On-chain information reveals the Bitcoin MVRV ratio is at present on the similar excessive ranges as people who led to the parabolic bull run again in 2020.

Bitcoin MVRV Ratio Has Shot Up As Newest Rally Has Occurred

As identified by CryptoQuant founder and CEO Ki Younger Ju in a post on X, the MVRV ratio has simply hit a worth of two.5. The “Market Worth to Realized Worth (MVRV) ratio” is a well-liked on-chain indicator that retains monitor of the ratio between the Bitcoin market cap and the realized cap.

The “realized cap” right here refers to a capitalization mannequin for BTC that assumes that the actual worth of any token in circulation isn’t its present spot value (because the market cap takes it to be), however fairly the worth at which the coin was final transferred on the community.

The earlier transaction for any coin could also be thought of the final time it modified arms, which suggests that the value on the time can be its present price foundation. As such, the realized cap provides up the fee foundation of each token in circulation.

Which means that the realized cap primarily retains monitor of the whole quantity of capital that the buyers have used to buy their Bitcoin. Because the MVRV ratio compares the market cap (that’s, the worth the buyers are holding proper now) towards this preliminary funding, its worth can inform us in regards to the quantity of revenue or loss the buyers as a complete are at present carrying.

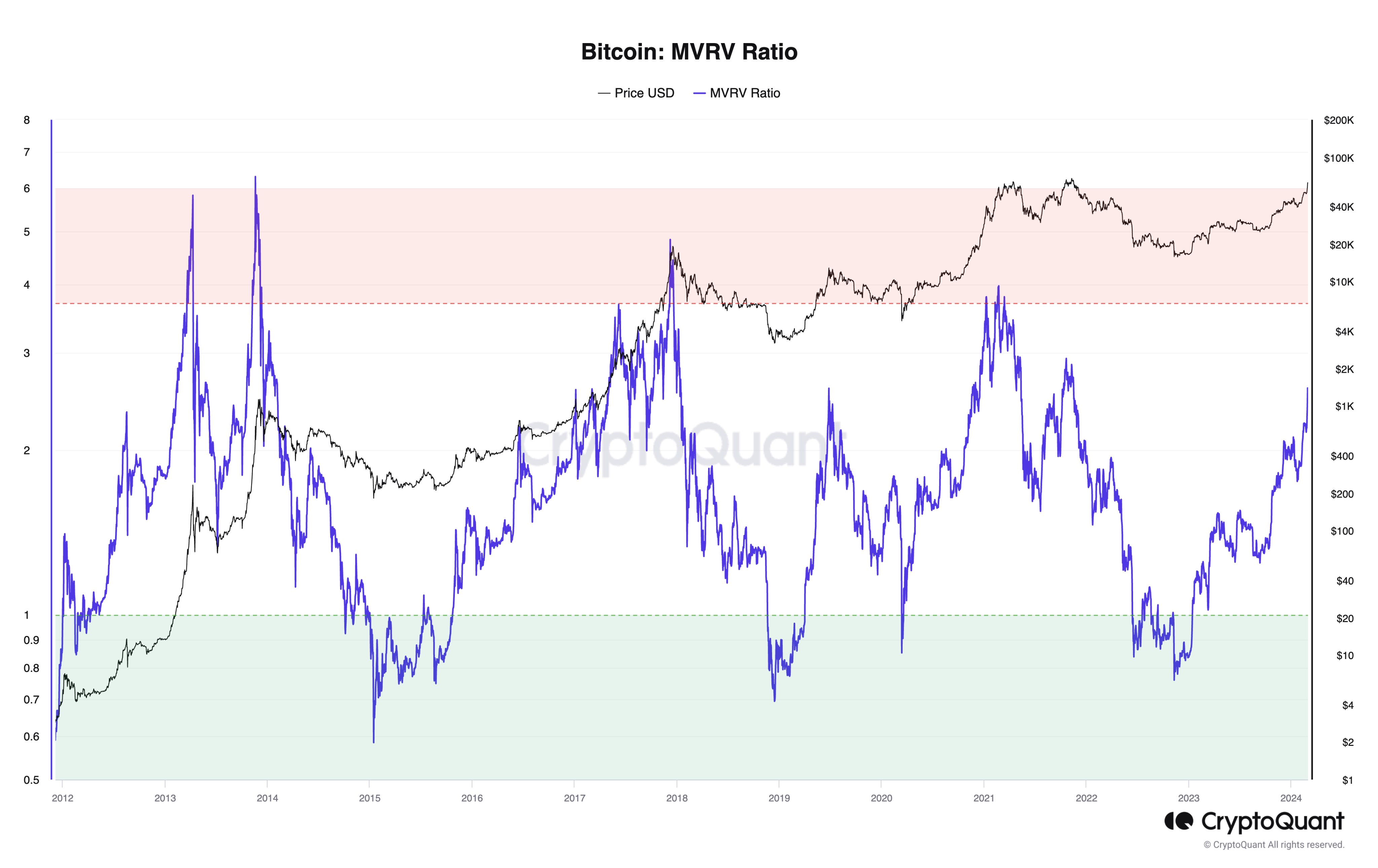

Now, here’s a chart that reveals the pattern within the Bitcoin MVRV ratio over the historical past of the cryptocurrency:

Appears to be like like the worth of the metric has been capturing up in latest days | Supply: @ki_young_ju on X

As is seen within the graph, the Bitcoin MVRV ratio has quickly climbed up because the asset’s value has gone by its newest rally. On this surge, the metric has managed to exceed the two.5 stage.

When the ratio is larger than 1, it signifies that the market cap is larger than the realized cap proper now, and thus, the general market is holding its cash at some revenue. A worth of two.5 implies the typical pockets is at present carrying positive factors of 150%.

“In Nov 2020, MVRV was 2.5 at $18K, previous the all-time excessive and parabolic bull run,” explains Ju. Again in that bull run, the height of the primary half of 2021 wasn’t hit till the MVRV ratio crossed the three.7 mark, similar to the 2 bull runs previous it.

The highest in November 2021, nevertheless, didn’t comply with this sample, because it shaped near the three.0 stage. It now stays to be seen which path Bitcoin would soak up its present rally, whether it is in any respect just like both of those.

BTC Value

Following Bitcoin’s spectacular 22% rally over the previous week, the asset’s value is now buying and selling across the $62,800 stage, not very removed from setting a brand new all-time excessive now.

The value of the asset has gone by fast progress over the previous few days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site fully at your individual danger.