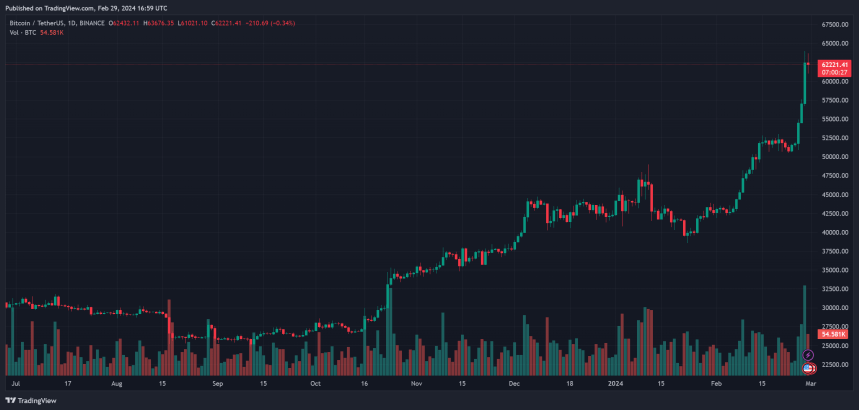

The value of Bitcoin appears getting ready to blasting previous its all-time excessive (ATH) on the excessive space of its present ranges. The cryptocurrency has been on a bull run because of the launch of spot Bitcoin Alternate Traded Funds (ETF), which formally onboarded establishments to the nascent sector.

As of this writing, Bitcoin (BTC) trades at round $62,900 with a 3% revenue within the final 24 hours. Within the earlier week, the cryptocurrency recorded a vital 22% revenue. It stood as one of many three prime gainers within the prime 10 by market cap, solely surpassed by Solana (25%) and Dogecoin (57%) in the identical interval.

Bitcoin-Primarily based Derivatives Trace At Additional Beneficial properties

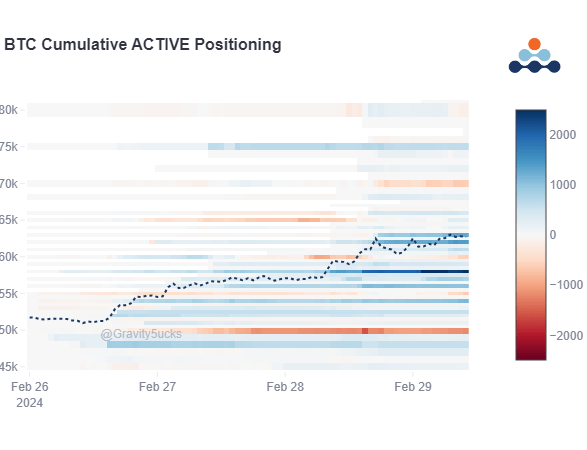

Knowledge from the derivatives platform Deribit signifies a spike in lengthy positions by Choices operators. Since early February, these merchants have amassed necessary name (purchase) contracts with a strike worth above $65,000.

At first, because the report signifies, the rise in bullish positions was considered a part of a Bitcoin “Halving” technique. Nevertheless, the BTC ETF Flows appear to be the important thing element behind the rally.

As cryptocurrency entered the $60,000 space, a number of operators rushed to build up name contracts, resulting in a Concern Of Lacking Out (FOMO) rally to its present ranges. The chart beneath exhibits that the FOMO shopping for started when BTC breached the $57,000 stage.

The spike in buying and selling exercise throughout yesterday’s session led to a big bounce in Implied Volatility (IV). Overleveraged positions additional propelled the metric, Deribit acknowledged:

The 62k to 64k surge was so fast, and with excessive leverage throughout the entire system, that when gross sales hit the market a cascade despatched BTC right down to 59k in 15mins, and a few Alts (additionally massively leveraged) dropped 50% on some exchanges earlier than promptly bouncing as BTC jumped to 61.5k.

Because the market continues to expertise sudden strikes because of the excessive IV, there may be little change out there construction within the derivatives sector. In different phrases, Deribit nonetheless data a variety of bullish positions for the approaching months, which suggests optimistic conviction by these gamers.

BTC Worth On The Brief Timeframe

Regardless of the bull run, the Bitcoin worth might dip as euphoria takes over the market. In line with economist Alex Krüeger, the spike in buying and selling quantity across the derivatives sector indicates the formation of a “native prime.”

The analyst believes that retail has returned to the market pushed by FOMO, which frequently hints at short-term predicaments for lengthy merchants. Krüger predicted additional positive aspects into the $70,000 space by way of his official X account after which a drop into the $55,000 space.

The analyst acknowledged:

ATH are inches away. That’s worth discovery territory. Thus very simple for issues to get even crazier. That is simply not the place one opens new longs. Too simple to get a fast flush out of nowhere. Ideally we see funding quiet down and worth consolidate beneath ATH then escape.

Cowl picture from Dall-E, Chart from Tradingview

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site solely at your personal threat.