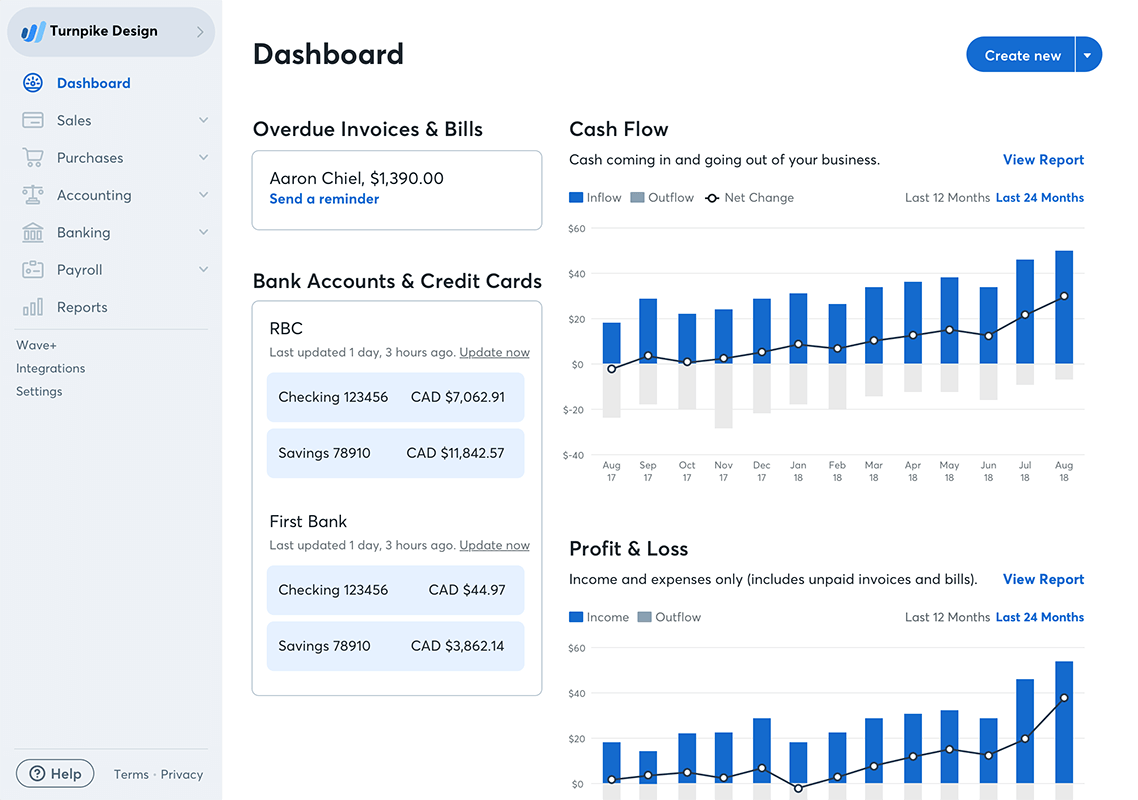

Wave Accounting: Least expensive possibility

Our star score; 4 out of 5

In case you’re on a critical price range, attempt Wave’s free accounting and invoicing plan. For probably the most half, the platform makes cash by normal fee charges and add-ons like cell receipts and payroll, though these providers aren’t necessary if you wish to use the accounting and invoicing options. Every Wave account comes with limitless invoices, purchasers, financial institution accounts and credit score connections — all completely free.

However when you want greater than the fundamental options you will get with Wave’s free plan, you possibly can improve to Wave Professional, which prices $16 per 30 days. Wave’s paid plan provides extra expansive options at a below-average beginning value, limitless receipt scanning and limitless customers included.

Pricing

- Wave Starter: Free ceaselessly.

- Wave Professional: $16 when billed month to month or $170 when billed as soon as per yr.

- Bank card funds: 2.9% (or 3.4% for AMEX) + $0.60 per transaction. (Value could also be lowered with Wave Professional relying on promotion.)

- Financial institution funds: 1% per transaction.

- Cell receipts: Free with Wave Professional or $11 a month or $96 a yr when included as an add-on with Wave Starter.

- Payroll: $40 a month in tax service states and $20 a month in self-service states, plus $6 per lively worker or unbiased contractor paid every month.

- Advisors: $149 a month for ongoing bookkeeping assist, or $379 for a one-time accounting and payroll teaching bundle.

Options

- Create invoices and arrange recurring billing.

- Primary accounting studies included.

- Constructed-in fee processing.

- Native payroll add-on obtainable.

Professionals

- Fully free accounting and invoicing plan.

- Limitless purchasers, invoices and financial institution accounts.

- Interface is easy to navigate.

- Can handle a number of companies in a single accounting software program.

Cons

- Free plan customers should pay for cell receipt seize.

- No built-in integrations.

- Not as many accounting options as QuickBooks and different rivals.

- Buyer assist not included with free plan and obtainable by e mail and chat solely with paid plan.

For extra info, learn the total Wave Accounting evaluate.

Zoho Books: Most totally featured

Our star score: 4.7 out of 5

Zoho Books provides a complete choice of accounting options mixed with six totally different clear pricing plans that supply plenty of scalability. Whereas the entry-level plans provide fairly fundamental options, the costlier plans get far more superior with instruments for gross sales approvals, workflow guidelines, stock controls, superior analytics and extra. Zoho Books additionally integrates with Zoho’s dozens of enterprise apps, making it doable to construct a complete Zoho software program stack.

Pricing

- Free: $0 for companies with lower than $50K USD per calendar yr.

- Commonplace: $15 per group per 30 days billed yearly, or $20 per group per 30 days billed month-to-month.

- Skilled: $40 per group per 30 days billed yearly, or $50 per group per 30 days billed month-to-month.

- Premium: $60 per group per 30 days billed yearly, or $70 per group per 30 days billed month-to-month. A 14-day free trial is obtainable for this plan.

- Elite: $120 per group per 30 days billed yearly, or $150 per group per 30 days billed month-to-month.

- Final: $240 per group per 30 days billed yearly, or $275 per group per 30 days billed month-to-month.

Zoho Books additionally provides the next add-ons:

- Further customers: $3 per person per 30 days.

- Superior auto scans: $10 per 30 days for 50 scans per 30 days.

- Snail mails: $2 per credit score.

Options

- Customized bill creator.

- Native time monitoring included.

- Connects with many alternative fee gateways.

- Every plan contains accountant entry.

Professionals

- Free Zoho Books webinar each week.

- Six pricing plans provide glorious scalability.

- Integrates seamlessly with your entire Zoho software program stack.

- Expense and mileage monitoring supported on all plans.

Cons

- Expenses a small payment for further customers.

- E mail-only assist for the free plan.

- Should improve to Skilled plan for timesheet administration.

- Can current the next studying curve than another choices on this listing.

For extra info, learn the total Zoho Books evaluate.

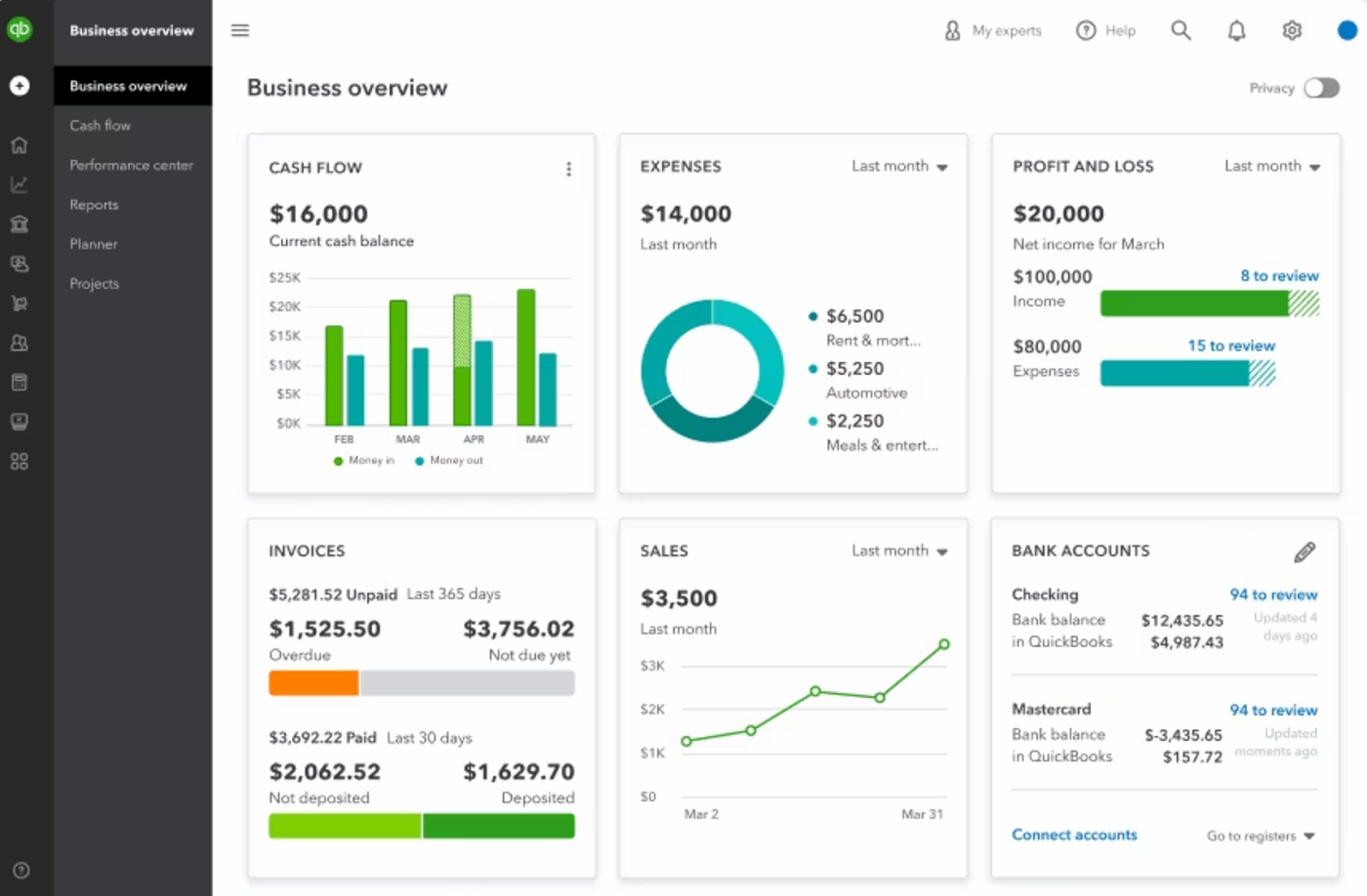

QuickBooks Self-Employed: Greatest tax monitoring

Our star score: 4.6 out of 5

QuickBooks provides among the most superior accounting options in the marketplace, and lots of freelancers will vastly recognize its tax preparation report. Even probably the most fundamental QuickBooks account contains bill creation, fee acceptance, expense monitoring, mileage monitoring, money circulate forecasting and fundamental studies. Nevertheless, its costs are above common in comparison with most different accounting software program for small companies, so not each freelancer can have a price range for it.

Pricing

- QuickBooks Easy Begin: $30 per 30 days with entry for one person.

- QuickBooks Necessities: $60 per 30 days with entry for as much as three customers.

- QuickBooks Plus: $90 per 30 days with entry for as much as 5 customers.

- QuickBooks Superior: $200 per 30 days with entry for as much as 25 customers.

Options

- Create invoices, estimates and quotes.

- Computerized earnings and expense monitoring.

- Generic accounting and finance studies.

- Stock administration instruments obtainable.

Professionals

- Complete double-entry accounting options.

- Limitless invoices, purchasers and payments on all plans.

- Acquainted to accountants all around the world.

- Expense and mileage monitoring on all plans.

Cons

- Customer support may very well be improved.

- Greater than common costs.

- Every plan limits the variety of customers.

- Should select between a free trial and a reduction on the primary three months of service.

For extra info, learn the total QuickBooks On-line evaluate.

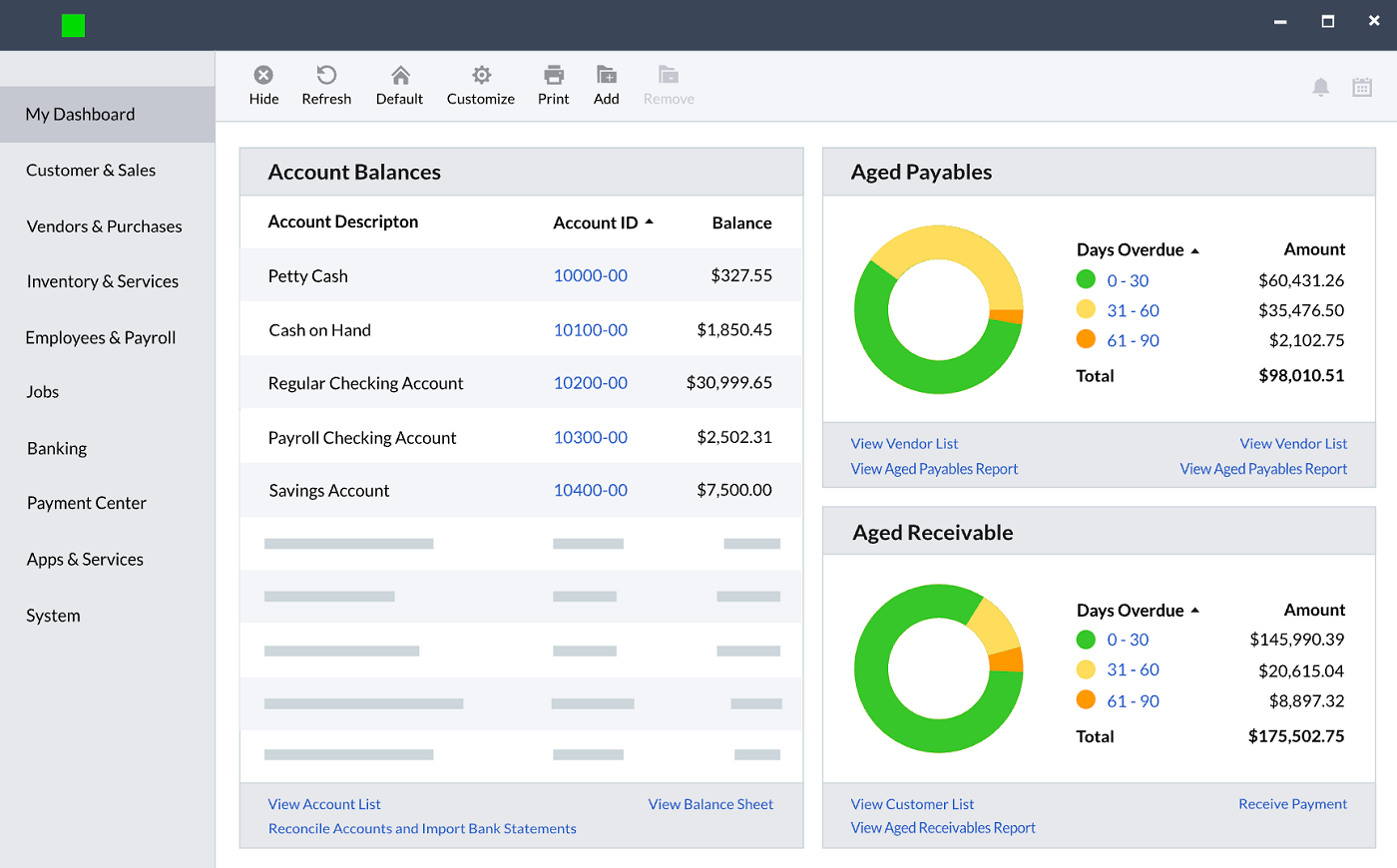

Sage 50 Accounting: Greatest assist for rising companies

Our star score: 4.6 out of 5

When you may affiliate Sage with enterprise software program, it additionally provides a number of instruments focused towards midsize companies, together with Sage 50 Accounting. Sage Accounting has an in depth data base to assist new enterprise house owners rise up to hurry on all issues accounting. In case you can’t determine issues out by yourself, then give the well-reviewed customer support division a name.

Pricing

- Sage Professional Accounting: Prices $58.92 per 30 days or $595 per yr for one person.

- Sage Premium Accounting: Prices $96.58 per 30 days or $970 per yr for one person.

- Sage Quantum Accounting: Prices $160 per 30 days or $1,610 per yr for one person.

Options

- Create quotes and invoices simply.

- Invoice fee operate.

- Nice stock monitoring.

Professionals

- Assist a number of currencies.

- Extraordinarily reasonably priced pricing plans.

- Limitless customers on Sage Accounting plan.

- In depth data base obtainable.

Cons

- Pricy beginning costs.

- Massive value improve for including a number of customers.

- Interface could seem outdated to some customers.

For extra info, learn the total Sage Accounting evaluate.

Key options of accounting software program for freelancers

Invoicing

Many freelancers use invoices to cost their purchasers, making this a completely important characteristic of any accounting software program for freelancers. The software program ought to permit customers to select from a number of e mail templates and customise them to their wants. It also needs to let customers create a proposal or estimate, which they’ll then convert to an bill after approval.

Time monitoring

Time monitoring is extraordinarily useful for any freelancer who expenses their purchasers per billable hour or who has part-time workers that they pay by the hour. Some accounting software program contains built-in time monitoring, whereas others depend on integration with third-party instruments for this characteristic. In case you use a payroll platform, then the time monitoring knowledge must be simple to import into that as effectively.

Expense and mileage monitoring

In case you should observe bills and mileage so your purchasers can reimburse you later, then undoubtedly search for accounting software program that provides this characteristic. Some software program confines this characteristic to costlier plans or forces you to pay an additional payment for cell receipt seize, so make sure to account for that in your price range.

Reporting

Whereas freelancers’ accounting could also be much less complicated than that of a big company, it’s nonetheless vital for them to have a transparent image of the monetary well being of their enterprise. That’s why you must search for accounting software program for freelancers that generates studies mechanically. The platform also needs to come preloaded with a choice of reporting templates to select from.

Stock monitoring

Not all freelancers promote merchandise, however when you do, you then undoubtedly want stock monitoring to handle your inventory ranges to see what’s promoting and what’s not. In case you get accounting software program with stock monitoring already included, that may make it extraordinarily simple to generate invoices for every merchandise bought and to log every transaction in your books.

How do I select one of the best accounting software program for freelancers for my enterprise?

Many freelancers are on a decent price range, so it’s vital to maintain that prime of thoughts when purchasing for one of the best accounting software program for freelancers. Fortuitously, there are a number of budget-friendly picks, together with some ceaselessly free choices like Wave Accounting. Every platform takes a special strategy to what options are included in every pricing tier, so get particular about your must-haves since that may have a huge impact in your price range.

Most accounting software program for freelancers provides free trials, and those who don’t encourage you to schedule a demo name with the gross sales group. Take your time testing out every software program to see if it meets your wants and if you are able to do with out the options on the costliest plans. In case you’re nonetheless not totally bought by the point your free trial ends, attempt a month-to-month subscription first so that you’re not locked into an annual contract with an accounting software program which may not meet your wants.

Methodology

To decide on one of the best accounting software program for freelancers, we consulted person opinions and product documentation. We thought of components corresponding to pricing, buyer assist and person opinions. We additionally thought of options corresponding to invoicing, time monitoring, expense monitoring, mileage monitoring, stock monitoring and monetary studies.